Tobacco Control

advertisement

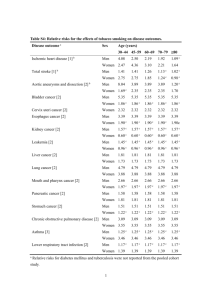

Health Care System and Tobacco Epidemic Ayda Yurekli, Senior Economic Advisor, Tobacco Free Initiative, WHO, Geneva Outline The link between health system & tobacco epidemic – – Should Serbia be worried about it? – – 2| TA diseases Who's burden is it anyway? Serbia's comprehensive on smoke-free legislation • Do smoke free policies hurt hospitality industry? Price, and taxes on cigarettes. Can Serbia do better? 28 April 2009 Deaths caused by tobacco use, by diseases Thousand deaths (2005) 1800 1600 (% of deaths from the disease caused by tobacco) 42% 1400 71% 1200 1000 800 8% 600 4% 400 10% 200 0 COPD Trachea, Ischemic bronchus hearth and lung disease cancers Source: Mathers and Loncar, 2006 3| 12% 28 April 2009 Cerebro Lower Tuberculosis Other TA vascular respiratory diseases infections Tobacco will kill 176 million people worldwide between 2005 and 2010. Cumulative tobacco related deaths (Million) The developing world's share will increase from 70% in 2005 to 77% in 2030 200 2005 2010 2020 2030 176 180 160 77% 140 120 99 100 72% 80 60 23% 40 20 74% 70% 34 26% 72% 28% 30% 29% 22 5.4 0 Developing countries Source: Lopez et al 2005 4| 2008 28 April 2009 Developed countries Total Who's burden is it anyway? Smokers & their families – High opportunity costs of tobacco expenditures – Lost family income due to diseases and disability – Out of pocket expenditures for • Tobacco products & • Cure for diseases Society – Cost for covering health care costs and production lost Government – Development issue- strong link between health & development 5| 28 April 2009 High opportunity cost to Families Example from Serbia On average Serbian daily smoker spend 35,804 Dinar / year on cigarettes. Given 317,623 Dinar GDP/capita in 2007 Daily smokers spend 11.3% of their annual income on cigarettes 6| 28 April 2009 Double burden on non-smokers and families Health Risks and Medical Costs Source: Donald F. Behan, Michael P. Eriksen and Yijia Lin March 31, 2005, 7| 28 April 2009 Double burden on non-smokers and families Economic Costs Source: Donald F. Behan, Michael P. Eriksen and Yijia Lin March 31, 2005, 8| 28 April 2009 9| 28 April 2009 Costs to Society Taiwan Type of Cost Cost (Million) Excess Absenteeism US$ 184 Sick leave due to ETS US$ Occupational injuries among smokers US$ 1,032 Scotland Absenteeism £ 40 Productivity loss £405 Loss due to fires £ Sources: Tsai et al Tobacco Control 2005;14:33-37 Parrotta et al Tob Control 2000;9:187-192 ( Summer ) 10 | 28 April 2009 4 81 Should Serbia be worried about it? SMOKING PREVALENCE RATE 2007 Ten leading risk factors as causes of disease burden measured in DALYs in Serbia and Montenegro (2002), Males(%) Smoking prevalence- age standardized (%) 60 50 48 43 41 40 38 40 34 32 32 30 30 30 30 30 27 27 25 25 23 22 20 20 10 0 R G us re si ec an e Fe d A . us tri a B Se os r ni bia a H e H rz. un g B ary ul ga ria La tv P ia ol an C d ro at i Tu a R rke om y an i Fr a a G nce e C rma ze ch ny R S ep. lo va S ki a lo ve ni a It a A ly lb an ia 0 Urban outdoor air pollution Lead Illicit drugs Physical inactivity Low fruit and vegetable intake High cholesterol High BMI Alcohol High blood pressure Tobacco 108.6 Deaths attributed to smoking, all cause (1000s) in 2002 100.1 79.2 69.1 33.0 29.0 11 | 28 April 2009 13.8 11.0 8.1 8.0 4.7 4.2 r ze bia ch R ep . G re ec Bu e lg ar ia C ro at ia Sl ov ak ia Li th ua ni a La tv ia Sl ov en ia um C Se ar y lg i Be H un g ia d an la n R om It a ly Po G er m an y U kr ai ne 18.6 18.0 17.7 2.8 5 10 15 20 25 Ten leading factors of disease burden measured in DALYs in Serbia Montenegro (2002), Females (%) Childhood sexual abuse Lead Alcohol Unsafe sex Low fruit and vegetable intake Physical inactivity High cholesterol Tobacco High BMI High blood pressure 0 5 10 15 20 Should Serbia be worried about it? Selected mortality as % of total mortality in Serbia and Montenegro, 2002 Other diseases 23% Digestive diseases 3% Respiratory diseases 3% Malignant neoplasms 17% 12 | 28 April 2009 Cardiovascular diseases 54% Should Serbia be worried about it? NO, because Serbia has been drafting a new law on Comprehensive Ban on Tobacco Smoking in (closed) public places to protect people from second hand smoke. Smoke-free laws are popular & do not harm business – 16 countries in the world are covered by comprehensive smoke-free comprehensive laws 13 | 28 April 2009 Political or economic argument? Do Smoke Free Policies Hurt Hospitality Industry? There is no evidence of negative impact on sales or employment in restaurant, bars and hotels found in 22 peerreviewed studies – negative effect found by TI sponsored not-peer reviewed studies NY introduced the smoke-free law in July 2003. – In 2004 8.7% increase in business receipts for restaurants and bars – 10,600 new jobs Sources: Scollo , Lal, Hyland and Glantz. Tob Control 2003; 12: 13-20. March 2004 The State of Smoke-Free New York City. A One-Year review, 14 | 28 April 2009 New York Bar and Restaurant Tax Receipts Continued Increase since SFAA Tax Receipts Collected $35,000,000 $31,040,049 $30,000,000 $25,000,000 $20,346,519 $21,295,278 4/02-3/03 (preSFAA) 4/03-3/04 (postSFAA) $20,000,000 $15,000,000 $10,000,000 $5,000,000 $0 Source: New York city, 2008 15 | 28 April 2009 4/06-3/07 Do Smoke Free Policies Hurt Hospitality Industry? Evidence says NO Sales rose after smoking banned in restaurants and bars in California 16 | 28 April 2009 WHO FCTC –Article 8 Protect people from tobacco smoke No safe level of second-hand smoke Smoke-free environments protect – non-smokers health, • help smokers quit & – encourage smoke-free homes 17 | 28 April 2009 Effect of smoke-free public places on smoking behavior at home There is no evidence found that total ban on public places would increase smoking in the home Evidence from UK show that total ban on public places has A. Increased: – Smoke-free homes –22% to 37% between 1996-2003 B. Saved – £181m from prevention of fires and reduced cleaning costs, and – £2.8bn from improved productivity of staff no longer taking smoking breaks Source: Adrian O’Dowd, BMJ 2005;331:129 (16 July) 18 | 28 April 2009 WHO FCTC –Article 8 Protect people from tobacco smoke Practical Approach Up to date, evidence show that there are no ventilation systems that prevent the exposure of SHS Without substantial capacity, air cleaners will have little impact on SHS levels 19 | 28 April 2009 Non smoking area Smoking area Urinating Prohibited 20 | 28 April 2009 Urinating permitted Serbian people deserves Clean Air Quality same as New Yorkers Ambient particulate matter, mg/m3 New York: Impact of smoking environments on air quality Before Smoke-Free Air Act (SFAA), Air Quality Was 50X Worse in Bars w/ Smoking than at the Holland Tunnel 1.535 1.6 1.4 1.2 Proposed EPA 24-hour outdoor standard (.05 mg/m3) 1.0 0.8 0.6 0.4 0.485 0.2 0.0 0.006 0.017 0.021 Central Park Holland Tunnel NonSmoking Bar Source: New York city, 2008 21 | 28 April 2009 Smoking Bar #1 0.580 Smoking Bar #2 Smoking Bar #3 Serbian people deserves Clean Air Quality same as New Yorkers Ambient particulate matter, mg/m3 New York: Air quality after smoking ban Air Quality in Bars Improved Significantly Post-SFAA 1.6 Pre-SFAA 1.4 1.2 1.0 0.8 0.580 0.6 0.485 0.4 0.2 0.174 0.146 0.021 0.042 0.093 0.0 Non-Smoking Bar Source: New York city, 2008 22 | 1.535 Post-SFAA 28 April 2009 Smoking Bar #1 Smoking Bar #2 Smoking Bar #3 Bottom-Line with Comprehensive Smoke-Free Laws Smoke free policies are cost effective on reducing smoking behavior and consumption: – WHO estimates that enforcement of smoke free policies would save one DALY for $358 • (US guidelines consider an cessation intervention costing $2,587 or less per life-year gained as cost effective) Many countries would likely to save from non-smoking legislation: – Evidence from: • Canada: $32.2 million, and • US: between $39 and $72 billion 23 | 28 April 2009 Costs to Government via Health Care System Economic Burden of Tobacco use Direct Costs from the treatment of illness directly attributed to tobacco usage accounted for – 0.46 to 1.15 percent of gross domestic product (GDP) for United States – 0.13 percent of GDP in the United Kingdom – 0.12 to 0.56 percent of GDP in Canada. – 0.43 percent of GDP in China The social costs amount to 1.4% to 1.6% of GDP in the US; a similar estimate came from Canada. The China study showed that amount to be 1.7% of GDP (Jha and Chaloupka, 2000). Social costs include costs due to indirect costs of morbidity and premature mortality, as well as direct medical costs. 24 | 28 April 2009 Serbia should NOT be worried Consumption, Income and Price of Cigarettes in Serbia 1998-2009 160 200 140 120 150 100 80 100 60 40 50 20 0 0 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 25 | 180 28 April 2009 GDP Index /capita,2005=100 Price Index/pack 2005=100 & Cigarette consumption/capita/pack 250 Per capita consumption/pack Price index January 99-09, 2005=100 GDP/capita Index at current prices 2005=100 Serbia should NOT be worried Serbia is among number of countries that ensures sustainable financing for Tobacco Control – Earmarked 1 dinar per cigarette pack (annually harmonized with the rate of inflation) to fund tobacco control work, • including smoking prevention, • diagnostics and treatment of tobacco related diseases 26 | 28 April 2009 Earmarking tobacco tax revenues for health: Examples Egypt: 10 piaster's per 20 cigarettes for the students health insurance Qatar: 2% of tobacco import revenues for health awareness activities and tobacco control activities Thailand: 2% of tobacco tax revenues for the Thai Health Promotion Foundation Nepal: 2 paisa/ stick on cigars and cigarettes for cancer care hospital Republic of Korea: 626 Korean Won/pack for the national Health Promotion Fund Mongolia: 2% of tobacco excise tax revenues for Prevention and Control for tobacco and alcohol Finland: 0.45 % of tobacco tax revenue goes to health promotion and anti-tobacco activities Iceland: 0.9% of gross tobacco sales for Public Health Institute Switzerland: 0.026 SFR per pack of cigarettes for tobacco control Poland: 0,5% of the value of the tobacco excise tax for smoking cessation Bulgaria: 1% of cigarette tax revenue for tobacco control and alcohol 27 | 28 April 2009 Can Serbia do better? YES. Serbia has the lowest excise tax and average retail price in the region Average retail prices and excise tax share in Cigarettes 2007 80 Price/pack US$ 5 69% 70 59% 58% 4 58% 57% 56% $3.2 50 4.5 66% 64% 60 3.5 44% 43% $3.0 40 3 2.5 $2.7 30 $2.1 $2.1 2 $2.0 $2.0 $1.9 1.5 20 $1.1 10 1 0.5 S bi a er S lo ve ni a ar y H un g d ol an P ia an om R ul ga B R ze ch C 28 April 2009 ria lic ep ub ki lo va S C us a 0 ro at ia 0 A 28 | Average Price $4.7 tri a Excise tax share as % of Retail Price Excise tax Can Serbia do better? YES. Assuming other than tax and producer's price, there is no change in other factors including per capita income Current 54.5% increase 21% increase in in excise from excise from 31 to 48 RSD 48 to 58 RSD Excise Tax/pack 31 48 58 Excise as % of RP 43.9% 47% 55% Price/pack (RSD) 70.6 90 Price elasticity=-0.4 Revenue (Bill. RSD) 105 RSD & ( percentage change from current level) 33.3 40.7 (+22%) 44.4 (+33%) 33.3 35.7 (+7%) 33.7 (+1%) Price elasticity= -0.8 Revenue (Bill. RSD) 29 | 28 April 2009 Conclusion Serbia already moved forward with TC and showed its political commitment with strong TC measures. Comprehensive smoke-free laws work and Serbians deserve clean air. Comprehensive smoke-free laws DO NOT HARM hospitality sector. Serbia has one of the lowest tax and price of cigarettes in the region and has room to increase its taxes to generate more revenues. 30 | 28 April 2009