Unit 7.

advertisement

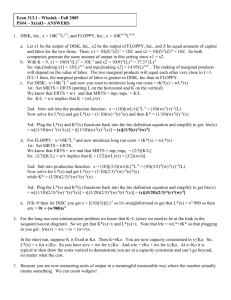

Unit 7. Analyses of LR Production and Costs as Functions of Output Palladium is a Car Maker’s Best Friend? Palladium is a precious metal used as an input in the production of automobile catalytic converters, which are necessary to help automakers meet governmental, mandated environmental standards for removing pollutants from automobile exhaust systems. Between 1992 and 2000, palladium prices increased from about $80 to over $750 per ounce. One response at Ford was a managerial decision to guard against future palladium price increases by stockpiling the metal. Some analysts estimate that Ford ultimately stockpiled over 2 million ounces of palladium and, in some cases, at prices exceeding $1,000 per ounce. Was this a good managerial move? This Little Piggy Wants to Eat Assume Kent Feeds is producing swine feed that has a minimal protein content (%) requirement. Two alternative sources of protein can be used and are regarded as perfect substitutes. What does this mean and what are the implications for what inputs Kent Feeds is likely to use to produce their feed? How Big of a Plant (i.e. K) Do We Want? Assume a LR production process utilizing capital (K) and labor (L) can be represented by a production function Q = 10K1/2L1/2. If the per unit cost of capital is $40 and the per unit cost of L is $100, what is the cost-minimizing combination of K and L to use to produce 40 units of output? 100 units of output? If the firm uses 5 units of K and 3.2 units of L to produce 40 units of output, how much above minimum are total production costs? Q to Produce at Each Location? Funky Foods has two production facilities. One in Dairyland was built 10 years ago and the other in Boondocks was built just last year. The newer plant is more mechanized meaning it has higher fixed costs, but lower variable costs (including labor). What would be your recommendation to management of Funky Foods regarding 1) total product to produce and 2) the quantities to produce at each plant? LR Max 1. Produce Q where MR = MC 2. Minimize cost of producing Q optimal input combination Isoquant The combinations of inputs (K, L) that yield the producer the same level of output. The shape of an isoquant reflects the ease with which a producer can substitute among inputs while maintaining the same level of output. Typical Isoquant SR Production in LR Diagram MRTS and MP MRTS = marginal rate of technical substitution = the rate at which a firm must substitute one input for another in order to keep production at a given level = - slope of isoquant = K L = the rate at which capital can be exchanged for 1 more (or less) unit of labor MPK = the marginal product of K = Q K MPL = the marginal product of L = Q = MPK K + MPL L Q = 0 along a given isosquant MPK K + MPL L = 0 K MPL L MPK Q L = ‘inverse’ MP ratio Indifference Curve & Isoquant Slopes Indiff Curve Isosquant - slope = MRS = rate at which consumer is willing to exch Y for 1X in order to hold U constant = inverse MU ratio = MUX/MUY For given indiff curve, dU = 0 Derived from diff types of U fns: 1) Cobb Douglas U = XY 2) Perfect substitutes U=X+Y 3) Perfect complements U = min [X,Y] - slope = MRTS = rate at which producer is able to exch K for 1L in order to hold Q constant = inverse MP ratio = MPL/MPK For given isoquant, dQ = 0 Derived from diff types of production fns: 1) Cobb Douglas Q = LK 2) Perfect substitutes Q=L+K 3) Perfect complements Q = min [X,Y] Cobb-Douglas Isoquants Inputs are not perfectly substitutable Diminishing marginal rate of technical substitution Most production processes have isoquants of this shape Linear Isoquants Capital and labor are perfect substitutes Leontief Isoquants Capital and labor are perfect complements Capital and labor are used in fixedproportions Deriving Isoquant Equation Plug desired Q of output into production function and solve for K as a function of L. Example #1 – Cobb Douglas isoquants – – – – – Desired Q = 100 Production fn: Q = 10K1/2L1/2 => 100 = 10K1/2L1/2 => K = 100/L (or K = 100L-1) => slope = -100 / L2 Exam #2 – Linear isoquants – – – – – Desired Q = 100 Production fn: Q = 4K + L => 100 = 4K + L K = 25 - .25L => slope = -.25 Budget Line = maximum combinations of 2 goods that can be bought given one’s income = combinations of 2 goods whose cost equals one’s income Isocost Line = maximum combinations of 2 inputs that can be purchased given a production ‘budget’ (cost level) = combinations of 2 inputs that are equal in cost Isocost Line Equation TC1 = rK + wL rK = TC1 – wL K = TC1 w L r r Note: slope = ‘inverse’ input price ratio K = L = rate at which capital can be exchanged for 1 unit of labor, while holding costs constant. Increasing Isocost Changing Input Prices Different Ways (Costs) of Producing q1 Cost Minimization (graph) LR Cost Min (math) - slope of isoquant = - slope of isocost line MPL w MPK r MPL w (r ) (r ) MPK r MPL (r ) 1 1 ( ) w( ) MPK MPL MPL r w MPK MPL MCK MCL Reducing LR Cost (e.g.) w r MPK MPL MC K MC L K, L SR vs LR Production Assume a production process: Q Q K L R W = = = = = = 10K1/2L1/2 units of output units of capital units of labor rental rate for K = $40 wage rate for L = $10 Given q = 1/2 1/2 10K L Q K L TC=40K+10L 40* 2* 8* 160* 100* 5* 20* 400* 40 5 3.2 232 100 2 50 580 * LR optimum for given q Given q = 10K1/2L1/2, w=10, r=40 Minimum LR Cost Condition inverse MP ratio = inverse input P ratio (MP of L)/(MP of K) = w/r (5K1/2L-1/2)/(5K-1/2L1/2) = 10/40 K/L = ¼ L = 4K Optimal K for q = 40? (Given L* = 4K*) q = 40 = 10K1/2L1/2 40 = 10 K1/2(4K)1/2 40 = 20K K* = 2 L* = 8 min SR TC = 40K* + 10L* = 40(2) + 10(8) = 80 + 80 = $160 SR TC for q = 40? (If K = 5) q = 40 = 10K1/2L1/2 40 = 10 (5)1/2(L)1/2 L = 16/5 = 3.2 SR TC = 40K + 10L = 40(5) + 10(3.2) = 200 + 32 = $232 Optimal K for q = 100? (Given L* = 4K*) Q = 100 = 10K1/2L1/2 100 = 10 K1/2(4K)1/2 100 = 20K K* = 5 L* = 20 min SR TC = 40K* + 10L* = 40(5) + 10(20) = 200 + 200 = $400 SR TC for q = 100? (If K = 2) Q = 100 = 10K1/2L1/2 100 = 10 (2)1/2(L)1/2 L = 100/2 = 50 SR TC = 40K + 10L = 40(2) + 10(50) = 80 + 500 = $580 Two Different costs of q = 100 LRTC Equation Derivation [i.e. LRTC=f(q)] LRTC = rk* + wL* = r(k* as fn of q) + w(L* as fn of q) To find K* as fn q from equal-slopes condition L*=f(k), sub f(k) for L into production fn and solve for k* as fn q To find L* as fn q from equal-slopes condition L*=f(k), sub k* as fn of q for f(k) deriving L* as fn q LRTC Calculation Example Assume q = 10K1/2L1/2, r = 40, w = 10 L* = 4K (equal-slopes condition) K* as fn q q = 10K1/2(4K)1/2 = 10K1/22K1/2 q = 20K K * .05q 20 LR TC = rk* + wL* L* as fn q = 40(.05q)+10(.2q) L* = 4K* = 2q + 2q = 4(.05 q) = 4q L* = .2q Graph of SRTC and LRTC Optimal* Size Plant (i.e. K) (*=> to min TC of q1) Step Example 1. Solve SR_ prod. fn. for L = f(q, K) q 10 K 1/ 2 L1 / 2 L1 / 2 q /(10 K 1/ 2 ) L q 2 / 100 K 2. Set up TC as fn of K (given q, r, w) q 40, r 40, w 10 SR TC r K wL 40 K 10 ( 40 2 / 100 K ) 40 K 160 K _ 3. Min TC w.r.t. K 1 TC 160 40 2 0 K K 2 K 4 K 2 Expansion Path LRTC Technological Progress Returns to Scale a LR production concept that looks at how the output of a business changes when ALL inputs are changed by the same proportion (i.e. the ‘scale’ of the business changes) Let q1 = f(L,K) = initial output q2 = f(mL, mK) = new output m = new input level as proportion of old input level Types of Returns to Scale: 1) Increasing q2 > mq1 2) Constant q2 = mq1 3) Decreasing q2 < mq1 output ↑ < input ↑ Assume a firm is considering using two different plants (A and B) with the corresponding short run TC curves given in the diagram below. $ TCA TCB Q1 Q of output Explain: 1. Which plant should the firm build if neither plant has been built yet? 2. How do long-run plant construction decisions made today determine future short-run plant production costs? 3. How should the firm allocate its production to the above plants if both plants are up and operating? Multiplant Production Strategy Assume: P = output price = 70 - .5qT qT = total output (= q1+q2) q1 = output from plant #1 q2 = output from plant #2 MR = 70 – (q1+q2) TC1 = 100+1.5(q1)2 MC1 = 3q1 TC2 = 300+.5(q2)2 MC2 = q2 PqT TC1 TC2 max d d ( PqT ) d (TC1 ) 0 dq1 dq1 dq1 MR MC1 d d ( PqT ) dTC2 0 dq2 dq2 dq2 MR MC2 Multiplant Max (#1) MR = MC1 (#2) MR = MC2 (#1) 70 – (q1 + q2) = 3q1 (#2) 70 – (q1 + q2) = q2 from (#1), q2 = 70 – 4q1 Sub into (#2), 70 – (q1 + 70 – 4q1) = 70 – 4q1 7q1 = 70 q1 = 10, q2 = 30 = TR – TC1 – TC2 = (50)(40) - [100 + 1.5(10)2] - [300 + .5(30)2] = 2000 – 250 – 750 = $1000 If q1 = q2 = 20? = - TR TC1 TC2 = (50)(40) - [100 + 1.5(20)2] - [300 + .5(20)2] = 2000 – 700 – 500 = $800 Multi Plant Profit Max (alternative solution procedure) 1. Solve for MCT as fn of qT knowing cost min MC1=MC2=MCT MC1=3q1 q1 = 1/3 - MC1 = 1/3 MCT MC2 = q2 q2 = MC2 = MCT q1+q2 = qT = 4/3 MCT MCT = ¾ qT 2. Solve for profit-max qT MR=MCT 70-qT = ¾ qT 7/4 qT = 70 q*T = 40 MC*T = ¾ (40) = 30 Multi Plant Profit Max (alternative solution procedure) 3. Solve for q*1 where MC1 = MC*T 3q1 = 30 q*1 = 10 4. Solve for q*2 where MC2 = MC*T q*2 = 30