Warm-up and Objective - Baltimore City Public School System

advertisement

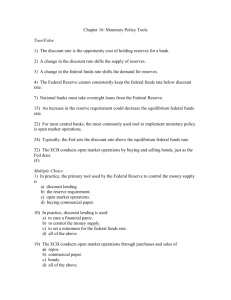

Monetary vs Fiscal Policy Monetary policy deals with changes in the amount of money in supply Fiscal policy deals with how money is taxed and spent Monetary Policy Why We Can’t Just Print More Money Monetary = Money • The amount of money in an economy is important... • If you have TOO MUCH: – It can cause inflation (high prices). • If you have TOO LITTLE: – It can cause a recession (unemployment). Who Manages the Money Supply? The Federal Reserve (called the “Fed”) The Fed can increase or decrease the money supply by using 3 tools When the Fed does this it is called: MONETARY POLICY Tool #1 - Discount Rate The interest rate that the Fed charges banks for short-term loans An interest rate is the price a borrower pays for the use of money they borrow from a lender. Scenario #1 If discount rate is high, then borrowing money becomes more expensive Discount Rate- The interest rate that the Fed charges banks for short-term loans Scenario #1 continued If discount rate is high, then borrowing money becomes more expensive This means there will be fewer loans and less money in the economy Tool #2 - Reserve Requirement The percentage of deposits (money) that banks must hold in their vault Scenario #2 If the reserve requirement is high, then banks have less money to lend Money Supply Will... If the reserve requirement is low, then banks can lend out more money Money Supply Will… Scenario #2 If the reserve requirement is high, then banks have less money to lend Money Supply Will...DECREASE •Economy Will… If the reserve requirement is low, then banks can lend out more money Money Supply Will…INCREASE •Economy will…. Scenario #2 If the reserve requirement is high, then banks have less money to lend Money Supply Will...DECREASE •Economy Will…SLOW DOWN If the reserve requirement is low, then banks can lend out more money Money Supply Will…INCREASE •Economy will….SPEED UP Tool #3 - Open Market Operations The buying and selling of securities (bonds) issued by the government Scenarios During a slow economy, the Fed buys back bonds to put cash back out there During an booming economy, the Fed sells bonds to take cash out of economy Business Cycle • Low Money Supply = Slow Economy – Needs More Money – To stop recession from rising unemployment • High Money Supply = Booming Economy – Needs Less Money – To stop inflation from rising prices Evaluating Fed Actions The Federal Reserve (“Fed”) manages money supply RAISE Discount Rate LOWER Discount Rate RAISE Reserve Requirement LOWER Reserve Requirement BUY Securities/Bonds SELL Securities/Bonds Evaluating Fed Actions The Federal Reserve (“Fed”) manages money supply RAISE Discount Rate LOWER Discount Rate RAISE Reserve Requirement LOWER Reserve Requirement BUY Securities/Bonds SELL Securities/Bonds Slow Down Evaluating Fed Actions The Federal Reserve (“Fed”) manages money supply RAISE Discount Rate Slow Down LOWER Discount Rate Speed Up RAISE Reserve Requirement LOWER Reserve Requirement BUY Securities/Bonds SELL Securities/Bonds Evaluating Fed Actions The Federal Reserve (“Fed”) manages money supply RAISE Discount Rate Slow Down LOWER Discount Rate Speed Up RAISE Reserve Requirement Slow Down LOWER Reserve Requirement BUY Securities/Bonds SELL Securities/Bonds Evaluating Fed Actions The Federal Reserve (“Fed”) manages money supply RAISE Discount Rate Slow Down LOWER Discount Rate Speed Up RAISE Reserve Requirement Slow Down LOWER Reserve Requirement Speed Up BUY Securities/Bonds SELL Securities/Bonds Evaluating Fed Actions The Federal Reserve (“Fed”) manages money supply RAISE Discount Rate Slow Down LOWER Discount Rate Speed Up RAISE Reserve Requirement Slow Down LOWER Reserve Requirement Speed Up BUY Securities/Bonds Speed Up SELL Securities/Bonds Evaluating Fed Actions The Federal Reserve (“Fed”) manages money supply RAISE Discount Rate Slow Down LOWER Discount Rate Speed Up RAISE Reserve Requirement Slow Down LOWER Reserve Requirement Speed Up BUY Securities/Bonds Speed Up SELL Securities/Bonds Slow Down