Chapter 5 Strategies in Action - Home

advertisement

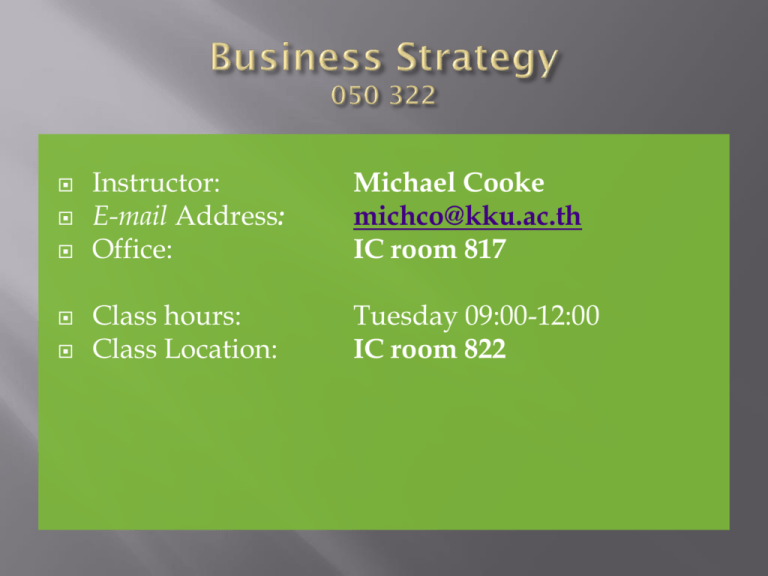

Instructor: E-mail Address: Office: Michael Cooke michco@kku.ac.th IC room 817 Class hours: Class Location: Tuesday 09:00-12:00 IC room 822 Complete student presentations Thai Rice Thai Auto industry Thai tourist industry Google, Exodus, and monetary policy Student discussion – HR related Distribute final exam essay questions Course evaluation at http://reg.kku.ac.th to 24-3 The Product Life-cycle The Changing Workforce in China At a Pearl River area factory labor costs (wages plus benefits) per worker have been rising 30 percent or more each year. Nationwide migrant worker wages are rising is 21 percent annually. The government has mandated 13 percent annual minimum wage increases through 2015. This is about three times inflation. Wages at the factory are rising fast because it is in an area that was slower to develop. Five years ago, the factory paid $90 to $120 a month to new workers. Workers gave $13 to $40 of their monthly pay for six months to their foreman for training. Now the factory offers new employees 2,500 renminbi a month, about $395, before overtime *. Six-person dorm rooms have been replaced with two-person apartments. Workers no longer have to give part of their wages to the foreman. Foremen now get an $8 to $16 bonus for each month that a new blue-collar employee stays on the job. The factory struggles to find workers. An outcome of China’s one-child policy is that many college graduates are only children with parents and grandparents who continue to support them into adulthood. Those children do not want factory work. A factory manager said: “Their parents, their grandparents give them money; they have six people to support them. They say, Why do I need to work? I can stay home and get 2,000 renminbi a month, why should I get on a bus every day to earn 2,500 a month?” China’s vocational schools and training programs are unpopular. They are seen as dead-ends. They are also seen as schools for people from peasant backgrounds. “The more educated people are, the less they want to work in a factory.” The number getting vocational training is about half that of students taking academic courses. The combination of the one-child policy and rising rates of college education is starting to hit the core of China’s factory work force: 18- to 21-year-olds not in college. Their numbers are on track to plunge by 29 percent from 2010 to 2020 even if enrollments in higher education hold steady. “We have jobs and positions for which skilled workers cannot be found, and on the other hand, we have talented people who cannot find jobs; technical and vocational education and training is the answer,” the vice minister of education said at a conference last June. * Note that in dollar terms wages have risen even faster than in renminbi due to exchange rates. http://www.nytimes.com/2013/01/25/business/as-graduates-rise-in-china-office-jobs-fail-to-keepup.html?nl=todaysheadlines&emc=edit_th_20130125&pagewanted=print What Strategists are Thinking About* China’s large pool of surplus rural labor has played a key role in maintaining low inflation and supporting China’s growth model. As agriculture surplus labor is exhausted, industrial wages rise faster, industrial profits are squeezed, and investment falls. Rebalancing China’s growth pattern would produce significant positive external spillovers and potentially raise output in those countries within the supply chain (mainly emerging Asia) and commodity exporters. Demographics strongly suggest an imminent transition to a labor-shortage economy. China will have a profound demographic shift within the next decade The UN projects that growth of the working age (15–64) population will turn negative around 2020. This forecast potentially understates prospects of a labor shortage: Industry employees are predominantly young. The growth rate of the core 20-39 subpopulation, shrank to zero in 2010 and will decline faster than the overall working age population. After a long period of “demographic dividends,” the share of dependents (those aged 0–14 and > 64 years of age) was lowest in 2010 and will rise (see next slide) Raising agricultural productivity by raising mechanization could result in a sizable release of rural workers that could partially offset labor shortfalls in urban areas. Scenario analysis shows that higher fertility through relaxation of the one-child policy will delay depletion of excess labor (slightly). Financial reform will accelerate the transition to a labor shortage economy, through wealth effects. Very low fertility rates still prevail, especially in the richest parts of the country. Shanghai reported fertility of just 0.6 in 2010—probably the lowest level anywhere in the world. According to the UN's population division, the nationwide fertility rate will continue to decline, reaching 1.51 in 2015-20 (http://www.economist.com/node/21553056) * From an IMF working paper. Effects of The Shrinking Labor Pool* Industry’s relocation to the interior provinces—where wages are lower and the large reserve of rural labor resides—has gathered pace since the global financial crisis. Parallel developments, such as an uptick in labor activism since the financial crisis is also consistent with strengthened bargaining power that accompanies a shrinking pool of labor. * From an IMF working paper. Other Points of View China’s demographic challenge may not be the disaster people are thinking about (A). China’s industries are not very automated compared to developed countries. China’s capital efficiency is poor. (Where, for example, does all that steel actually go? Think of the old Soviet Union’s steel and concrete production.) If China’s capital efficiency rose to match Japan’s, China’s growth prospects could theoretically remain high. China invests a higher percentage of GDP, but invests less efficiently than Japan, South Korea and Taiwan during their rapid expansions. (A) In 2012 the working-age population in China decreased 3.45 million. It is 937.27 million according to the director of the National Bureau of Statistics. (B) The director said that China should work to boost labor productivity, as well as improve people's education and adjust types of employment to extend the dividend. (B) An economist at the China Center for International Economic Exchanges in Beijing says that the fading of China's demographic dividend has required China to increase spending on education and culture to boost the quality of the country's human resources, said (B) A) FT.com 6 Feb 2013 B) http://news.xinhuanet.com/english/indepth/2013-01/18/c_132112584.htm Changing Dependency Ratios Graph on the Left Includes Under 16 and Over 65 http://www.economist.com/node/13611235 right side, and http://www.investmentu.com/2010/January/the-dependency-ratio.html Golden Population Structure FT.com 6 Feb 2013 Do You Know These Men? http://news.cnet.com/8301-1023_3-57618445-93/take-a-trip-down-memory-lane-to-googles-first-data-center/ Some Intersecting Stories Before Urs Hölzle became Google's eighth employee and first chief engineer, he took a tour of the company's server room at the Exodus Communication, Inc. data center in Santa Clara, Calif. Hölzle was taken there by Google co-founder Larry Page on February 1, 1999. The data center was a cage 7 feet by 4 feet with 30 personal computers arranged on the shelves providing Google to the world. Google's main ads database was on one machine back then Because of the way the data center was arranged at the time, many of the hottest companies in Silicon Valley, such as EBay, were near Google’s servers. Google was able to get a discount on some of its bandwidth. Larry had convinced the salesperson that they should give it to us for "cheap" because it's all incoming traffic, which didn't require any extra bandwidth for them Exodus’ data traffic was primarily outbound (Page’s cost management and negotiating style) Google had begun as a research project at Stanford University in 1996, and remained privately held until 2004 The founders had been reluctant to give up control in the early years Many employees became millionaires from the IPO With a market capitalization of over $300BB Google is among the three most valuable companies in the world http://news.cnet.com/8301-1023_3-57618445-93/take-a-trip-down-memory-lane-to-googles-first-data-center/ The Passing of Fourteen Years Market Capitalization in 2000 Rank in 2013 Market Capitalization in 2013 (October) Apple Google $4 billion $0 $460 billion $340 billion 1 3 Exodus $30 billion $0 N.A. MCC Exodus, Ellen Hancock, and Apple Exodus Communication filed for bankruptcy in September 2001. The stock reached $62.38 September, 2000 It closed at 17 cents one year later (on 563MM common shares). Exodus had burned through almost $300 million in cash in the first six months of 2001, much of it to make interest payments on debt. Just before the bankruptcy filing the CEO Ellen Hancock and several other executives left the company Hancock, 58, joined Exodus in 1998 after being pushed out as chief technology officer at Apple Computer Inc. In March, 1997 Newsweek reported that Steve Jobs called Hancock, the CTO at Apple, a ‘bozo’ - in part because of R&D spending. Jobs also said “I have no desire to run Apple Computer. I deny it at every turn, but nobody believes me.” Compiled from SF Gate, Newsweek, and Information Week Exodus’ Failed Strategy Exodus maintained a network of 40 data centers that hosted Web sites such as Yahoo and Hotmail, and grew with the Internet boom. (Any barriers to entry?) Their strategy included acquisitions, which led to problems when demand dropped EXDS “expanded their fixed-cost infrastructure and financing with debt at a time when industry growth was slowing dramatically," said an analyst at Lehman Bros. in New York. When the Federal Reserve Bank began monetary tightening after Y2K, Exodus could no longer get access to loans to cover widening losses. In 2000 Exodus added capacity and staff to handle projected annual revenue in excess of $2,000 million Annualized revenue in the first six months of 2001 were $1,334 MM Six month revenue was double the prior year period Revenue had grown from $1MM in five years The revenue shortfall versus projections arose from excess capacity. By 2001 data-center use was around 50% of capacity. Even if demand picked up, the price of floor space had declined because of the excess capacity. Like commercial landlords, Exodus competed for tenants. With a lot of choices, tenants get better pricing. The "fatal flaw" was fixed cost infrastructure financed by $3 billion in debt. Exodus lost $583.4 million in Q1 2001, versus $51.8 million in the year-ago quarter. The company also cut 30 percent of its staff of 4,500 in early 2001 A class-action lawsuit was filed in 2001, alleging that Exodus tried to inflate the value of its common stock in June 2001. (SF Gate September 5, 2001) The lawsuit was settled for $5MM seven years later, with tiny payments going to former shareholders. Compiled from Information Week and SF Gate What is a yield curve? And why not fund projects with short term (cheap) money? Wall Street Journal 7 Feb 2014. Ryan index is a portfolio of 2-30 year maturities. Why did Exodus and Others Fail in 2001? On the surface, we had a bubble which burst. Why did the bubble expand in 1999 and contract in 2001? In early September 2000 the 3 month rate was 6.3% and the 30 year rate was 5.7%. One year earlier the rates were 4.8% and 6.1%. Campbell R Harvey, Duke University 2011 Currency Cross Rates Ch 5 -18 Wall Street Journal 7-Feb-2014 Microsoft’s New Chairman John Thompson Microsoft typically holds five board meetings a year on-site, Thompson said. One of these is typically a strategy meeting, via which the board hears about planned strategies for each part of Microsoft's business. The other four meetings tend to be focused on specific operating unit issues, and leaders of those units typically speak to the board about their particular issues and "what the financial returns will be." Thompson emphasized that the board does not devise Microsoft's strategy; it provides insight and input on behalf of the shareholders. The board's role is "more a monitoring responsibility," he stressed. The board is charged with evaluating whether strategies are correct and product teams are executing well; whether the right financial terms and plans are in place; and how Microsoft is thinking about "human capital" in order to sustain leadership. From an interview by Cnet published 4 Feb 2014 A Few Labor Cost-Saving Tactics Labor markets, labor agreements, government policy directly affect use of these. Salary Freeze Hiring Freeze Salary Reductions Incumbent versus new hire wage structure Across the board versus selected positions Reduce Employee Benefits Time off (vacations, sick leave, etc.) Health care Retirement Reduce paid hours Layoffs Temporary Voluntary Mandatory Hire contractors or temps Early retirement, voluntary buyouts Reduce bonuses Human Capital How could a company compete for human capital under wage controls (such as in the USA during WWII)? What are the limits of using salary and bonus to motivate or reward employees? Agency problems? Resources? Diminishing returns? What other forms of self-interest might an employee or manager have, which an organization might use to motivate or compete for human resources? Would all forms of reward be the same across cultures? What Motivates a Three Toed Sloth To Leave His Tree in Costa Rica? http://www.wimp.com/slothcrossing/