New Brunswick's Shared Risk Plan

advertisement

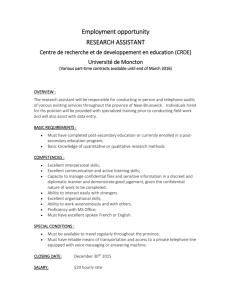

Atlantic Connection Conference New Brunswick’s Shared Risk Plan July 9, 2014 Health * Benefits * Employee Assistance * Retirement Business. Needs. People. Challenges facing traditional pension plans Confidential – Not for Distribution 2 DB plans are proving to be costly Falling interest rates Increasing life expectancy Investment losses and volatility Earlier retirements Confidential – Not for Distribution 3 NB asked: are DB benefits secure? Most believe DB plans are guarantees The DB promise is only as good as the sponsor’s willingness and ability to pay When there is no longer an ability to pay, plans close and benefits are cut (Fraser Papers, Nackawick, etc.) When there is no longer a willingness to pay, benefits are curtailed or changed Confidential – Not for Distribution 4 DB plans create inequity across generations Current DB legislation does not allow for reductions in accrued benefits Only corrective pension actions are Increasing active member contributions Reducing future active member benefit accruals Increasing employer contribution Confidential – Not for Distribution 5 DB plans create inequity across generations Increasing employer contributions Revenue base relatively fixed If more of this money is diverted to the pension plan then Maybe wage freezes Maybe fewer jobs Maybe reductions in other employee benefits Maybe new equipment desperately needed isn’t purchased The net impact of all of these actions is felt by active members only Confidential – Not for Distribution 6 The New Brunswick Journey Confidential – Not for Distribution 7 How NB approached these problems Appointed an independent Task Force The mandate of the Task Force was to achieve Security Sustainability Affordability Transparency Equity Confidential – Not for Distribution 8 How NB approached these problems Public consultation Conducted research on best pension systems in the world Process was consultative among the Province, Unions and the Task Force Unions played a large part in the final design New Brunswick Nurses Union CUPE New Brunswick Union of Public and Private Employees Confidential – Not for Distribution 9 The Shared Risk Plan is created Process resulted in the creation of the Shared Risk Plan (SRP) Draws inspiration from both DB and DC designs On a high level Introduces benefit flexibility Introduces strong stable funding requirements Introduces rigorous risk management requirements Introduces independent governance Legislation introduced on July 1, 2012 allowing any plan sponsor in the Province to adopt an SRP Confidential – Not for Distribution 10 SRP has high security but no guarantees Two levels of benefits are defined: Base benefits and Benefit Intention BENEFITS INTENTION Contribution rates set to provide very high security for base benefits and reasonable probability of achieving the benefit intention However, accrued base benefits can be reduced in very poor economic scenarios There are no absolute guarantees BASE Confidential – Not for Distribution 11 SRP benefits absorb volatility Benefits fluctuate based on plan performance BENEFITS Typically conditional pre and post retirement indexing varies and absorbs a lot of the plan volatility Surpluses to be used on member benefits Sponsor has no right to surplus Sponsor has minimal opportunity for contribution holidays Confidential – Not for Distribution 12 SRP has strong legislated governance Funding policy Gives Trustees a set of benefit and contribution instructions agreeable to both parties under which they are to operate Investment policy Sets out target asset mix and investment goals Rigorous risk management Annual monitoring and compliance At least 1,000 20-year scenarios tested each year Confidential – Not for Distribution 13 SRP governance requirements work together All aspects of these requirements work together FUNDING POLICY Together they must satisfy benefit security tests set out in the Regulations 97.5% probability of not reducing base benefits over a 20 year period At least a 75% probability of providing benefit intention INVESTMENT POLICY RISK MANAGEMENT ANNUAL MONITORING Confidential – Not for Distribution Typical best estimate DB contributions have about a 50% chance of providing fixed DB 14 SRP has certain employer advantages Employer commitment is only the contributions in the funding policy ++ + Employer has no responsibility to backstop deficits if they arise Cost stability Essentially works like DC (with a narrow range of contribution levels) for the employer Confidential – Not for Distribution 15 SRP has employer trade-offs Contribution holidays are not permitted unless required by the Income Tax Act Such holidays are expected to be very rare Large majority of generated surplus spent on member benefits Confidential – Not for Distribution ++ ++ + + 16 SRP has certain advantages for the member Employer can’t take contribution holiday Large majority of generated excess funding spent on member benefits Governed by Arm’s length Trust Upside potential to participate in plan gains for both active members and retirees Stable contributions within a narrow range Confidential – Not for Distribution ++ + 17 SRP has certain advantages for the member Very high benefit security Intergenerational equity All members participate in surpluses and deficits, not just active members ++ + Still providing DB-like benefit to members Still pooling longevity risk Base benefit based on salary / service history Confidential – Not for Distribution 18 SRP has member trade-offs Base benefit likely less than current DB “promises” to meet security targets ++ ++ + + Base benefit not guaranteed Ultimate benefit difficult to predict Contributions may be higher than current Confidential – Not for Distribution 19 Why consider SRP? Cost stability for sponsors and members High benefit security Rigorous governance and risk management Investment and longevity risk pooling Benefit aligns with what the plan can afford to pay Contributions + Investment income = ultimate level of benefits Confidential – Not for Distribution 20 What lessons did we learn Be collaborative and transparent Be realistic about the problems State outcome goals up front Take a long term approach Think differently! Confidential – Not for Distribution 21 Appendix: Progress made Confidential – Not for Distribution 22 What’s happened since SRPs were introduced SRP legislation was effective July 1, 2012 We know of at least 10 plans that have converted or have announced their intent to convert including: Certain Bargaining Employees of NB Hospitals City of Fredericton City of Saint John Public Service Superannuation Act (Province of NB) University of New Brunswick Saint John Energy Confidential – Not for Distribution 23 What’s happened since SRPs were introduced On April 24, 2014 Canada’s Federal Department of Finance issued a consultation on target benefit plans Many proposed concepts similar to NB SRP Would allow SRP-like plan design for federally regulated pension plans such as Airlines Telecommunications Railways Confidential – Not for Distribution 24 What’s happened since SRPs were introduced Province of Prince Edward Island recently made similar changes Flexible benefits pre and post retirement to reduce cost volatility Expropriation of vested indexing rights to improve intergenerational inequity Stochastic measurement and communication of risks Funding policy to manage contributions and benefits These changes were made to their two largest public sector pension plans Confidential – Not for Distribution 25 What’s happened since SRPs were introduced Government of NB successfully negotiated a pension deal with Teachers’ union In the fall, op-ed in the paper from three union presidents supporting the design National and international attention An entire chapter in Jim Leech’s book “The Third Rail” A large Ontario plan worked with us to explore SRP Multiple industry speaking engagements all over Canada and the US Multiple articles in Benefits Canada We’re here talking to you today! Confidential – Not for Distribution 26 Thank You Paul T. Lai Fatt, FSA, FCIA Partner plaifatt@morneaushepell.com (902) 474-3236 Visit us: morneaushepell.com Follow us: @Morneau_Shepell Confidential – Not for Distribution 27