The Fiscal Responsibility

of

Value Analysis

April 2009

Dee Donatelli

Vice President VHA

Learning Objectives

• Outline how integrating best practices from

P&T model to value analysis can produce

better results.

• State key fundamentals of P&T and value

analysis.

• Identify areas of application.

2

Key Functions of Value Analysis

• The value of a product will be interpreted in different ways by

different customers.

• Its common characteristic is a high level of performance,

capability, emotional appeal, style, etc. relative to its cost.

• This can also be expressed as maximizing the function of a

product relative to its cost:

Value = (Performance + Capability)/Cost

Value is not a matter of minimizing cost.

3

Google….Value Analysis

in Health Care

Remember, costs (utilization and value mismatches)

are always our enemy, we must always be on the

attack! We must always seek out new and

innovative methods to UNCOVER and drive out these

unwanted and unnecessary expenditures before they

seriously damage our bottom line.

4

Fundamental Benefits of Value Analysis

Takes product and service evaluation from subjective to objective

Provides a formal, customized, collaborative approach to reduce

and manage expenses

Involves interdisciplinary teams

Includes all supplies and services

Ensures optimal benefits because of staff buy-in

Integrates the Medical Staff into the ongoing process

Supported by clinical documentation which maintains and/or

improves quality and customer satisfaction

© 2009 VHA Inc. All rights reserved.

5

Stakeholder Involvement in Value Analysis

Physicians

• Decision Process

• Product Selection

• Structure

Clinicians

© 2009 VHA Inc. All rights reserved.

Operations

6

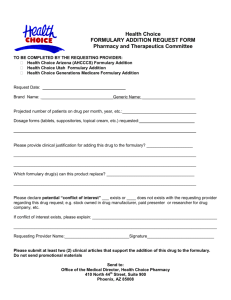

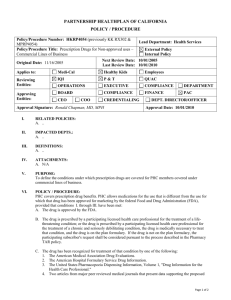

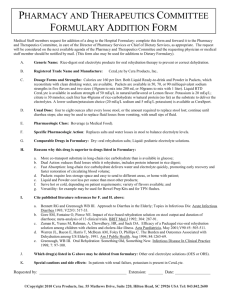

Key Functions of a Drug Formulary

• The Drug Formulary is a list of prescription drugs and supplies

that reflect the current recommendations of the Pharmacy

and Therapeutics (P&T) Committee.

• The P&T Committee consists of physicians and pharmacists

dedicated to providing patients with high-quality, costeffective drug therapy.

• The P&T Committee meets regularly to maintain an up-todate and comprehensive formulary that follows current

medical practices.

• Drugs are selected for addition to the formulary after

considering safety, efficacy, uniqueness and cost.

7

From P&T to Value Analysis

the Purpose of a Product Formulary

• A product formulary is a component of a larger supply chain strategy.

• What do you want it to do?

– A formulary can identify opportunities for standardization.

• On formulary vs. Off formulary spend.

– A formulary can be the tool requestors use to source products.

• What is the right product to buy.

– A formulary can help control inappropriate spend.

• If it isn’t in the formulary, you can’t order it. (locked formulary)

• Two Types of formularies:

– Driver (proactive approach)

– Control (reactive approach)

8

Driver Formulary

• Premise 1: In the past year the hospital has purchased

everything they have needed to do everything they have done.

• Premise 2: No one has died in the halls nor been sent home

due to the lack of supplies needed to treat them.

• Steps:

– Capture and classify all existing items in the item master file

as either “in formulary” or “out of formulary”.

– All repeat specials will be identified and added to item

master and classified.

– Develop reports to identify areas of opportunity.

9

Control Formulary

• Premise 1: An active value analysis committee is in

place.

• Steps:

– Capture “In Formulary” and “out of Formulary”

products as a result of a the value analysis

process decisions.

– Formulary will grow as more projects are

completed and more areas are standardized.

10

Clinical Buy In

• Driver Formulary: Original classification is based

primarily on financial criteria.

– Once areas of opportunity are identified, the buy in

comes during the value analysis or

standardization work where we normally seek buy

in.

• Control Formulary: Buy-in is accomplished during

the value analysis or standardization project work.

– Products are not classified until agreed upon by

teams.

11

How to categorize

• Preferred / Non- preferred status: To identify the products that have

been reviewed, and approved for primary use.

• In general terms, a preferred product is the product you want the

vast majority of your clinicians and MD’s using the vast majority of

the time.

•

“Clinical Equivalency” (an MD determination) the product that

provides the most beneficial financial impact will be assigned

“preferred” status.

• Other clinically equivalent products in the same category may be

assigned “non-preferred” status. This may be dependent upon

contracting strategy.

12

How to categorize “Preferred”

• Any product linked to a market share agreement (volume or $) of

50% or greater commitment should be assigned “Preferred” status.

• Any item that is determined to have a superior clinical benefit for

majority of patients, and is recommended as the clinical standard

for all users should be assigned “Preferred” status.

• Any product that is required for existing Capital equipment should

be flagged as “Preferred.”

• “Preferred” status is based on the assumption that all similar items

will be removed specifically if they provide a lesser clinical value,

and that attempts will be made to enter into some type of beneficial

contract on the “preferred” product.

13

How to categorize “Non-preferred”

• Any product that is approved for use as an exception, i.e. this is

only used in specific clinical situations will be assigned “nonpreferred” status.

• Any product approved for a specific MD, when a preferred product

exists in that product category will be assigned “non-preferred”

status.

• Any item that does not meet “preferred” status will be assigned

“non-preferred” status.

14

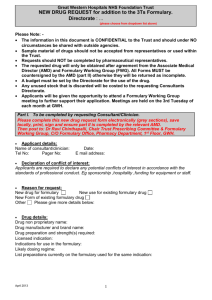

Supply Formulary Business Rules

• Any item add that is generated out of the value analysis process

should have its preferred status entered, and if it is replacing

and existing product, the existing products status should be

reviewed and modified as needed.

• Any routine item add that doesn’t replace an existing item

should have a status entered based on criteria above.

• Any item that is being added to an existing contract should have

a status added or modified to duplicate other items within the

same contract or product family on that contract.

• Any Mass Contract changes should have a status entered for

each item, and any items being replaced should have their

status reviewed and changed as is appropriate.

• Basically, anytime we add, remove, or change and item, the

preferred status needs to be reviewed.

15

Maintaining a Supply Formulary

• Strict business rules must be maintained.

– Who can enter or change status

– What process must be applied to make changes

• Status should be applied at the item level.

– Not all items on a contract may be determined to be

“preferred” just as items not on a contract or on a competing

contract may be classified as “non-preferred”.

• Lawson users can add this as an item attribute.

• If this is not an option, a separate database will need to be

maintained to house the formulary classification.

16

Supply Formulary Use

• Used primarily at the Materials level to:

– Identify areas of opportunity or where there is a

significant amount of “Non-preferred” spend.

– Supply chain staff or value analysis teams can

focus on Non-preferred spends and determine if

there is financial or contractual benefit to target

for standardization.

– Once standardized, move to the elimination of all

non-preferred items and prohibit their being

ordered.

17

Supply Formulary Value

• Identifies areas for review and possible standardization.

• Flags departments or locations that are not purchasing

“Preferred” products.

• Allows tracking of “Preferred” vs. “Non-preferred” spend

as a metric.

• Provides an organized “Preferred” list of products for

clinician use and ordering.

• Utilizes a systematic approach to supply management.

18

Thank You

Dee Donatelli

Vice President VHA

Performance Services

ddonatel@vha.com

19