Slide 1

advertisement

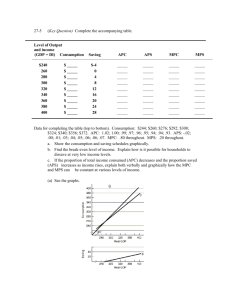

Consumption and Saving Schedule Alomar_111_12 1 GDP=DI C $370 $375 390 390 410 405 430 420 450 435 470 450 490 465 510 480 530 495 550 510 S $ -5 0 5 10 15 20 25 30 35 40 APC 1.01 1 .99 .98 .97 .96 .95 .94 .93 .93 Alomar_111_12 APS - .01 .00 .01 .02 .03 .04 .05 .06 .07 .07 MPC MPS 0.75 0.25 0.75 0.25 0.75 0.25 0.75 0.25 0.75 0.25 0.75 0.25 0.75 0.25 0.75 0.25 0.75 0.25 0.75 0.25 2 APC and APS APC: average propensity to consume: APS: average propensity to save APC = C / DI and APS = S / DI The % of total income that is consumed (APC), and the % of total income that is saved (APS). APC falls and APS rises as DI increases. Alomar_111_12 3 MPC and MPS MPC: marginal propensity to consume MPS: marginal propensity to save MPC = ∆C / ∆DI and MPS = ∆S / ∆DI The % of any change in income that is consumed (MPC) and the % of income that is saved (MPS) MPC + MPS = 1 --- (1) Alomar_111_12 4 MPC and MPS are slopes: The slope of the consumption schedule = MPC, the slope of the saving schedule = MPS. Even when DI=0, C≠0. Alomar_111_12 5 Consumption Schedule C Income (Y) Break-Even Point (C=Y) C Saving Dissaving 45o DI Alomar_111_12 6 Consumption Schedule C Income (Y) Break-Even Point (C=Y) C Saving Dissaving 45o DI Autonomous C (a) Alomar_111_12 7 Saving Schedule S + S 0 - DI Break-Even point (S=0) Alomar_111_12 8 Saving Schedule S + S DI - Break-Even point (S=0) Autonomous C (-a) Alomar_111_12 9 Determinants of Consumption and Saving The most important factor is income (DI): an increase in DI will lead to an increase in C by (MPC.DI) and increase in S by (MPS.DI). This will be a move along the C schedule and S schedule. The same result apply when DI declines. DI is the only factor that leads to a move along the lines. Alomar_111_12 10 Non-income determinants: Non-income factors will shift the C and S schedules. 1. Wealth: an increase in wealth will increase C and reduces S (shift the C schedule upward, S schedule downward). Alomar_111_12 11 This is the case since people save to accumulate wealth. As wealth increases, no need to save as much as before. This is called “wealth effect”. Alomar_111_12 12 2. Expectations: about future prices and income level. Expectations affect spending (C) and saving. Expectations of an increase in price level (or future income): increase C and reduce S today, C schedule shifts upward while S schedule shifts downward. Alomar_111_12 13 3. Taxation: increase in taxes will shift both C and S schedules downward: DI = C + S + T While tax reduction will shift both upward (higher DI) Alomar_111_12 14 4. Household Debt: borrowing money allow C to shifts upward, but if the debt is large, then C may shift downward. Alomar_111_12 15