Eco 200 – Principles of Macroeconomics

advertisement

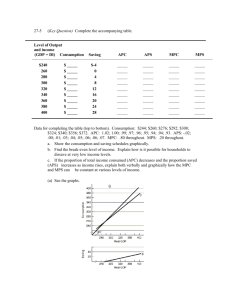

Eco 200 – Principles of Macroeconomics Chapter 10:Aggregate Expenditures Consumption and Saving Yd = C+S S = Yd – C C = a + bYd a = intercept b = slope (= DC/DYd) Saving and Dissaving C > Yd: S < 0 C < Yd: S > 0 C = Yd: S = 0 MPC and MPS MPC = marginal propensity to consume = additional consumption resulting from an additional dollar of disposable income MPC = DC/DYd = slope of the consumption function (b in the example above) MPS = marginal propensity to save = additional saving resulting from an additional dollar of disposable income = DS/DYd MPC + MPS = 1 C = a + bYd S=? S = -a + (1-b) Yd APC and APS Average propensity to consume (APC) = C / Yd Average propensity to save (APS) = S / Yd APC + APS = 1 When C > Yd, APC > 1, APS < 0 C = Yd, APC=1, APS = 0 C < Yd, APC < 1, APS > 0 Example: Consumption function Yd C 0 40 100 120 200 200 300 280 400 360 500 440 S APC APS MPC MPS Example: Consumption function Yd C S 0 40 -40 100 120 -20 200 200 0 300 280 20 400 360 40 500 440 60 APC APS MPC MPS Example: Consumption function Yd C S APC 0 40 -40 - 100 120 -20 1.20 200 200 0 1.00 300 280 20 0.93 400 360 40 0.90 500 440 60 0.88 APS MPC MPS Example: Consumption function Yd C S APC APS 0 40 -40 - - 100 120 -20 1.20 -0.20 200 200 0 1.00 0.00 300 280 20 0.93 0.07 400 360 40 0.90 0.10 500 440 60 0.88 0.12 MPC MPS Example: Consumption function Yd C S APC APS MPC 0 40 -40 - - - 100 120 -20 1.20 -0.20 0.8 200 200 0 1.00 0.00 0.8 300 280 20 0.93 0.07 0.8 400 360 40 0.90 0.10 0.8 500 440 60 0.88 0.12 0.8 MPS Example: Consumption function Yd C S APC APS MPC MPS 0 40 -40 - - - - 100 120 -20 1.20 -0.20 0.8 0.2 200 200 0 1.00 0.00 0.8 0.2 300 280 20 0.93 0.07 0.8 0.2 400 360 40 0.90 0.10 0.8 0.2 500 440 60 0.88 0.12 0.8 0.2 Determinants of consumption The consumption function (as a function of real GDP) will shift due to changes in: taxes and transfer payments wealth expectations demographics Investment Investment is autonomous (it is assumed that investment doesn’t change when real GDP changes) Determinants of investment Investment spending is affected by: the interest rate profit expectations technological change cost of capital goods capacity utilization Volatility of investment Investment is the most volatile component of aggregate expenditures as a result of: large fluctuations in interest rates sudden changes in expectations uneven rates of technological change changes in tax policy fluctuations in capacity utilization over the business cycle Government spending autonomous Net Exports Exports – assumed to be autonomous Imports – increase with GDP X – declines as GDP rises MPI Marginal propensity to import = change in imports that result from a one-dollar increase in income = Dimports / DY Y Exports Imports X 0 20 0 20 100 20 10 10 200 20 20 0 300 20 30 -10 MPI = ? Aggregate expenditures AE = C + I + G + X AE AE 45-degree line 45-degree line C+I+G C+I C Y C+I+G C+I+G+X Y