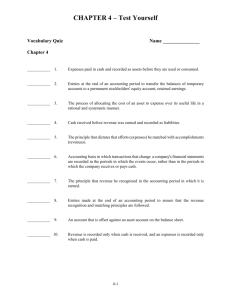

CHAPTER 3 Measuring Business Income: The

advertisement

CHAPTER 3 Measuring Business Income: The Adjusting Process Chapter Outline At the beginning of Chapter 3, the importance of financial statements for measuring net income is explained and linked to the accounting cycle, which had been introduced earlier in the textbook. Before the first Learning Objective is introduced, the key time-period assumption and accounting period are examined. A. Time-period assumption 1. The time-period assumption ensures that accounting information be reported at regular intervals. 2. It defines the accounting period and interacts with the revenue- and expense-recognition criteria to underlie the use of accruals. B. The accounting period for most business is one year. At this time, a business measures its income. 1. Some businesses use the calendar year—January 1 to December 31. 2. Other businesses use a fiscal year with a year-end usually corresponding with a low point in business activity. 3. Interim periods are less than a year. Monthly, quarterly or semiannual periods are the most common. Learning Objective 1: Apply the recognition criteria for revenues and expenses A. Revenue Recognition 1. The revenue recognition criteria states that revenues are recorded when earned. Revenue is earned in most cases when the business has delivered a completed good or service to the customer. 2. The amount of revenue recorded equals the cash value of the goods or services transferred to the customer. B. Recognition criteria for expenses 1. The matching objective directs accountants to identify all expenses incurred during the accounting period; measure the expenses and match the expenses against the revenues earned during that period. 2. Expenses (example: sales commission) with a natural link to revenues will be matched against the revenue of a period. Other expenses (example: rent) that are not easily linked with a particular sale will be identified with a particular time period. Because of these concepts, special journal entries, called adjusting entries, must be recorded to ensure that all revenues and expenses for the accounting period have been properly recorded. Learning Objective 2: Distinguish accrual-basis accounting from cash-basis accounting A. To measure income, businesses must apply accounting principles and concepts, such as accrualbasis accounting, the accounting period, the recognition criteria for revenues and expenses. 1. 2. In accrual-basis accounting, the accountant enters the transactions when the business performs a service or incurs an expense, not when cash has been received or paid. (Exhibit 3-3 compares the accrual basis and cash basis of accounting.) Accrual-basis accounting provides more complete information. 2 3. 4. Only very small businesses use cash-basis accounting. In cash-basis accounting, cash receipts are treated as revenues, and cash payments are treated as expenses. Three concepts used in accrual basis accounting are the accounting period, the recognition criteria for revenues and expenses, and the time-period assumption. Learning Objective 3: Make adjusting entries A. Adjusting entries assign revenues to the period in which they are earned and expenses to the period in which they are incurred. They are needed to measure properly the period’s income on the income statement and bring related asset and liability accounts to correct balances for the balance sheet. (The information provided in the unadjusted trial balance in Exhibit 3-4 is used in all of the detailed examples to illustrate the adjusting entries.) B. Adjusting entries can be divided into prepaids (deferrals) and accruals. Exhibit 3-7 illustrates the prepaid- and accrual-type adjustments. 1. Prepaid-type adjustments are needed when the cash transaction occurs before the related expense or revenue is recorded. 2. Accrual-type adjustments are needed when the cash transaction occurs after the related expense or revenue is recorded. C. Adjusting entries can be divided into five categories: prepaid expenses, amortization, accrued expenses, accrued revenues, and unearned revenues. 1. Prepaid expenses (or deferrals) require adjustment because the cash is paid in one period, but the resource is not completely used until a later period. The text provides three examples: insurance, rent, and supplies. a. The entry to record the payment for the prepaid expense would increase the asset and decrease cash. Prepaid Insurance (Supplies) XX Cash XX b. The adjusting entry records an expense and a decrease in the asset; the entry reflects the amount expired or used up. Insurance (Supplies) Expense XX Prepaid Insurance (Supplies) XX 2. Amortization of property, plant and equipment and intangible assets is the allocation of the cost of a capital asset, except land, to expense over its useful life. (Exhibits 3-5 and 3-6 show two different presentations of capital assets.) a. Amortization is similar to prepaid expenses in that an asset is recorded when the plant or equipment is acquired. The asset is expensed as it is used. Both, in substance, are prepaids. The major difference is that prepaids usually expire within a year while plant and equipment assets remain for a number of years. Amortization Expense XX Accumulated Amortization XX b. As the asset is amortized, the asset’s book value declines. Book value is not the same as market value. Instead of reducing the asset account, another account, Accumulated Amortization, is used. 1) Accumulated amortization is a contra asset account; that is, an asset account with a credit balance. 2) The carrying (book) value of the asset is determined by the following formula: Carrying (Book) value = Cost of asset – Accumulated amortization 3 D. 3. Accrued expenses are expenses that are incurred by the end of the period but will not be paid until a later period. The adjusting entry records the expense and a liability. Salaries, interest, and taxes are examples of accrued expenses. The text uses the example of salaries to illustrate this topic. It is an example that many students should be able to relate to, as they have experienced being paid on a schedule – either a weekly, bi-weekly or monthly basis. That schedule wouldn’t necessarily correspond with the end of the month. Salary Expense XX Salary Payable XX 4. Accrued revenues are revenues that have been earned (because the good or service has been delivered) but not yet received. The adjusting entry records a revenue and a receivable. Interest and service revenue are examples of accrued revenues Interest Receivable XX Interest Revenue XX 5. Unearned revenues arise when a business receives cash in one period but does not earn all of it until the next period. Even though this is presented last, due to its level of difficulty, it is a prepaid (deferral) type of adjusting entry – the only difference is the cash is not paid in advance; rather the cash is received in advance. The cash is prepaid by the customer and the recognition of the revenue is deferred until it is earned. a. An unearned revenue is a liability because the business owes the customer a good or service. The receipt of the cash would increase cash and increase a liability. Cash XX Unearned Revenue XX b. The adjusting entry records the part of the unearned revenue that has been earned. Unearned Revenue XX Service Revenue XX In summary, each adjusting entry adjusts an income statement account--either a revenue or an expense. Each adjusting entry also adjusts a balance sheet account—either an asset or a liability. No adjusting entry ever adjusts the balance of Cash. (Exhibit 3-8 summarizes the adjusting entries and Exhibit 3-9 illustrates all of the adjusting entries and T-accounts for Hunter Environmental Consulting (HEC).) Learning Objective 4: Prepare an adjusted trial balance A. The adjusted trial balance is prepared after the adjusting entries have been journalized and posted. (Exhibit 3-10 shows the trial balance, adjustments, and the adjusted trial balance in work sheet form for Hunter Environmental Consulting (HEC).) B. The adjusted trial balance serves as the basis for the preparation of the financial statements. Learning Objective 5: Prepare the financial statements from the adjusted trial balance A. The financial statements are prepared using the account balances found on the adjusted trial balance. B. The income statement is prepared first, followed by the statement of owner’s equity, and then the balance sheet. C. The essential features of all financial statements are: 1. The heading of the statement, which includes: 4 a. b. c. 2. the name of the entity the title of the statement the date or period covered by the statement The body of the statement varies from statement to statement and depends on the purpose of the statement. The text explains this throughout the two sections under this Learning Objective. a. Income Statement reports the profit or loss; therefore, the body includes revenue and expenses. b. Statement of Owner’s Equity explains how equity changed in the year; therefore, the body includes all accounts impacting equity. c. Balance Sheet reports the financial position of a company at a specific point in time; therefore, the body includes all asset and liability accounts, plus the ending balance from the Statement of Owner’s Equity. D. The following relationships exist among the financial statements: 1. Net income calculated from the income statement is used in preparing the statement of owner’s equity. 2. The ending balance of the statement of owner’s equity is used in preparing the balance sheet. 3. Arrows in Exhibits 3-11, 3-12, and 3-13 illustrate these relationships. E. Accrual accounting provides some ethical challenges that cash accounting avoids. 1. Since expenses are not necessarily expensed when paid in accrual accounting, management can exercise some discretion when recording expenses. 2. Estimates must be used when recording amortization, accrued revenues, and accrued expenses. Unethical people can manipulate these estimates to reflect favourably upon their company. Learning Objective 6: Describe the adjusting-process implications of international financial reporting standards (IFRS) A. The adoption of IFRS for publicly accountable enterprises in 2011 will have no direct impact on the adjusting process. There is an impact on the way the financial statements are presented (covered in Chapter 4). B. The adoption of IFRS in Canada has caused some change in the way private companies record and report transactions and will be discussed in later chapters.