10

Firms in Different Markets

不同市场结构下的企业

10.1 Competitive Markets

(see Textbook Chapter 14)

10.1 竞争市场上的企业

(见教材第14章)

N. G R E G O R Y M A N K I W

Premium PowerPoint® Slides

by Ron Cronovich

2008 update

© 2008 South-Western, a part of Cengage Learning, all rights reserved

In this chapter, look for the answers to

these questions:

What is a perfectly competitive market?

What is marginal revenue? How is it related to

total and average revenue?

How does a competitive firm determine the

quantity that maximizes profits?

When might a competitive firm shut down in the

short run? Exit the market in the long run?

What does the market supply curve look like in the

short run? In the long run?

1

Introduction: A Scenario

简介:情景讨论

Three years after graduating, you run your own

business.

You must decide how much to produce, what price

to charge, how many workers to hire, etc.

What factors should affect these decisions?

• Your costs (studied in preceding chapter)

• How much competition you face

We begin by studying the behavior of firms in

perfectly competitive markets.

2

Characteristics of Perfect Competition

完全竞争的特征

1. Many buyers and many sellers

2. The goods offered for sale are largely the same.

3. Firms can freely enter or exit the market.

Because of 1 & 2, each buyer and seller is a

“price taker” – takes the price as given.

3

The Revenue of a Competitive Firm

竞争企业的收益

Total revenue (TR)

TR = P x Q

Average revenue (AR)

TR

=P

AR =

Q

Marginal Revenue (MR):

The change in TR from

selling one more unit.

∆TR

MR =

∆Q

4

ACTIVE LEARNING

Exercise

1:

Fill in the empty spaces of the table.

Q

P

TR

0

$10

n.a.

1

$10

$10

2

$10

3

$10

4

$10

AR

MR

$40

$10

5

$10

$50

5

ACTIVE LEARNING

Answers

1:

Fill in the empty spaces of the table.

Q

P

TR = P x Q

0

$10

$0

AR =

TR

Q

MR =

∆TR

∆Q

n.a.

$10

1

2

3

$10

$10

$10

Notice that

$20

$10

MR = P

$10

$30

$10

$10

$10

$10

$10

4

$10

$40

$10

$10

5

$10

$50

$10

6

MR = P for a Competitive Firm

对竞争企业而言,边际收益等于物品的价格

A competitive firm can keep increasing its output

without affecting the market price.

So, each one-unit increase in Q causes revenue

to rise by P, i.e., MR = P.

MR = P is only true for

firms in competitive markets.

7

Profit Maximization

利润最大化

What Q maximizes the firm’s profit?

To find the answer,

“Think at the margin.”

If increase Q by one unit,

revenue rises by MR,

cost rises by MC.

If MR > MC, then increase Q to raise profit.

If MR < MC, then reduce Q to raise profit.

8

Profit Maximization

利润最大化

(continued from earlier exercise)

At any Q with

MR > MC,

increasing Q

raises profit.

At any Q with

MR < MC,

reducing Q

raises profit.

Q

TR

TC

0

$0

$5

–$5

1

10

9

1

2

20

15

5

3

30

23

7

4

40

33

7

5

50

45

Profit MR MC

Profit =

MR – MC

$10 $4

$6

10

6

4

10

8

2

10

10

0

10

12

–2

5

9

MC and the Firm’s Supply Decision

边际成本与企业的供给决策

Rule: MR = MC at the profit-maximizing Q.

At Qa, MC < MR.

So, increase Q

to raise profit.

Costs

MC

At Qb, MC > MR.

So, reduce Q

to raise profit.

At Q1, MC = MR.

Changing Q

would lower profit.

MR

P1

Q a Q1 Q b

Q

10

MC and the Firm’s Supply Decision

边际成本与企业的供给决策

If price rises to P2,

then the profitmaximizing quantity

rises to Q2.

The MC curve

determines the

firm’s Q at any price.

Costs

MC

P2

MR2

P1

MR

Hence,

the MC curve is the

firm’s supply curve.

Q1

Q2

Q

11

Shutdown vs. Exit

停止营业与退出

Shutdown:

A short-run decision not to produce anything

because of market conditions.

Exit:

A long-run decision to leave the market.

A key difference:

• If shut down in SR, must still pay FC.

• If exit in LR, zero costs.

12

A Firm’s Short-run Decision to Shut Down

企业短期停止营业决策

• Cost of shutting down:

revenue loss = TR

• Benefit of shutting down:

cost savings = VC

(firm must still pay FC)

So, shut down if TR < VC.

Divide both sides by Q: TR/Q < VC/Q

So, firm’s decision rule is:

Shut down if P < AVC

13

A Competitive Firm’s SR Supply Curve

竞争企业SR的供给曲线

The firm’s SR

Costs

supply curve is

the portion of

its MC curve

If P > AVC, then

above

AVC.

firm produces Q

where P = MC.

If P < AVC, then

firm shuts down

(produces Q = 0).

MC

ATC

AVC

Q

14

The Irrelevance of Sunk Costs

与沉淀成本无关

Sunk cost: a cost that has already been

committed and cannot be recovered

Sunk costs should be irrelevant to decisions;

you must pay them regardless of your choice.

FC is a sunk cost: The firm must pay its fixed

costs whether it produces or shuts down.

So, FC should not matter in the decision to shut

down.

15

A Firm’s Long-Run Decision to Exit

企业退出一个市场的长期决策

• Cost of exiting the market:

revenue loss = TR

• Benefit of exiting the market:

cost savings = TC

(zero FC in the long run)

So, firm exits if TR < TC.

Divide both sides by Q to write the firm’s

decision rule as:

Exit if P < ATC

16

A New Firm’s Decision to Enter Market

新企业进入一个市场的决策

In the long run, a new firm will enter the market if

it is profitable to do so: if TR > TC.

Divide both sides by Q to express the firm’s

entry decision as:

Enter if P > ATC

17

The Competitive Firm’s Supply Curve

竞争企业的供给曲线

The firm’s

LR supply curve

is the portion of

its MC curve

above LRATC.

Costs

MC

LRATC

Q

18

2A:

Identifying a firm’s profit

ACTIVE LEARNING

A competitive firm

Determine

this firm’s

total profit.

Identify the

area on the

graph that

represents

the firm’s

profit.

Costs, P

MC

MR

ATC

P = $10

$6

50

Q

19

ACTIVE LEARNING

Answers

2A:

A competitive firm

Costs, P

profit per unit

= P – ATC

= $10 – 6

= $4

MC

MR

ATC

P = $10

profit

$6

Total profit

= (P – ATC) x Q

= $4 x 50

= $200

50

Q

20

2B:

Identifying a firm’s loss

ACTIVE LEARNING

A competitive firm

Determine

this firm’s

total loss,

assuming

AVC < $3.

Identify the

area on the

graph that

represents

the firm’s

loss.

Costs, P

MC

ATC

$5

MR

P = $3

30

Q

21

ACTIVE LEARNING

Answers

2B:

A competitive firm

Costs, P

MC

Total loss

= (ATC – P) x Q

= $2 x 30

= $60

ATC

$5

P = $3

loss

loss per unit = $2

MR

30

Q

22

Market Supply: Assumptions

市场供给:假设

1) All existing firms and potential entrants have

identical costs.

2) Each firm’s costs do not change as other firms

enter or exit the market.

3) The number of firms in the market is

•

•

fixed in the short run

(due to fixed costs)

variable in the long run

(due to free entry and exit)

23

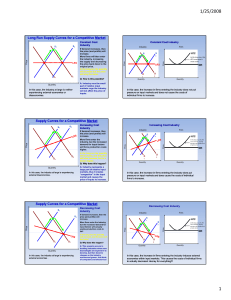

The SR Market Supply Curve

短期市场的供给曲线

As long as P ≥ AVC, each firm will produce its

profit-maximizing quantity, where MR = MC.

Recall from Chapter 4:

At each price, the market quantity supplied is

the sum of quantities supplied by all firms.

24

The SR Market Supply Curve

短期市场的供给曲线

Example: 1000 identical firms.

At each P, market Qs = 1000 x (one firm’s Qs)

P

One firm

MC

P

P3

P3

P2

P2

AVC

P1

Market

S

P1

10 20 30

Q

(firm)

Q

(market)

10,000

20,000 30,000

25

Entry & Exit in the Long Run

进入或退出一个市场的长期决策

In the LR, the number of firms can change due to

entry & exit.

If existing firms earn positive economic profit,

• New firms enter, SR market supply shifts right.

• P falls, reducing profits and slowing entry.

If existing firms incur losses,

• some firms exit, SR market supply shifts left.

• P rises, reducing remaining firms’ losses.

26

The Zero-Profit Condition

零利润的条件

Long-run equilibrium:

The process of entry or exit is complete –

remaining firms earn zero economic profit.

Zero economic profit occurs when P = ATC.

Since firms produce where P = MR = MC,

the zero-profit condition is P = MC = ATC.

Recall that MC intersects ATC at minimum ATC.

Hence, in the long run, P = minimum ATC.

27

Why Do Firms Stay in Business if Profit = 0?

为什么企业利润为零仍然经营

Recall, economic profit is revenue minus all

costs – including implicit costs, like the

opportunity cost of the owner’s time and money.

In the zero-profit equilibrium,

• firms earn enough revenue to cover these costs

• accounting profit is positive

28

The LR Market Supply Curve

长期市场供给曲线

The LR market supply

curve is horizontal at

P = minimum ATC.

In the long run,

the typical firm

earns zero profit.

P

One firm

MC

P

Market

LRATC

P=

min.

ATC

long-run

supply

Q

(firm)

Q

(market)

29

SR & LR Effects of an Increase in Demand

SR & LR 对需求增长的影响

…but then an increase

A firm begins in

profits

to zero

…leadingeq’m…

to…driving

SR

Over time,

profits

induce

entry,

in

demand

raises

P,…

long-run

andfirm.

restoring

long-run

eq’m.

profits for the

shifting

S to the

right, reducing P…

P

One firm

Market

P

S1

MC

Profit

S2

ATC

P2

P2

P1

P1

Q

(firm)

B

A

C

long-run

supply

D1

Q1 Q2

Q3

D2

Q

(market)

30

Why the LR Supply Curve Might Slope Upward

为什么LR供给曲线会向上倾斜

The LR market supply curve is horizontal if

1) all firms have identical costs, and

2) costs do not change as other firms enter or

exit the market.

If either of these assumptions is not true,

then LR supply curve slopes upward.

31

1) Firms Have Different Costs

企业的成本不同

As P rises, firms with lower costs enter the market

before those with higher costs.

Further increases in P make it worthwhile

for higher-cost firms to enter the market,

which increases market quantity supplied.

Hence, LR market supply curve slopes upward.

At any P,

•

For the marginal firm,

P = minimum ATC and profit = 0.

•

For lower-cost firms, profit > 0.

32

2) Costs Rise as Firms Enter the Market

随着企业进入市场成本增加

In some industries, the supply of a key input is

limited (e.g., there’s a fixed amount of land

suitable for farming).

The entry of new firms increases demand for this

input, causing its price to rise.

This increases all firms’ costs.

Hence, an increase in P is required to increase

the market quantity supplied, so the supply curve

is upward-sloping.

33

CONCLUSION: The Efficiency of a

Competitive Market

结论:竞争性市场的效率

Profit-maximization:

Perfect competition:

So, in the competitive eq’m:

MC = MR

P = MR

P = MC

Recall, MC is cost of producing the marginal unit.

P is value to buyers of the marginal unit.

So, the competitive eq’m is efficient, maximizes

total surplus.

In the next chapter, monopoly: pricing &

production decisions, deadweight loss, regulation.

34

CHAPTER SUMMARY

For a firm in a perfectly competitive market,

price = marginal revenue = average revenue.

If P > AVC, a firm maximizes profit by producing

the quantity where MR = MC. If P < AVC, a firm

will shut down in the short run.

If P < ATC, a firm will exit in the long run.

In the short run, entry is not possible, and an

increase in demand increases firms’ profits.

With free entry and exit, profits = 0 in the long run,

and P = minimum ATC.

35

10.2 Monopoly 垄断

PRINCIPLES OF

ECONOMICS

FOURTH EDITION

N. G R E G O R Y M A N K I W

Premium PowerPoint® Slides

by Ron Cronovich

2008 update

© 2008 South-Western, a part of Cengage Learning, all rights reserved

Introduction导言

A monopoly is a firm that is the sole seller of a

product without close substitutes.

In this chapter, we study monopoly and contrast

it with perfect competition.

The key difference:

A monopoly firm has market power, the ability

to influence the market price of the product it

sells. A competitive firm has no market power.

39

Why Monopolies Arise

产生垄断的原因

The main cause of monopolies is barriers

to entry – other firms cannot enter the market.

Three sources of barriers to entry:

1. A single firm owns a key resource.

E.g., DeBeers owns most of the world’s

diamond mines

2. The govt gives a single firm the exclusive right

to produce the good.

E.g., patents, copyright laws

40

Why Monopolies Arise

产生垄断的原因

3. Natural monopoly: a single firm can produce

the entire market Q at lower ATC than could

several firms.

Example: 1000 homes

need electricity.

ATC is lower if

one firm services

all 1000 homes

than if two firms

each service

500 homes.

Cost

$80

Electricity

ATC slopes

downward due

to huge FC and

small MC

$50

ATC

500

1000

Q

41

Monopoly vs. Competition: Demand Curves

垄断与竞争:需求曲线

In a competitive market,

the market demand curve

slopes downward.

but the demand curve

for any individual firm’s

product is horizontal

at the market price.

The firm can increase Q

without lowering P,

so MR = P for the

competitive firm.

P

A competitive firm’s

demand curve

D

Q

42

Monopoly vs. Competition: Demand Curves

垄断与竞争:需求曲线

A monopolist is the only

seller, so it faces the

market demand curve.

To sell a larger Q,

the firm must reduce P.

P

A monopolist’s

demand curve

Thus, MR ≠ P.

D

Q

43

1:

A monopoly’s revenue

ACTIVE LEARNING

Moonbucks is

the only seller of

cappuccinos in town.

The table shows the

market demand for

cappuccinos.

Fill in the missing

spaces of the table.

What is the relation

between P and AR?

Between P and MR?

Q

P

0

$4.50

1

4.00

2

3.50

3

3.00

4

2.50

5

2.00

6

1.50

TR

AR

MR

n.a.

44

ACTIVE LEARNING

Answers

Here, P = AR,

same as for a

competitive firm.

Here, MR < P,

whereas MR = P

for a competitive

firm.

Q

1:

P

TR

AR

0

$4.50

$0

n.a.

1

4.00

4

$4.00

2

3.50

7

3.50

3

3.00

9

3.00

4

2.50

10

2.50

5

2.00

10

2.00

6

1.50

9

1.50

MR

$4

3

2

1

0

–1

45

10.3 Oligopoly 寡头

PRINCIPLES OF

ECONOMICS

FOURTH EDITION

N. G R E G O R Y M A N K I W

Premium PowerPoint® Slides

by Ron Cronovich

2008 update

© 2008 South-Western, a part of Cengage Learning, all rights reserved

Introduction:

Between Monopoly and Competition

简介:垄断与竞争

Two extremes

• Competitive markets: many firms, identical

products

• Monopoly: one firm

In between these extremes

• Oligopoly: only a few sellers offer similar or

identical products.

• Monopolistic competition: many firms sell

similar but not identical products.

47

Measuring Market Concentration

衡量市场集中

Concentration ratio: the percentage of the

market’s total output supplied by its four largest

firms.

The higher the concentration ratio,

the less competition.

This chapter focuses on oligopoly,

a market structure with high concentration ratios.

48

Concentration Ratios in Selected U.S. Industries

美国工业的集中比率

Industry

Video game consoles

Tennis balls

Credit cards

Batteries

Soft drinks

Web search engines

Breakfast cereal

Cigarettes

Greeting cards

Beer

Cell phone service

Autos

Concentration ratio

100%

100%

99%

94%

93%

92%

92%

89%

88%

85%

82%

79%

49

EXAMPLE: Cell Phone Duopoly in Smalltown

示例:小城市的手机双寡头

Smalltown has 140 residents

P

Q

$0

140

5

130

10

120

15

110

20

100

25

90

30

80

(duopoly: an oligopoly with two firms)

35

70

Each firm’s costs: FC = $0, MC = $10

40

60

45

50

The “good”:

cell phone service with unlimited

anytime minutes and free phone

Smalltown’s demand schedule

Two firms: T-Mobile, Verizon

50

EXAMPLE: Cell Phone Duopoly in Smalltown

示例:小城市的手机双寡头

P

Q

Revenue

Cost

Profit

$0

140

5

130

650

1,300

–650

10

120

1,200

1,200

0

15

110

1,650

1,100

550

20

100

2,000

1,000

1,000

25

90

2,250

900

1,350

30

80

2,400

800

1,600

35

70

2,450

700

1,750

40

60

2,400

600

1,800

45

50

2,250

500

1,750

$0 $1,400 –1,400

Competitive

outcome:

P = MC = $10

Q = 120

Profit = $0

Monopoly

outcome:

P = $40

Q = 60

Profit = $1,800

51

EXAMPLE: Cell Phone Duopoly in Smalltown

示例:小城市的手机双寡头

One possible duopoly outcome: collusion

Collusion: an agreement among firms in a

market about quantities to produce or prices to

charge

T-Mobile and Verizon could agree to each produce

half of the monopoly output:

• For each firm:

Q = 30, P = $40, profits = $900

Cartel: a group of firms acting in unison,

e.g., T-Mobile and Verizon in the outcome with

collusion

52

1:

Collusion vs. self-interest

ACTIVE LEARNING

P

Q

$0

140

5

130

10

120

15

110

20

100

25

90

30

80

35

70

40

60

45

50

Duopoly outcome with collusion:

Each firm agrees to produce Q = 30,

earns profit = $900.

If T-Mobile reneges on the agreement and

produces Q = 40, what happens to the

market price? T-Mobile’s profits?

Is it in T-Mobile’s interest to renege on the

agreement?

If both firms renege and produce Q = 40,

determine each firm’s profits.

53

ACTIVE LEARNING

Answers

P

Q

$0

140

5

130

10

120

15

110

20

100

25

90

30

80

35

70

40

60

45

50

1:

If both firms stick to agreement,

each firm’s profit = $900

If T-Mobile reneges on agreement and

produces Q = 40:

Market quantity = 70, P = $35

T-Mobile’s profit = 40 x ($35 – 10) = $1000

T-Mobile’s profits are higher if it reneges.

Verizon will conclude the same, so

both firms renege, each produces Q = 40:

Market quantity = 80, P = $30

Each firm’s profit = 40 x ($30 – 10) = $800

54

Collusion vs. Self-Interest

合作与自我兴趣

Both firms would be better off if both stick to the

cartel agreement.

But each firm has incentive to renege on the

agreement.

Lesson:

It is difficult for oligopoly firms to form cartels and

honor their agreements.

55

2:

The oligopoly equilibrium

ACTIVE LEARNING

P

Q

$0

140

5

130

10

120

15

110

20

100

25

90

30

80

35

70

40

60

45

50

If each firm produces Q = 40,

market quantity = 80

P = $30

each firm’s profit = $800

Is it in T-Mobile’s interest to increase its

output further, to Q = 50?

Is it in Verizon’s interest to increase its

output to Q = 50?

56

ACTIVE LEARNING

Answers

P

Q

$0

140

5

130

10

120

15

110

20

100

25

90

30

80

35

70

40

60

45

50

2:

If each firm produces Q = 40,

then each firm’s profit = $800.

If T-Mobile increases output to Q = 50:

Market quantity = 90, P = $25

T-Mobile’s profit = 50 x ($25 – 10) = $750

T-Mobile’s profits are higher at Q = 40

than at Q = 50.

The same is true for Verizon.

57

10.4 Monopolistic Competition

垄断竞争

PRINCIPLES OF

ECONOMICS

FOURTH EDITION

N. G R E G O R Y M A N K I W

Premium PowerPoint® Slides

by Ron Cronovich

2008 update

© 2008 South-Western, a part of Cengage Learning, all rights reserved

Introduction to Monopolistic Competition

垄断竞争介绍

Monopolistic competition:

a market structure in which many firms sell

products that are similar but not identical.

Examples:

• apartments

• books

• bottled water

• clothing

• fast food

• night clubs

59

Comparing Perfect & Monop. Competition

完全竞争与垄断性竞争的比较

perfect

competition

monopolistic

competition

number of sellers

many

many

free entry/exit

yes

yes

long-run econ. profits

zero

zero

the products firms sell

identical

differentiated

firm has market power? none, price-taker

yes

D curve facing firm

downwardsloping

horizontal

60

Comparing Monopoly & Monop. Competition

完全垄断与垄断性竞争的比较

monopoly

monopolistic

competition

number of sellers

one

many

free entry/exit

no

yes

long-run econ. profits

positive

zero

firm has market power?

yes

yes

D curve facing firm

downwarddownwardsloping

sloping

(market demand)

close substitutes

none

many

61

Comparing Oligopoly & Monop. Competition

寡头与垄断造性竞争的比较

oligopoly

number of sellers

few

monopolistic

competition

many

importance of strategic

high

interactions between firms

low

likelihood of fierce

competition

high

low

62