12.1 P A - Accounting7.com

advertisement

Problem:

The following data have been taken from the accounting records of Lam Electronics Corp. at December

31:

END OF

YEAR

Balance sheet account:

Accounts receivable………………………………………………

Accrued interest receivable…………………………………..

Inventories…………………………………………………………….

Short-term prepayments……………………………………….

Accounts payable (merchandise supplies)…………….

Accrued operating expenses payable…………………….

Accrued interest payable……………………………………….

Accrued income taxes payable………………………………

Income statement amounts:

Net sales………………………………………………………………..

Dividend income……………………………………………………

Interest revenue……………………………………………………

Cost of goods sold…………………………………………………

Operating expenses………………………………………………

Interest expense……………………………………………………

Income taxes expense…………………………………………..

$ 600,000

6,000

800,000

20,000

570,000

65,000

21,000

22,000

BEGINNING

OF YEAR

$ 720,000

4,000

765,000

15,000

562,000

94,000

12,000

35,000

2,950,000

104,000

70,000

1,550,000

980,000

185,000

110,000

Additional information:

1) Dividend revenue is recognized on the cash basis. All other income statement amounts are

recognized on the accrual basis.

2) Operating expenses include depreciation expense of $ 115,000.

Instructions:

Prepare a partial statement of cash flows, including only the operating activities section of the

statement. Show supporting computations for the amounts of:

1)

2)

3)

4)

Cash received from customers.

Interest and dividends received.

Cash paid to suppliers and employees.

Interest and income taxes paid.

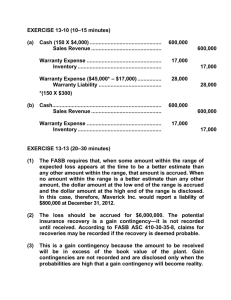

Solution:

1) Cash received from customers.

Cash received from customers =

=

=

2) Interest and dividends received.

Interest and dividends received =

=

Net sales {+Decrease in AR or –Increase in AR}

2,950,000 + 120,000

3,070,000

Interest revenue + Dividends income {+Decrease in

relating Receivable or –Increase in relating Receivable}

70,000 + 104,000 – 2,000

172,000

3) Cash paid to suppliers and employees.

Cash paid to suppliers and employees =

=

=

A. Cash payment for purchases

=

B. Cash payment for employees

=

=

=

=

=

4) Interest and income taxes paid.

Interest and income taxes paid =

=

=

Cash flows from operating activities:

A+B

1,577,000 + 899,000

2,476,000

COGS {+Increase in inventory –Decrease in

inventory}{+Decrease in AP or –Increase in

AP}

1,550,000 + 35,000 – 8,000

1,577,000

Expenses {-Depreciation and other non-cash

expenses} {+Increase in related prepayments or

–Decrease in related prepayments} {-Increase in

related accrued liabilities or +Decrease in

related accrued liabilities}

980,000 – 115,000 + 29,000

899,000

Interest expense + Income taxes expense {+Decrease in

related accrued liabilities or –Increase in related

accrued liabilities}

185,000 + 110,000 + 4,000

299,000

1. Cash received from customers…………………..…………..

2. Interest and dividends received………..……………………

Cash provided by operating activities…………….

3. Cash paid to suppliers and employees………….……….

4. Interest and income taxes paid…………………..………….

Cash disbursed for operating activities………….

Net cash flows from operating activities…………………….

$ 3,070,000

172,000

$ 3,242,000

(2,474,000)

(299,000)

(2,773,000)

$ 469,000