Ch 3 - Porter Competitive Model

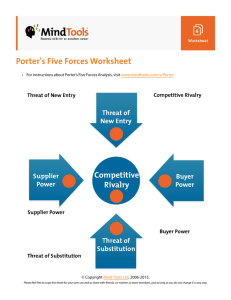

advertisement

What’s Happening?! Apple announced all-time record quarterly earnings. Intel exceeded earnings expectations for the quarter. 2004 holiday sales were the best since 1999. Wal-Mart on the offensive against critics regarding employment practices and impact on communities. Americans are Fat and Binge Drink 2001 Study We are a society that is somewhat taken with excesses. More than one in five people are obese. 300,000 U.S. adults die from causes related to obesity. 100,000 Americans die a year because of alcohol abuse. Half of adult Americans do not drink at all. An On-going Issue with Newspapers The function of the press is to inform but its role is to make money. Investigative reporting wins Pulitzer Prices but costs a lot of money. Announcements Complete list of student presentations are on the course web page. First ISM Toastmasters meeting a week from today at noon in new Engineering Building room 280. Sign up today and make sure your email address is legible. Global Competitiveness Ranking Criteria: 1. Quality of national business environment. 2. The set of institutions, market structures and economic policies supportive of high level of prosperity. 3. Company operations and strategy ranking. Michael Porter, Institute for Strategy and Competitiveness, Harvard Business School World Economic Forum web page. 1998 Rankings 1. Singapore 11. Ireland 2. Hong Kong 12. Japan 3. US 13. New Zealand 4. UK 14. Australia 5. Canada 15. Finland 6. Taiwan 16. Denmark 7. Netherlands 17. Malaysia 8. Switzerland 18. Chile 9. Norway 19. Korea 10. Luxembourg 20. Austria Source: World Economic Forum Global Competitiveness Ranking 2002 1. US (2) 11. Japan (15) 21. Norway (19) 2. Finland (1) 12. Austria (13) 22. New Zealand (20) 3. UK (7) 13. Belgium (14) 23. Korea (26) 4. Germany (4) 14. Australia (9) 24. Italy (24) 5. Switzerland (5) 15. France (12) 25. Spain (23) 6. Sweden (6) 16. Taiwan (21) 26. Malaysia (37) 7. Netherlands (3) 17. Iceland (16) 27. Slovenia (32) 8. Denmark (8) 18. Israel (17) 28. Hungary (27) 9. Singapore (10) 19. Hong Kong (18) 29. South Africa (25) 20. Ireland (22) 30. Estonia (28) 10. Canada (11) Global Competitiveness Ranking 33. Brazil (30) 37. India (36) 38. China (47) 48. Poland (42) 55. Mexico (52) 61. Philippines (53) 58. Russia (58) 60. Vietnam (62) 79. Bolivia (75) 80. Haiti 2004 Ranking Country 2004 rank 2004 score 2003 rank Finland 1 5.95 1 United States 2 5.82 2 Sweden 3 5.72 3 Taiwan 4 5.69 5 Denmark 5 5.66 4 Norway 6 5.56 9 Singapore 7 5.56 6 Switzerland 8 5.49 7 Japan 9 5.48 11 Iceland 10 5.44 8 Country United Kingdom Netherlands Germany Australia Canada New Zealand France Korea China Italy Mexico India Brazil Poland Indonesia Russian Federation Philippines Vietnam Kenya Chad 2004 rank 2004 score 2003 rank 11 12 13 14 15 18 27 29 46 47 48 55 57 60 69 70 76 77 78 104 5.30 5.30 5.28 5.25 5.23 5.18 4.92 4.90 4.29 4.27 4.17 4.07 4.05 3.98 3.72 3.68 3.51 3.47 3.45 2.50 15 12 13 10 16 14 26 18 44 41 47 56 54 45 72 70 66 60 83 101 Major Points It is no longer possible for a country to insulate itself from the rest of the world. Within the current industrialized world there is a narrowing of the gap between it and third world countries. The accelerated pace of change is what disturbs the pessimists, because they can see it happening. It took Britain 60 years to double its output, the US 50 years but developing countries are doubling output every 12 years. China has actually doubled its GDP in seven years. In many respects the developing world is unknown economic and financial territory. Conclusions • The diamond of national advantage makes sense as a means of understanding global economic success. • Domestic success does prepare companies to compete globally. • Major European and an increasing number of Asian countries are capable of competing on a global basis. • The global marketplace is only going to get tougher based on more, tougher competitors. • The diamond can help to anticipate and understand new competitors. Chapter 2 Summary Business Competitive Environment The First of Three Perspectives: The Business Environment • Business Environment • Enterprise Environment • IT Environment Business Success Important Factors to Understand the BCE of a Company Defining Competitiveness and a Competitive Model How a Company Gains a Competitive Advantage. The benefits to be gained from understanding the Competitive Advantage of Nations concepts. The Company Agenda The Role of Government Competitiveness: A Definition The degree to which a nation can, under free and fair market conditions, produce goods and services that will meet the test of international markets while simultaneously maintaining or expanding the real income of its citizens. Summary of Competitive Model Three primary inputs to improved domestic performance – Human Resources – Capital – Technology Trade policy and new competition act as possible barriers to go global Trickle down effect for increased standard of living How Does a Company Gain Competitive Advantage? Providing value to customers is what competitiveness is all about. A Good Competitor Knows: – Its Products and Services – Its Customers – Its Competitors The Diamond of National Advantage Chance Firm Strategy, Structure and Rivalry Factor Conditions Demand Conditions Related and Supporting Industries Government The Competitive Advantage of Nations The home nation plays a major role in the achieving and sustaining competitive advantage among companies The home nation acts a catalyst in creating the right business competitive environment “Perceive a new basis for competing or find a better means of competing in old ways” Michael Porter The Company Agenda – To Create Pressure for Innovation – To Be Strong at Home – To Go Global The Role of Government – Should Act Like A Referee – Should Act Like A Coach – Create an environment that challenges companies to compete successfully. Clusters are Prevalent The diamond of National Advantage promotes industry clusters and the presence of strong industry rivals within the same host nation. Disagreement Kenichi Ohmae disagrees on the importance of the role of the nation. He believes successful companies transform themselves into truly global firms. Possible Exam Questions Define and defend the basic concepts of the Diamond of National Advantage. Use the Diamond of National Advantage to analyze a dominant industry in a specific country Chapter 3 The Porter Competitive Model for Industry Structure Analysis Key Chapter Objectives • Introduce the structure and use of the Porter Competitive Model. • Introduce the structure and use of Porter’s Value Chain. • Illustrate how these models can be used to evaluate a company and its competitive ability within an industry. • Draw conclusions between the use of Information Systems, and the two Porter models. The Porter Competitive Model • Used to understand and evaluate the structure of an industry’s business environment, and the threats of competition to a specific company. • Breaks an industry into small parts to avoid defining an industry too narrowly. • The model was not designed to assess a companies use of Information Systems, yet it can pinpoint strategic areas to deploy Information Systems. Porter Competitive Model Potential New Entrants Bargaining Power of Suppliers Intra-Industry Rivalry Strategic Business Unit Bargaining Power of Buyers Substitute Products and Services Source: Michael E. Porter “Forces Governing Competition in Industry Harvard Business Review, Mar.-Apr. 1979 Figure 3-1 Competitive Strategies Countering Competitive Forces Basic Objectives • Create effective links with consumers and suppliers. • e.g. Improving your supply chain and locking in customers. • Build barriers to new entrants and substitutes. Two Strategies to Accomplish The Basic Objectives • Differentiation Strategy • Provide a superior product. • If done correctly allows for premium pricing. • Usually more costly to implement. • Low-Cost Strategy • Leverage economies of scale, past experience, and alliances to provide the cheapest prices. • IS can play a key role. Supporting Strategies Augment Competitive Strategies • Innovation – Can help contribute to product differentiation and operational efficiency. • Growth – Certain industries reward firms exhibiting explosive growth (ex. Federal Express). • Alliance – Allows strategies to be used which would be impossible to implement alone (ex. Airlines sharing routes to expand reach). The Porter Value Chain • Focuses on a companies INTERNAL operations, specifically efficiency and added value. • Identifies sources of competitive advantage. • Objective: • Maximize value adding activities. • Minimize non-value adding activities. Porter Value Chain Manufacturing Industry Value Chain Research and Development Production Engineering and Manufacturing Sales Marketing and Distribution Service Value Chain & Information Systems • Value chain breaks business operation into functional pieces. • These pieces can be analyzed to see if IS may add efficiency. • Nearly all of the pieces can benefit from the correct use of IS, given the necessary talent and adequate funding. In Closing • Porter’s models have become standard analysis tools. • Combined they provide both external and internal visibility. • Both must be used carefully to avoid negative results or misdirection. Chapter 3 Porter Competitive Model for Industry Structure Analysis The Plan for Today • Address the Concepts of the Porter Competitive Model. • Provide some industry examples using the Competitive Model. • Address the Value Chain conceptually and with industry examples. • Gain necessary understanding so can revisit each of these using the airline industry as the example in Chapter 4. Awareness of competitive forces can help a company stake out a position in its industry that is less vulnerable to attack. Michael E. Porter Competitive Strategy Porter Competitive Model • Was not developed for IS use. • Breaks an industry into logical parts, analyzes them and puts them back together. • Avoids viewing the industry too narrowly. • Provides an understanding of the structure of an industry’s business environment. • Provides an understanding of competitive threats into an industry. Two Key Questions 1. How structurally attractive is the industry? 2. What is the company’s relative position within the industry? Why Do You Care? The collective strength of the industry forces determines the ultimate profit potential of an industry. The strongest competitive forces are of greatest importance in formulating competitive strategies. Every industry has an underlying structure, or a set of fundamental economic and technical characteristics that gives rise to these competitive forces. Why Do You Care? This view of competition pertains to industries selling products and those dealing in services. A few characteristics are often key to the strength of each competitive force. Key Industry Analysis Factors • Collecting the data. • Determining which data is important. • Selecting an appropriate overall approach. • Deciding on the logical starting point. Basic Objective of the SBU 1. To create effective links with buyers and suppliers. 2. To build barriers to new entrants and substitute products. Porter Competitive Model Potential New Entrants Bargaining Power of Suppliers Intra-Industry Rivalry Strategic Business Unit Bargaining Power of Buyers Substitute Products and Services Source: Michael E. Porter “Forces Governing Competition in Industry Harvard Business Review, Mar.-Apr. 1979 Figure 3-1 Definitions New Entrant: An existing company or a startup that has not previously competed with the SBU in its geographic market. It can also be an existing company that through a shift in business strategy begins to compete with the SBU. Substitute Product or Service: An alternative to doing business with the SBU. This depends on the willingness of the buyers to substitute, the relative price/performance of the substitute and/or the level of the switching cost. Rivalry Likelihood? • Profit margins. • Industry growth rate and potential. • A lack of capacity to satisfy the market. • Fixed costs. • Competitor concentration and balance. • Diversity of competitors. • Existing brand identity. • Switching costs. • Exit barriers. A Buyer Has Power If: 1. It has large, concentrated buying power that enables it to gain volume discounts and/or special terms or services. 2. What it is buying is standard or undifferentiated and there are multiple alternative sources. 3. It earns low profit margins so it has great incentive to lower its purchasing costs. 4. It has a strong potential to backward integrate. 5. The product is unimportant to the quality of the buyers’ products or services. A Supplier Has Power If: 1. Its product is unique or at least differentiated. 2. It has built up switching costs. 3. It provides benefits through geographic proximity to its customers. 4. It poses a definite threat to forward integrate into its customers’ business. 5. A long time working relationship provides unique capabilities. Possible Barriers to Entry • Economies of scale. • Strong, established cost advantages. • Strong, established brands. • Proprietary product differences. • Major switching costs. • Limited or restrained access to distribution. • Large capital expenditure requirements. • Government policy. • Definite strong competitor retaliation. Substitute Threats • Buyer propensity to substitute. • Relative price/performance of substitutes. • Switching costs. Competitive Strategies • What is driving competition in my current or future industry? • What are my current or future competitors likely to do and how will we respond? • How can we best posture ourselves to achieve and sustain a competitive advantage? Strategy Options According to Michael Porter Primary Strategies 1. Differentiation 2. Least Cost Supporting Strategies 1. Innovation 2. Growth 3. Alliance Can Information Systems: 1. Build barriers to prevent a company from entering an industry? 2. Build in costs that would make it difficult for a customer to switch to another supplier? 3. Change the basis for competition within the industry? 4. Change the balance of power in the relationship that a company has with customers or suppliers? 5. Provide the basis for new products and services, new markets or other new business opportunities? Porter Competitive Model Heavyweight Motorcycle Manufacturing Industry North American Market • Parts Manufacturers • Electronic Components • Specialty Metal Suppliers • Machine Tool Vendors • Labor Unions • IT Vendors Bargaining Power of Suppliers • Automobiles • Public Transportation • Mopeds • Bicycles • Foreign Manufacturer Potential New Entrant Intra-Industry Rivalry SBU: Harley-Davidson Rivals: Honda, BMW, Suzuki, Yamaha Substitute Product or Service • Established Company Entering a New Market Segment • New Startup Bargaining Power of Buyers • Recreational Cyclist • Young Adults • Law Enforcement • Military Use • Racers Business Strategy Model Asks Fundamental Questions 1. What products and/or services do we intend to offer? 2. What price range of products do we intend to offer? 2. What customer targets do we intend to pursue? 3. What geographic markets do we intend to address? 4. How will we obtain products to sell to our customers? 5. How will we deal with sales to our customers? 6. What company structure do we intend to create? 7. What information systems approach will we take? Business Strategy Model - Motorcycle Manufacturing Industry Product Strategy Type/Purpose/Size Heavyweight Off-Road Dual Purpose Road Racing Café Racer Price Strategy Entry Level Law Enforcement Moderate Market Strategy Premium Military Recreational Professional Young Adult North American Europe Japan/Asia Manufacturing Strategy Vertically Integrated Vendor Emphasis Latin America Outsource Sales/Distribution Strategy Distributors Independent Dealers Franchised Dealers Company Structure Independent Alliances Joint Ventures/Subsidiaries Information Systems Engineering Product Design Manufacturing Sales/Distribution Business Business Strategy Model – Food Service Industry Product Strategy Limited Specialized Products Broad Range of Specialized Products Wide Range of Non-specialized Products Health Conscious Products Customer Strategy Young Adults Parents Teenagers with Social with Focus Kids Time Conscious Adults Leisure Adults Senior Citizens Store Format Strategy Dine In Wait Service Dine In Counter Service or Buffet Take Out Drive Through Vendor Strategy Competitive Bids Long Term Contracts Alliances Vertically Integrated Market Strategy Local Regional National International Ethnic Focus Company Structure Strategy Independent Alliances Franchises Subsidiary Information Systems Strategy Customer Systems Store Logistical Systems Product Analysis System Business Systems Strategy Options According to Michael Porter Primary Strategies 1. Differentiation 2. Least Cost Supporting Strategies 1. Innovation 2. Growth 3. Alliance Porter Competitive Model Tips 1. To incorrectly define the industry can cause major problems in doing Section I of the analysis term paper. 2. You must identify the specific market being evaluated. 3. Your analysis company is the Strategic Business Unit. 4. Identify rivals by name for majors, by category for minor rivals if needed to present the best possible profile of rivals. Porter Competitive Model 5. Be sure to address the power implications of both customers and suppliers. Power buys them what? 6. Identify buyers and suppliers by categories versus companies. 7. Summarize your Porter Model analysis. Computer Industry Why is this industry more of a challenge to evaluate using the Porter Competitive Model? Old Computer Industry Layer 5 Distribution Layer 4 Application Software Layer 3 Operating System Software Layer 2 Computing Platforms Layer 1 Basic Circuitry IBM DEC HP Fujitsu NCR Figure 3-3 The New Computer Industry Layer 5 Distributors Computer Dealers Super Stores Mass Clubs Merchandisers Mail Order Value-add Resellers Direct Sales Force Other Layer 4 Applications Lotus 1-2-3 •Spreadsheets •Word Processors •Database Layer 3 Operating System Software Layer 2 Computer Platforms Layer 1 Microprocessor MS DOS Novell Netware IBM Compaq Intel X86 Microsoft Excel Windows Quattro Pro OS/2 Banyan Unix IBM Other Intel-Based PCs Motorola Apple Others Apple Macs RISC Other Power PC Figure 3-4 The Computer Industry Layer 6 Sales and Distribution Layer 5 Application Software •Enterprise •Specific Layer 4 Database & Networking Software Layer 3 Operating System Software Layer 2 Computer Hardware Platforms Layer 1 Microprocessor Computer Stores Super Stores Mass Mail Merchandisers Order Value-add Resellers Direct Sales Force Internet Direct Desktop Suites Enterprise Resource Planning Supply Chain Management Other Word Processors Spread Sheets Publishing Groupware Data Warehouse Other LAN, WAN and Internet Software Interfaces, Browsers and Search Engines Hierarchical Database Windows Unix Relationship Database Linux Supercomputer Mainframe Midrange Workstation PC Intel X86 Motorola Apple Handheld Device RISC Power PC The Computer (IT/IS?) Industry as seen by IBM in 2002 1. Services 2. Applications Software 3. Middleware Software 4. Systems The Computer Industry IT Consulting Systems Integration Outsourcing Training and Education Financing Services Maintenance Web Sites E-Commerce Personal Productivity Engineering & Design Supply Chain Human Resources CRM* Business Intelligence Applications Software *Customer Relationship Management Systems Management Application and Transaction Servers Collaboration & Messaging Middleware Software Database Operating System Memory Networking Displays Processors Storage Systems Source: Who Says Elephants Can’t Dance by Louis Gerstner Computer Industry Hardware • Processors • Input/Output Devices • Storage Devices Networking Equipment? Multiple processor segments in the computer industry. Processor companies versus specialized hardware companies. Software • Systems Software • Operating Systems • Database Systems • Network Systems • Utility Software • Performance and Security Software • Development Software • Programming Languages • CASE Software • Applications Software Hardware vendors versus independent software companies. Applications Software Specific application software to do numerous things. Running on a range of processors. Applications suites (integrated applications) Some call these integrated enterprise applications Is game software from Sony a part of the computer industry? Is software to run numerical control machine tools part of the computer industry? Is software to analyze automobile smog tests part of the computer industry? Worldwide Computer Hardware Sales 2000 1999 1998 Supercomputer 1997 Mainframe Midrange Workstation 1996 Personal Computer 1995 Source: Dataquest 1994 Millions of Dollars 1993 0 50,000 100,000 150,000 200,000 250,000 300,000 350,000 Worldwide Hardware Sales 2002 PCs Total Hardware 2001 Billions of $s 2000 0 100 200 300 Billions of $s Source: Dataquest What is a PC? 1. A desktop tool—word processor, spreadsheet, publishing tool, data store. 2. An entertainment device. 3. Communication device—email. 4. Information source—Internet sources. 5. A collaboration tool. PC Industry Segment 1. Passed $100 billion in sales in the first ten years. 2. Growth and competition was based on industry standards like never before. 3. This has spawned thousands of niche companies. 4. The PC has fundamentally restructured the Computer Industry. 5. Industry pioneers believe the revolution is no more than half over. Change Relative to Selling PCs 1. Languages 2. Application Packages 3. Connectivity and Compatibility 4. Multimedia 5. Communication Device--Groupware PC Industry Change • Atari • Dell • Cromemco • Gateway • Fortune Systems • IBM • Wicat Systems • HP (Compaq) • Kaypro • NEC • Morrow Designs • Osborne Computer • Victor Technologies The Future Computer Industry 1. Traditional US Companies (large). 2. Asian Electronic Companies. 3. The New Strategy Companies. Why has the US continued to be the world leader in the computer industry? Porter Value Chain Basic Concept: 1. Deals with core business processes. 2. Enables tracking a new idea to create a new product and/or service from origination all the way to customer satisfaction. Porter Value Chain Manufacturing Industry Value Chain Research and Development Production Engineering and Manufacturing Sales Marketing and Distribution Service Retail Industry Value Chain Partnering with Vendor Managing Buying Inventory Distributing Operating Inventory Stores Marketing and Selling Value Chain Things to Remember 1. Value to customer objective is not clear. 2. Relay team concept is too time consuming and doesn’t work in the current competitive environment. 3. Maximize the value-add activities and eliminate as much as possible the things that do not add value. 4. Make sure that each step in the overall process (each function) does things consistent with the overall objective of value to customer. SUPPORT ACTIVITIES Generic Value Chain FIRM INFRASTRUCTURE HUMAN RESOURCE MANAGEMENT TECHNOLOGY DEVELOPMENT PROCUREMENT INBOUND LOGISTICS OPERATIONS OUTBOUND LOGISTICS MARKETING AND SALES SERVICE PRIMARY ACTIVITIES Adapted with the permission of the Free Press, an imprint of Simon & Schuster Inc.. from COMPETITIVE ADVANTAGE: Creating and Sustaining Superior Performance by Michael Porter. Copyright © 1985 by Michael E. Porter. Figure 3-6 Property and Casualty Industry Value Chain FIRM INFRASTRUCTURE -Financial Policy HUMAN RESOURCE MANAGEMENT -Regulatory Compliance - Accounting Agent Training Actuary Training Actuarial Methods Investment Practices TECHNOLOGY DEVELOPMENT - Legal Product Development Market Research Claims Training Claims Procedures I/T Communications PROCUREMENT •Policy Rating • Underwriting • Investment •Independent Agent Network •Billing and Collections •Policy Sales •Policy Renewal •Agent Management •Advertising INBOUND LOGISTICS OPERATIONS OUTBOUND LOGISTICS MARKETING AND SALES •Claims Settlement •Loss Control SERVICE Included with permission of Michael E. Porter based on ideas in Competitive Advantage: Creating and Sustaining Superior Performance, copyright 1985 by Michael E. Porter. Figure 3-7 Technologies in the Value Chain Information System Technology Planning and Budgeting Technology Office Technology FIRM INFRASTRUCTURE Training Technology Motivation Research Information Technology HUMAN RESOURCE MANAGEMENT Product Technology Computer-Aided Design Pilot Plant Technology TECHNOLOGY DEVELOPMENT Software Development Tools Information Systems Technology Information Systems Technology Communication System Technology Transportation System Technology PROCUREMENT •Transportation Technology •Material Handling Technology •Storage and Preservation Technology •Communication System Technology •Testing Technology •Information Technology INBOUND LOGISTICS •Basic Process Technology •Materials Technology •Machine Tools Technology •Materials Handling Technology •Packaging Technology •Testing Technology •I/nformation Tech. OPERATIONS •Transportation Technology •Material Handling Technology •Packaging Technology •Communications Technology •Information Technology •Multi-Media Technology •Communication Technology •Information Technology •Diagnostic and Testing Technology •Communications Technology •Information Technology OUTBOUND LOGISTICS MARKETING AND SALES SERVICE Adapted with the permission of the Free Press, an imprint of Simon & Schuster Inc.. from COMPETITIVE ADVANTAGE: Creating and Sustaining Superior Performance by Michael Porter. Copyright © 1985 by Michael E. Porter., p. 167. Figure 3-8

![[5] James William Porter The third member of the Kentucky trio was](http://s3.studylib.net/store/data/007720435_2-b7ae8b469a9e5e8e28988eb9f13b60e3-300x300.png)