appendices (for all plan members)

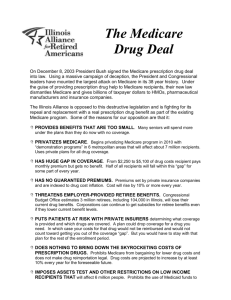

advertisement