Business Math Questions.

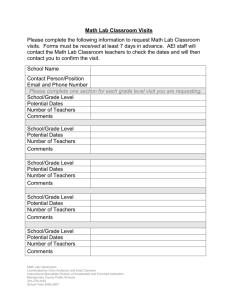

advertisement

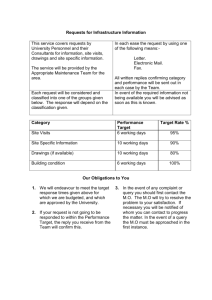

Barbara Johnston has a family membership in a group health insurance program. The annual premium is $12,890. Barbara's employer pays 75% of the total cost. What is Barbara's annual contribution? A) $171.87 B) $3,222.50 C) $6,666.36 D) $9,667.50 2 Emilio Mendoza has a single plan. The PPO annual premium is $10,980. The employer pays 85% of the cost. How much is deducted from his weekly paycheck? A) $31.67 B) $44.87 C) $179.48 D) $1,647.00 3 Savanah Hankinson has a family plan. Her HMO annual premium is $15,230. Her employer pays 65% of the cost. How much does Savanah have deducted from her semimonthly paycheck? A) $205.02 B) $222.10 C) $412.48 D) $9,899.50 4 Parker Moore is single and pays into an HMO. The total cost is $8,550 annually and the employer pays 90% of the total cost. Parker also pays 50% of the optional annual dental premium of $782. How much is deducted each week from his paycheck? A) $16.44 B) $23.96 C) $47.92 D) $51.18 5 Chelsea and Zach Curry are self-employed writers. They pay 100% of the PPO annual insurance premium of $13,210. They also have a dental plan that costs $890 annually and a vision plan that costs $340 annually. The premiums are paid quarterly. How much do they pay each quarter? A) $277.69 B) $2,740.00 C) $3,610.00 D) $14,440.00 6 Robert Finch is single and has a health insurance plan with the benefits listed below. His recent network health care costs include co-payments for 1 emergency room visit, 8 physician visits, and 4 specialist visits. What amount did Robert pay? A) $695 B) $670 C) $590 D) $570 7 Use the table in problem 6. Carmen Phan has a family health insurance plan with the benefits listed. Her recent network health care costs include co-payments for 9 physician visits and 8 specialist visits. What amount did Carmen pay? A) $375.00 B) $560.00 C) $750.00 D) $1,125.00 8 Use the table in problem 6. Determine your network plan (single) costs with the following copayments: 7 physician visits, 2 specialist visits, and 12 physical therapy visits at $90 each. A) $275.00 B) $345.00 C) $620.00 D) $760.00 9 Use the table in problem 6. Determine a family's network plan costs with the following copayments: 22 physician visits, 10 specialist visits, and 8 physical therapy visits at $80 each, 1 emergency room visit plus ambulance fee. There was also a hospital charge of $2,390. A) $825 B) $1,303 C) $2,053 D) $3,215 10 Use the table in problem 6. After meeting the family's deductible, Ben Monerstersky had the following family, non-network medical bills: 18 physician visits, 9 specialist visits, and 25 physical therapy visits at $95 each. Hospital charges totaled $55,600 plus an emergency room visit. A) $2,464.00 B) $16,680.00 C) $19,042.50 D) $19,144.00 11 Zina Jamal is 30 years old. She wants to purchase a $50,000, 5-year term life insurance policy. What is her annual premium? A) $138.50 B) $149.00 C) $160.50 D) $1,385.00 12 Use the table in problem 11. Omar Ahmed is 35 years old. He wants to purchase an $80,000, 5year term life insurance policy. What is his annual premium? A) $238.40 B) $280.80 C) $340.00 D) $362.20 13 Use the table in problem 11. A 45 year-old male purchases a $100,000, 5-year term policy. What is the annual premium? A) $450 B) $460 C) $542 D) $759 14 Use the table in problem 11. Find the percent increase in premiums. At age 40, Veronica Vega purchases a $70,000, 5-year term policy. She is now 45 years old. A) 24.6% B) 32.5% C) 67.5% D) 75.4% 15 Use the table in problem 11. Find the percent increase in premiums. At age 45, Zahara Washington purchases an $80,000, 5-year term policy. She is now 55 years old. A) 46.4% B) 53.6% C) 85.5% D) 86.5% 16 Use the table in problem 16. Tara Kiminski is 25 years old. She wants to purchase a whole life policy with a face value of $150,000. What is her annual premium? Age 20 25 30 35 40 Whole Life Male Female $8.00 $6.25 $9.50 $7.50 $11.75 $9.25 $15.00 $11.50 $19.50 $14.50 A) $72 B) $1,125 C) $1,725 D) $3,600 17 Use the table from problem 16. Tom White Oak is 25 years old. He wants to purchase a whole life policy with a face value of $70,000. What is his annual premium? A) $525.00 B) $665.00 C) $962.50 D) $1,120.00 18 Use the table from problem 16. Forty-year old Marcus Vance's policy is a "whole life" for $50,000. What is his semi-annual premium? A) $492.38 B) $624.00 C) $1,248.00 D) $1,313.00 19 Use the table from problem 16. Gustavo and Miriam Lazo each purchase a $100,000 whole life insurance policy. Both are 30 years of age. How much more is Gustavo's annual premium than his wife's? A) $200 B) $250 C) $475 D) $1,175