Inge Kauer - ATNI 2013

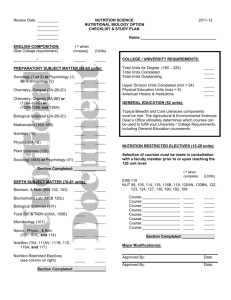

advertisement

PACO III ATNI 2013 1 Rationale Given their size and reach, companies can make a significant contribution to addressing obesity and undernutrition ATNI seeks to Provide companies a tool for benchmarking their nutrition practices Serve as an impartial source of information for interested stakeholders Civil society Facilitate effective advocacy Stimulate dialogue and action Policymakers Inform development of nutrition policies Investors Provide context for company engagement Media Raise profile of industry role in malnutrition Academics Stimulate research on best practices Encourage improvements in companies’ policies, practices and performance to result in: • Greater consumer access to more nutritious foods and beverages • An environment facilitating the consumption of healthier foods and beverages through improvements in areas such as marketing, labeling, and package sizes 2 2 June 2013 Governance Funders Executive Director and ATNI team Independent Advisory Panel Provides strategic advice on stakeholder engagement, institutional considerations and financial sustainability Expert Group Provides technical advice on methodology for assessing companies Global Stakeholder Network Widest possible network of stakeholders, including those involved in public consultation on Index methodology 3 3 June 2013 Methodology development Company assessment methodology was developed through an extensive multi-stakeholder process 4 June 2013 Methodology and scoring weights 5 June 2013 Geographic scope Global Index 3 Spotlight Indexes 25 of the worlds largest food and beverage companies 10 of the largest companies by F&B revenue in each market Regional balance: 1 country per major region ‘Double burden’ of malnutrition Mexico India Large or growing F&B industry South Africa 6 June 2013 Value of Spotlight Indexes Purpose Expected outcomes • Assess the extent to which multinational companies implement their global commitments within specific countries • Understand local context and how that drives/affects companies’ responses • Compare the performance of multinational companies between countries – how consistently do they implement their commitments? • Compare the performance of local vs multinational companies – is there a significant difference in how they tackle nutrition issues? 7 • Provide a tool for local stakeholders to monitor major F&B companies in their market • Encourage action from both local and multinational players • Identify opportunities for further research and collaboration with local organisations and experts June 2013 Companies in Spotlight Indexes: not yet rated INDIA MEXICO SOUTH AFRICA Britannia Industries Coca Cola AVI Coca Cola Grupo Bimbo Coca Cola Gujarat Milk Marketing Federation (Amul)* Grupo Herdez Groupe Danone ITC Grupo Industrial Lala Kraft Foods Inc (now Mondelez) Kerala Milk Marketing Federation** Kellogg Company Parmalat (now owned by Lactalis) Mother Dairy Fruit & Veg ** Kraft Foods Inc (now Mondelez) Pioneer Food Group Parle Products Nestlé PepsiCo PepsiCo PepsiCo Nestlé Nestlé Sigma Alimentos (ALFA) Tiger Brands Unilever Unilever Unilever * Cooperative ** Government-owned 8 June 2013 Global ranking 2013 9 June 2013 Key findings • Across the board, the world’s largest food and beverage manufacturers can do substantially more to improve consumers’ access to nutrition o Only three companies scored above 5.0 on a 10-point scale o The majority of companies scored below 3.0 • Many companies are now taking at least some action to improve access to nutrition o Companies are doing the most in the area of incorporating nutrition into their corporate governance and management systems o Many companies are motivated to act by the business risks associated with nutrition, as well as the opportunity to play a more active role in addressing nutrition challenges • Danone, Unilever and Nestlé are the highest-ranking companies o They have corporate strategies that include explicit commitments to improving nutrition and the corresponding integration of nutrition considerations into core business activities o But even their scores demonstrate that there is significant room for improvement o Danone and Nestlé’s reported lack of compliance with the International Code of Marketing of Breast-milk Substitutes is a significant concern • Companies’ practices often do not measure up to their commitments o Companies’ scores on nutrition strategy and governance were higher than their scores on product formulation, accessibility, and marketing o Within each of these areas, their level of implementation lagged behind their stated commitments • Companies could do more to address undernutrition and at a broader scale o Company scores on undernutrition are significantly lower than those on obesity o Many companies do not articulate a clear recognition of the role they can play in addressing undernutrition • Many companies are not very transparent about their nutrition practices o In particular, the lowest-ranked companies on the Index do not disclose sufficient information on their policies and practices to evaluate any approaches they may have to nutrition 10 June 2013 Key recommendations • An essential first step for companies to address the challenges of obesity and undernutrition is to integrate nutrition into their corporate strategies o Companies should develop clear and measurable corporate objectives and targets on nutrition o They should also create robust incentive and accountability structures • Stronger mechanisms are needed to track companies’ performance on their commitments and targets in order to improve consumers’ access to nutrition, including: o External mechanisms, such as independent audits, third-party evaluations, and incorporation of input from experts or other stakeholders o Internal mechanisms, such as Board and executive-level oversight of the company’s performance against its nutrition commitments • Companies’ priorities for improving their approach to nutrition should include: o Ensuring product formulation, marketing and labeling efforts are in line with recommendations from norm-setting bodies such as the World Health Organization and the Food and Agriculture Organization of the United Nations o Setting product formulation targets for all relevant ingredients and across their entire product portfolios and articulating these targets in a format that allows for a clearer understanding of the scope of such efforts o Identifying and applying approaches to make products of high nutritional quality more affordable and widely available, especially to lower-income consumers o Implementing a strict and comprehensive policy on marketing to children that applies to all media channels and all countries in which a company operates o Increase efforts to address undernutrition and scale up those approaches that are the most successful o For companies that manufacture breast-milk substitutes, ensure compliance with the International Code of Marketing of Breast-milk Substitutes • Companies should increase public disclosure of their nutrition activities 11 June 2013 Post launch reaction to ATNI: What companies are saying “High ranking in ATNI index particularly around products, lifestyle & engagement with an action plan for improvement” Unilever News @Unilever “#Nestle ranks highly in #ATNI: We commit to further action on malnutrition in new CSV report” “We welcome a continuous dialogue with ATNI (the index) that enables us to identify and address challenges collaboratively” “On the next index in two years, we will perform better.” Coca-Cola 12 12 News from Nestle @nestlemedia FrieslandCampina June 2013 Post launch reaction to ATNI: What media are saying “New nutrition index rates food with thought” Nancy Hellmich USA Today “Danone, Unilever and Nestlé ranked top for nutrition – but could do better” Caroline Scott-Thomas FoodNavigator “Nutrition index ranks US below European producers” Andrew Jack Financial Times “Work to be done to address global nutrition challenges” Eric Schroeder Food Business News “indexes such as the ATNI can be used to increase the buy-in of stakeholders and to monitor corporate behaviour by reinforcing companies with the best business practices and identifying those that fail to improve” Op-Ed The Lancet 13 13 June 2013 Investor support 40 firms collectively managing over $2.6 trillion in assets have signed the ATNI Investor Statement 14 14 June 2013 Assessing impact Activities Outputs Outcomes Impact Encourage improvements in companies’ policies, practices and performance to result in: Increased market availability & household accessibility of healthy foods and improved food consumption environment • Greater consumer access to more nutritious foods and beverages Improved diets Engagement with and uptake by: (illustrative measures) Provide companies a tool to benchmark their nutrition practices Food and beverage manufacturers • # of company engagements • # of company press releases about ATNI Stimulate dialogue and action # of interactions between stakeholders Serve as an impartial source of information for interested stakeholders Investors # of statement signatories and $AUM Media # of stories about ATNI and companies • An environment facilitating the consumption of healthier foods and beverages through improvements in areas such as marketing, labeling, and package sizes Improved health status Civil society # of invitations to make presentations Policymakers # of requests for dialogue Academics # of times cited in relevant articles 15 15 Improved nutritional status Improvement over time as measured by company ratings on subsequent versions of ATNI These impacts will not be directly attributable to ATNI but links to impact may be plausible June 2013 Future plans ATNI has the potential to magnify its impact over time in numerous ways and improve: Publish company ranking every two years • First version of Global Index launched in March 2013; Spotlight Indexes during 2013 • In order to maximize impact: o Release rankings on a regular basis to track company improvements o Allow enough time between editions for companies to make meaningful changes • Constructively engage with companies to augment impact of ranking • Iterative approach to improving methodology for future versions but maintain most of initial structure to enable year-on-year comparison • Regularly monitor impact Facilitate nutrition ‘knowledge agenda’ • First version of ATNI represents current state of knowledge and consensus around best practices • Final report highlights important issues that require further research and/or consensus building • Facilitate progress by convening key stakeholders Evaluate opportunities for growth • Depending on the nature of stakeholder response and demand, consider opportunities such as: o Expanding number of companies evaluated o Expanding geographic scope (additional Spotlight countries) o Expanding scope across value chain (upstream suppliers, retailers) 16 June 2013 Knowledge agenda Issues requiring further research and/or consensus-building • • • • • • • • • • • 17 Greater clarity on what constitutes a robust nutrient profiling system and movement towards a consensus ‘gold standard’ A standard format in which to report product reformulation efforts, which allows an understanding of the scope of such efforts and comparison of companies’ efforts Research on how pricing affects low-income consumers’ purchasing decisions of healthier products Characterization of how individual companies affect the food consumption environment (for instance, through their marketing activities or labeling practices), and development of metrics that capture these impacts Assessment of companies’ role in encouraging food safety (for example, through efforts such as package labeling systems that provide transparency in the production of food or educate consumers on appropriate ways to prepare foods at home to ensure their safety) Guidelines for and methods to assess company performance on responsible: o Commercial sports sponsorship o Nutrition education (or, more broadly, support of healthy diet and active lifestyles) o Marketing to adolescents Development of a rigorous, transparent and methodologically reliable on-the-ground assessment of breast-milk substitute manufacturers’ marketing practices Characterization of food purchasing patterns among consumers in markets with a significant burden of undernutrition, so as to better understand the role played by processed foods in their diets Role of fortification of packaged foods in the context of broader national fortification strategies Appropriate role for food and beverage companies in interventions other than fortification to address undernutrition Guidelines for the responsible marketing of foods, particularly for those being sold in markets with a burden of undernutrition where guidance is less well developed, including complementary foods June 2013 Corporate Profile methodology structure - detail 18 June 2013