Lecture 7: The "Bank War"

advertisement

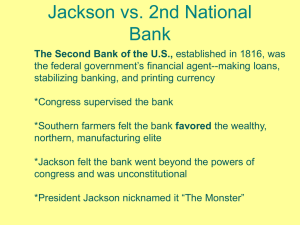

“The Bank War” and the Crash of 1837 Second Bank of the United States • Given a charter by Congress in 1816. • John Calhoun guided the bill though the House. He turned the earlier constitutional objection around. He argued that the Constitution required Congress to establish an agency for the regulation of currency because “No one could doubt that the power to coin money and regulate the value thereof included now paper money as well as coin.” • Vote for the Bank was 80-71 in the House and 22-12 in Senate • Geographical distribution of votes was reverse of 1791 with most of opposition coming from the Northeast where state banking was the strongest---competition. • Daniel Webster argued that a national bank was unnecessary. 420 Chestnut Street Philadelphia • Chartered for 20 years in 1816. • Capital $35 million. 1/5 by government and 4/5 by private subscribers. 25 directors—20 elected by shareholders and 5 appointed by President. • Head Office in Philadelphia plus branches • Large commercial business and biggest dealer in foreign exchange. • Third president of Bank was Nicholas Biddle---wealthy and brilliant intellect. Second Bank of the United States • Quickly establishes 18 branches by 1817. • Banks charter included limit of loans to government of $500,000. • Bank forbidden to suspend repayment of gold or silver of its obligations; penalty to pay 12% interest to customers. • Poorly managed first few years. • Stabilized by Biddle. Second bank as “proto-central” bank • No power to create high powered money—no open market operations, like Bank of England or Bank of France in this period. • But, powerful because of largest reserve of specie and conservative lending policy. • Fiscal agent of government—large reserves • Balance of payments outflow of gold in 1831. Provides credit to other banks and helps to head off a panic. • As a proto-central bank it: – Serves as a “Lender of Last Resort” to state banks---borrow specie from it in times of crisis. – Regularly presents of notes of state banks---limits their expansion. • But, at same times also a competitor with state banks • Opposition from the state banks, especially in the North........laissez faire • Key figure: Jackson’s Attorney General and 4th Secretary of the Treasury Roger Taney. Later Chief Justice of the Supreme Court. • Baltimore attorney and shareholder in banks, enemy of the privilege. • Taney: “the stockholders in the state banks, who are generally men in moderate circumstances are subject to the weight of unlimited war taxation whenever the public exigency may require it—why should the stock in the Bank of the United States which is generally held by the most opulent monied men, many of them wealthy foreigners be entirely free from the additional taxation which war or any other calamity may bring upon the rest of the community.” Why is 2nd Bank not rechartered? Forces Hostile to the Bank are gathering!! Forces Hostile to the Bank are gathering!! • Some enemies of the Bank were anti-bank agrarians. Ban all banks only hard money, others were inflationists • Senator Thomas Hart Benton of Missouri in 1831 on the 2BUS actions lending to other banks. “This is enough! Proof enough! For all who are unwilling to see a moneyed oligarchy established in this land and the entire Union subjected to its sovereign will. The power to destroy all others banks is admitted and declared.” • Vice President Martin Van Buren was the former governor and sought New York City’s dominance over Philadelphia. He opposed Hamilton’s consolidation of federal power and defended states’ rights. • Wall Street banks felt that BUS restrained the r freedom to lend and make money. • 1828 Andrew Jackson elected President. Hated banks—early in his life he received large quantity of worthless banknotes and felt banks had overcharged him. In his first address to Congress 1829---he aims to end the bank---announced nearly 7 years in advance. • Biddle tries to win him over but Henry Clay persuades Biddle to let him make the question of re-charter a campaign issue in 1832. • Early re-charter bill in 1832 is vetoed by Jackson: unconstitutional, too much foreign ownership, domestic ownership concentrated in East---and it is an instrument of the rich to oppress the poor. • Opposition in West and South where conservative policies deny easy credit • Opposition from Wall Street which wants to supplant Philadelphia. Andrew Jackson http://www.yale.edu/lawweb/avalon/ presiden/veto/ajveto01.htm Rockoff • Is Jackson a villain and Biddle a hero? • Is Jackson responsible for the macroeconomic problems of the 1830s--inflation and financial crises? Chronology---recession, boom and crash • • • • • • • • • • • • 1828: Deflation/Jackson elected 1829: Deflation 1830: Deflation 1831: Mild Inflation 1832: Mild Inflation/Re-charter Vetoed/ Jackson Re-Elected 1833: Mild Inflation/Jackson withdraws govt deposits 1834: Inflation/Biddle reduces 2BUS operations 1835: Inflation 1836: Inflation/Specie Circular/Distribution of Surplus Act 1837: Inflation, Bank of England raises discount rate, (May) Financial Crisis/Banks Suspend 1838: Deflation/Bank Resume payments 1839-1841: New financial crisis: bank failures, falling stock prices and Depression BACKGROUND Note: Specie Standard Guarantees Long But Not Short-Term Price Stability 1820-1845 135 130 125 120 1820 = 100 115 110 105 100 95 90 85 80 1820 1822 1824 1826 1828 1830 1832 Real GDP pc 1. Deflation 1820-1830 2. Mild Inflation 1830-1833 1834 1836 1838 1840 1842 1844 Price Level 3. Rapid Inflation 1834-1837 4. Crisis and Deflation 1837-1843 What Causes Economic Instability? 1. Exogenous Shocks 2. Government Policy What exogenous shocks and government policies does Rockoff identify? What were they in Rockoff (1972)? A. Exogenous Shocks 1. Increased Silver Imports from Mexico 2. Decreased Silver Exports to China 3. Bank of England raises its discount rate in 1837 B. Government Policy 1. Jackson’s Veto of Recharter 2. Biddle’s contraction of the Second Bank 3. Jackson’s withdrawal of deposits from the Second Bank and distribution to “Pet” banks 4. Distribution Act 5. Specie Circular We need a Detailed Chronology of the 1830s----a tumultuous decade--details are important Jackson’s 1832 Landslide!!! • 1833, Jackson orders government to stop making deposits in the bank and begins to withdraw funds. Moves funds to “pet” banks---Biddle responds by contracting loans—tight money and financial “stringency” in 1834. • Bank loses its federal charter in 1836 and becomes a Pennsylvania state bank. The Boom (Bubble?) Economy of the 1830s • Commodity prices rose at 13% a year in 1835 and 1836 • Urban and agricultural land prices and sales boom • Prices of slaves soars. • Large-scale foreign investment • Canal boom of the 1830s. • Securities prices boom • Distribution Act. In June 1836, Congress authorizes distribution of federal reserve surplus to the states to begin January 1837. Huge investments in transportation The Boom Economy Jackson’s response to the boom • Inflation begins---traditionally blamed on transfer of government deposits to over-expansive state banks • August 1836 Jackson issues the “Specie Circular” tries to check speculative purchases of public land sales and orders Public Land Office to accept only specie in payment. • May 1837 financial panic. Banks suspend convertibility of notes into gold. • 1838 Banks resume specie payments. Recovery. • 1839 new financial crisis. Bank failures including 2BUS. • Severe Depression 1839-1843: 194 of 729 banks close their doors, 45% reduction of bank assets, railroad stocks fall by 63%, banking stocks by 32%, investment negative. Rockoff: Was Jackson to Blame for Boom and Bust? Money Supply in the Specie Standard • • • • • • M = [(1 + c)/(c + r + e)]H c = coins/deposits + banknotes r = bank reserves in coin/deposits + banknotes e = excess reserves/deposits + banknotes Specie---gold and silver coin David Hume’s price-specie-flow mechanism. Payments surplus/deficit determines changes in H. • Rockoff’s version: M = S/[(C/M) + (R/D) – (C/M)(R/D)] M($m) S($m) R/D(%) C/M(%) 1832 1833 150 168 31 41 16 18 5 8 1834 1835 172 246 51 65 27 18 4 10 1836 1837 276 232 73 88 16 20 13 23 1838 1839 1840 240 215 186 87 83 80 23 20 25 18 23 24 Was Jackson to blame for the boom? • Bank veto and removal of federal funds from the 2BUS does not start monetary expansion leading to inflation. • There is no decline in the bank reserve to liability ratios. AND there was no decline in the public’s coin to deposit ratio. • Big increase occurs because of increase in high powered money. • Sources: Surplus with Mexico which covers with silver exports. Surplus of U.S. and U.K. with China, silver for opium. Heavy British investment in American securities, especially canal stocks. Was Jackson to blame for the boom? Regional reserve ratios (%) N.E. M.A. S.E. S.W. N.W. 1834 .06 .22 .24 .13 .46 1835 .07 .16 .21 .15 .28 1836 .07 .14 .18 .14 .30 1837 .09 .19 .24 .13 .32 Was Jackson to blame for the Crash and Depression? • Specie Circular helps to prick bubble. The official and supplemental inter-bank transfers to distribute federal surplus placed huge stress on financial system in 1836. • Heightened demand for specie in the West beginning in August 1836. But it did not dampen the boom in Western land sales • Together these force a reduction in specie reserves of NYC banks from $7.2 million 9/1836 to $1.5 million 5/1837. Huge effect when total specie is $70 million and 42% in individuals’ hands. • President Martin van Buren refuses to repeal the specie circular causing a rise in precautionary holding of specie. • End result is a financial collapse and deep recession from several large monetary shocks. Was Jackson to blame for the Crash and Depression? • Peter Temin (The Jacksonian Economy, 1969) blames Panic of 1837 on Bank of England raises its discount rate in 1836 to stem outflow of specie. • Bank of England instructs its Liverpool office to reject American bills to “recover” specie. Fall in market value of cotton-backed bills leads to default of cotton factors, defaults on bank loans and panic. • Interest rise in U.S. and U.K. and cotton prices and other goods and securities begin to fall. • Key: U.S. a small open economy, subject to international shocks. The Aftermath • Between 1830-1839 debts of U.S. states increase 13 times. • British and Dutch investors hold large shares. ($20 of $35 million of Pennsylvania’s debt). • Between 1841-1843, 8 states and one territory defaulted on their debts. • Primary investments are transportation and banking. Many projects not complete by the time of the depression. No revenue and must pay interest. • These are sovereign debts because U.S. Constitution forbids suits against states to enforce payment of debts. • Economic sanctions by another country (e.g. UK or Netherlands) against states are virtually impossible--part of one large union, not trade or war against one. • Only “sanction” is the loss of reputation. Western and Southern debts • PA and MD borrow for canals, rich, populous, defaults in depression outrage European investors, don’t repudiate. Raise taxes pay debt and arrears. OH, IN, IL MI, LA borrow for canals, similar but don’t make all payments on bonds. FL, MISS disasters— repudiation of state bank bonds. So why did some states pay? • Key—those that repay can borrow, even if default, those that repudiate debt can’t. Mississippi and Florida issue no new bonds before Civil War. • Temporary defaults recover low yields. Indiana and Illinois receive new loans to allow completion. • Clearly reputation matters. The U.S. post-1837/1843? • Bimetallic System • No central bank. No monetary policy, no lender of last resort, no fiscal agent. The U.S. government uses system of “sub-treasuries” to collect and disburse funds. • Federal debt declining. No big wars and no large projects. Damaged reputation on international capital markets slowly recover. • No federal regulation of banking---regulation of banks left completely to the states and a new period of experimentation begins---the “Free Banking Era” • A truncated “Hamiltonian” system.