Accident-Investigation-and-Claims-Management

advertisement

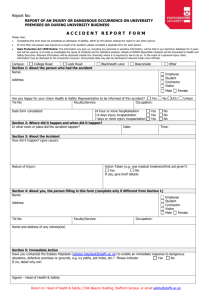

Accident Investigation and Claims Management Training Revised 07232012 1 You need value added claims reporting solutions! All Auto Accidents Are To Be Reported To: National Interstate 3250 Interstate Drive Richfield, Ohio 44286-900 By Phone: 866- 294-8264 By Fax: 877-303-3832 By E-mail: newclaims@natl.com For Serious or Catastrophic Cases: 800-929-0870 (24/7) CA Work Comp Claims Are To Be Reported To: Liberty Mutual Insurance Co. 330 N. Brand Blvd. – Suite 500 Glendale, CA 91203 Phone: 800-281-1120 First Report Fax: 800-329-3297 To Report by Phone: 800-362-0000 Policy Number: WA7-65D-290802-012 General Liability Claims Are To Be Reported To: Please contact Doug Lawson or Drew Jones before reporting claims in this category. Scottsdale Insurance Co. Address: PO BOX 4120 Scottsdale, AZ 85261 Phone # Fax # 800-423-7675 480-483-6752 REPORT YOUR CLAIMS TO: TOM COLE Unit Manager PIMA CENTER Scottsdale, AZ 85258 Phone: (480)365-3607 Policy Number: BCS0027919 Property Damage Only Claims Are To Be Reported To: For damage of $25,000 or greater to Keolis or in cases where Keolis operates client owned vehicles and provides PD coverage by contract Liberty Mutual Insurance Co. Fax: By Phone: 800-329-3297 800-362-0000 TO REPORT A WORK COMP CLAIM VIA THE WEB Proper Accident / Claims Reporting Is Essential to Effective Claims Management Accident / Claims Reporting PLEASE DO NOT LEAVE ANY BLANK SPACES ON THE FORM Accident / Claims Reporting 1. Ensure entire accident report form is accurate and complete. 2. Ensure all other pertinent documents concerning the accident are gathered and sent to the insurance carrier. 3. Fax or email the accident report and all other applicable documents within 24 hours of becoming aware of the accident. 4. Refer all calls from claimants or their attorneys to the adjuster handling the claim. Do not comment on liability or other aspects of the incident. Important claims reporting guidelines: 1. It is not the duty or responsibility of any Keolis personnel to determine liability, only to report the facts surrounding the accident. 2. Statements concerning liability or preventability are not to be made on the accident report form. Some critical shots that can make or break the ultimate outcome!!!! 1. 2. 3. 4. 5. 6. 7. Vehicles @ point of impact. Shots of approach views @ varying distances. Use a common point of reference. Photos of visible damage to vehicles and property. Shots of skid marks. Pictures of debris. Photos of traffic controls & signals. Some critical shots that you may not consider that may make or break the ultimate outcome!!!! 1. Pictures of other vehicles & license plates @ the scene. 2. Shots of by-standers & possible witnesses. 3. Shots of inside the vehicles. 4. Pictures of surveillance cameras in close proximity. Please properly identify all photos as follows: 1. 2. 3. 4. 5. Date of accident. Vehicle number. Location number. Driver and other party’s name. Name of person who took the photos. Serious accidents are defined as follows, but not limited to: Fatality (including accidental death on a bus or company property, regardless of fault) Serious burns Quadriplegia or Paraplegia Amputation Brain damage – actual or alleged Serve injury with apparent permanent disability Severe cosmetic disfigurement Blindness or loss of hearing Serious accidents are defined as follows, but not limited to: Severe fractures or multiple fractures Psychiatric problems due to trauma, actual or alleged Serious vascular abnormalities due to trauma Any accident involving more than four persons Any pedestrian accident Assault or molestation incidents Severe bleeding Vehicle roll-over Work comp program features: Bill Review – Physician & Hospital. Telephonic Case Management. Pharmacy Benefit Management. Utilization of Re-employability. Utilization Review. Some general observations about work comp: Historically, our subrogation results have been lackluster. Our ratio of Lost Time to Med Only cases is out of sync. Our denial rate is 3.77% . 58% of our WC claims are reported 5 or more days late. 17% of our WC claims are reported 10 or more days late. There are 3 types of workers’ comp fraud: Applicant Fraud These cases involve workers who fake an injury, lie about the extent of their injury, lie by denying filing previous claims, fail to disclose a prior injury to the same body part, claim a non-work injury is work related, or illegally work while obtaining benefits. Sub rosa surveillance tapes regularly expose applicants who are fraudulent. Claim Mills Organized workers’ compensation fraud involving doctors and lawyers have been an ongoing problem, especially in Southern California. Fraud rings have made a practice of recruiting people to file phony work injury claims. The workers are sent to medical clinics or legal referral centers (commonly known as "claim mills"), which in turn refer them to a doctor or lawyer who is in on the scheme. Provider Fraud Regardless of the legitimacy of the original claim, many medical or other health practitioners fraudulently maximize the number of medical reports and referrals in each case to increase the number of billings. They may also over bill or render unnecessary treatment. Some common work comp fraud indicators: 1. Injury that has no witness other than the employee 2. Injury occurring late Friday or early Monday 3. Injury not reported until a week or more after it supposedly occurred 4. Injury occurring before a strike or holiday, or in anticipation of termination 5. Injury occurring in a location where the employee would not normally work Some common work comp fraud indicators: 6. Injury that is inconsistent with normal job duties 7. Employee observed in activities inconsistent with the reported injury 8. Employee history of workers' comp claims 9. Conflicting diagnoses from subsequent treating providers 10.Evidence of employee working elsewhere while drawing benefits Subrogation Claims Management What is subrogation? Subrogation is the process in which Keolis attempts to recover a loss from a third party when our property is damaged as a result of a negligent act by a third party also referred to as the “adverse party”. There are 4 keys to successful subrogation: Proper Investigation Timely Reporting Complete Maint. Records Professional Litigator This is a straight forward process! 1 2 KEOLIS CONDUCTS ACCIDENT INVESTIGAT ION 3 GENERAL MANAGER SENDS SUBRO PROVIDER ACCIDENT REPORT 6 5 KEOLIS AWAITS OUTCOME OF SUBRO VENDOR’S EFFORTS 1 1 IF NO RECOVERY IF RECOVERY 4 SUBRO VENDOR DETERMINES IF SUBROGATA BLE IF APPLICABLE VENDOR CONTACTS KEOLIS FOR FURTHER INFORMATION IF APPLICABLE 1 0 7 SUBRO VENDOR REVIEWS MATERIAL 8 VENDOR ISSUES CHECK TO KEOLIS 9 KEOLIS ENTERS RESULT INTO SUBRO LOG KEOLIS PROCESS ES CHECK 1 2 CLAIM IS CLOSED Your Subrogation Service Provider Ward and Federman, Attorneys at Law 1177 Marsh St., 2nd Floor San Luis Obispo, CA 93401 T: 805-542-9002 F. 805-544-5837 E-mail your Accident Reports to: doug@wardandfederman.com You must allow the adverse party / insurance carrier the opportunity to inspect your damages and conduct an appraisal within a reasonable period of time. Documents to be Obtained for Subrogation Claims Accident report. Repair estimates, invoices and receipts. Police report, if available. Photos of damages. Preparing Estimates: All receipts & invoices for replacement parts. All invoices for outside services performed. The total number of labor hours is to be noted separately from the cost of parts. Towing charges and storage fees are to be included. Downtime If downtime is being claimed, the documentation substantiating the loss must be provided with the accident report documents, i.e., copy of the page from our contract which reflects the revenue per vehicle per day if applicable. Our Primary Goal: Getting Paid !!!!!!!