File

advertisement

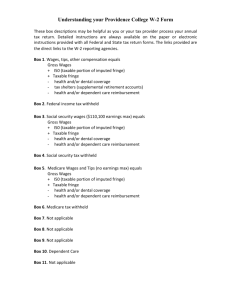

ASSOCIATION OF TAXATION AND LAW STUDENTS ACADEMICS DEPARTMENT http://www.facebook.com/atlas.ue 0915-1049090 & 0905-2101285 Note: No Copyright Intented Sources: Income Taxation, Omar Erasmo G. Ampongan; Transfer and Business Taxation, Edwin Valencia; CPAR and ReSA Review Materials Topic: FRINGE BENEFITS & FRINGE BENEFITS TAX Fringe Benefit -is any good, service, or other benefit furnished or granted by an employer, in cash or in kind, in addition to basic salaries. Fringe Benefit Tax -it is a tax on fringe benefits granted by the employer for the employee. - paid by the employee within 30 days after the end of the month. - is a final tax on the grossed-up monetary value of the fringe benefit being given to a managerial or supervisory employee. It is considered a final income tax on the employee. Regardless of whether the employer is an individual, partnership, or corporation, this tax applies. 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. Housing Expense Account Vehicle Household Personnel Interest on loan Membership fees Foreign travel Holidays and Vacation expense Educational Assistance Life or Health Insurance Two Kinds of Fringe Benefit a.) De Minimis Fringe Benefit - It is a not taxable fringe benefit but taxable to the receiver in excess of the law requires. ATLAS 2012-2013 TAXATION b.) Taxable Fringe Benefit - It is subject to fringe benefit tax paid by the employer. Two kinds of Employee a.) Rank and File - It does not require managerial decision. (Clerk / Bookkeeper / Accountant). They are not subject to fringe benefit tax but they are subject to De Minimis Benefit. b.) Supervisory or Managerial - It requires managerial decision (President / CEO / Manager). They are subject to fringe benefit tax. De Minimis Benefit Medical Cash Allowance…………….….P750 per semester or P125 per month Rice Subsidy………………………….….P1500 per month or 50kg per month Uniform Allowance………………………P4000 per annum Laundry Allowance…………..………….P300 per month Gift……………………………………...…P5000 per annum How do you compute for fringe benefits tax? Housing Lease Monthly Rental Multiply by Taxable Portion Monetary Value Divide by Grossed-up Monetary Value Multiply Rate of Tax Fringe Benefit Tax Own And Installment FMV of Land/ Acquisition cost Multiply by Value of the Benefit Multiply by Taxable Portion Monetary Value Divide by Grossed-up Monetary Value Multiply Rate of Tax Fringe Benefit Tax ATLAS 2012-2013 xx 50% xx 68% xx 32% xx xx 5% xx 50% xx 68% xx 32% xx TAXATION Transfer of ownership FMV of CIR and FMV Assessor (whichever is higher, minus the cost to the employee) Divide by Grossed up monetary Value Multiply by Rate of Tax Fringe Benefit Tax xx 68% xx 32% xx Vehicle Purchase or Cash paid Monetary Value Divide by Grossed-up Monetary Value Multiply Rate of Tax Fringe Benefit Tax Installment Value of the Benefit Divide by Monetary Value Divide by Grossed-up Monetary Value Multiply Rate of Tax Fringe Benefit Tax xx 68% xx 32% xx xx 5 yrs. xx 68% xx 32% xx Own Value of the Benefit Divide by Value of the Benefit xx 5 yrs. xx Multiply by Taxable Portion 50% Monetary Value Divide by Grossed-up Monetary Value Multiply Rate of Tax Fringe Benefit Tax xx 68% xx 32% xx Value of the Benefit Multiply by Taxable Portion Monetary Value Divide by Grossed-up Monetary Value Multiply Rate of Tax Fringe Benefit Tax xx 50% xx 68% xx 32% xx Rental ATLAS 2012-2013 TAXATION Topic: TAXATION OF PARTNERSHIP AND PARTNERS Kinds of partnership 1. Exempt partnership 2. Taxable partnership(all other partnership) Tax liability of partners in a partnership 1. Share in the net income of a general professional partnership. 2. Share in the income of taxable partnership. Optional standard deduction (OSD) for general professional partnership and partners of GPP - A general professional partnership is not a taxable entity for income tax purposes since it is only acting as a “pass through” entity where its income is ultimately taxed to the partners comprising it. General professional partnership avails of itemized deductions If the partnership availed of itemized deduction in computing its net income, the individual partners may still claim itemized deductions from said share. ATLAS 2012-2013 TAXATION Topic: TAXATION OF ESTATE AND TRUST DEFINITION OF TERMS Estate (inheritance) – refers to all the property, rights and obligations of a person which are not extinguish by his death and also those which have accrued thereto since the opening of the succession. – refers to a mass of property inherited from the decedent and becomes an income producing property to the heirs. Heir – Is the person called to the succession either by the provision of a will or by operation of law. – Is a beneficiary of the property left by the deceased person. Descendant – refers to deceased person who left properties upon his death to heirs. Trust – is the arrangement created by will or an arrangement under which title to property is passed to another for conservation or investment with the income there from and ultimately the corpus (principal) to be distributed in accordance with the directions of the creation as expressed in the governing instrument. – Is a fund given to the beneficiary (grantee) by the grantor on the motives of generosity. Grantor – Is the person who establishes a trust. – The giver of the fund Grantee (beneficiary) – Is the person for whose benefit the trust has been created – The receiver of the fund Trustee – Is the one whom confidence is reposed as regards property for the benefit of another person Legatee – An heir who inherits personal property by will Devisee – An heir who inherits real property by will If the property concern is under administration to earn income, that estate property becomes a taxpayer. If the property concern is not under administration – co-ownership exist. RULES FOR COMPUTING FOR THE INCOME TAX OF AN ESTATE AND TRUST 1. The 5-32% tax table (intended for individual taxpayers) shall apply in the computation of income tax due on estates and trusts. The computation proceeds in the same manner as with an individual taxpayer. 2. Special deductions are allowed in the computation, e.g., amount received, transferred, or credited to the beneficiary. 3. The law allows an exemption of P20,000 4. The income tax return shall be filed and paid by the executor, administrator, or fiduciary if the gross income is more than P20,000. CRITERIA FOR TAXATION OF A TRUST Under the law, the following are considered as taxable trusts: 1. A trust which accumulates income for the benefit of the beneficiaries and which income accumulated will be for future distribution under the terms of the will or trust ATLAS 2012-2013 TAXATION 2. A trust that earns income to be distributed by the fiduciary to the beneficiaries, and which income collected by a guardian of a minor beneficiary is to held or distributed as the court may direct 3. A trust whose income, in the discretion of the fiduciary, may either be distributed to the beneficiaries or accumulated Where two or more trusts are created by the same grantor, and the beneficiary in each instance is the same person, the fiduciaries shall file a separate return for and pay the income tax of each, but the commissioner of the BIR shall cause the income tax to be computed on the consolidated taxable income of the different trusts, allowing an exemption of P20,000. The computed and consolidated taxable income shall be allocated between the several trusts in proportion to their respective taxable incomes. There shall be an income tax due on each of the several trusts. CO-OWNERSHIP There shall be a co-ownership whenever the ownership of an undivided thing or right is transferred to another person, or group of persons with a common interest in the property. The property is transferred through inheritance or donation made by a deceased person or donor, respectively, for the heir/s or donee/s, respectively. Under the co-ownership, beneficiaries are taxable entities if they share income from the common property. For income tax purposes, a co-ownership is deemed to have arisen: 1. When the donor donates undivided property to two or more donees and the donees decide to generate income from the properties 2. When two or more heirs inherit an undivided income-earning property 3. When two or more persons buy an undivided property for profit, with an agreement to be coowners of the property Exempt activity of a co-ownership A co-ownership may or may not be exempt from income taxation, depending on certain conditions. 1. A co-ownership is exempt from income taxation if the co-owners receive income suitable for the preservation of the property, i.e., the income generated from the property is enough to preserve or maintain the property. If the co-owners receive excess income from the property, that income is to be included in the taxable income proportionally with the respective equities. 2. A co-ownership is taxable if the owners decide to pursue the inherited or donated property for profit and in addition invest some money or property to pursue the business that the coownership constitutes as an unregistered partnership. Therefore, income or corporate taxation applies. “If any of you lacks wisdom let him ask God, who gives generously to all without reproach, and it will be given him.” -James 1:5 “God is able to do immeasurably more than what we can think or imagine.” –Ephesians 3:20 “I can do all things through Christ who strengthens me.” –Philippians 4:13 ATLAS 2012-2013 TAXATION