Big Pictures of Technology and Industry/Business Part II

advertisement

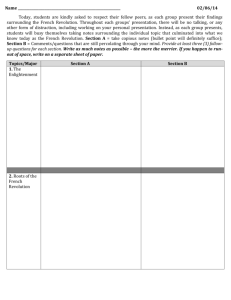

Big Pictures of Technology and Industry/Business: Part II Daniel Hao Tien Lee http://danieleewww.yolasite.com/ Outline • Kondratiev Wave • Big Pictures of Carlota Perez’s: : The Dynamics of Bubbles and Golden Ages • Video Course: Prof Carlota Perez at FINNOV Final Conference 2012, ICI, London, UK http://www.youtube.com/watch?v=k8S0OSx Wmuo&list=UUX6QveqMpgeaEIPJvndQ90Q&i ndex=1&feature=plcp • Fun Drill ! Kondratiev Wave • The Kondratieff Wave is an economic theory that states that Western capitalist economies are susceptible to extreme performance volatility as they expand and contract over the years. Unlike what is referred to as the business cycle, the Kondratieff Wave holds that these fluctuations are in fact part of a much longer cycle periods known as “super cycles” that last between 50-60 years or longer depending upon factors such as technology, life expectancy, etc Kondratiev Wave Kondratiev Wave Period First Industrial Revolution (Mechanical Age) Railroad and Steam Engine Era Age of steel, electricity and internal combustion Date (Prosperity to prosperity) Innovation Saturation point Circa 1787– 1843 Cotton-based technology: spinning weaving; atmospheric stationary steam engines replaced by high pressure engines, wrought iron, iron displaces wood in machinery, canals, turnpikes. Development of machine tools Cotton textiles: British market saturated ca. 1800. By 1840, 71% of British cotton textiles were exported Circa 1842– 1897 Age of steam railways, steam shipping and machinery. First inexpensive steel, telegraph, animal powered combine harvesters, etc. Final development of and diffusion of machine tools and interchangeable parts. Emergence of petroleum and chemical industries and heavy industries after 1870. Beginning of public water and sewer systems. Canals: Late 1840s1870: Steam exceeds water power and animal power. 1890s: Railroads. Track mileage continued to grow but much is later abandoned. Steel, electric motors, electrification of factories and households, electric utilities, aluminum, chemicals and petrochemicals, internal combustion engine, automobiles, highway system, Fordist mass production, telephony, beginning of motorized agricultural mechanization, radio. Electric street railways help create streetcar suburbs. Build out of urban public water supply and sewage systems. 1917: Railroads nationalized. Post World War I short depression. Railroads and electric street railways decline after 1920. Horses, mules and agricultural commodities: 1919. After 1923 industrial output rises as workforce slowly declines. Depression of 1930s: Overcapacity in manufacturing, real estate. Work week reduced from 50 to 40 hours in mid-1930s. Total debt reaches 260% of GDP during early 1930s. 1897–1939 Kondratiev Wave Period War and Post-war Boom: Suburbia Post Industrial Era: Information Technology and care of elderly Date (Prosperity to prosperity) Innovation Saturation point 1939–1982? Oil displaces coal. Suburban growth and infrastructure. Greatest period of agricultural productivity growth 1940s-1970s. Consumer goods, semiconductors, business computers, plastics, synthetic fibers, fertilizers, television and electronics, green revolution, military-industrial complex, diffusion of commercial aviation and air conditioning, beginning nuclear utilities. 1940s-50s: Diesel locomotives replace steam.1971: Peak U.S. oil production 1973: Peak steel consumption in U.S. Pennsylvania steel cities and industrial midwest turn into "rust belt". 1973: Slow economic and productivity growth noted. 1980s: Highway system near saturation Fiber optics and Internet, personal computers, wireless technology, on line commerce, biotechnology, Reagan's "Star Wars" military projects. Energy conservation. Beginning of industrial robots. In the U.S. health care becomes a major sector of the economy (16%) and financial sector increases to 7.5% of economy. 1984: Peak U.S. employment in computer manufacturing. Long term decline in U.S. capacity utilization 1990s: Automobiles, land line telephones, chemicals, plastics, appliances, paper, other basic materials, commercial aviation. 2001:Computers, fiber optics 2000s: Crop yields approach limits of photosynthesis. 2008: Developed world on verge of depression. Widespread overcapacity except some nonferrous metals and oil. Large housing and commercial real estate surplus. GDP no longer responds to increases in debt. Total debt exceeds 360% of GDP by late 2009. 1982? – ?? Kondratieff cycles – long waves of prosperity. Rolling 10-year yield on the S&P 500 since 1814 till March 2009 (in %, p. a.) Five Successive Technological Revolutions, 1770s to 2000s Technologic al revolution Popular name for the period Core country or countries Big-bang initiating the revolution Year FIRST The ‘Industrial Revolution’ Britain Arkwright’s mill opens in Cromford 1771 SECOND Age of Steam and Railways Britain (spreading to Continent and USA) Test of the ‘Rocket’ steam engine for the LiverpoolManchester railway 1829 THIRD Age of Steel, Electricity and Heavy Engineering USA and Germany forging ahead and overtaking Britain The Carnegie Bessemer steel plant opens in Pittsburgh, Pennsylvania 1875 FOURTH Age of Oil, the Automobile and Mass Production USA (with Germany at first vying for world leadership), later spreading to Europe First Model-T comes out of the Ford plant in Detroit, Michigan 1908 FIFTH Age of Information, Computing, and Telecommunications USA (spreading to Europe and Asia) The Intel microprocessor is announced in Santa Clara, California 1971 Source: Carlota Perez 2002 Big-Bang • For society to veer strongly in the direction of a new set of technologies, a highly visible ‘attractor’ needs to appear, symbolizing the whole new potential and capable of sparking the technological and business imagination of a cluster of pioneers. • This attractor is not only a technical breakthrough. What makes it so powerful is that it is also cheap or that is makes it clear that business based on the associated innovations will be cost-competitive. That event is defined here as the big-bang of the revolution. Big-Bang of Each Revolution (initiated by a narrow community of entrepreneurs and technical people) • Arkwright’s Cromford mill opened in 1771: the future paths to cost reducing mechanization of the cotton textile and other industries were powerfully visible • Stephenson’s ‘Rocket’ steam locomotive announced and triumphed in 1829: the world of railways and steam power were non-stoppable • Carnegie’s highly efficient Bessemer steel plant opened in 1875: inaugurating the Age of Steel • Ford’s the first Model-T prototype in 1908: layout of the future of production patterns for standardized, identical products, and choice of Age of Oil • Intel’s first microprocessor in 1971: the original and simplest ‘computer on a chip’ seen as the birth of the Information Age, based on the amazing power of low-cost microelectronics Double Nature of Technological Revolutions A CLUSTER OF NEW DYNAMIC PRODUCTS, TECHNOLOGIES INDUSTRIES AND INFRASTRUCTURES NEW INTERRELATED GENERIC TECHNOLOGIES AND ORGANIZATIONAL PRINCIPLES generating explosive growth and structural change capable of rejuvenating and upgrading mature industries A CHANGE OF TECHNO-ECONOMIC PARADIGM New engines of growth for a long-term upsurge of development A higher level of potential productivity for the whole productive system Source: Carlota Perez 1998 Big-Bang as Creative Destruction Five Great Surges of Development in 240 Years (driven by successive technological revolutions with collapse and readjustment) Courtesy of Source: Based on Technological Revolutions and Financial Capital: The Dynamics of Bubbles and Golden Ages, Carlota Perez; IBM 2004 Annual Report Scientific Technology Revolution Cycles (Nominal Time 50-60 Years: Perez 2002, Hirooka, 2003) Is modern technology revolution driven by model or luck, or spirit ? Courtesy of John. P. Dismukes, U. Toledo 2005 Life Cycle of a Technological Revolution Phase One Phase Two Phase Three Last new products and industries. Earlier ones approachin maturity and market saturation Full constellation (new industries, technology systems And infrastructures) Early new products and industries. Explosive growth and fast innovation Gestation Paradigm period configuration Big-bang Phase Four Full expansion of innovation and market potential Introduction of successive new products, industries and technology systems, plus modernization of existing ones Around half a century Constriction of potential Courtesy of Carlota Perez 2002 Two Different Periods in Each Great Surge -- INSTALLATION PERIODTurning-- DEPLOYMENT PERIOD point Big-bang Next Big-bang Courtesy of Carlota Perez 2002 Recurring Phases of Each Great Surge in the Core Countries Turning --------INSTALLATION PERIOD point -- DEPLOYMENT PERIOD MATURITY Socio-political split Previous Great surge Last products and industries Market saturation and technological maturities of main industries Golden Age Disappointment vs. complacency Coherent growth with Increasing externities Production and employment SYNERGY FRENZY Financial bubble time Intensive investment in the revolution Decoupling of the whole system Polarization of rich and poor Gilded Age Techno-economic split IRRUPTION Irruption of the technological revolution Decline of old industries Unemployment Big-bang Crash Institutional recomposition Next Big-bang Courtesy of Carlota Perez 2002 The Irruption Phase: A Time for Technology • It begins with the big-bang of the technological revolution amidst a world threatened with stagnation, as in Britain in the 1830s and 1870s or the USA in the 1970s. • This period is marked by increasing unemployment stemming from various sources, ranging from economic stagnation, through rationalization efforts, to technological replacement. – The world seems to be falling apart and the old behaviors and polices are impotent to save it. • Meanwhile, the new entrepreneurs are gradually articulating the new ideas and successful behaviors into a new bestpractice frontier that serves as the guiding model or technoeconomic paradigm. The Frenzy Phase: A Time for Finance • A phase characterized by very strong centrifugal trends in society at large – a small but growing portion at the top is rich and getting richer while there is deterioration and growing outright poverty at the bottom • A time of speculation, corruption and unashamed love of wealth – ‘The Gilded Age’ which appears of shinning prosperity and its socially insensitive inside of base metal • Frenzy phase is also one of intense exploration of all the possibilities opened up by the technological revolution – though bold and diversified trial and error investment • A phase of fierce ‘free’ free competition with tremendous excess money poured into the infrastructure (e.g. canal mania, railway mania, Internet mania), often leading to overinvestment that might not fulfill expectations – a sort of gambling economy with asset inflation in the stock market, looking like a miraculous multiplication of wealth so late Frenzy phase becomes “Financial Bubble time” Recession time The Turning Point: Rethinking and Rerouting Development • A process of contextual change to move the economy from a Frenzy mode, shaped by financial criteria, to a Synergy mode, solidly based on growing production capabilities – e.g. Bretton Woods meetings, enabling the orderly international Deployment of the fourth surge – e.g. The repeal of the Corn Laws in Britain, facilitating the Synergy of the second • The turning point has to do with the balance between individual and social interests within capitalism – it is the swing of the pendulum from the extreme individualism of Frenzy to giving greater attention to collective well being, usually through the regulatory intervention of the state and civil societies • The unsustainable structural tensions that build up the economy and society, especially during Frenzy, must be overcome by a recomposition of the conditions for growth and development The Synergy Phase: A Time for Production • Synergy is the early half of the deployment period. This phase can be the true ‘Golden Age’ – e.g. Victorian England after the Great exhibition – e.g. America after the Second World War • A mode of growth based on social cohesiveness, moral principles are in force, ideas of confidence flourish and business is satisfied about its positive social role – it’s a time of advance in labor laws and other measures for social protection of the weak, a time for income redistribution in one form or another, leading to enlarged consumption markets. It’s above all the reign of the ‘middle class’. Fast and easy millionaires are rare, though investment and work lead to persistent accumulation of wealth. “ Production is the key word in this phase” The Maturity Phase: A Time for Questioning Complacency • All the signs of prosperity and success are still around. Those who reaped the full benefits of the ‘golden age’ continue to hold on to their belief in the virtues of the system and to proclaim eternal and unstoppable progress, in a complacent blindness, which could be called the ‘Great Society Syndrome’ • Markets are saturating and technologies maturing, therefore profits begin to feel the productivity constriction, leads to concentration through mergers or acquisitions, as well as export drives and migration of activities to less-saturated markets abroad Approximate Timeline of Each Great Surge of Development (1770s and early 1980s) (late 1780s and early 1790) (1813-1829) (1850-1857) (1857-1873) 1793-97 (1840s) (1830s) (1798-1812) 1848-50 (1895-1907) (1875-1884) (1908-1918) 1893-95 (1884-1893) (1908-1920) (1920-1929) (1971-1987) (1987-2001) Europe 1929-33 USA 1929-43 2001-? (1943-1959) (1960-1974) Geographic Outspreading of Technologies as They Mature (USA case) Net exporter Time New products Net importer Mature products LDC: less developed country Phase I Phase II Phase III Phase IV Phase V All production in USA Production started in Europe Europe exports to LDCs Europe exports to USA LDCs exports to USA US Exports to many countries US Exports mostly to LDCs US Exports to LDCs displaced Mass-Production Paradigm and Information Revolution • 1950s was a period of expansion in the USA, which served to pull the front-running European countries • By the 1960s the main dynamism moved towards Europe and Asia, producing the so-called ‘miracles’ in Germany, Italy and Japan • In the 1970s, it was Brazil, Taiwan and Korea that had taken over the baton • After the mid-1970s, some of the oil countries were able to attempt growth using the mature energy-intensive technologies in aluminum, petrochemicals and so on. But by then, the information revolution was already taking force in the USA and other core countries and the organizational revolution was catapulting Japan to the front ranks while the stagflation of the irruption phase was entering he scene of the old advanced countries. Definition of Financial Capital and Production Capital • Financial capital (paper wealth/economy) – Represents criteria and behavior of possessing wealth in the form of money or other paper assets – to use money to make more money by receiving interest, dividends or capital gains – Tools: deposits, stocks, bonds, oil futures, derivatives, diamonds or whatever – Services: banks, brokers and other intermediaries who provide information to make paper wealth growth – Mobile and footloose in nature – Flee from danger but enable the rise of the new entrepreneurs • Production capital (real wealth/economy) – Generate new wealth by producing goods or performing services (including transport, trade and other enabling activities) – Typical with borrowed money from financial capital or use their own money – Purpose of production capital is to produce in order to be able to produce more – objective is to accumulate greater and greater profit-making capacity – Tied to concrete products, and knowledge about product, process and markets is the very foundation to potential success – Roots in an area of competence and even in a geographic region – Has to face every storm by holding fast, ducking down or innovating its way forward or sideways – but when it comes to radical changes, incumbent production capital can become conservative Recurring sequence in the relationship between financial capital (FK) and production capital (PK) Turning --------INSTALLATION PERIOD point -- DEPLOYMENT PERIOD MATURITY Signs of Separation Previous Great surge IRRUPTION Love affair of FK with revolution Financial capital searching on its own SYNERGY Decreasing investment opportun Recoupling FK-PK Idle money moving to new area, sectors and regions Production capital at the helm Recoupling of real and paper wealth FRENZY Decoupling FK-PK Coherent growth Bubble economy Divorce between paper and real value Asset inflation Financial Revolution Intense funding of the new technologies Disdain of old assets Big-bang Crash Next Great Surge Institutional recomposition Next Big-bang Courtesy of Carlota Perez 2002 Five successive surges, recurrent parallel periods and major financial crises ? Financial and Social Impact by Technology Revolution • National market in the Victorian boom, from the mid-nineteenth century after the 2nd. technology revolution: That prosperity was brought about on the basis of a whole set of new institutions that ordered national markets and regulated the national banking and financial worlds, which facilitated the continued expansion of the railway system and the network of steam-powered factories in the growing industrial cities. • International markets arisen, two decades after the big-bang of Age of Steel, required worldwide regulation (from the general acceptance of the London-based Gold Standard to universal agreements on measurement, patents, insurance, transport, communications and shipping practices), which the structural changes in production, including the growth of important science-related industries had to be facilitated by deep educational reforms and social legislation. • Mass production and massive consumption, based on the massproduction technologies of the fourth paradigm had been diffusing since the 1910s and 1920s demanded institutions facilitating massive consumption, by the people or by the governments. Only is such a context could full flourishing be achieved. • Cohesive growth based on the information revolution, would seem to require a global network of institutions, involving the supranational, national and local regulatory levels --- Globalization Impact of War Expenditure • War served to spread technology among the adversaries and thus create future peace-time competitors. – The massive war expenditures of the First and Second World War came to rescue of investment opportunities and profits in the maturity phase of the third and fourth surge ,respectively, in the main advanced countries. – Vietnam war plus the intensification of the Cold War and the Space Race, had a similar effect for the US economy during Maturity in the fourth surge. Attributes of Past Revolutions • Each begins in a core country and later becomes dominant both in economy and politics worldwide. • Each defines new/or redefines industries and infrastructures. • Each generates new techno-economic paradigm – New “common sense” innovation principles which define best competitive practices. • Each takes 40-60 years going through Carlota Perez’s 3stage model to spread across world: – Installation period (Irruption and Frenzy Bubble) • Each generates technology bubble (massive over-investment) and later spearheads into financial panic and collapse. – Turning point • Each turning point required collective vision. – Deployment period (Golden Age (Synergy) and Maturity) • Each Golden Age has been facilitated by enabling regulation and policies for shaping and widening markets. Attributes of Past Revolutions • Resistance from established firms/institutions • Functional separation between financial capital and production capital • Paradigm shift led by financial capital, which forms bubble, which bursts, leading to hyper-adaptation (common-sense) • Production capital then controls propagation • Huge surge is divided into two extremely different periods. Installation period vs. Deployment period What’s the status we have now: Still stuck at the turning Point ; Perez’s Recent Presentation Courtesy of Carlota Perez 2008 The Historical Record: Bubble Prosperities, Recessions and Golden Ages Courtesy of Carlota Perez 2008 Courtesy of Carlota Perez 2008 Courtesy of Carlota Perez 2008 THE ELEMENTS OF THE DEMAND OPPORTUNITY SPACE Generic technologies Infrastructures EXTERNALITIES Supply opportunity space for INNOVATION Sources of DEMAND DIRECTIONALITY Sources of DEMAND VOLUME The coherence and synergy among the elements generates self-reinforcing loops Courtesy of Carlota Perez 2010 The demand opportunity space that shaped the Post War Golden Age INNOVATION ENABLERS Cheap oil and materials FOR MASS Universal electricity PRODUCTION Road and airway network Suburbanisation Post-war reconstruction Cold war SPECIFIC DEMAND AS DIRECTION FOR INNOVATION Welfare State Labour unions Public procurement Credit system DEMAND VOLUME, PROFILE AND TRENDS The various elements were provided in different proportions in each “First World” country The current opportunity space for a global positive-sum game “GREEN” Revamping transport, energy, products and production systems to make them sustainable is equivalent to post-war reconstruction and suburbanisation Cheap ICT Full internet access at low cost is equivalent to electrification and suburbanisation in facilitating demand (plus education) FULL GLOBAL DEVELOPMENT Incorporating successive new millions into sustainable consumption patterns is equivalent to the Welfare State and government procurement in terms of demand creation Courtesy of Carlota Perez 2010 The three forces defining the opportunity space are interdependent THE FACILITATOR ICT Information and communications technologies ICTs are the main enabling instruments of sustainability “GREEN” THE DIRECTION Internet access is the social, economic and geographic frontier of the global market FULL GLOBAL DEVELOPMENT Only with sustainable production and consumption patterns Is full globalisation possible THE VOLUME There is enough space and potential to lift all boats but the markets cannot do it without the support of enabling policies Courtesy of Carlota Perez 2010 Each technological revolution has led to a change in consumption patterns with new life-shaping goods and services at „affordable‟prices DEPLOYMENTPERIOD LIFESTYLE 1850s-1860s Urban industry-aided VICTORIAN LIVING in Britain 1890s-1910s Urban cosmopolitan lifestyle of THE BELLE EPOQUE in Europe 1950s-1960s Suburban energy-intensive AMERICAN WAY OF LIFE Each style became “the good life” that shaped people's desires and values and guided innovation trajectories 2010s-20??s Will the developed and emerging countries develop a variety of ICT-intensive “GLOCAL” SUSTAINABLE LIFESTYLES ??? Courtesy of Carlota Perez 2010 The direction of innovation after the financial collapse ICT for green growth and global development Carlota Perez Cambridge, LSE and Sussex Universities, U.K. Tallinn University of Technology, Estonia 9TH Triple Helix Conference Stanford, July 2011 Perhaps the most important lesson that Chris Freeman taught us is: THAT ECONOMICS IS INCAPABLE OF UNDERSTANDING GROWTH WITHOUT INTERDISCIPLINARITY Economics HISTORY Technology Institutions That wider framework helps us identify long-term regularities ANDALLOWS US TO GLEAN POSSIBLE FUTURES FIVE TECHNOLOGICAL REVOLUTIONS IN 240 YEARS 1771 The ‘Industrial Revolution’(machines, factories and canals) 1829 Age of Steam, Coal, Iron and Railways 1875 Age of Steel and Heavy Engineering (electrical, chemical, civil, naval) 1908 Age of theAutomobile, Oil, Petrochemicals and Mass Production 1971 Age of InformationTechnology and Telecommunications 20?? Age of Biotech, Nanotech, Bioelectronics and New Materials? EACH ONE DRIVES AGREAT SURGE OF DEVELOPMENT AND CHANGES THE TECHNO-ECONOMIC PARADIGM GUIDING INNOVATION Due to the massive “creative destruction” required DIFFUSION TAKES PLACE IN TWO DISTINCT PERIODS The first half is the INSTALLATION PERIOD led by finance and free markets when innovation concentrates to set up the new infrastructure, to let markets pick the new winners and to modernize the old economy The second half is the DEPLOYMENT PERIOD led by production aided by the State when innovation spreads across the board to reap the full economic and social benefits THE MAJOR BUBBLE COLLAPSE MARKS THE SWING OF THE PENDULUM THE HISTORICAL RECORD Bubble prosperities, recessions and golden ages INSTALLATION PERIOD GREAT SURGE Year country 1st 1771 Britain 2nd 1829 Britain Bubble prosperity TURNING POINT Collapse & Recessions DEPLOYMENT PERIOD “Golden Age” prosperity Canal mania 1793–97 The Great British leap Railway mania 1848–50 The Victorian Boom 1890–95 Belle Époque (Europe) “Progressive Era” (USA) Post-war Golden age 1875 Infrastructure bubbles 3 rdBritain / USA of first globalisation Germany (Argentina, Australia, USA) 4th 1908 USA The roaring twenties Europe 1929–33 USA 1929–43 5th 1971 USA Internet mania and financial casino 2000 & 2007/8 -???? Maturity Global Sustainable ”Golden Age”? The shift from financial mania and collapse to Golden Ages occurs when enabled by regulation and policies to shape and widen markets WHY TWO PERIODS? WHY THE BUBBLE? RESISTANCE TO THE NEW Old industries old habits old methods Need a period of CREATIVE DESTRUCTION to force modernization UNCERTAINTY Which products? Which technologies? Which companies? Which markets? Need to experiment in ferocious “free market” COMPETITION NATURE OF INFRASTRUCTURES All or nothing Invest up-front Revenues come later Need credit creation through bubble boom and short-term CAPITAL GAINS Once the bubbles collapse, the job is done THE NEW PARADIGM IS INSTALLED AND CAN BE DEPLOYED But that requires a structural shift away from the casino economy HOW WAS THE MASS PRODUCTION GOLDENAGE UNLEASHED? ? • Through very strict financial regulation in each country Glass Steagall, “Chinese walls”, deposit insurance, capital export controls, etc. • International stability through the Bretton Woods agreements US dollar as “gold”, IMF, GATT, World Bank (then IBRD), etc. • Keynesian policies for stable growth within national borders Counter-cyclical measures, stimulus spending, etc. and a set of policies… …INDUCING STRUCTURAL CHANGE IN FAVOR OF MASS CONSUMPTION! THE SYNERGISTIC CONDITIONS THAT SHAPED THE POST WAR GOLDENAGE INNOVATION ENABLERS FOR MASS PRODUCTION FORCES SHAPING THE DIRECTION OF INNOVATION Suburbanization Post-war reconstruction R&D funding Cold war Cheap oil and materials Universalelectricity Road and airway networks FACILITATORS OF DEMAND GROWTH FOR MASS CONSUMPTION Welfare State Public procurement Labour unions Personal credit system They were provided in different proportions in each “First World” country A POSITIVE-SUM GAME THAT TURNED WORKERS INTO MIDDLE INCOME CONSUMERS AND BROUGHT THE GREATEST BOOM IN HISTORY THE NEW TECHNOLOGICAL POTENTIAL AMAJOR TECHNO-ECONOMIC PARADIGM SHIFT A change in relative cost structures changes the direction of innovation FROM THE LOGIC OF CHEAP ENERGY (oil) for transport, electricity, synthetic materials, etc. Preference for tangible products and disposability Unthinking use of energy and materials TO THE LOGIC OF CHEAP INFORMATION its processing, transmission and productive use Preference for services and intangible value Huge potential for savings in energy and materials Capacity for Unavoidable environmental friendliness environmental destruction Cheap Asian labor and the return of cheap oil have hindered the use of this huge opportunity space The new global positive-sum game Universal ICT “GREEN” GROWTH Revamping transport, energy, products, production and consumption patterns to make them sustainable is equivalent to post-war reconstruction and the spread of suburbia Full internet access at low cost is equivalent to electrification and suburbanization in facilitating demand (and, this time, also education) FULL GLOBAL DEVELOPMENT Incorporating successive new millions into sustainable consumption patterns is equivalent to the Welfare State and government procurement in terms of demand creation And the elements are interconnected ICT ICTs are the main enabling instruments of sustainability “GREEN” Internet access is the social and geographic frontier of the global market FULL GLOBAL DEVELOPMENT Only with sustainable production and consumption patterns Is globalization possible But we need policy consensus involving government, business and society GLOBAL DEVELOPMENT is not only a humanitarian goal It is about healthy growth, markets and employment in the advanced, emerging and developing worlds “GREEN” is not only about saving the planet It is about saving the economy and having a high (but different) quality of life But it cannot happen by guilt or fear but by desire and aspiration “GREEN” MUST BECOME THE “LUXURY LIFE” WHAT LOOKS IMPOSSIBLE NOW MAY SEEM OBVIOUS LATER But later it was obvious that… it seemed impossible to imagine… …that blue collar workers would have lifetime jobs and fully equipped suburban houses with a car at the door …or that most colonies would gain independence And it seemed impossible in the late 1960s… …to expect some of the values of the hippie movement [back to natural materials, organic food, etc.] to become the luxury norms …increasing wages created many more millions of consumers for mass production and sustained growth …the new middle classes rising in the developing world widened world markets for mass production by adopting the “American Way of Life” But now it is obvious that… …innovations in natural textile fibers have transformed the world of high fashion … and innovations in distribution logistics have made organic foods the premium segment in supermarkets Shifts in consumption patterns shift profit-making opportunities THE TECHNOLOGICAL STAGE IS SET TODAY FOR THE GLOBAL GOLDEN AGE OF THE 21st CENTURY It is up to business, government and society to agree on the convergent actions for making it a reality