Ireland Didn't Deserve a Downgrade

advertisement

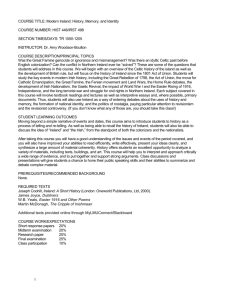

Wall Street Journal – 20/07/2011 Ireland Didn't Deserve a Downgrade Moody's provided speculation, not analysis. By David Byrne It is bizarre when a country is downgraded even though it has improved its creditworthiness. Yet this is what happened on July 13 when Moody's reduced Ireland's credit rating by one notch, taking it out of investment grade for the first time. Despite Moody's rating, the facts show that Ireland's solvency has improved this year. And, if we analyze the period since Moody's downgrade of Ireland in April, the reasons for their decision are even less compelling. In the last three months, Ireland has hit the fiscal targets for the first half of 2011, completed two troika reviews and seen confirmation of a return to economic growth in the first quarter. This year, three key events pointed Ireland on the path to recovery. First, the banks, guaranteed by the Irish taxpayer, were subject to rigorous stress tests and radical restructuring plans. The €35 billion ($49.6 billion) earmarked for recapitalization out of Ireland's financial assistance program were not used up, making remaining funds available to fund budget deficits. The total recapitalization cost under the most adverse scenario was €24 billion, which included a buffer of more than €5 billion beyond the requirements of the stress tests conducted by Blackrock Solutions. But the cost to the state will be limited to about €19 billion after the burden-sharing with subordinated bondholders in the banks, which is now substantially completed. Following the recapitalization, which should be complete by the end of July, the pro forma capital ratios of Ireland's banks will be among the highest in the euro zone. Ireland's stress tests were far more stringent than the recent European Banking Authority tests because the bar was raised following the inadequate attempts at recapitalization in 2009 and 2010. Investors have been impressed with the Irish tests' rigor and transparency. Second, the most recent quarterly troika mission to Ireland has concluded. The statements of the European Commission, IMF and ECB confirm that Ireland meets all program targets in the areas of fiscal consolidation, banking and structural reform. Ireland eclipsed the primary balance target (budget balance excluding interest payments) for the second quarter. In fact, the target had to be tightened during the quarter. In the first half of the year, tax revenue was in line with expectations while expenditure was kept tight. Ireland is on track to beat the 2011 government budget deficit forecasted by the European Commission and IMF. Third, economic growth returned in the first quarter following a deep three-year recession. In the first quarter, Ireland's GDP increased 1.3% from the final three months of 2010. Revisions to the previous year were favorable too. The level of nominal GDP was revised upward by €2 billion, improving debt and deficit ratios. View Full Image Barbara Kelley This year, Ireland also recorded its first current account surplus since 1999. That highlights two factors: Ireland has regained significant competitive ground and it is no longer a net importer of capital following the collapse of the construction sector. As a result, the country will reduce its net external debt, currently around 100% of GDP, as long as it continues to run current account surpluses. The latest data shows that the value of Irish exports has reached a record high. It has continued to outperform on metrics such as unit labor costs and real exchange rate. Now, Ireland is forecast to continue to enjoy healthy export growth for the medium-term. The gradual restoration of cost competitiveness with other European countries may also help explain the continuing rise in foreign direct investment. None of this is has been achieved without considerable effort. The Irish taxpayer, on whose shoulders this burden rests, has been faced with increases in taxation and compression in wages. Nonetheless, without any personal responsibility for the problems created or resort to public demonstrations, the Irish taxpayer has mandated the new government in Ireland to take austerity measures. This attitude deserves credit. Yet Moody's ignored these positive developments. In fact, they played no part in its decision to downgrade Ireland. This damaging decision was based on speculation and conjecture. Moody's judged that Ireland's chances of market re-entry in 2012 or 2013 had diminished because of the thrust of the crisis debate at European level. It is particularly concerned about private sector involvement in Ireland's debt market. The rationale for the downgrade was that if Ireland failed to re-enter the bond market it would need official financing from the new ESM at the end of 2013. This would entail a debt sustainability test, to which Moody's must be attaching a non-negligible probability of failure. Rather than speculate, it is worth analyzing Ireland's likely debt sustainability at end-2013. Unfortunately, this is analysis that Moody's failed to provide. All forecasts suggest that Ireland will be close to primary budget surplus again by end 2013 and probably only 2-3 percentage points of GDP short of a surplus sizeable enough to stabilize the government debt ratio. Ireland's average interest rate on its stock of debt will be no more than 5.5%. Nominal GDP growth will revert to the trend range of at least 4%, according to IMF forecasts. And Ireland's banking system will be among the cleanest in the euro zone. Ireland's market re-entry has been made more difficult by this ratings downgrade. Sometimes these actions risk self-fulfilling prophecy. Some funds will no longer be allowed to purchase Irish government bonds thanks to investor-agreed ratings thresholds. A degree of forced selling has already begun: Ireland's bond yields have jumped 50-200 basis points (depending on the maturity) since Moody's rating action. Nonetheless, the rating agency is still in the minority: Ireland has investment grade ratings three notches higher with both Fitch and Standard & Poor's. Therefore, Ireland remains a component part of most major bond indexes. Apart from the arithmetic, it is unfathomable that Moody's made this decision without waiting for the outcome of crisis talks in the euro zone. These talks may result in improvement to Ireland's creditworthiness through a large reduction in its bailout interest rate or other changes to the loan terms. In addition, a more comprehensive solution for Greece and overhaul of the euro-zone architecture may limit contagion, easing the path to market re-entry. The president of the European Commission has described Moody's action as "incomprehensible." The downgrade is likely to reinforce the commission's concern regarding the role of the rating agencies and their influence on the continuing euro-zone crisis. Mr. Byrne is chairman of the advisory committee of Ireland's National Treasury Management Agency. He is a former European commissioner and attorney general of Ireland.