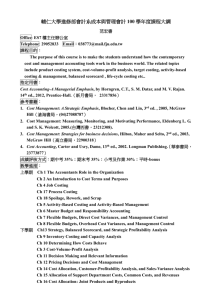

ACC 3123 Accounting Exam 1 - Fall 2010

advertisement

ACC 3123 / EXAM 1 / FALL 2010 UPPER CASE ONLY: LAST-NAME FIRST-NAME SEAT # WRITE ALL YOUR ANSWERS ON THIS ANSWER-SHEET. SHOW ALL YOUR WORK ON THE BLANK SIDES OF THE EXAM. USE 4-DECIMALS IN ALL YOUR WORK. ALL QUESTIONS ARE WORTH EQUAL POINTS. Q# 1 2 3 4 5 6 7 8 9 10 ANSWER Q# 11 12 13 14 15 16 17 18 19 20 ANSWER ACC 3123 / EXAM 1 / FALL 2010 QUESTIONS 1-3: The following information is for the Mitchell Company for November. Inventories Raw Material Work in Process Finished Goods Beginning $19,750 35,350 21,300 Direct Labor (22,000 DLH @ $14) Raw Material Purchases Indirect Labor Factory Supplies Used Other Expenses: Depr.-Factory Equipment Ending $15,400 32,200 27,900 $155,000 Insurance-Office 11,600 Office Supplies Expense 475 Insurance-Factory Depr. Office Equipment 18,100 Repair/Maintenance-Factory 2,750 1,050 1,825 3,900 7,800 1. Refer to Mitchell Company. What was the total manufacturing costs during the year? 2. Refer to Mitchell Company. What was the Cost of Goods Manufactured? 3. Refer to Mitchell Company. What was the Cost of Goods Sold? QUESTIONS 4-7: Davis Company manufactures wood file cabinets. The following information is available for June 2008: Raw Material Inventory Work in Process Inventory Finished Goods Inventory Beginning $ 6,000 17,300 21,000 Ending $ 7,500 11,700 16,300 Direct labor is $9.60 per hour and overhead for the month was $9,600. 1,500 direct labor hours were used and $21,000 of raw material was purchased. 4. Refer to Davis Company. What is the Cost of Goods Manufactured for June? 5. Refer to Davis Company. What is the total conversion cost for June? 6. Refer to Davis Company. What is the prime cost for June? 8. 7. Refer to Davis Company. How much is Cost of Goods Sold? Deep Sea Motor Company is exploring different prediction models that can be used to forecast indirect labor costs. One independent variable under consideration is machine hours. Following are matching observations on indirect labor costs and machine hours for the past six months: 2 Month 1 2 3 4 5 6 Machine hours 300 400 240 370 200 225 Indirect labor costs $20,000 $24,000 $17,000 $22,000 $13,000 $14,000 Deep Sea Motor Company is planning on using 350 machine hours in the next month. Using the high low method, what is the projected indirect labor cost for the next month? 9. Refer to Deep Sea Motor Company above. Re-answer question 8 using the regression method. QUESTIONS 10-11: The following data are available for the Schilling Manufacturing Company for the year 2005, its first year of operations. These pertain to total production. Beginning inventory in units Units produced Units sold Sales Material cost (DM) Variable conversion cost used (DL+VMOH) Indirect manufacturing cost (FMOH) Indirect non-manufacturing costs (NMOH) 10. Calculate cost of goods sold under variable costing. 11. Calculate cost of goods sold under full absorption costing. 0 2,400 2,000 $200,000 $24,000 $48,000 $36,000 $40,000 QUESTIONS 12-13: Marx Brothers, Inc. provides you with the following information. Actual FMOH $25,545 Estimated FMOH $27,000 Actual VMOH $57,651 Estimated VMOH $56,000 Estimated DM cost per unit $5.11 (cost driver for VMOH) Actual DM cost per unit $5.33 Actual DL cost per unit $10.66 Estimated DL cost per unit $10.51 (cost driver for FMOH) Actual units produced 9,554 Estimated units 10,000 12. Calculate the applied FMOH using Normal Costing. 13. Calculate the applied VMOH using Standard Costing. QUESTIONS 14-15: 3 McMahon Company would like to institute an activity-based costing system to price products. The company's Purchasing Department incurs costs of $550,000 per year and has six employees. Purchasing has determined the three major activities that occur during the year. Activity Issuing purchase orders Reviewing receiving reports Making phone calls Allocation Measure # of purchase orders # of receiving reports # of phone calls # of People 1 2 3 Total Cost $150,000 $175,000 $225,000 During the year, 50,000 phone calls were made in the department; 15,000 purchase orders were issued; and 10,000 shipments were received. Product A required 200 phone calls, 150 receiving reports, and 50 purchase orders. Product B required 350 phone calls, 400 receiving reports, and 100 purchase orders. 14. Determine purchasing department cost per unit of product A, if 1,500 units of Product A and 3,000 units of Product B were manufactured during the year. 15. Determine purchasing department cost per unit of product B, if 1,500 units of Product A and 3,000 units of Product B were manufactured during the year. QUESTIONS 16-17: Erin Sacks, CPA, J.D., provides accounting and tax services to her clients. In 2010, she charged $175 per hour for accounting and $200 per hour for tax services. Erin estimates the following costs for the year 2011. Office supplies, advertising and miscellaneous Computer fees Secretary's salary Rent $ 32,000 48,000 50,000 36,000 $166,000 Operating profits declined last year and Ms. Sacks has decided to use activity based costing (ABC) procedures to evaluate her hourly fees. She has gathered the following information from last year's records: Activity Levels Activity Office Supplies Computer fees Secretary's salary Rent Cost Driver Hours billed Computer hour used Number of clients Types of services offered Accounting 1,000 250 32 1 Tax Services 1,000 750 168 1 Required: 16. Erin wants her hourly fees for the Accounting services to be 150% of their activity-based costs. What is the fee per hour for this service that Erin must charge? 17. Erin wants her hourly fees for the Tax services to be 200% of their activity-based costs. What is the fee per hour for this service that Erin must charge? 4 QUESTIONS 18-19: Farris Corporation produces a single product. The following is a cost structure applied to its first year of operations. Sales price Variable costs: SG&A Production Fixed costs (total cost incurred for the year): SG&A Production $15 per unit $2 per unit $4 per unit $14,000 $20,000 During the first year, Farris Corporation manufactured 5,000 units and sold 3,800. There was no beginning or ending work-in-process inventory. 18. How much income before income taxes would be reported if Farris Corporation uses full absorption costing? 19. How much income before income taxes would be reported if variable costing was used? _________________________________________________________________________________ 20. Executive Images Corporation produces two types of wooden bookends: plain and hand-carved. The following information about the production process is available: Number produced Machine hours Inspection hours Revenues Direct costs Plain 120,000 95,000 7,000 $4,800,000 $3,800,000 Hand-Carved 75,000 25,000 35,000 $4,400,000 $3,100,000 Total factory overhead is $1,200,000. Of this overhead, $500,000 is related to utilities (cost driver = machine hours) and the remainder is related to quality control (cost driver = inspection hours). If the Corporation uses ABC allocation method, what is the profit per unit of “Plain” bookend? Per unit of “Hand-Carved” bookend? 5