Get Notes (4) Here

advertisement

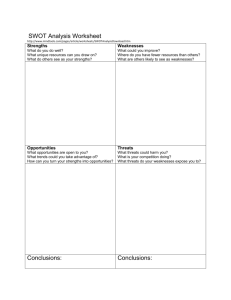

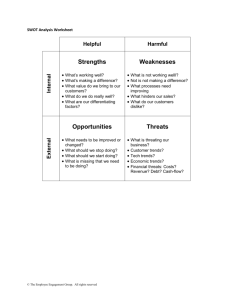

INTERNAL ANALYSIS Payne (4) 1 Components of Internal Analysis Value Creation Core Competencies Discovering Core Competencies Competitive Advantage Capabilities Four Criteria of Sustainable Advantages Resources • Tangible • Intangible • • • • Valuable Rare Costly to Imitate Nonsubstitutable Value Chain Analysis • Outsource 2 The Links between Resources, Capabilities and Competitive Advantage COMPETITIVE ADVANTAGE INDUSTRY KEY SUCCESS FACTORS STRATEGY ORGANIZATIONAL CAPABILITIES RESOURCES TANGIBLE INTANGIBLE •Financial •Physical •Technology •Reputation •Culture HUMAN •Skills/know-how •Capacity for communication & collaboration •Motivation 3 Strengths / Weaknesses / Opportunities / Threats SWOT Use Value Chain Analysis Strengths and Resource Analysis Weaknesses Opportunities Build from Industry and Competitive Analysis Threats Strategy-making must be well-matched to both: A firm’s resource strengths and weaknesses A firm’s best market opportunities and external threats to its well-being 4 SWOT Analysis -- Examples Potential Resource Strengths Potential Resource Weaknesses Potential Company Opportunities Potential External Threats • Core competencies in key areas • Adequate financial resources • Strong brand name image/reputation • An acknowledged market leader • Access to economies of scale • Cost advantages • Better advertising campaigns • Product innovation skills • Proven management • Superior technologies • Others • No clear strategic direction • Obsolete facilities • Excess debt • Lack of managerial depth and talent • Missing key skills/competencies • Internal operating problems • Poor implementation capabilities • Weak distribution network • Too narrow product line • Weak marketing skills • Expanding customer groups • Expanding geographic areas • Expanding product needs from key customer groups • Available firms for purchase or alliance due to economic changes • Falling trade barriers in attractive foreign markets • Changes in legal / regulatory demands • Complacency among rival groups • Development of new technologies • Entry of new competitors • Rising viability of substitutes • Slowing market growth • Adverse shifts in exchange rates and trade policies • Costly new regulations and legal requirements • Economic recessions or negative business cycles • Growing leverage of customers or suppliers • Changing buyer needs / trends • Demographic changes 5 Appraising Resources RESOURCE CHARACTERISTICS Financial Tangible Resources Debt/ Equity ratio Credit rating Net cash flow Physical Technology Intangible Resources Reputation Human Resources Borrowing capacity Internal funds generation INDICATORS Plant and equipment: size, location, technology flexibility. Land and buildings. Raw materials. Market value of fixed assets. Scale of plants Alternative uses for fixed assets Patents, copyrights, know how R&D facilities. No. of patents owned Royalty income Technical and scientific R&D expenditure employees R&D staff Brands. Customer loyalty. Company reputation (with suppliers, customers, government) Brand equity Customer retention Supplier loyalty Training, experience, adaptability, Employee qualifications, commitment and loyalty of employees pay rates, turnover. 6 The World’s Most Valuable Brands, 2003 Rank Company Brand value ($bn.) Rank 1 2 3 4 5 6 7 8 9 10 70.45 65.17 51.76 42.34 31.11 29.44 28.03 24.69 22.18 21.31 11 12 13 14 15 16 17 18 19 20 Coca-Cola Microsoft IBM GE Intel Nokia Disney McDonald’s Marlboro Mercedes Company Brand value ($bn.) Toyota 20.78 Hewlett-Packard 19.86 Citibank 18.57 Ford 17.07 American Express 16.29 Gillette 15.98 Cisco 15.57 Honda 15.63 BMW 15.11 Sony 13.15 Source: Interbrand 7 Organization Capabilities • Capabilities are what a firm does, and represent the firm’s capacity to deploy resources that have been purposely integrated to achieve a desired end state. • Firm competences or skills the firm employs to transfer inputs to outputs • Capacity to combine tangible and intangible resources, using organizational processes to attain desired end. • The purposeful coordination of resources and competencies. Examples: •Outstanding customer service •Excellent product development capabilities •Innovativeness of products and services •Ability to hire, motivate, and retain human capital 8 Appraising the Capabilities of a Business School Superfluous strengths Relative Strength Superior Key strengths 6 9 3 5 Parity 2 Inconsequential weaknesses 8 4 12 11 Deficient Not important 10 7 Importance 1 Key: 1 Alumni relations 2 Student placement 3 Teaching 4 Administration 5 Course devlpmnt 6 Student recruitment 7 Research 8 Corporate relations 9 Marketing 10 IT 11 PR 12 HRM Key weaknesses Critically important 9 Approaches to Capability Development Mergers and Acquisitions Strategic Alliances Using separate units can protect the new venture from incompatibilities with existing structures, management systems, and behavioral norms. Yet, the new venture still has access to existing resources. Product Sequencing More targeted and cost effective. Includes joint research, technology-sharing, joint marketing, etc Incubating Capabilities Fast, but expensive and sometimes risky. Microsoft: eShop (1997), Hotmail (1998), NetGames (2000), etc. Allows for an incremental and indirect approach to capability development by driving product development. (e.g., 3M or Hyundai) Managing the Process Commitment to ambitious performance goals can create a driving force for capability development. See strategic intent, resource leverage and stretch (Prahalad & Hamel, 1996). 10 A Framework for Analyzing Resources and Capabilities 4. Develop strategy implications: (a) In relation to strengths - How can these be exploited more effectively? (b) In relation to weaknesses - Identify opportunities to outsourcing activities that can be better performed by other organizations. - How can weaknesses be corrected through acquiring and developing resources and capabilities? STRATEGY POTENTIAL FOR 3. Appraise the firm’s resources and capabilities in terms of: (a) strategic importance (b) relative strength SUSTAINABLE COMPETITIVE ADVANTAGE 2. Explore the linkages between resources and capabilities CAPABILITIES 1. Identify the firm’s resources and capabilities RESOURCES 11 Competencies vs. Core Competencies vs. Distinctive Competencies A competence is an internal activity that a company performs better than other internal activities. A core competence is a well-performed internal activity that is central, not peripheral, to a company’s strategy, competitiveness, and profitability. A distinctive competence is a competitively valuable activity that a company performs better than its rivals. 12 Assessing Sustainability of Resources and Capabilities: Four Criteria Is the resource or capability . . . Implications Valuable • Neutralize threats and exploit opportunities Rare Difficult to imitate • Not many firms possess Difficult to substitute • No equivalent strategic resources or capabilities • Physically unique • Path dependency (how accumulated over time) • Causal ambiguity (difficult to disentangle what it is or how it could be recreated) • Social complexity (trust, interpersonal relationships, culture, reputation) 13 Criteria for Sustainable Competitive Advantage and Strategic Implications Is a Resource… Valuable Rare Difficult Without to Imitate Substitutes Implications for Competitiveness No No No No Competitive disadvantage Yes No No No Competitive parity Yes Yes No No Temporary competitive advantage Yes Yes Yes Yes Sustainable competitive advantage 14 Why Rival Companies Have Different Costs Companies do not have the same costs because of differences in: Prices paid for raw materials, component parts, energy, and other supplier resources Basic technology and age of plant & equipment Economies of scale and experience curve effects Wage rates and productivity levels Marketing, promotion, and administration costs Inbound and outbound shipping costs Forward channel distribution costs 15 What Determines Whether a Company Is Cost Competitive? A company’s cost competitiveness depends on how well it manages its value chain relative to competitors Three areas contribute to cost differences 1. Suppliers’ activities 2. The company’s own internal activities 3. Forward channel activities Activities, Costs, & Margins of Suppliers Internally Performed Activities, Costs, & Margins Activities, Costs, & Margins of Forward Channel Allies & Strategic Partners Buyer/User Value Chains 16 The Value Chain Concept Identifies the separate activities and business processes performed to design, produce, market, deliver, and support a product / service – it can lead to cost efficiencies or competency development. Consists of two types of activities Primary activities Support activities 17 Service Marketing & Sales Procurement Technological Development Human Resource Mgmt. Firm Infrastructure Support Activities The Basic Value Chain Outbound Logistics Operations Inbound Logistics Primary Activities 18 Primary activities of the VALUE CHAIN Inbound Logistics Operations Production Layout control systems & work-flow design Efficiency of finished goods delivery Marketing and Sales Productivity of equipment Production processes Outbound Logistics Soundness of material and inventory handling Efficiency of warehousing activities Effective market research Innovative sales promotion Sales force Image, brand loyalty Service Customer feedback mechanisms Customer education and training Warranty, guarantee, repair 19 Support activities of the VALUE CHAIN Infrastructure Technology Development Physical: Size, location, age, flexibility of facilities and equipment Financial: Risk, cost and use of funds, ability to raise capital Research and development Interaction with other departments Technology transfer Encourage innovation Procurement Obtain raw materials acceptable quality lowest cost Supplier relationships Human Resources Knowledge: Types, levels of knowledge possessed by employees throughout the firm Skills: Various categories of skills and abilities developed over time 20 From Value Chain Analysis to Competitive Advantage A company can create competitive advantage by managing its value chain so as to Integrate the knowledge and skills of employees in competitively valuable ways Leverage economies of learning / experience Coordinate related activities in ways that build valuable capabilities Build dominating expertise in a value chain activity critical to customer satisfaction or market success The strategy-making lesson of value chain analysis: Sustainable competitive advantage can be created by (1) managing value chain activities better than rivals, and (2) developing distinctive capabilities to serve customers! 21 Service Procurement Technological Development Human Resource Mgmt. Usually this is because the specialty supplier can provide these functions more efficiently Firm Infrastructure Outsourcing is the purchase of some or all of a valuecreating activity from an external supplier Support Activities Outsourcing Marketing & Sales Outbound Logistics Operations Inbound Logistics Primary Activities 22 Strategic Rationales for Outsourcing Improve Business Focus Provide Access to World-Class Capabilities Achieves re-engineering benefits more quickly by having outsiders-who have already achieved world-class standards--take over process Share Risks The specialized resources of outsourcing providers makes worldclass capabilities available to firms in a wide range of applications Accelerate Business Re-Engineering Benefits Lets company focus on broader business issues by having outside experts handle various operational details Reduces investment requirements and makes firm more flexible, dynamic and better able to adapt to changing opportunities Free Resources for Other Purposes Permits firm to redirect efforts from non-core activities toward those that serve customers more effectively 23 Outsourcing Issues Greatest Value Evaluating Resources and Capabilities Do not outsource primary and support activities that are used to neutralize environmental threats or complete necessary ongoing organizational tasks Non-strategic Team of Resources Do not outsource activities in which the firm itself can create and capture value Environmental Threats and Ongoing Tasks Outsource only to firms possessing a core competence in terms of performing the primary or support activity being outsourced Do not outsource capabilities that are critical to their success, even though the capabilities are not actual sources of competitive advantage Firm’s Knowledge Base Do not outsource activities that stimulate the development of new capabilities and competencies 24