Texas Intestate Distribution of Real Property

advertisement

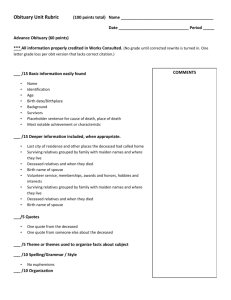

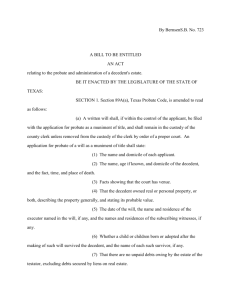

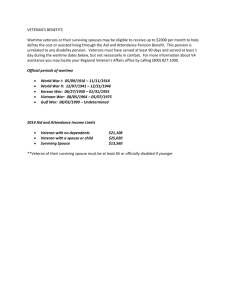

TEXAS INTESTATE DISTRIBUTION OF REAL PROPERTY Philip C. Mani & Associates, P.C. 20726 Stone Oak Parkway, Suite 116 San Antonio, Texas 78258 www.philipcmani.com TEXAS INTESTATE DISTRIBUTION OF REAL PROPERTY Table of Contents Table of Contents .....................................................2 MORE-ADVANCED POSSIBILITIES FOR DISTRIBUTION INTRODUCTION Per Capita, Per Stirpes and Per Capita with Representation .........................................................................22 Who Inherits Real Property In Texas When There Is No Will?.3 Who Inherits Real Property When There Is No Will .................4 Per Capita with Representation..................................................23 What Is Separate Property and Community Property? ..............5 Separate Property – Unmarried with No Surviving Parents, Surviving Siblings or Descendents of Deceased Siblings..........24 COMMUNITY PROPERTY Adopted Children and Half Siblings ..........................................25 Community Property Distribution Basics .............................6 Separate Property – Unmarried with no Surviving Parents and Surviving Full-Blood and Half-Blood Siblings .........................26 Married with No Children..........................................................7 Married with Children of the Marriage ......................................8 CONCLUSION Married with only Children of the Marriage ..............................9 Conclusion .................................................................................27 Married with Children who are Not also Children of the Surviving Spouse .......................................................................10 Texas Probate Code ...................................................................28 SEPARATE PROPERTY Separate Property Distribution Basics...................................11 Married with Children................................................................12 Married with No Children..........................................................13 Married with One Deceased Parent ...........................................14 Married with No Parents and Siblings Only ..............................15 Married with No Living Family Members.................................16 Unmarried with Children ...........................................................17 Unmarried with no Children but with Surviving Parents...........18 Unmarried with One Surviving Parent and Siblings ..................19 Unmarried with No Surviving Parents and Surviving Siblings .20 No Surviving Spouse and No Children......................................21 2 Who Inherits Real Property In Texas When There Is No Will? This is determined by the Texas laws of intestate succession and the laws of descent and distribution applying to real property found in Texas Probate Code, Sections 38 and 45. 3 Who Inherits Real Property When There Is No Will First: Determine whether the real property is the Decedent’s community property or separate property. The rules of who inherits are different for each type of property. Second: Determine (a) whether the Decedent was married and (b) whether the Decedent had children or descendents of children at the time of death. 4 What Is Separate Property and Community Property? Separate Property is all property acquired while single, or by gift, or by devise (through a Will), or by inheritance (through intestacy), or purchased with separate property funds while married. Community Property is all other property. All property acquired while married is presumed to be Community Property, which may be expressly controverted in a deed or other instrument conveying the property, or by proving it was acquired as Separate Property. 5 Community Property Distribution Basics (Texas Probate Code § 45) If Decedent was married and had no children, Decedent’s surviving spouse inherits all Community Property. If Decedent died On or Before September 1, 1993, married and had children, Decedent’s surviving spouse retains his/her one-half of the Community Property and the Decedent’s children inherit the Decedent’s one-half of the Community Property. If Decedent died After September 1, 1993, married and had only children of that marriage, Decedent’s surviving spouse retains his/her one-half of the Community Property and inherits the Decedent’s remaining one-half of the Community Property. If Decedent died After September 1, 1993, married and had children other than, or in addition to, the children with the surviving spouse, the surviving spouse retains his/her one-half of the Community Property and the Decedent’s children inherit the Decedent’s one-half of the Community Property. If Decedent was survived by children but no surviving spouse, the Decedent’s children inherit all of Decedent’s Property (see this in Separate Property Distribution Basics). Examples are provided on the next several slides. 6 COMMUNITY PROPERTY Married with No Children Texas Probate Code § 45(a)(1) 8/8 Deceased Spouse (1/2) Surviving Spouse (1/2) Surviving Spouse (1/2) At death of Deceased Spouse, Surviving Spouse will own 8/8. 7 COMMUNITY PROPERTY Married with Children of the Marriage (Decedent died Before September 1, 1993) 8/8 Deceased Spouse (1/2) Child (1/4) Surviving Spouse (1/2) Child (1/4) At death of Deceased Spouse, Deceased Spouse’s one-half community property will be equally divided between the children of the marriage. 8 COMMUNITY PROPERTY Married with only Children of the Marriage (Decedent died On or After September 1, 1993) Texas Probate Code § 45(a)(2) 8/8 Deceased Spouse (1/2) Surviving Spouse (1/2) Surviving Spouse (1/2) At death of Deceased Spouse, Surviving Spouse will own 8/8 so long as the spouses had only children of the marriage. If they have children, other than children of the marriage, the Deceased Spouse’s children inherit all of Decedent’s property. 9 COMMUNITY PROPERTY Married with Children who are Not also Children of the Surviving Spouse Texas Probate Code § 45(b) Family Structure Intestate Distribution Deceased Spouse Second Spouse (Surviving Spouse) First Spouse Child 8/8 Child Child Child of Deceased Spouse (1/6) Deceased Spouse Surviving Spouse (1/2) Child of Deceased Spouse (1/6) Child of Deceased Spouse (1/6) 10 Separate Property Distribution Basics Texas Probate Code § 38 If Decedent had children but no surviving spouse, the Decedent’s children inherit all of Decedent’s Separate Property. If Decedent was survived by a spouse and by children, Decedent’s surviving spouse inherits a life estate in 1/3 of the Separate Property, and the children inherit all of the Separate Property, subject to the surviving spouse’s life estate. If Decedent was survived by a spouse but had no children, Decedent’s surviving spouse inherits one-half of the Separate Property and Decedent’s father inherits one-fourth of the Separate Property and Decedent’s mother inherits the remaining one-fourth of the Separate Property. If only one parent survives, that parent inherits one-fourth of the Separate Property and the other one-fourth is inherited by Decedent’s brothers and sisters and/or their decedents, per stirpes (i.e. by their deceased parents’ share; referred to hereafter as “brothers and sisters” for simplicity). If no brothers and sisters survive Decedent, then the surviving parent inherits one-half of the Decedents Separate Property. If there is no surviving parent, the brothers and sisters inherit one-half of the Decedent’s Separate Property. “Children” or “Child” includes descendents of a predeceased child, per stirpes. Examples are provided on the next several slides. 11 SEPARATE PROPERTY Married with Children Texas Probate Code § 38(b)(1) 8/8 Deceased Spouse Surviving Spouse (Life Estate); Children (Remainder) (1/3) Child (1/2 of 2/3 Fee Simple) Child (1/2 of 2/3 Fee Simple) 12 SEPARATE PROPERTY Married with No Children Texas Probate Code § 38(b)(2) Deceased Spouse (8/8) Surviving Spouse (1/2) Surviving Father (1/4) Surviving Mother (1/4) 13 SEPARATE PROPERTY Married with One Deceased Parent Texas Probate Code § 38(b)(2) Deceased Spouse (8/8) Surviving Spouse (1/2) Surviving Parent (1/4) Surviving Sibling (1/8) Surviving Sibling (1/8) “Surviving Sibling” also means descendents of predeceased siblings. 14 SEPARATE PROPERTY Married with No Parents and Siblings Only Texas Probate Code § 38(b)(2) Deceased Spouse (8/8) Surviving Spouse (1/2) Surviving Sibling (1/6) Surviving Sibling (1/6) Surviving Sibling (1/6) 15 SEPARATE PROPERTY Married with No Living Family Members Texas Probate Code § 38(b)(2) Deceased Spouse (8/8) No Surviving Parents, Siblings, or Descendents of Siblings Surviving Spouse (All) 16 SEPARATE PROPERTY Unmarried with Children Texas Probate Code § 38(a)(1) Deceased (8/8) Child (1/3) Child (1/3) Child (1/3) 17 SEPARATE PROPERTY Unmarried with no Children but with Surviving Parents Texas Probate Code § 38(a)(2) Deceased (8/8) Surviving Mother (1/2) Surviving Father (1/2) 18 SEPARATE PROPERTY Unmarried with One Surviving Parent and Siblings Texas Probate Code § 38(a)(2) Deceased (8/8) Surviving Parent (1/2) Surviving Sibling * (1/4) * Or descendents of siblings, per stirpes. Surviving Sibling * (1/4) 19 SEPARATE PROPERTY Unmarried with No Surviving Parents and Surviving Siblings Texas Probate Code § 38(a)(3) Deceased (8/8) Surviving Sibling * (1/3) Surviving Sibling * (1/3) * Or descendents of siblings, per stirpes. Surviving Sibling * (1/3) 20 SEPARATE PROPERTY No Surviving Spouse and No Children Texas Probate Code § 38(a)(4) The Distribution of the Separate Property of an individual dying with no surviving spouse and no children or descendents of children, becomes very fact specific. It is not possible to provide the flowcharts depicting the mesne possibilities and outcomes which result from Texas Probate Code § 38 (a)(4). As a result, you should consult an attorney or your Probate Code. However, some basic distribution scenarios are included below. 21 Per Capita, Per Stirpes and Per Capita with Representation Texas Probate Code § 43 Per Capita translates to mean “by head” Per Stirpes means “through roots” When the Deceased’s surviving heirs are all of the first order and equal standing (i.e. children), they inherit per capita – in equal shares per the number of children. When the Deceased’s surviving heirs are of more than just the first order and have different standing (i.e. children vs. grandchildren of a child who predeceased the Deceased), the descendants inherit only such portion of the real property as their parent, through whom they inherit, would be entitled to if their parent were alive (called “per capita with representation”). 22 Per Capita with Representation Deceased Predeceased Sibling Predeceased Child of Sibling Predeceased Predeceased Sibling Surviving Child Of Predeceased Sibling (1/6) Surviving Sibling (1/3) Surviving Child Of Predeceased Sibling (1/6) Grandchild of Predeceased Sibling (1/3) 23 SEPARATE PROPERTY Unmarried with No Surviving Parents, Surviving Siblings or Descendents of Deceased Siblings Texas Probate Code § 38(a)(3) Deceased (8/8) Predeceased Sibling Predeceased Sibling’s Child (1/2 of 1/3) Surviving Sibling (1/3) Surviving Sibling (1/3) Predeceased Sibling’s Child (1/2 of 1/3) 24 Adopted Children & Half Siblings Adopted children inherit the same proportion from their adoptive parent as a natural born child. However, where an adopted child is the Decedent, the intestate distribution scheme can require the assistance of an attorney to determine. Half Blood. Where the surviving siblings of decedent (or their descendants) are full-blood to decedent, they inherit a full “share”, but where there are both full-blood siblings and half-blood siblings, the half-blood siblings (or their descendants) inherit half as much as the full-blood siblings. To calculate a full-blood sibling’s share versus a half-blood sibling’s share, you multiply the number of full-blood siblings by 2 (Example: 3 full-blood siblings x 2 = 6). Then add that number to the number of half-blood siblings (Example: 1 half-blood sibling + 6 = 7). The total is the denominator to use for your ownership (Example: each full-blood sibling is entitled to 2/7, and the half-blood sibling is entitled to 1/7 of the Deceased’s real property). An example is provided on the next slide. 25 SEPARATE PROPERTY Unmarried with No Surviving Parents and Surviving Full-Blood and Half-Blood Siblings Texas Probate Code § 38(a)(2)&(3) Deceased (8/8) Surviving Full-Blood Sibling * (2/7) Surviving Full-Blood Sibling * (2/7) * Or descendents of siblings, per stirpes. Surviving Full-Blood Sibling * (2/7) Surviving Half- Blood Sibling * (1/7) 26 These slides are a visual depiction of certain theoretical distribution scenarios under the Texas Probate Code Sections 38 and 45; they are not legal advice and should not be relied upon as a substitute for legal advice. Always consult an Attorney licensed to practice law in the State of Texas if you wish to determine who inherits real property in Texas when there is no Will. Philip C. Mani & Associates, P.C. 20726 Stone Oak Parkway, Suite 116 San Antonio, Texas 78258 www.philipcmani.com 27 Texas Probate Code § 38. Persons Who Take Upon Intestacy (a) Intestate Leaving No Husband or Wife. Where any person, having title to any estate, real, personal or mixed, shall die intestate, leaving no husband or wife, it shall descend and pass in parcenary to his kindred, male and female, in the following course: 1. To his children and their descendents. 2. If there be no children nor their descendants, then to his father and mother, in equal portions. But if only the father or mother survive the intestate, then his estate shall be divided into two equal portions, one of which shall pass to such survivor, and the other half shall pass to the brothers and sisters of the deceased, and to their descendants; but if there be none such, then the whole estate shall be inherited by the surviving father or mother. 3. If there be neither father nor mother, then the whole of such estate shall pass to the brothers and sisters of the intestate, and to their descendants. 4. If there be none of the kindred aforesaid, then the inheritance shall be divided into two moieties, one of which shall go to the paternal and the other to the maternal kindred, in the following course: To the grandfather and grandmother in equal portions, but if only one of these be living, then the estate shall be divided into two equal parts, one of which shall go to such survivor, and the other shall go to the descendant or descendants of such deceased grandfather or grandmother. If there be no such descendants, then the whole estate shall be inherited by the surviving grandfather and grandmother. If there be no surviving grandfather or grandmother, then the whole of such estate shall go to their descendants, and so on without end, passing in like manner to the nearest lineal ancestors and their descendants. (b) Intestate Leaving Husband or Wife. Where any person having title to any estate, real, personal or mixed, other than a community estate, shall die intestate as to such estate, and shall leave a surviving husband or wife, such estate of such intestate shall descend and pass as follows: 1. If the deceased have a child or children, or their descendants, the surviving husband or wife shall take one-third of the personal estate, and the balance of such personal estate shall go to the child or children of the deceased and their descendants. The surviving husband or wife shall also be entitled to an estate for life, in one-third of the land of the intestate, with remainder to the child or children of the intestate and their descendants. 2. If the deceased have no child or children, or their descendants, then the surviving husband or wife shall be entitled to all the personal estate, and to one-half of the lands of the intestate, without remainder to any person, and the other half shall pass and be inherited according to the rules of descent and distribution; provided, however, that if the deceased has neither surviving father nor mother nor surviving brothers or sisters, or their descendants, then the surviving husband or wife shall be entitled to the whole of the estate of such intestate. § 45. Community Estate (a) On the intestate death of one of the spouses to a marriage, the community property estate of the deceased spouse passes to the surviving spouse if: (1) no child or other descendant of the deceased spouse survives the deceased spouse; or (2) all surviving children and descendants of the deceased spouse are also children or descendants of the surviving spouse. (b) On the intestate death of one of the spouses to a marriage, if a child or other descendant of the deceased spouse survives the deceased spouse and the child or descendant is not a child or descendant of the surviving spouse, one-half of the community estate is retained by the surviving spouse and the other one-half passes to the children or descendants of the deceased spouse. The descendants shall inherit only such portion of said property to which they would be entitled under Section 43 of this code. In every case, the community estate passes charged with the debts against it. 28