Here Be Dragons - Association of Corporate Counsel

Here Be Dragons

Your Company is Going International…

What You Don’t Know Can Burn You

Presented by:

Cara Group, Newton Consulting, LLC

Angela Hughes, Franklin Electric Co., Inc.

Denis Quinlan, Calix, Inc.

Phil Strauss, Ebates Inc.

“We have decided to open a new facility in _______ country. How do we get started?”

YOU: Suppress the deer in the headlights look and say,

“I will get on it.”

Now What?

• Where to start

• Departments necessary for success

• Timing of various issues

• Questions to consider

• Where to find the answers

• Russia

• China

• Expats

• Excess Baggage

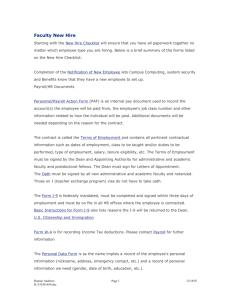

Departments necessary for success

Does timing matter

❑

Permits and licenses

❑

Government approvals

❑

Business unit expectations

❑

Director and Officer approvals

❑

Insurance

Where do I start?

Questions to Consider

1. THRESHOLD QUESTION : What does he mean when the CEO says “we want to be in ____”? Does he mean launch a website? Contract with a local distributor? Set up a new legal entity? Open a sales office? Hire employees? Sell locally?

2. What are the most common forms of business vehicle used in the jurisdiction and what are the main registration and reporting requirements?

3. What are management structures and key liabilities related to those vehicles?

4. What local licenses will the business need?

5. Are there any restrictions on doing business with certain jurisdictions?

Questions to Consider (cont.)

6. Are there any exchange control or currency regulations?

7. What are the main laws regulating employment relationships?

8. Is a written contract of employment required? If so, what main terms must be included in it? Do any implied terms and/or collective agreements apply to the employment relationship?

9. Do foreign employees require work permits and/or residency permits?

10. In what circumstances is an employee taxed in the jurisdiction and what criteria are used?

Questions to Consider (cont.)

11. What income tax and social security contributions must be paid by the employee and the employer during the employment relationship?

12. When is a business vehicle subject to tax in the jurisdiction?

13. What are the main taxes that potentially apply to a business vehicle subject to tax in the jurisdiction (including tax rates)?

14. Are there any thin capitalization rules (restrictions on loans from foreign affiliates)?

15. Must the profits of a foreign subsidiary be imputed to a parent company that is tax resident in the jurisdiction (controlled foreign company rules)?

Questions to Consider (cont.)

16. Are there any transfer pricing rules?

17. Are restrictive agreements and practices regulated by competition law? Is unilateral (or single-firm) conduct regulated by competition law?

18. Are mergers and acquisitions subject to merger control?

19. Are marketing agreements regulated?

20. Are there specific statutory data protection laws? If not, are there laws providing equivalent protection?

21. How is product liability and product safety regulated?

Where to find answers

ACC Resources: eGroups, forms, online education, quick references, etc.

Corporate Executive Boar d (formerly General Counsel Roundtable); “International Expansion Support

Center”. It provides information, tools, and advice to support successful entry into and operations in new markets through country specific legal, political, and cultural information; best practices for structuring legal services in emerging markets; and due diligence checklists and templates. https://gcr.executiveboard.com/Members/DecisionSupportCenters/Abstract.aspx?cid

=100235692

Getting the Deal Through . An international workflow tool for corporate counsel and legal practitioners.

Getting the deal through is a database of law and regulation in 65 practice areas and more than 150 jurisdictions containing concise explanations to the most important legal and regulatory matters that arise in business deals and disputes worldwide. http://gettingthedealthrough.com

LexMundi : Guides to Doing Business. These guides provide a comprehensive overview of the legal and business environments in more than 100 jurisdictions worldwide. http://www.lexmundi.com/lexmundi/Guides_To_Doing_Business.asp

Practical Law Corporation : Global Law Department resources. Provides egal know-how, transactional analysis and market intelligence for international and cross-border work. http://global.practicallaw.com

h

Russian Into Things

•

The Initial Call – We want to hire in Russia

•

Immediately

•

Finding Help

•

Hire a Law Firm?

•

Existing firm

•

ACC eGroups Recommendation

•

Work with your Accounting Firm?

•

Retain a Global Consultant?

Steppe Onboard

Hiring Options

•

Hire as Independent Contractor

•

Fastest option

•

Requires registration as “individual entrepreneur” by contractor

(stringent individual tax filing requirements make it less popular)

•

Comes with risks (similar to those in US): limited control; harder to protect CI and IP; could be deemed an employee

•

Hire IC via Third-party Agency (simpler, but similar risks)

•

Hire as direct employee of foreign entity?

•

Nyet under Russian law

•

Hire as an employee of new or existing Russian entity

Pushkin Forward

Types of Legal Entities

•

Representative Office

•

Simplest but limits on its functions and lifespan (3 years)

•

Cannot “carry out commercial activities” on its own, but may sign contracts and bind its foreign head office

•

Branch Office

•

Subdivision of foreign legal entity

•

May engage in any function in which its parent engages

•

Limited to 5-year lifespan

•

Local Subsidiary

•

Russian LLC or Joint Stock Company

Long To-Do List to Chekov

•

Legal Entity Creation Requirements Include

•

Executing establishment documents

•

Obtaining accreditation from State Registration Chamber

•

Tax registration

•

Manufacture of the seal

•

Registration with statistics authorities

•

Registration with Pension Fund

•

Registration with Social Insurance Fund

•

Registration with Employment Quotation Center

•

Opening of bank accounts

Process can take many months

What a Bunch of Bolshoi!

Documentation Challenges

•

Need for documents that sometime don’t exist

•

Provide proof that the VP of Sales is the VP of Sales

•

Need to provide proof of the obvious

•

Proof that the CEO has the authority to bind the company

•

Need to prove that individuals exist

•

Via “legalized” copies of passports and even utility bills

•

Apostille-apalooza, complicated by . . .

•

The notary disconnect: Most US notaries can only notarize signatures and cannot certify the authenticity of documents. In other countries a “notary” is an uber-lawyer whose main function is to authenticate legal instruments

You Just Have to Want it Badenov

•

Expect the unexpected

•

Expect the rules to change midstream

•

Expect requests for additional documents and additional in-country resources

• i.e. Bank account may require two signatories, one of which should be the “Chief Accountant” of the company in Russia. We didn’t have one.

Putin on the Risk

And just when it looked like we were done . . .

. . . Crimea and Punishment!

The bank account we spent six months setting up was with a bank that was hit with sanctions

Quit Stalin!

Plan B: Retain a Global Service Provider with In-Country Resources

•

Takes the project management off your plate

•

Can help set up local entity and bank accounts more efficiently

•

Can provide local Directors, Managers and Chief Accountants

•

Can provide managed payroll, auditing and tax services

China - Your Choices Have Consequences

•

Business License Description

• E.g., simplicity of shelf corporation may not have appropriate business description

•

Foreign Ownership Restrictions

• E.g., having a Hong Kong subsidiary is expensive (accounting, tax, legal, etc.)

China - What Are You Doing

Other Licenses May Be Required

• E.g., Internet Hosting in China may require ICP license

“Procure your own or partner with a third party?”

China:

Some Things Are Much More Expensive

• Trademark searches in a character-driven language

• Enforcement of intellectual property rights are sporadic

• Evidence is expensive to acquire

• Infringing shops closes and sets up next door

®

China - Other Considerations

● Currency issues - getting money into and out of China

● Cultural differences in contract drafting make it difficult to negotiate without a native speaker

● Blue ball point pen… only!?!?

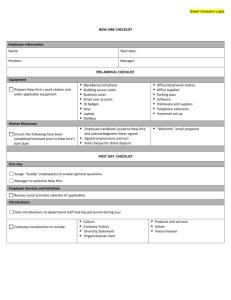

Expat Process:

Who to Send?

Questions to ask?

● what type of need are we filling?

○ executive

○ sales

○ on-the-ground worker

● who do we have that is willing to go?

○ family considerations

○ time

○ ability to obtain a visa

Visa

Don’t leave home without it

● Why type of visa/immigration documentation is required for this country?

● What type(s) of visas are available?

● What are the requirements for these visas?

○ Which visa(s) is the expat candidate eligible for?

● Will the company be sponsoring (can the company become a sponsor)?

● How to get advice on obtaining a visa in this country?

○ Local counsel

○ Consulting firm

○ Immigration advice from local country

Other Baggage to Consider

● Housing

● Schooling (for any children)

○ private schooling

○ public schooling

○ does it fit in with home country (determination of grade level)

● Tax issues - social security certificate

● Health Insurance – Social Benefits

○ what type of scheme is available in the visiting country

○ is the Expat eligible of this

○ supplemental insurance

● Car/transit

● Pets

● Shipping goods vs. buying new items in country