File - New Venture Creation

Enrp 1. Lecture 2

I D E N T I F Y I N G N E W B U S I N E S S

O P P O R T U N I T I E S

Learning Outcomes

Describe the new venture creation process

Compare and contrast business life cycles with industry life cycles

Explain how opportunity recognition occurs

Discuss the critical components of a business concept

Describe the feasibility analysis process

Explain bootstrapping as an entrepreneurial strategy

Outline

Start-Up Resources

The New Venture Creation Process

Launching a New Business

Feasibility Analysis

THE NEW VENTURE

CREATION PROCESS

The environment is the most comprehensive component in the venture creation process.

It includes all the factors that affect the decision to start a business, for example, government regulation, competitiveness, and life cycle stage.

Within specific industries and in specific geographic regions, environmental variables and the degree of their impact will differ.

The new venture process begins with an idea for a product, service, or business.

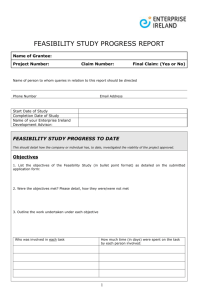

Feasibility Analysis

The entrepreneur develops an idea into a business opportunity or business concept that is then tested in the market through a process of feasibility analysis.

Feasibility analysis is used to inform the entrepreneur about the conditions required to move forward and develop the business. This may involve market research.

Once the entrepreneur has determined that the concept is feasible, a business plan is developed to detail how the company will be structured and to describe its operation

Viability

Testing the business concept in the real world is what actually determines if the business has viability. Thus, the business must actually be launched and operated in the environment to determine viability.

In a business, the term viability is the point when the company is able to generate sufficient cash flows to allow the business to survive on its own without cash infusions from outside sources such as the entrepreneur's own resources, investors, or a bank loan.

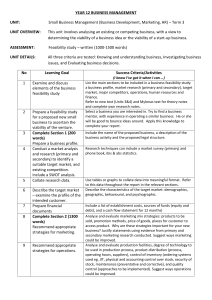

The Five Stages of a Business’s Life Cycle

LAUNCHING A NEW BUSINESS

Three key issues in the pre-start-up phase:

1) Testing concept feasibility

2) Developing a business plan

3) Acquiring resources ($$$ and personnel)

Three key issues in the start-up phase:

1)

2)

3)

Finding customers

Building a structure

Generating positive cash flows

Opportunity Creation

Developing a product, service, process, or niche that has not existed before. Opportunity recognition requires high levels of creativity.

Opportunity Creation

Typically, opportunity creation involves an invention process that is characterized by four activities:

connection, discovery, invention, and application

Opportunity Creation

Connection occurs when two ideas are brought together that normally are not juxtaposed, such as nature and machines, which produced the field of nanotechnology or microscopic machines that copy nature in the way that they operate.

Discovery happens once a connection has been made. It is actually the result of the connection in the form of an idea.

Inventions are the product of turning an idea into a product or service.

Application comes about when the inventor is able to apply the invention to a number of different uses or applications in a variety of industries and situations.

Opportunity Recognition

The process of using creative skills to identify a new innovation --- (a product, service, process, or marketing method) --which is often based on something already existing in the marketplace .

How to recognize a business opportunity

List all the ideas in no particular order.

Eliminate those ideas that can’t generate a profit and don’t fit the business model very well.

Review the remaining ideas and choose the one that inspires the most passion and enthusiasm

The Initial Business Concept:

There are four essential elements required to test whether or not a potential business idea is feasible:

What is the product and/or service that is the basis for the business?

Who is the customer likely to be?

What is the benefit of your product/service to the customer?

How will the benefit be delivered?

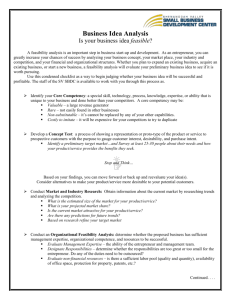

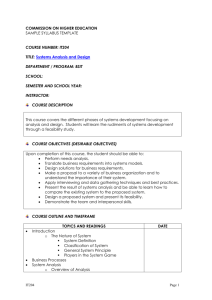

Feasibility Analysis

The business concept

(which is essentially a specific product or service) is tested through a process of feasibility analysis that answers three fundamental questions:

1. Are there customers and a market of sufficient size to make the concept feasible?

2.Do the capital requirements to start, based on estimates of sales and expenses, make sense?

3.Can an appropriate start-up team be put together to make it happen?

Components of Feasibility Analysis

Thus, there are actually four areas which are tested in the feasibility analysis:

The product/service

Industry/market/consumer

Founding team

Financials

Feasibility Analysis:

Key Questions

Porter’s Five Force Model: Analysis of the industry

Goals of Market Research

To find out:

Who is most likely to purchase the product or service at market introduction?

What do these customers typically buy, how do they buy it, and how do they hear about it?

What is their buying pattern? How often do they buy?

What are the customers’ needs and how can the new venture meet those needs?

The Best Founders

Founders of successful companies have many things in common. They are:

A common vision

Passion and a willingness to dedicate themselves

Experience in the industry

Contacts for capital

Experience in basic business functions

Excellent credit ratings

Bootstrappers

Bootstrappers are start-up entrepreneurs who have no financial resources beyond their own savings.

They realize that to get what they need to start their businesses—location, equipment, money, and perhaps employees—they must possess a double dose of ingenuity and supreme self-assuredness .

Successful Bootstrappers

John Schnatter founded Papa John’s International, the

$164+ million pizza restaurant franchise, with $1,600 in personal savings.

Bill Gates and Paul Allen started Microsoft in a cheap apartment in Albuquerque with virtually no overhead, a borrowed computer, and very little capital.

The Bootstrap Business Location

Businesses that don’t require a storefront location can begin their development in a spare room or a garage.

Negotiate free rent and lower lease rates in buildings where a lessor is having difficulty releasing the space.

Lease a portion of a larger company’s space and take advantage of its reception area and conference room.

START-UP RESOURCES

Putting together sufficient resources to start a business requires enormous creativity and persistence, with the ultimate reward being a company that is able to reach critical mass and take advantage of significantly more choices for growth capital.

Why are So Many Ventures Self-Funded?

Many new ventures are initially funded by the entrepreneur, because:

No intellectual property rights or licenses to give them a competitive advantage

Many lack a significant track record of success

Many ventures have not fully defined themselves in the marketplace, which makes investment risky.

Investors see new ventures as too risky