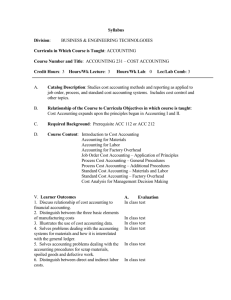

MSD-109 Chapter 10

advertisement

SURVEY OF ACCOUNTING Chapter 10 PowerPoint Presentation by Gail B. Wright Professor of Accounting Bryant University CARL S. WARREN © Copyright 2007 Thomson South-Western, a part of The Thomson Corporation. Thomson, the Star Logo, and South-Western are trademarks used herein under license. LEARNING OBJECTIVES When you finish this chapter, you should be able to 2 LEARNING OBJECTIVES 1. Distinguish activities of manufacturer from merchandising or service firm. 2. Define, illustrate materials, labor, factory overhead costs. 3. Describe accounting systems used by manufacturing businesses. 4. Describe, illustrate job order cost system. Continued 3 LEARNING OBJECTIVES 5. Use job order cost information for decision making. 6. Diagram flow of costs for a service business that uses job order cost system. 7. Describe just-in-time manufacturing 8. Describe, illustrate activity-based costing in a service business. 4 LEARNING OBJECTIVE 1 Distinguish activities of manufacturer from merchandising or service firm. 5 LO 1 MANUFACTURING FIRM DIFFERENCES Service firms earn revenue from providing services Merchandising firms earn revenue from selling merchandise inventory Manufacturing firms Earn revenue from manufacturing and selling finished goods Have 3 inventories: materials, work-in-process, finished goods 6 LEARNING OBJECTIVE 2 Define, illustrate materials, labor, factory overhead costs. 7 LO 2 EXHIBIT 1 Goodwell Printing Co. has 2 departments 8 LO 2 GOODWELL PRESS Costs Cost is payment or commitment to pay cash for future revenues Manufacturing costs Direct materials Direct labor Manufacturing overhead 9 LO 2 What are these manufacturing costs? 10 LO 2 DIRECT MATERIALS COSTS Cost of direct materials is cost of raw materials used in the manufacture of a product Goodwell Printing Paper Book covers 11 LO 2 DIRECT LABOR COSTS Direct labor is Labor used to convert materials into product Goodwell Printing Wages of employees who operate printing presses 12 LO 2 FACTORY OVERHEAD COSTS Factory overhead is costs other than materials, labor incurred in manufacturing process Machine depreciation Factory insurance 13 LEARNING OBJECTIVE 3 Describe accounting systems used by manufacturing businesses. 14 LO 3 What are 2 manufacturing cost accounting systems? 15 LO 3 COST ACCOUNTING SYSTEMS Job order costing Costs accumulated by job for Custom products, large variety of products Levi Strauss Process costing Costs accumulated by department, process Oil refineries 16 LEARNING OBJECTIVE 4 Describe, illustrate job order cost system. 17 LO 4 EXHIBIT 2 Illustration of 3 perpetual inventories, ending in cost of goods sold. 18 LO 4 EXHIBIT 3 Materials accounted & requisitioned for each job. 19 ACCOUNTING FOR MATERIALS Cash Flows Balance Sheet Assets = Liabilities Materials = A/P 10,500 = 10,500 LO 4 Income Statement + Equity Receiving report #196 documents materials purchased. 20 LO 4 REQUISITIONING MATERIALS Cash Flows Balance Sheet Assets = Liabilities Income Statement + Equity Materials WIP = -13,000 13,000 Materials requisitioned for conversion. 21 LO 4 DIRECT LABOR Cash Flows Balance Sheet Assets = Liabilities WIP = Wages Pay 11,000 = Income Statement + Equity 11,000 Direct labor cost from time cards of job assigned to work-in- process. 22 LO 4 FACTORY OVERHEAD: Examples Examples of factory overhead Indirect materials Indirect labor Factory utilities Factory depreciation Factory overhead allocated based on activity driver at predetermined rate Direct labor, direct materials 23 ACCUMULATING FACTORY OVERHEAD COSTS Cash Flows Balance Sheet Assets = Liabilities Mat O/H LO 4 Income Statement + Equity A/D = Wages Pay Util Pay -500 4,600 -1,200= 2,000 900 Factory overhead is accumulation of indirect costs of manufacturing process. 24 LO 4 PREDETERMINED OVERHEAD RATE Goodwell Printers estimates total factory overhead to be $50,000 and direct labor (activity base) to be 10,000 direct labor hours. Predetermined O/H rate = Est. O/H costs/ Est. activity base Predetermined O/H rate = $50,000/10,000 = $5 per direct labor hour 25 ACCUMULATING FACTORY OVERHEAD COSTS Cash Flows Balance Sheet Assets = Liabilities WIP O/H 4,250 -4,250 LO 4 Income Statement + Equity Factory overhead assigned to work-in-process inventory based on 850 direct labor hours. 26 DISPOSING OF EXCESS OVERHEAD COSTS Cash Flows Balance Sheet Assets = Liabilities O/H LO 4 Income Statement + Equity Ret Earn -150 -150 Excess overhead costs charged to cost of goods sold expense. -150 CGS 27 LO 4 JOB #71 Costs to complete Job #71 28 LO 4 ACCOUNTING FOR JOB #71 Cash Flows Balance Sheet Assets = Liabilities WIP Fin. Goods -10,250 10,250 Income Statement + Equity Completed job transferred from WIP to finished goods. 29 LO 4 EXHIBIT 6 Job costs transferred to WIP control sheet 30 LO 4 EXHIBIT 7 Finished goods ledger account 31 LO 4 SALE Cash Flows Balance Sheet Assets = Liabilities A/R Fin. Goods = 28,000 -20,000 Income Statement + Equity Ret Earn 8,000 Sale of finished goods costing $20,000 for $28,000. 28,000 Sales -20,000 CGS 32 LO 4 PERIOD COSTS Period costs are non-manufacturing costs 33 LEARNING OBJECTIVE 5 Use job order cost information for decision making. 34 LO 5 BASIS FOR DECISION MAKING When 2 jobs for the same product have different costs, what is the problem? Inexperienced labor? Poor quality materials? Tools need repair? Carelessness? Incorrect instructions? 35 LO 5 EXHIBIT 10 36 LEARNING OBJECTIVE 6 Diagram flow of costs for a service business that uses job order cost system. 37 LO 6 EXHIBIT 11 Job costs in service industry 38 LEARNING OBJECTIVE 7 Describe just-in-time manufacturing. 39 LO 7 EXHIBIT 12 Just in time (JIT) reduces costs, requires new approach. 40 LEARNING OBJECTIVE 8 Describe, illustrate activity-based costing in a service business. 41 LO 8 EXHIBIT 13 Hopewell Hospital accumulates costs by specific activities. 42 LO 8 USING ACTIVITY BASED COSTING Assigning costs based on different activities is basis of patient billing. Helps manage costs. 43 CHAPTER 10 THE END 44