Perkins Loan Program

advertisement

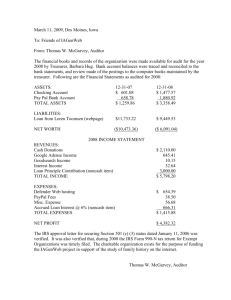

ILASFAA Leaves of Change: Harvesting New Ideas Federal Update November 2015 Angela Smith, Training Officer U.S. Department of Education Prior – Prior and Early FAFSA Start-Up 2 Prior-Prior Year • President’s Announcement – FAFSA Start-Up on October 1 • Use of Prior-Prior Income Data • • Beginning with the 2017-2018 FAFSA October 1, 2016 • 2015 Tax Year • 3 FAFSA CHANGES FOR 2017-18 Questions? 4 Prior-Prior • Issues Verification • Conflicting information • Outreach • Professional Judgement • State grant agencies • Early awarding • Deadlines • 5 FAFSA – List of Schools • Beginning with the 2016-2017 FAFSA the names colleges listed by applicants on FAFSAs will not be included on ISIRs provided to institutions. • Will continue to be included on ISIRs provided to state grant agencies • Will be on the SAR provided to the FAFSA applicant. 6 Perkins Loan Program (DCL GEN-15-3) 7 Perkins Loan Program • Dear Colleague Letter GEN-15-03 • No congressional action - program ended on September 30, 2015 • Schools may not make Federal Perkins Loans to new borrowers after September 30, 2015. 8 Perkins Loan Program If prior to October 1, 2015, a school makes the first disbursement of a Federal Perkins Loan to a student for the 2015-2016 award year, the school may make any remaining disbursements of that 2015-2016 loan after September 30, 2015. 9 Perkins Loan Program Narrow “grandfathering” provision • Allows schools to make Perkins Loans to certain students for up to five additional years (through September 30, 2020) to enable students who received loans for award years “to continue or complete courses of study. • Loans can be made only if ALL of the following conditions are met: • 10 Perkins Loan Program: Grandfathering provision • The school made at least one loan disbursement to the student on or before June 30, 2015. • The student is enrolled at the same institution where the last Perkins Loan disbursement was received. • The student is enrolled at the same academic program for which the last Perkins Loan disbursement was received. • Need remains after Direct Sub awarded 11 Must I liquidate my Perkins portfolio? NO Note: While currently the Department cannot require schools liquidate, Section 466(c) of the Higher Education Act requires institutions to return to the Department of Education (Department) the Federal share of any Excess Liquid Capital (ELC) in the institution’s Federal Perkins Loan Revolving Fund (Fund). This statutory requirement for institutions to return ELC is not directly related to the wind-down of the Perkins Loan program. See DCL GEN-15-19, published September 29, 2015 for details. 12 Perkins Loan Program: Excess Liquid Capital • DCL GEN-15-19 • Attached Excel Work-Sheets Calculate Excess Cash • Calculate Federal/School Shares • • 13 Return Federal Funds by December 31, 2015 http://ifap.ed.gov/ifap/cbp.jsp 14 ATB and Career Pathway Programs 15 ATB and Career Pathway Programs • Consolidated and Further Continuing Appropriations Act, 2015 • Establishes Ability-to-Benefit alternatives for students without a high school diploma, or equivalent (or home schooled) who are enrolled in an eligible “Career Pathway” “Program”. • ATB – • • • • 16 Pass an ED approved ATB test State Process (none have ever been submitted) Complete six credit hours (or equivalent) Beginning July 1, 2015, reduced Pell Grant payment schedule ATB and Career Pathway Programs • Career Pathway Program: • • • • • • • 17 Concurrently enrolls students in “connected adult education” and an eligible Title IV academic program Provides counseling and supportive services Provides “structured course sequences” Provides opportunities for acceleration Organized to meet the needs of adults Aligned with the education and skill needs of the regional economy Developed in collaboration with business, workforce development, and economic development. 18 Limited Pell Grants • Any student whose first enrollment in ANY Title IV eligible postsecondary program was on or after July 1, 2015, and is eligible under one of the ATB alternatives for enrollment in an eligible career pathway program, will ONLY be eligible for a limited Pell Grant award • Maximum limited Pell Grant amount for 2015/16 is $4,860 19 Verification 2016-17 Verification – Overview • • • • Same data elements as for 2015-2016 award year Some modifications and clarifications to acceptable documentation In limited circumstances, an applicant’s Verification Tracking Group could change Resources GEN-15-11 • Federal Register Notice – June 26, 2015 • Suggested Text – Coming soon! • 2016-17 Verification • Verification Tracking Group changes: Verification Tracking Group V3 (Child Support Paid) has been removed • Applicants placed in V1, V4, V5, and V6 must still verify child support paid if reported on ISIR • 22 2016-17 Verification • Verification Tracking Group changes: Applicants may be moved from previously assigned Groups V1, V4, and V6 to Verification Tracking Group V5 • Applicant is only required to verify the additional items in V5 that were not previously verified • If the applicant is moved to Verification Tracking Group V5, no additional disbursements of any Title IV aid may be made until verification is satisfactorily completed • 23 2016-17 Verification • Verification Tracking Group changes: Applicants moved to Verification Tracking Group V5 • If Title IV aid had been disbursed prior to receiving an ISIR with the new V5, and the applicant does not complete verification, the applicant is liable for the full amount of TIV aid disbursed for 2016-2017 • The institution is not liable • 24 2016-17 Verification Income Information for Non-IRS Tax Filers • Tax filers who filed an income tax return with a taxing authority in a U.S. territory (Guam, American Samoa, the U.S. Virgin Islands) or commonwealth (Puerto Rico and the Northern Mariana Islands) or with a foreign central government, must submit a copy of a transcript of their tax information • 25 A signed copy of the applicable 2015 income tax return that was filed with the taxing authority is only acceptable if tax filers are unable to obtain a free copy of a transcript of their tax information 2016-17 Verification Income Information for Non-IRS Nontax Filers • Residents of the Freely Associated States (Republic of the Marshall Islands, the Republic of Palau, the Federated States of Micronesia), and a U.S. territory or commonwealth or a foreign central government who are not required to file an income tax return under that taxing authority’s rules must submit: • • 26 a copy of their Wage and Tax Statement (or equivalent documentation) for each source of employment income and a signed statement identifying all of the individual’s income and taxes Verification Policy Updates Tax filers and Nontax filers—if a copy of the tax return was not retained and cannot be located by the IRS, must submit: Copy of all relevant W-2s • Signed statement that individual did not retain a copy of his or her tax account information, and • Documentation from the IRS that indicates that the individual’s tax account information cannot be located • Child support paid • Removed a separation agreement or divorce decree from acceptable documentation Verification Policy Updates High School Completion Status • For V4 and V5, if institution successfully verified and documented applicant’s high school completion status for a prior award year, verification of high school completion status is not required for subsequent years • An institution may not accept as alternative documentation an applicant’s self-certification, nor a DD Form 214 Certificate Identity/Statement of Educational Purpose • The valid government-issued photo identification used to verify an applicant’s identity must not have expired 28 Verification Policy Updates Victims of IRS tax-related identity theft must submit: Statement signed and dated by tax filer indicating they were victims of IRS tax-related identity theft and the IRS has been made aware of the taxrelated identity theft; and • A Tax Return DataBase View (TRDBV) transcript obtained from the IRS • • Tax filers who cannot obtain a TRDBV transcript may instead submit another official IRS transcript or equivalent document provided by the IRS if it includes all of the income and tax information required to be verified Guidance applies to 15/16 and subsequent years • Posted in 6/26/15 Federal Register Notice 29 Verification Policy Updates Individuals who filed an amended tax return must submit: an IRS Tax Return Transcript, or any other IRS tax transcript(s) that include all of the income and tax information required to be verified; and • a signed copy of the IRS Form 1040X that was filed with the IRS • Guidance effective 8/13/15 for 15/16 and subsequent years • Posted on Program Integrity Q & A website 30 2015-2016 – Transcripts Unavailable • • EA dated October 2, 2015 Alternative documentation allowed when tax filer RECENTLY requested but unable to obtain an IRS Tax Return Transcript using the IRS paper or on-line request process No alternative documents for telephone requests • Exception not permitted for – • • transcripts unable to be obtained simply because the IRS has not had time to process the data due to a recent filing • saying the "Get Transcript Online" tool is not available 31 2015-2016 – Transcripts Unavailable Alternative documentation includes: • Signed copy of relevant 2014 IRS tax return AND • Statement from tax filer, on or attached to the return, certifying same data submitted to the IRS AND • Communication from IRS stating request unsuccessful • • Letter from IRS (signed and dated by tax filer); or Screen shot print (signed and dated by tax filer) AND • 32 Completed and signed IRS Form 4506 T-EZ or 4506-T listing institution as third party Regulatory Update 33 Borrower Defenses • Rules to allow borrowers to request loan discharge based on a borrower defense of school misrepresentation • August 20, 2015 - Federal Register Notice: Public Hearings • October 20, 2015 – Federal Register Notice: Negotiator Nominations and Schedule of Committee Meetings 34 Borrower Defenses • Schedule for Negotiations Session 1: January 12–14, 2016 • Session 2: February 17–19, 2016 • Session 3: March 16–18, 2016 • 35 Revised Pay As You Earn (REPAYE) • Negotiations held February - April, 2015; Committee reached consensus • NPRM published July 9, 2015; 30-day comment period ends August 10, 2015 • Final regulations published on October 30 • Early implementation in December 2015 36 Proposed Changes for REPAYE • Extends the 10 percent payment cap to an additional 6 million loan borrowers. • Creates a streamlined process to identify military service members who hold FFEL program loans and who are eligible for lower interest rates. 37 Cash Management • Negotiations held in early 2014 • NPRM published in May of 2015 • Public comment period closed July 2, 2015 • • Received over 200 comments Final regulations published on October 30 • Effective July 1, 2016 38 Cash Management • Proposed regulations include tougher standards and greater transparency around agreements between colleges and companies providing prepaid/debit cards to students Meaningful choice of products • Clear and neutral information • Looking at fees charged • 39 Gainful Employment 40 The HEA provides that to be Title IV eligible an educational program must be offered by: A public or non-profit postsecondary educational institution and leads to a degree; or Any institution and “to prepare students for gainful employment in a recognized occupation”. 41 Generally, all non-degree programs must lead to gainful employment Generally, all programs must lead to gainful employment Gainful Employment (GE) • Rules became effective July 1, 2015 • Published DCL GEN-15-12 on June 30, 2015, summarizing the rules • Reporting of data by July 31, 2015 and by October 1, 2015 42 Which Programs are GE Programs • At public institutions and not-for-profit institutions, all NON-DEGREE programs are GE Programs except for – Programs of at least two years in length that are designed to be fully transferable to a bachelor’s degree program • Preparatory coursework necessary for enrollment in an eligible program (loan only) • 43 Which Programs are GE Programs • At proprietary institutions, all programs are GE Programs except for – Preparatory coursework necessary for enrollment in an eligible program • Bachelor’s degree programs in liberal arts offered since January 2009 that are offered by a proprietary institution that has been regionally accredited since October 2007 • 44 Gainful Employment Measure • Debt-to-earnings (D/E) rates Annual Earnings D/E rate • Discretionary Income D/E rate • Passing: Annual D/E < = 8% or Discretionary D/E < = 20% • Failing: Annual D/E > 12% or Discretionary > 30% • Zone: Annual D/E > 8% and < = 12% or Discretionary D/E > 20% and <= 30% • 45 Gainful Employment Results • Program’s loses Title IV eligibility if: D/E measures – Fails in two out of three years; OR • D/E measures - Fails or in the zone for four consecutive years • 46 GE Reporting • Report all Title IV Students by July 31, 2015 Report 2008 – 2009 through 2013 – 2014 award years. • Programs with Medical and Dental Residencies report 2007 – 2008 through 2013 – 2014 award years. • • Report following award years by October. • 47 Report 2014 – 2015 Award Year by October 1, 2015 Gainful Employment Disclosures • Beginning in 2017, in addition to program information will include: pCDR • D/E rates • Loan repayment rates • Completion rates • Withdrawal rates • Placement rates • Median loan debt • Percent borrowing • 48 Certifications • December 31, 2015 – Transitional Certifications Due • • 49 Signed by CEO, Chancellor, or equivalent Certifications renewed when institution recertifies Program Participation Agreement (PPA) Certifications • Each currently eligible GE Program is: Approved by accrediting agency and State. • Is programmatically accredited if that is required for that profession in the state. • Graduates qualify to meet licensing or certification exam requirements to work in the state, if any. • 50 Certifications Certification processing instructions and sample certification language are attached to the GE EA #54 Questions/concerns, please email GECertification@ed.gov 51 GE Resources 53 2015 FSA Training Conference!! • Tuesday, December 1 – Friday, December 4, 2015 • Conference and lodging registration are open now! – Over 5,400 currently registered – Mandalay Bay is sold out! – Delano Hotel still available • Tentative agenda is posted. fsaconferences.ed.gov 54 The HEA turned 55 Active Contracts Active Contracts List on ED’s OCFO’s website: www2.ed.gov/about/offices/list/ocfo/contrac ts/active_contracts_list.xls 56 Your Feedback is Requested To ensure quality training, we ask all participants to complete an online evaluation for each session. Using the link below, please complete an evaluation of my presentation. https://s.zoomerang.com/s/AngelaSmith-Reg5 Thank you! Or, feel free to contact my supervisor: JoAnn Borel Joann.borel@ed.gov 57 Questions about this presentation? Feel free to contact me: Angela Smith, Training Officer Angela.smith@ed.gov 312-730-1552 58