Presentation

advertisement

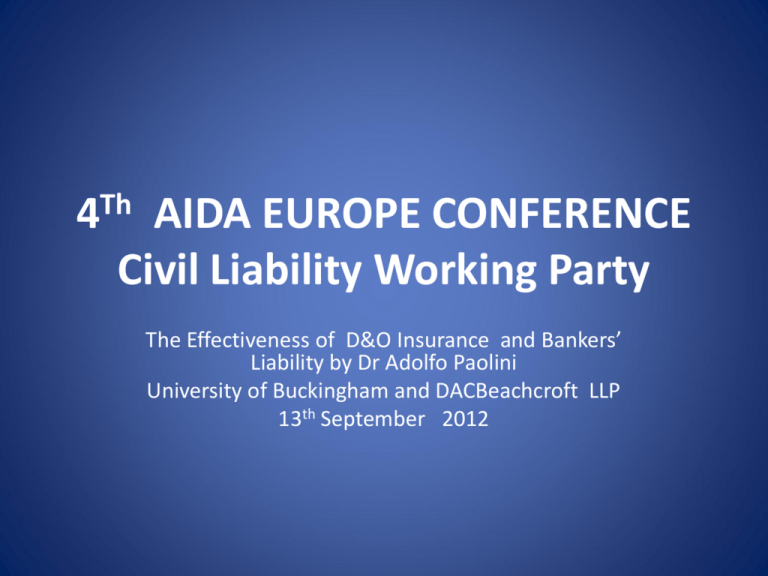

4Th AIDA EUROPE CONFERENCE Civil Liability Working Party The Effectiveness of D&O Insurance and Bankers’ Liability by Dr Adolfo Paolini University of Buckingham and DACBeachcroft LLP 13th September 2012 Risk Management in Banking “ If you open the vaults of a bank, you may think you would know what you would find there. You would be wrong. What is really there, hidden behind the stacks of currency, is the bank’s inventory risk.” Allen L & Saunders A in The Oxford Handbook of Banking, OUP 2012 at 90 Risk Management in Banking • • • • Liquidity Management Asset Management Liability Management Capital Adequacy Management Directors of Financial Institutions • • • • • • BCBS “ … the board should take into account the legitimate interest of shareholders , depositors and other relevant stakeholders..” OECD: Duty of Loyalty “...to act in the interest of the company and shareholders” Companies Act 2066 ss 170-177 Shareholders cannot recover for reflective loss. Prudential Assurance v Newman Industries/Impossibility to sue as member of a Class /Class Action. Civil Liability to third parties is unlikely: Williams v Natural Life Health Food Ltd. Criminal Liability /Tort of Deceit/Fraud was found on a director personally: Standard Chartered Bank v Pakistan National Shipping Corporation Scenario: Sub-Prime Lending/CDO’s & CDS’s • Sub – Prime Lending • Over the Counter Derivatives (OTC) • Collateralised Debts Obligations (CDO’s) • Credit Default Swaps ( CDS’s) D&O: Directors v. Company • • • • CA 2006 s 174: Monitoring and Supervising Sub-Prime Lending Negligence? Levels of Speculation Were Almost Reckless Lehman Brothers: Repo 105 /108 (off balance sheets products) sales or liabilities? • D&O does not cover wilful misconduct • Side ‘C’ cover and the effect of Stone & Rolls v Moore Stephens and Safeway Stores v Twigger D&O: Directors v. Investors Civil Liability/Misrepresentation 1. Hedley Byrne/ Caparo Industries v Dickman • Assumption of Responsibility: Williams 2. Reliance on Financial Advice 3. Contractual and /or Statutory Financial Advice D&O: Directors v. Unsophisticated Investors • Who are they? • FSA principles of Business ( PRIN 9): “reasonable care to ensure the suitability of its advice and discretionary decisions for any customer who is entitled to rely upon its judgment” • Bank/Customer Contractual Relationship • FSMA 2000 s 150: private and non-private customers • Director’s Personal Liability? D&O: Directors v. Sophisticated Investors • JP Morgan Bank (formerly Chase Manhattan Bank) v Springwell Navigation Corp • IFE Fund SA v Goldman Sachs International • Peekay Intermark Ltd v Australia & New Zealand Banking Group Ltd • Titan Steel Wheels v RBS • D&O substantive cover: Liability cannot be ascertained LIBOR Twist • • • • • Interest Rate Manipulation Derivatives Market relies on LIBOR rates Intentional / Wrongful Act D&O: Public Policy to deny cover Defence Cost Cover still available for investigations. Conclusions • Company v Directors: D&O cover for breaches of the duty of care, skill and diligence • Director v Unsophisticated investors: D&O unlikely to cover / only exceptionally • Directors v Sophisticated Investors: D&O unlikely to cover/ not reliance defeats the claim • LIBOR: D&O/ failure to monitor/ intentional manipulation may defeat the claim Thank You Dr Adolfo Paolini adolfo.paolini@buckingham.ac.uk apaolini@dacbeachcroft.com