International Financial Management

International Financial

Management: INBU 4200

Fall Semester 2004

Lecture 1:

The Globalization Process and Some

Initial Concepts and Issues

(Chapter 1)

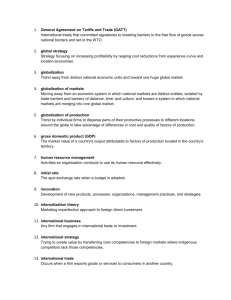

Globalization Defined

• Becoming world wide in scope or application

– Applies to markets (where we are selling and buying):

• Industrial goods and consumer goods.

– Applies to factors of production (where we are getting our inputs for production):

• Capital (Financial markets), technology, labor

– Applies to business firms (where we do business; how we set up our enterprises):

• Financial institutions (including exchanges).

• Non-financial firms: manufacturing and service firms.

Globalization: Functions

• Consumption (Sales)

– McDonalds Corporation

– Starbucks

• Production

– Nike Corporation

• Finance

– Citigroup

– Foreign Exchange Market

– Euronext Stock Exchange

Consumption (Sales)

McDonalds operates in 120

Countries.

- 64% of 2003 sales were from international operations.

Starbucks has 1500

“ licensed

” international retail coffee stores operating in

31 countries.

- licensed international stores accounted for about 17% of Starbucks 2002 earnings.

Production

• About 99% of all Nike brand apparel is produced outside the US in 35 different countries.

Country

China

Percent

38%

27 Indonesia

Vietnam

Thailand

18

16

Finance

• Citigroup with its combined banking, insurance, and investment businesses operates in over 100 countries.

• In 2003, 46% of its revenues from operations resulted from activities outside of North America!

Finance

• Euronext Stock Exchange, based in Paris,

France (example of regionalization).

– F ormed by the merger of the Paris, Brussels,

Amsterdam (in 2000) stock exchanges and Lisbon (in

2002) stock exchange.

– Currently lists over 1,400 firms.

– Second largest stock exchange in Europe, behind

London Stock Exchange.

Globalization of Financial

Markets

• Resulted from major market deregulations over the last 20 years.

– Lifting of U.S. Glass Steagall Act (in 1999)

– “Big Bang” in London (in 1986)

– “Big Bang” in Japan (in 1998)

– Developing nations (especially in Asia; India and China) also opening their financial markets to non-resident investors.

• Attracting capital and financial institutions.

• Threat to traditional financial centers?

The Globalization Process for a Firm

“The globalization process of a firm can be viewed and studied by the operational and managerial changes and challenges experienced by that firm as it moves from a purely domestic firm to one with global operations .”

Moving Beyond a Domestic

Firm

• Stage 1: Domestic to International

Trade Phase.

– Domestic: Suppliers and buyers in home country.

• Payments in home currency; firm operates under home country legal environment (credit risk).

– International Trade Phase: Suppliers and buyers in foreign countries linked through exporting and importing activities.

• Payments in foreign currencies; firm operates under host country legal environments (credit risk).

Why Does a Firm Move from

Domestic to International Trade?

• Access to cheaper production inputs through imports.

• Possible economies of scale gained through expanded foreign markets.

– Resulting in higher production volumes/sales to cover fixed costs.

• Home market fully captured.

• Stagnant home market.

• Competitive forces from home and foreign country competitors.

– Product life cycle of mature firm with mature products.

Viewing The Globalization

Process: A Domestic Firm

Phase One: Domestic Operations

U.S. Suppliers

(domestic) All payments in US dollars;

All credit risk under U.S. law

U.S. Buyers

(domestic)

Sean Skate Boards Inc

Boulder, Co

From Domestic Firm to International

Trade Firm

Phase One: Domestic Operations

U.S. Suppliers

(domestic)

All payments in US dollars

All credit risk under U.S. law

U.S. Buyers

(domestic)

Sean Skate Boards, Inc

Boulder, Co

Japanese Suppliers Canadian Buyers

Are Japanese suppliers dependable?

Will Sean Inc pay in US$ or Yen?

Are Canadian buyers creditworthy?

Will payment be made in US$ or C$?

Phase Two: Expansion into International Trade

Becoming a Multinational

Firm

• Stage 2: International Trade Phase to

Multinational Phase (physical presence abroad)

• Multinational Firm Defined: A firm with dispersed production and/or sales around the world.

Characterized by:

– Involvement in many financial markets

– Dealings in many different currencies

– Dealings with many different national and business cultures

– Dealings with many different partnering relationships.

The Multinational Sequence

Domestic Company

Sean Skate Boards, Inc Greater Foreign Presence

Can it Establish a

Competitive Advantage?

Exploit Its Competitive

Advantage Abroad

Greater

Foreign

Investment

Production at Home:

Exporting

Licensing Production

To Foreign Manufacturer

Production Abroad

Joint Venture with Foreign

Partners

Building a New Facility:

Greenfield Investment

Control of Production Assets

Abroad

Establish a Wholly-Owned

Subsidiary

Acquisition of a Existing

Foreign Enterprise

Multinational Firms and Risk

• As a firm proceeds along the multinationalization sequence, it takes on new and greater risks.

– The initial foreign exchange and credit risk assumed by an international trade company has expanded for a multinational firm.

– This expanded risk environment facing multinational firms is referred to as country risk!

Country Risk and Multinational

Firms

• Foreign exchange exposure, risk and management

• Different legal and political environments

– Common law to civil law!

• Different economic environments

• How best to structure global operations?

• Location decisions (based on the comparative advantages of various countries).

• Where to financing globally?

• Dealing with different corporate cultures

– Shareholder value or corporate wealth value!

– Impact on corporate goals and shared management decisions.

• Impact of foreign operations on domestic results

(consolidated results).

Why is International Finance

Difference from Domestic Finance?

• Foreign Exchange Risk

• Political Risk

• Market Imperfections

• Expanded Opportunity Set

• Cultural Differences

• Corporate Governance Issues

Foreign Exchange Risk

• Occurs because you are dealing in different currencies.

– Other than your home (reference) currency

• Composition of your production and sales can be a big factor here.

– Can be used as an operational offset to foreign exchange exposure!

• Currencies you are dealing in also critical.

– How stable, how volatile?

Political Risk

• Involves:

– Contract enforcement; protection of private property (legal systems important here)

– Foreign exchange market controls and government intervention (manipulation!)

– Profit repatriation process

– Nationalization of assets

– Taxation policies (including withholding taxes on dividends and tax treaties)

Market Imperfections

• Multinational Firms Operate in a World of Market

Imperfections.

– Factors which restrict “free trade.”

• Government Restrictions

– Tariffs affecting MNC location decisions.

– Import substitution policies

• Encouraging a physical presence as opposed to importing.

– Anti-Dumping Actions

– Restricting shares of stock to be held by foreigners

(not as much of an issue today).

• Transaction and Transportation Costs

Expanded Opportunities

• Possibility for activities in many markets allows for:

– Possible economy of scale in operations.

• Issue of Standardization versus Localization of products and activities.

– Expanded revenues

– Expanded financing and investment opportunities

• But not without RISK!

Cultural Differences

• Anglo Saxon Model

– Focus on (Long Run) Profit Maximization!

• “Shareholder Wealth.” Stresses Market Price, EPS.

• Continental Europe

– Consider all “stakeholders” of enterprise.

• Employees, community, suppliers, state.

• Asia

– Japan: Maximize market share to reinforce “keiretsu.”

• Interlocking arrangements between companies and their suppliers and bankers.

• Put in place in the 1970s as a way of discouraging foreign takeovers.

– China: Joint venturing with state owned enterprises with their goals of employment or output.

• Consistent with the planned economy era.

The “Appropriate” Goal of

Management

Anglo-American markets believe that a firm’s objective should be to maximize shareholder wealth

• These countries include the US, Canada, Australia,

United Kingdom.

Non-Anglo-American markets believe that a firm’s objective should be to maximize corporate (stakeholder) wealth

• These countries include the EU, Japan and Latin

American countries

• How does this affect the performance and management of joint ventures between two different business cultures!

Corporate Wealth Concept

– Came about because of:

• Distrust of Anglo-American capitalism especially in Europe.

– Definition of corporate wealth is broader than

Anglo-American viewpoint (where wealth is strictly financial)

– A corporation’s role in wealth maximization includes the firm’s technical, market and human resources

• Considerations as to the implications of strategic moves affecting all parties, human resources, community, state, etc.

• Advisory Committees in Europe!

• Labor laws in Europe.

• Life time employment concept in Japan

– Has weakened in the 1990s

Capital and Cultures

“Impatient Capital” “Patient Capital”

Stakeholders

Shareholders

Firm

(management)

Banks

Firm

(management)

Banks Employees

The Anglo-American Model has been frequently criticized as focusing on short-term profitability rather than long-term growth.

The Non-Anglo-American Model has come under increasing criticism for its lack of accountability to equity investors – its shareholders – while focusing on the demands of too diffuse a group of stakeholders.

Corporate Governance

• The financial and legal framework for

“regulating the relationship between managers and owners.”

– (Relatively) well defined in the United States.

– Not so in other parts of the world.

• No independent boards of directors in China!

• Who are the owners?