an application form for a Wandsworth Business Loan

advertisement

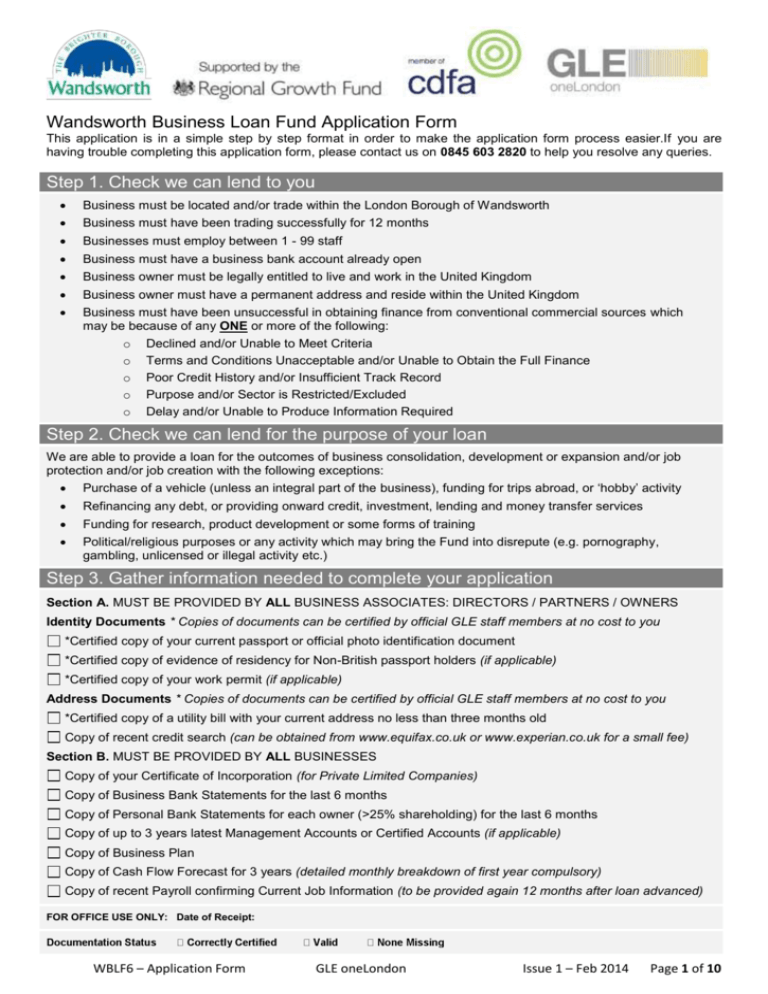

Wandsworth Business Loan Fund Application Form This application is in a simple step by step format in order to make the application form process easier.If you are having trouble completing this application form, please contact us on 0845 603 2820 to help you resolve any queries. Step 1. Check we can lend to you Business must be located and/or trade within the London Borough of Wandsworth Business must have been trading successfully for 12 months Businesses must employ between 1 - 99 staff Business must have a business bank account already open Business owner must be legally entitled to live and work in the United Kingdom Business owner must have a permanent address and reside within the United Kingdom Business must have been unsuccessful in obtaining finance from conventional commercial sources which may be because of any ONE or more of the following: o Declined and/or Unable to Meet Criteria o Terms and Conditions Unacceptable and/or Unable to Obtain the Full Finance o Poor Credit History and/or Insufficient Track Record o Purpose and/or Sector is Restricted/Excluded o Delay and/or Unable to Produce Information Required Step 2. Check we can lend for the purpose of your loan We are able to provide a loan for the outcomes of business consolidation, development or expansion and/or job protection and/or job creation with the following exceptions: Purchase of a vehicle (unless an integral part of the business), funding for trips abroad, or ‘hobby’ activity Refinancing any debt, or providing onward credit, investment, lending and money transfer services Funding for research, product development or some forms of training Political/religious purposes or any activity which may bring the Fund into disrepute (e.g. pornography, gambling, unlicensed or illegal activity etc.) Step 3. Gather information needed to complete your application Section A. MUST BE PROVIDED BY ALL BUSINESS ASSOCIATES: DIRECTORS / PARTNERS / OWNERS Identity Documents * Copies of documents can be certified by official GLE staff members at no cost to you *Certified copy of your current passport or official photo identification document *Certified copy of evidence of residency for Non-British passport holders (if applicable) *Certified copy of your work permit (if applicable) Address Documents * Copies of documents can be certified by official GLE staff members at no cost to you *Certified copy of a utility bill with your current address no less than three months old Copy of recent credit search (can be obtained from www.equifax.co.uk or www.experian.co.uk for a small fee) Section B. MUST BE PROVIDED BY ALL BUSINESSES Copy of your Certificate of Incorporation (for Private Limited Companies) Copy of Business Bank Statements for the last 6 months Copy of Personal Bank Statements for each owner (>25% shareholding) for the last 6 months Copy of up to 3 years latest Management Accounts or Certified Accounts (if applicable) Copy of Business Plan Copy of Cash Flow Forecast for 3 years (detailed monthly breakdown of first year compulsory) Copy of recent Payroll confirming Current Job Information (to be provided again 12 months after loan advanced) FOR OFFICE USE ONLY: Date of Receipt: WBLF6 – Application Form GLE oneLondon Issue 1 – Feb 2014 Page 1 of 10 Proof of Identity & Address Documents may be certified by any ONE of the following (some may charge): Government Department Employee (Jobcentre Plus Official, Police Officer, Teacher in current employment at a state school, Social Worker, Care Home Manager, Prison Governor, Probation Officer). Selected Post Office Counters, FSA Authorised Firms (Bank, Individual Finance Advisor, Stockbroker etc.), Firm of Solicitors / Chartered Accountants / Chartered Surveyors. Doctor / Nurse from your own registered practice, Midwife or District Nurse (must visit client in own home), Magistrate or Justice of the Peace, Member of Parliament, Local or County Councillor. Minister of Religion, Officer of the Armed Forces (i.e. Warrant or Petty Officer etc.), or Person with Honours (OBE, MBE etc.). Proof of Identity Proof of IDENTITY documents must have the following phrase: ‘Certified True Copy and True Likeness of [full name as printed on document]. The Certifier must also include: The signature of the certifier The printed name of the certifier – including first name and surname The position (job title) of the certifier The date of the certification being signed The name of the organisation (including office stamp if available) Proof of Identity MUST be a CERTIFIED copy of ONE of the following: A signed valid passport. A European Economic Area (EEA) Member State ID card. An identity card issued by the Electoral Office for Northern Ireland. Benefits book or original letter from the relevant benefits agency confirming rights to benefits or state pension (including Job Seekers Allowance Award Letter or JSA Signing On Booklet A current EEA or UK photo card driving licence. (including valid UK provisional driving licence) If you are self-employed within the construction industry, one of the following photographic registration cards: C1S4, CIS4(P), C1S4(T), C1S5 or C1S6. A shotgun or firearms certificate. Personal licence for selling alcohol – Issued by the local authority (must be valid) Proof of Address Proof of ADDRESS documents must have the following phrase: “Certified True Copy”. The Certifier must also include: The signature of the certifier The printed name of the certifier – including first name and surname The position (job title) of the certifier The date of the certification being signed The name of the organisation (including office stamp if available) Proof of Address MUST be a CERTIFIED copy of ONE of the following: A recent (within last 3 months) utility bill or statement, or certificate from a supplier of utilities confirming arrangements to pre-pay for the services bill. Such bill/statement/certificate should not be printed from the internet; a mobile telephone bill is not acceptable. Local Authority tax bill valid for the current year. Recent (within last three months) Bank or Credit Card Statement. PDF Online printed statements are acceptable Other system –generated or signed documentation from a regulated financial sector company confirming an account/investment/insurance relationship exists and which contains the customer’s address is acceptable. Solicitor’s letter confirming recent house purchase or land registry confirmation. Local council rent card or tenancy agreement. A letter from the local authority giving details of council tax benefit (This is the only benefit letter that is acceptable) WBLF6 – Application Form GLE oneLondon Issue 1 – Feb 2014 Page 2 of 10 Step 4. Complete the following section fully (incomplete forms will delay the process) You and Your Business Business name (including trading name) Business Address Legal structure of business (tick as appropriate) Postcode Sole Trader Private Limited Company Partnership Limited Liability Partnership Co-operative Company Limited by Guarantee Other (please state)________________________ Date Business started trading Company Registration Number (if applicable) VAT Registration Number (if applicable) NI Class 2 Date of Registration (if applicable) Telephone number Mobile Telephone number Email Website Number of Current Full Time Staff Number of Current Part Time Staff Total Business Debt (incl. overdrafts / loans / cards) Total Business Debt Repayments per month Turnover (at end of last accounting year end) Net Profit (at end of last accounting year end) Depreciation (at end of last accounting year end) Wage Costs (at end of last accounting year end) Name of Business Bank Name on Business Bank Account Bank address Account Number Sort Code Postcode Time with Bank new WBLF6 – Application Form GLE oneLondon <2yrs 2 to 5 yrs > 5 yrs Issue 1 – Feb 2014 Page 3 of 10 Funding Required Purpose of Loan (break down by category and provide total) Fixtures & Fittings Equipment Working Capital Other Marketing Total How many jobs currently exist and in the absence of the loan are at risk of being lost within 12 months? Of these how many are MALE staff? FT PT Of these how many are FEMALE staff? FT PT FT means Full Time i.e > 30 hours per week. PT means Part Time i.e. >15 hours but < 30 hours per week How many jobs that do not currently exist will the loan help create within 12 months, if you receive the loan? Of these how many do you expect to be: FT PT Business Sector (Please select ONE of the following) Agriculture Production - Media Banking Services Forestry Production – Oil & Mineral Insurance & Pensions Fishing Repair – Manufacturing Equipment Financial Administration Services Coal Mining Repair – Motor Transport Real Estate & Lettings Petroleum & Natural Gas Repair – Personal Goods Legal & Accounting Services Mining Non Ferous Metals Construction – Commercial & Domestic Management Consultancy Mining Organic Materials Construction – Civil Engineering Architectural & Urban Planning Mining & Quarrying Support Construction – “Skilled Trades” Research Manufacturing – Food Transport – Land Advertisting & Marketing Manufacturing – Drinks Transport – Sea Design & Photography Manufacturing – Tobacco Transport – Air Veterinary Services Manufacturing – Textiles Transport – Service Activities Renting & Leasing Manufacturing – Clothes Postal & Courier Services Human Resources Manufacturing – Leather Power Generation Travel & Tour Operating Manufacturing – Wood Water Collection Private Security & Investigation Manufacturing – Paper Sewerage Cleaning Services Manufacturing – Chemicals Waste Disposal Administrative & Events Services Manufacturing – Pharmaceuticals Waste Management Services Public Administration Manufacturing – Plastics & Rubber Wholesale Education Manufacturing – Glass Stone Ceramics Retail Sale Human Health Services Manufacturing – Metals Recreational Accommodation Social Care Services Manufacturing – Metal Products Restaurants & Pubs Child Care Manufacturing – Electronics Publishing Arts Manufacturing – Electrics Equipment Video & Music Production Library & Museum Manufacturing – Machinery Broadcasting Activities Gambling & Betting Services Manufacturing – Road Vehicles Telecommunications Sports & Fitness Manufacturing – Ships Heavy Machinery Information Technology Professional Organisations Manufacturing – Furniture Data Processing & News Services Beauty & Physical Wellbeing Manufacturing – Jewellery Banking Services Domestic Personnel WBLF6 – Application Form GLE oneLondon Issue 1 – Feb 2014 Page 4 of 10 Personal Details (please copy or print this form and complete for all business associates) Title Mr Ms Mrs Miss Other (specify): Surname Forenames Home address Previous address (if less than three years) Postcode Postcode Residential status Residential status Owner Tenant Owner Tenant Living with parents Other (specify): Living with parents Other (specify): Time at current address Time at previous address Total Personal Debt (incl. mortgage / loans / cards) Total Personal Debt Repayments per month Home telephone number Mobile number National Insurance Number Nationality Email (personal) Marital status Date of birth (dd/mm/yyyy) Number of dependants Position in your business Shareholding %age (owner/partner): Director and Owner Director only Owner only Partner Date of Expiry of Work Permit (if applicable) WBLF6 – Application Form GLE oneLondon Issue 1 – Feb 2014 Page 5 of 10 Personal Details continued (please copy or print this form and complete for all business associates) THE INFORMATION COLLECTED ON THIS PAGE WILL NOT AFFECT YOUR ASSESSMENT THE INFORMATION IS COLLECTED TO TRACK THE DIVERSITY OF BUSINESS ASSOCIATES Have you ever been convicted of an offence? Yes No Are you currently claiming any government benefits? Yes No If YES, upon receiving this loan will it enable you to stop claiming any government benefits? Yes No Do you consider yourself disabled? Yes No If you consider yourself disabled and would like us to make reasonable adjustments to accommodate your disability, please state what those reasonable adjustments would be: Ethnic origin (select one of the categories) Asian or Asian British – Bangladeshi Mixed – White & Asian Asian or Asian British – Indian Mixed – White & Black African Asian or Asian British – Pakistani Mixed – White & Black Caribbean Asian or Asian British – Other Mixed – Other Black or Black British – African White – Britsh Black or Black British – Caribbean White – Irish Black or Black British – Other White – Other Chinese Prefer not to say Other WBLF6 – Application Form GLE oneLondon Issue 1 – Feb 2014 Page 6 of 10 Personal Survival Budget (please copy or print this form and complete for all business associates) Type of Expense Monthly Rent or Mortgage Council Tax Credit & Store Cards Personal Loans Other Debts Savings Plans Insurance (car, home, life etc) Transport (private and/or public transport) Electricity Gas Water Home Telephone Mobile Phone Food Clothes Childcare Entertainment Contingency Other (please specify) Total Expenses Type of Income Monthly Your Business Income Your Other Income (i.e. from Property Investment, Shares or other sources) Spouse’s / Partner’s Income Benefits & Tax Credits Other (please specify) Other (please specify) Total Income Disposable Income (Total Income – Total Expenses) WBLF6 – Application Form GLE oneLondon Issue 1 – Feb 2014 Page 7 of 10 Step 5 . State Aid Declaration - Please read and complete the following section There are European Community rules governing ‘State Aid’, which is the aid that individual member countries give to support resident businesses. As the loan package provided by One London Ltd t/a GLE oneLondon are provided with support from both European and UK Government funds, we have a duty to establish support received to date in order to avoid breaking these rules. One London Ltd t/a GLE oneLondon operates under a part of the State Aid rules known as de minimis that allows member states to give small amounts of aid to businesses without notifying it to the European commission. Under de minimis the maximum amount of aid that can be given to any single business must not currently exceed 200,000 Euros (approximately £170,000) in the three year period prior to the point of the loan package being advanced. As the provider of this State Aid, One London Ltd t/a GLE oneLondon must check that this limit is not exceeded when new aid is given. If your business has received any other European or UK Government State Aid in this period One London Ltd t/a GLE oneLondon will need to check this to determine how much is de minimis and whether or not it will have any effect on the loan package you are applying for. You should note that the value of the aid is not equal to the loan package itself but is calculated according to a formula that takes into account a number of factors (interest charged etc.). Please complete the below table listing any other State Aid received by your business in the past three years and sign the declaration below. One London Ltd t/a GLE oneLondon will then be able to check the de minimis position as part of the eligibility assessment process. Declaration I understand that my application for a loan package from One London Ltd t/a GLE oneLondon is governed by the European Community rules on State Aid, in particular, that the loan package is a de minimis aid and that, therefore, my application must satisfy the condition of the de minimis rule. I further understand that aid that exceeds the de minimis limit is possibly illegal aid, which my business may be required to repay. I confirm that I have listed below the total amount of all forms of aid received by my business in the past three years and I acknowledge that One London Ltd t/a GLE oneLondon will use this information to determine whether or not my application meets the conditions of the de minimis rule. Please list below any loan packages received from public (UK Government or European) sources over the past three years. Date(s) funding was provided: Organisation(s) which provided the funding: Value of funding received from each organisation: WBLF6 – Application Form GLE oneLondon Issue 1 – Feb 2014 Page 8 of 10 Step 6. Read the Terms & Conditions and all directors/partners/owners sign here Protecting your privacy This application form and all supporting documentation becomes the property of One London Ltd & GLE Loan Finance Ltd t/a GLE oneLondon. Personal information provided by you will be held on a database by One London Ltd & GLE Loan Finance Ltd t/a GLE oneLondon. If you have questions regarding the use of your details in this way, please write to: GLE oneLondon, 10-12 Queen Elizabeth Street, London, SE1 2JN. Agreement I/We agree that One London Ltd & GLE Loan Finance Ltd t/a GLE oneLondon , credit reference agencies, appointed recovery agents, funding bodies and mentors may be provided with appropriate information that you have disclosed for their specific purposes or needs. The way this information will be used will be: One London Ltd & GLE Loan Finance Ltd t/a GLE oneLondon will use your information to assess your proposal, record your details when lending funds and manage your loan throughout its life. Information will be stored securely for 6 years after the loan is repaid. Credit Reference Agencies may be provided with details of non payment if we make demand for repayment but receive no satisfactory proposal for this. This information may become available to people or organisations who have access to this agency information. Appointed Recovery Agencies may be provided with details of your personal and business information to assist them with the recovery of the debt where your loan is in default and we have received no satisfactory repayment proposals. Funding Bodies may be given any of your information, business or personal at any time. Mentors may be provided information as necessary to assist you, from time to time, to support your business. You have a right to apply for a copy of your information for which we may charge a small fee and to have any inaccuracies corrected. I/We confirm that I/we have been unsuccessful in raising commercial finance. Below are the details of where we have been unsuccessful: Name of Finance Provider Branch / Location of Finance Provider Date I/We agree that all the information contained in this application is, to the best of our knowledge, true and any misuse of funds will be repaid in full. All applicants must sign below: Print name: Signed: Date: Print name: Signed: Date: Print name: Signed: Date: Print name: Signed: WBLF6 – Application Form Date: GLE oneLondon Issue 1 – Feb 2014 Page 9 of 10 Step 7. Please send your application with all information requested attached to GLE oneLondon, Business Finance Team, 10-12 Queen Elizabeth Street, London, SE1 2JN Step 8 . We will progress your application in the following way WBLF6 – Application Form GLE oneLondon Issue 1 – Feb 2014 Page 10 of 10