Travelclick PowerPoint

advertisement

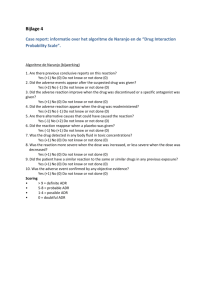

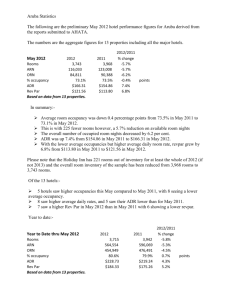

2015 Lodging Outlook Katie Moro Global Director, Demand360 Data Partnerships Nationally, business on the books for the coming 12 months is up 1.1% over same time last year. 16.0% Top 25 North American Markets 14,000,000 14.0% 12,000,000 12.0% 10,000,000 10.0% 8,000,000 8.0% 6,000,000 6.0% 4,000,000 4.0% 2,000,000 2.0% 0 0.0% -2,000,000 -2.0% -4,000,000 -4.0% Mar Apr May Group Jun Jul Transient Aug Sep Oct Var % to LY Nov Dec Jan Full Yr Var % Feb Var % to LY Room Nights 16,000,000 All major segments of demand are up over last year in both occupancy and ADR. Year over year variance % to same time last year for demand on the books for 2015 in top 25 North American markets The mid-scale segments are growing occupancy and ADR, and helping to drive the market. YoY % Change in Occupancy/ADR – 2015 Demand 9.0% 8.0% 7.0% 6.0% 5.0% 4.0% 3.0% 2.0% 1.0% 0.0% Total Occ Total ADR All Transient Occ Mid-Upscale Transient ADR Channel mix varies considerably by transient segment, and continues to shift online. Brand.com Voice Direct GDS OTA Retail Business Negotiated Discount Leisure Qualified Wholesale 0 10,000,000 20,000,000 30,000,000 40,000,000 50,000,000 60,000,000 Business guests are booking on brand.com more, and turning away from offline channels. Brand.com Voice Direct GDS OTA Retail Negotiated 0 10,000,000 20,000,000 30,000,000 40,000,000 50,000,000 60,000,000 YoY Var % 15.0% 10.0% 5.0% 0.0% -5.0% Brand.com Voice Direct Occ ADR GDS OTA For the leisure segment, online channel share, both brand.com and OTA, is growing. OTA discounts are narrowing. Brand.com Voice Direct GDS OTA Discount Qualified Wholesale 0 10,000,000 20,000,000 30,000,000 40,000,000 YoY Var % 15.0% 10.0% 5.0% 50,000,000 60,000,000 9.8% 4.6% 0.0% -5.0% Brand.com Voice Direct Occ ADR GDS OTA 2015 Outlook Group pace for Q4 is strong, laying a strong foundation for overall demand performance and pricing. Transient business demand growth has moderated, but remains positive. Pricing has improved across the board, but most significantly in the business segment. The pricing environment will continue to improve, with demand growing across all major segments. 2015 RevPAR growth (5-7%) will be led by ADR increases (4-6%) while occupancy grows at a slower pace (1-3%). Katie Moro March 25, 2015 This Presentation is Online: www.TravelClick.com