Retail Strategy - Cloudfront.net

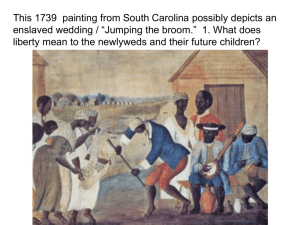

advertisement

Dec Retail Strategy Selfridges & Co vs. Liberty & Co A comparison of two major high street department stores Amir Gill, Emily O’Donnell, Hajarah Namulondo, Myles Atkinson 10 Table of Contents Executive Summary ........................................................................................................... 3 Introduction ......................................................................................................................... 4 External Environment ....................................................................................................... 5 External macro environment..................................................................................................... 5 Political, legal, government environment ................................................................................. 5 Economic/ Financial environment............................................................................................. 6 Marco Social/Cultural Environment .......................................................................................... 6 Technological environment ....................................................................................................... 8 Market Competition .................................................................................................................. 8 Internal Environment ....................................................................................................... 9 Retail Mix ................................................................................................................................... 9 Resource Mix ........................................................................................................................... 12 Recommendations........................................................................................................... 15 Bibliography ...................................................................................................................... 16 2 Executive Summary The external environment affects how Selfridges and Liberty are able to trade their products. Having no control over such factors, the stores have to work around these influences and compete more specifically through their positioning. When the macro-environment changes – whether it is for better or for worse – it will essentially affect the stores equally because both are UK-based stores. However, the two retail stores have different aims and therefore go about this external-environment differently in order to stay in line with the desire of their specific target audience; while Selfridges tends to be the more busy, ‘up-and-coming’ and modern-technologically focused of the two, Liberty tends to focus more on conserving their image and reputation rather than getting too caught up in the macro-economic factors. Internally, the retail mix reflects the brand identity. Selfridges targets the wide audience, with their prime location and more general assortments; the store therefore communicates an energetic and busy feel. On the other hand, Liberty positions itself to the specific, premium, and strictly high-end market; the store, therefore, has a relaxed, ‘living room’ ambience. Selfridge’s branding review in the 1990’s, found them competing directly with Liberty for premium stockists. Nevertheless, Liberty is still renowned for their excellent ties with designers and has access to more exclusivity in the designer-market. After analysing both of the strategic aims of the two stores through their external and internal opportunities. It was found that Selfridges should endeavour to broaden its target market to become more resilient to market fluctuations. Both stores should embrace the multi-cultural UK society by incorporating religious celebrations from minority groups into the business model. They should continue to develop their USP to improve differentiation and maintain their market share. Both stores should also continue to develop their integration of technology by incorporating new payment methods and continuing to develop their online communication 3 Introduction The aim of this report is to compare two of the UK’s leading department stores by first analysing their external environment and how each organisation accommodates issues outside of their physical control. From here we will look into the internal environment and what strategies each organisation uses to differentiate from its competitors and maintain market share. Once these areas have been analysed we will have a thorough understanding of the industry, which we can utilise to create a definition of the businesses and put forward recommendations for the future. The first store contained in the report is Liberty & Co, which was founded by Arthur Lasenby Liberty in 1875. The store grew rapidly selling ornaments, fabric and objects d'art from Japan and the East. By 1885 the store had expanded into fabric, carpets and furniture, and become one of the most fashionable places to shop in London. The store has since expanded to sell cosmetics, accessories and books. Since 1988 Liberty has sold Liberty branded products in Japan through selected retailers as well as providing signature Liberty fabrics to fashion houses and manufacturers worldwide. The other store for comparison is Selfridges & Co founded by American H. Gordon Selfridge. The key philosophy was to make shopping a fun adventure rather than a chore. Many of the ideas first displayed at Selfridges are used uniformly today by its competitors, such as touchable merchandise. The flagship store is accompanied by two Manchester outlets, and a Birmingham outlet, with land and planning permission held in Glasgow. 4 External Environment External macro environment Although the business may have no control over the environmental factors covered in PESTLE, the business can ensure that they are positively monitored in order to keep their target audience or markets positive. Liberty and Selfridges has corporate social responsibilities that the businesses follow with aims to be an environmentally responsible companies, working with customers, people, partners, suppliers and communities on combating climate change, managing waste, safeguarding natural resources and trading ethically.1 Political, legal, government environment The political environment has a huge influence upon the regulation of businesses, and the spending power of consumers in many ways. For example regulation and de-regulation trends, social and employment legislation, tax policy, and trade and tariff controls. Visa restrictions or delays are one political factor that is affecting the way Liberty and Selfridges trade their products. Datamonitor 2010 suggests that the UK could be losing potential foreign visitors to other European countries due to visa restrictions. Tourists visiting Europe have to apply for a separate visa for the UK, which could put off potential visitors. If the holiday visa application form were made simpler and easier for tourists, we would expect to see visitor levels and tourist expenditure rise. Trade and tariff controls are also making it harder for organisations to trade, as countries can make it difficult for firms to import or export products by imposing restrictions and interfering with the way businesses operate. Regardless of the above the UK import in clothes has been rising since 2005 (see appendix 10). The idea of VAT moving to 20% would not have a major affect on sales. However as this is likely to be part of regaining economic stability, it will affect the businesses profits. That is to say because of the currently economic condition (consumers are already facing a strong curb on liquidity with pay effectively lower than previous years) the VAT increases will draw consumers away from visiting the business in favour of shopping online. Online retail improved 14.6% in January year on year with high street shops only reporting 1.2% improvement on average. This does indicate a consumer trend towards increased online retailing.2 The reduction of disposable income such as the ending of EMA (Education maintenance allowance), the proposed increase in student fees and the restructuring of income tax will affect the businesses operation. Ending of EMA 1 2 http://www.selfridges.com/en/StaticPage/Environment/?msg= Datamonitor 5 and increasing student fees will affect the way the organisations target group spends on products; this will mean that they will not be able to afford expensive products from bigger department stores resulting in the purchase of cheaper substitute products. Furthermore, disposable income is at its lowest level for a decade, people have far less of that money to spend each month after they have paid their overheads even though the average household gross income has climbed over the past decade from £34,796 to £53,8353. Economic/ Financial environment One of the factors that affect both Selfridges and Liberty’s consumers is the level of real disposable household income. This is the most important factor in determining the way we spend (Appendix 1). John Maynard Keynes developed a theory of consumption that focused primarily on the level of people’s disposable income in determining their spending. The rate at which consumers increase demand as income rises is called the marginal propensity to consume. In the last three years the economic environment has been affected by the economic collapse. This has resulted in many people losing their jobs or a decrease in their hours of work, as a result less income was gained in most households, which meant that most people had to spend less in order to be able to pay off their overheads. The above is known as income elasticity demand; this measures the way businesses respond to the quantity of products demanded to the change of consumer’s income. The more a consumer makes (income elasticity), the more they will demand a desired product and will be willing to pay more for it. (Appendix 2) Regardless of the recession, Selfridges and Liberty reported an increase in profits at the end of 2009, where Selfridges’ sales rose by 6% to £809 million and profit grew by 8% to £88.1 million in the year ended 31 January 20094 where as Liberty 20% revenue uplift to £59.6m against £49.9m last year, and flagship store sales were 18% higher at £37.3m against £31.5m a year earlier.5 The emergence from recession will affect the business in different ways; the main problem that the businesses will face is the illiquidity of the market, i.e. there is very little available cash in the market. That’s to say the banks will not be able to lend money to businesses or consumers and as a result plans for future expansions or product innovation will be affected. Marco Social/Cultural Environment Consumer’s religious beliefs can influence the way they perceive the business. 3 4 Datamonitor http://www.selfridges.com/en/StaticPage/Corporate/?msg= 5 http://www.liberty.co.uk/pws/images/investor/Dec_2009.pdf 6 The New West End Company reported that Middle Eastern shoppers spent £200m in the six week run up to Ramadan in 2009 and it expects this to grow by 20% in 2010, making this customer base crucial for department stores’ sales over the summer period.6 Datamonitor claims that Ramadan enabled Selfridges department store to put pressure on its competitors such as Libertys, Harrods, Harvey Nichols and the rest of the high street by bringing their summer price cut period forward in order to clear stock and make room for full price Autumn/Winter ranges, which Middle Eastern shoppers traditionally prefer to buy into. Liberty did not pay attention to the Ramadan period as they concentrated on traditional trends, which resulted in opportunity costs. The prohibition of the Burka in France could benefit Liberty and Selfridges, that’s to say under the French president’s ruling, Muslim women are now banned from wearing the full body veil with either a lace eye window or a full-face veil with a slit for the eyes. (Appendix 7) This could augment the number of Middle Eastern tourists visiting the UK every year, which can enable Selfridges and Liberty to boost sales by stocking the Burka. Another social economic factor that can have an impact on the demand for Liberty and Selfridges products is consumer’s life style, for example some consumers prefer paying someone to shop for them instead of them walking up and down the store. Datamonitor (2010) reports that over the last 10 years personal shopping has become an important service for department stores to offer customers, with older shoppers remaining a key customer base for department stores – in 2010 55+s made up 42.9% of all department store shoppers. With women working longer hours in more professional roles this demographic has a lot of spending power. Selfridges & Libertys have always got professional stylists on hand to offer fashion and beauty advice to customers, advising them of style, fit, colour themes and other key trends for the season. They usually offer this service for free, which makes the customers feel looked after which results in their loyalty to the business. Furthermore, adding entertainment and lifestyle pleasures such as restaurants, nail bars, spas, hair salons and personal shopper suites can keep customers in store for longer by enabling shoppers to enjoy different types of leisure entertainment under one roof. Both Selfridges and Liberty have a variety of food and drink formats such as self-service cafés and more formal restaurants, meeting the needs of shoppers in a hurry or those wanting a leisurely experience. (See Appendix 9) 6 http://www.newwestend.com/ 7 Technological environment The technological environment analysis details the changes in technology, which may perhaps force the business to shift towards the changes or away from the changes. The rapid growth in technology has dictated the way Selfridges and Liberty operate that’s to say both stores have an online presence (Appendix 3&4). Online presence has enabled the businesses to reach a large number of existing or prospective consumers at any location or in the comfort of their own home through click and deliver (Appendix 3&4). Although the use of online shopping has had an advantage for the businesses in terms of gaining consumers, this can also affect the businesses profits. If consumers come in the store to purchase one intended item, their physical presence in the store could attract them to buy more items than they would have using online shopping. An introduction of click and collect will enable both stores to combine the convenience of online shopping with getting their consumers in store to collect, encouraging impulse purchases. (Datamonitor2010). Since both department stores are in one of the UK’s biggest areas for tourists with a high footfall, it is essential that stores cater for their needs at all times especially during peak visiting periods to ensure potential sales are maximised. In June 2010 Selfridges started to accept the CUP card – China’s sole bankcard that many other UK department stores including Liberty currently do not accept (Appendix 5). Selfridges Managing Director reported that the store accepting China’s sole bankcard has increased the number of Chinese tourists by 130% at the luxury department store in its 2009/10 financial year. If Liberty wants to maximise sales, the store has to keep up with the rapid growth in technology in order to keep ahead of competitors. Liberty can prepare for the 2012 Olympics when large numbers of tourist are expected to visit the UK for the games, which will give the store an opportunity to gain new customers. Other technical advances have enabled both stores to social network with consumers through the use of sites such as Facebook, Twitter, Blogging, regular newsletters, and interactive display windows. These are a great method of engaging with the next generation of shoppers and building customer loyalty, while functionality improves the accessibility of the brand and can encourage sales if the purchase process is easy for the customer. (Appendix 6) Market Competition The retail industry is renowned for being one of the most competitive industries to operate in due to fluctuating consumer demand, seasonal trends, and the sheer number of competitors. Direct competitors for Selfridges and Liberty would be other established department stores such as Harvey Nichols, John Lewis, Debenhams as well as specialist department stores Dover Street Market and the popular Harrods organisation. With the main indirect competition coming from Primark and Topshop who are located in the 8 immediate area. Selfridges can mitigate some of this competition due to the range of merchandise it supplies being far greater than some of the competition such as Liberty and Dover Street Market, where these stores have opted to be more specialist in order to gain competitive advantage. The key to maintaining and increasing market share in the central London retail industry is differentiation and brand image. Selfridges aim to appeal to a younger market with a high disposable income through the use of an energetic and metropolitan corporate image, the core of which is the pantone 109 colour scheme. Liberty differentiates itself by creating an individual in store aesthetic and exploits its history as a leading retailer to convey is corporate image, with the use of deep purple, and earth tones. A strong brand identity will ensure market recognition and therefore greatly help in retention of market share as the organisation becomes part of the consumers evoked set. Both organisations further differentiate themselves from the immediate competition in the Oxford Street area by using a higher pricing strategy than that of John Lewis, Debenhams and indeed Topshop and Primark. This strategy seems to payoff, as figures from 2009 show that despite having far fewer outlets than their rivals, Selfridges and Liberty generated sales of £94.5m and £32m on average per store, respectively (Mintel), putting them ahead of the likes of Harvey Nichols and Debenhams. Internal Environment Retail Mix The general merchandise assortment within Selfridges is very wide, carrying a great depth in assortments of luxury brands, often arranged into separate boutiques within each department. On the other hand, the merchandise assortment within Liberty is not quite as wide, and the depth is a bit shallower. For example, within the Selfridges clothing department – consumers can shop for Topshop/Topman (small-medium width, small depth) additionally, designer shopping – like Burberry (large width, large depth) is also an option. However, in the Liberty clothing departments, it is designer selections (large width, small depth). Liberty holds a renowned haberdashery, one department Liberty has that Selfridges does not. 9 General Merchandise & Service Assortment Department/Product/Service Clothing Accessories Cosmetics Footwear Lingerie Furniture Children’s Clothing Toys Cookware Restaurants Spa Stationary Jewellery Sweets Books Travel – Agency & Luggage Electronics Gallery Seasonal Section HMV Haberdashery Selfridges Liberty The pricing position within Selfridges is mid-high, with a tendency towards high. At Liberty, the pricing position is strictly high. A wider range of consumers could walk into Selfridges and buy merchandise, whereas the market for Liberty is placed at a higher and more specific/prestigious level. In Liberty, the prices were not as flaunted and were mostly hidden; the target market for Liberty is less concerned with the price and more concerned with the exclusive experience and premium goods/services. The location of Selfridges is very primary – Oxford Street – where it is hard for consumers to miss and flowing along with the many shops located on Oxford Street. Conversely, Liberty is in a secondary location – Carnaby Street – set back and would not be easily seen or found by a consumer who was not specifically looking for the store. Strategically, this location does work for the type of merchandise and more specific target market at Liberty – where the majority of the consumers go out of their way to get the premium selections available there. 10 VS Within Selfridges, facilities offered include parking (where your purchases can be delivered to the car), doormen, restaurants, spa, the option for a personal shopper, a barbershop and a gallery. Following the ‘exclusive’ description of Liberty offerings, the facilities include the option for a personal shopper, a barbershop, restaurants, champagne bar, and a gallery. It seems in Liberty their offerings are more premium and focused, while Selfridges has more offerings, they are broader and there seems to be less of a premium feel. The escalators are the main way for the consumers to get from one floor to another in Selfridges, whereas in Liberty the stairs were a part of the ambience, with the option to take the elevator as well. The escalator facilities within Selfridges are clearly built for the massive amounts of people that Selfridges attracts, whereas the stair/elevator facilities within Liberty is left the way it has been for the traditional and ‘living room’ feel it seeks to convey. VS The ambience/image given off by Selfridges’ general setup and communications is a crisp energetic, professional/sophisticated, and high-end feel. Selfridges uses the original features of the building to its advantage; the original columns create a classical feel for the store, while the bright LED lighting keeps it modern at the same time. In addition, Selfridges has extravagant seasonally influenced window displays that are mainly directed towards women; these displays attract much attention from passer-bys. Selfridges’ store layout is very strategic; for example, the perfume counter is placed front and centre on the ground level and all the newest merchandise is put on display. The displays are crisp, bright, and are focused on showing the product as best as possible. In Liberty, the ambience is more traditional, where the features of the store communicate its’ quality, premium offerings, and exclusiveness. 11 VS Libertys doesn’t communicate its’ brand as much as Selfridges – a customer could walk the store without noticing the brand. The store is comfortable to browse and their focus is not on throwing advertisements in the faces of the consumers, but to create an at ease environment for the shoppers; its’ three open spaces, surrounded by smaller rooms make the experience more relaxed and “at home.” The displays give a ‘classic shop’ feel and they are not only focused on displaying the product, but also making the store feel like a living room rather than a store. Both department stores communicate quality with their products; the difference is the fact that Libertys holds more premium designer product that cannot be found in Selfridges. Additionally, the shopping bags of Selfridges communicate their youthful and energetic, yet still professional and sophisticated approach, whereas Libertys shopping bags communicate their more discreet, laid back, and premium approach. 7 VS 8 The layout in terms of signs and services within Selfridges is much more clear and accessible. In Liberty, the fire exit signs are clear; however, Selfridges’ signs make it much easier to find an extinguisher, A.E.D, and even the bathroom facilities. With this information, it is obvious that Selfridges is the more ‘tourist’ market driven of the two places; it is large-scale and attempts to attract the bulk of the public, while Liberty wants to appeal to the keen, specific and up-scale shoppers. Resource Mix The competition for land is unlikely to be a factor for these two central London stores, as the are unlikely to physically expand there central London presence. Liberty has its single store on Carnaby Street, Whilst Selfridges has a primary location on Oxford Street. More of a concern will be the rising business rates of the area, and property rent (should they not already own the premises) given the primary location of the two stores. Selfridges and Liberty compete directly 7 8 http://domesticali.typepad.com/.a/6a00e54fad366988330120a4c8a478970b-500wi http://www.juliegartha.com/wp-content/uploads/2009/11/Selfridges-1024x768.jpg 12 for premium stockists in order to attract the lucrative young, high-spending customers. Selfridges underwent a huge branding review in the 1990’s investing £160million9 in redesigning the brand identity, transforming the image from dowager, to metropolitan and energetic. This brought them into closer competition with Liberty who were already stocking premium brands, but with a more conservative identity. The battle for premium stockists is mainly fought between the fashion buyers of each store and the relationship they can create with the stockist. Although the new identity of Selfridges and its larger retail space has enabled them to secure a large width of merchandise assortment in each retail sector, it is argued that Liberty actually has a better relationship with its stockists. This is shown in the fact that it is often Liberty who is chosen to stock Limited Edition products such as the To Ki To collaboration with Barbour. Liberty is also able to negotiate a better price for the customer in its store, in comparison to Selfridges where the price for designer products is often slightly higher, for example a men’s Burberry London Pea Coat retails for £695 at Liberty and in the Burberry Store but at Selfridges it retails for £725. That said, Selfridge can benefit by stocking a greater width of brands due to its greater size, and can also boast of collaborations with key brands, for Selfridges 100th birthday brands such as Converse, Fender, Ralph Lauren, Coke, Blackberry and Levi all released birthday editions in Selfridges signature pantone 109. During a recession it is essential that both organisations retain and develop a quality workforce in order to adapt to more intense competition for the disposable income of its customers and indeed retain its customer base. In order to attract and retain skilled workers both organisations offer a training scheme and staff discount package, with Liberty offering employees staff discount, online appraisal to increase chances of promotion from within and encourage a strong work ethic, in house training, and probably most importantly a 3% commission scheme to encourage salesmanship and retention of its staff10. Liberty was voted ‘best retail store in London’ by Time Magazine, which may also attract people to work there. Selfridges however seem to be pursuing the development and retention of staff more aggressively, with an estimated 4000 employees in its London store alone (Fame, 2010). They too offer staff discount but also offer a health scheme, a pension scheme, performance and loyalty bonuses, long holiday entitlement that increases with loyalty to the organisation, they educate their staff heavily by providing weekly training workshops and encouraging and supporting employees through further education11. It is therefore clear Selfridges is trying to market itself as a ‘job for life’. However despite Selfridge’s greater width of career benefits it could be argued that Liberty’s benefit package is more effective at motivating its workforce as during the 2009 recession Selfridges sales rose by 6% and its revenue by 8% in comparison to Liberty where sales were up 18% and profit rose by 20%12. 9 http://www.brandchannel.com/features_effect.asp?pf_id=5 www.liberty.co.uk 11 www.selfridges.com 12 datamonitor 10 13 In 2003, the Weston Group bought Selfridges for £600m, which benefits from a wide industry spread from biscuits to clothing. This wide spread allows Selfridges to benefit from reduced financial risk as well as economies of scale as the group also owns retailer Brown Thomas of Ireland. The Weston Group shelved plans to invest in developing more locations for the Selfridges brand in favour of renovating the flagship store in 2003, as it was recognised that this is the main source of revenue for the brand. Liberty & Co operates as an organisation traded on the FTSE 100 with a pre recession stock high of 128.69 per share13. However this form of generating investment revenue obviously poses significant financial risk to Liberty as they are more greatly affected by changes in the global economy. Liberty attempted to create satellite stores by opening a Liberty of London on Sloane Street in 2008 but this store was closed by June 2009. The Liberty of London label has remained active through other ventures, such as discount collaboration with American discount fashion chain Target. Selfridges and Liberty are increasingly using technology to improve the retail experience and communicate with their customers. Liberty lead the way by introducing the first interactive display window in collaboration with leading fashion blog ShowStudio where customers and passers-by were able to photograph themselves and the winning outfit from the campaign received a prize. For the current Christmas season Selfridges created an interactive window where passers-by could interact with the new Xbox Kinect. Both stores are also increasing the efficiency of the purchase process by introducing Chip & Pin throughout their stores as well as incorporating e-commerce into the business. Undoubtedly the next advancement will be the introduction of RFID technology into the payment process, which will speed up point of sale transactions and reduce queue times, making purchasing more efficient for the consumer. This technology is already available when using BarclayCard in some retailers such as Prêt-A-Manger. Liberty and Selfridges assort their merchandise in contrasting manners. Selfridge prefers to use rails and hang key items for clear display, whilst also drawing attention to these key pieces. In contrast Liberty opt for a more aesthetic approach, incorporating the merchandise into the store by displaying items on tables and in cabinets with less use of the traditional rail, and very few manikins. And in both stores, each department is divided up to differentiate the different product offerings on sale and to make each section of the store look unique. There is no definitive answer to which use of resources is more effective as its felt each strategy will appeal to customers on an individual basis, and improve the stores differentiation. 13 Financial Times 14 Recommendations In summary of this report, it is felt that Selfridges needs to broaden its target market due to the reduction of disposable income in its target ‘youth’ market, from factors such as the VAT increase, restructuring of tax brackets, ending of EMA and increase in tuition fees. This point is reiterated by the comparative sales percentages for 2009 where Liberty performed markedly better than Selfridges due to the financial resilience of its customers. The report also identifies that given that the UK is one of the most multi-cultural societies in the world, both organisation are doing very little to exploit this to their advantage. The organisations need to move away from a traditional western retail calendar based on Christian holiday periods towards a more integrated calendar that incorporates holidays and celebrations from all of the leading religions and cultural groups, as demonstrated by Selfridges success with Ramadan. Both stores can secure market share by continually creating a unique selling point through differentiation from competitors. Selfridges, given its exciting brand image and superior size and service offering should aim to communicate itself as an experience-shopping destination. Where customers can spend the whole day being groomed in the spa or hairdressers, perusing the merchandise assortment, and lunching in one of the many eateries before retiring for the evening with ingredients purchased from the food hall. Whereas Liberty given it’s brand history and reputation for premium service should market itself as a destination store where customers can utilise the premium service and knowledge available from employees and benefit from the exclusive products that Liberty can offer. Liberty & Co operates a risky investment strategy by flotation on the stock market, in order to spread risk in the emergence from the recession, and create brand awareness early in a younger market (it’s future customer base) Liberty & Co should aim to develop the almost defunct Liberty of London label through specific collaborations with more affordable or more widely recognised brands. In view of the Olympics both organisations should aim to increase their online presence so as to fully exploit their wider international recognition, and increase payment flexibility through the introduction of RFID technology and major payment methods such as Selfridges accepting the CUP card. Selfridges should also aim to introduce a commission scheme as this is undoubtedly helping Liberty to maintain its growth despite the recession. 15 Bibliography Unknown. (2010). Selfridges Brand | Retail Clothing | brandchannel.com. Available: http://www.brandchannel.com/features_effect.asp?pf_id=5. Last accessed 13th December 2010. Levy, M. Weitz, B (2008) Retail Management. 7th Ed. McGraw Hill Berman, B. Evans, J (2006) Retail management a Strategic Approach, 10th Ed. Prentice Hall McGoldrick, P. (2002) Retail Marketing, McGraw Hill Datamonitor Research Store, (2010). UK Department Stores 2010. [online] Datamonitor. Available from: <http://www.datamonitor.com/store/Product/toc.aspx?productId=DMVT 0658> [Accessed 16/11/10]. Fame, (2010). Detailed Information on UK and Irish Companies. [online] BUREAU VAN DIJK. Available from: <https://fame2.bvdep.com/version-2010126/Report.serv?context=L0KX 62PRD7CYPLL&_cid=134> [Accessed 28/11/10]. Liberty PLC, (2009). LIBERTY PLC: FINAL RESULTS FOR 12 MONTHS TO 31 DECEMBER 2009. [online] Available from: <http://www.liberty.co.uk/pws/images/investor/Dec_2009.pdf> [Accessed 27/11/10]. Mintel Oxygen Report, (2009). Table listing for Department Store Retailing - UK - January 2007. [online] London: Mintel International Group Ltd. Available from:<http://academic.mintel.com/sinatra/oxygen_academic/search_res ults/show&/display/id=220227/displaytables/id=220227> [Accessed 16 05/12/10]. Selfridges & Co, (2010). The Business. [online] Available from: <http://www.selfridges.com/en/StaticPage/Corporate/?msg=> [Accessed 25/11/10]. Selfridges & Co, (2010). Environment. [online] Available from:<http://www.selfridges.com/en/StaticPage/Environment/?msg= > [Accessed 25/11/10]. (2009). Liberties Shopping Bag. [online image] Available from: <http://domesticali.typepad.com/.a/6a00e54fad366988330120a4c8a47 8970b-500wi> [Accessed 06/12/10]. (2009). Selfridges Shopping Bag. [online image] Available from: <http://www.juliegartha.com/wp-content/uploads/2009/11/Selfridges-10 24x768.jpg> [Accessed 07/12/10]. 17