Annual Master Circular

advertisement

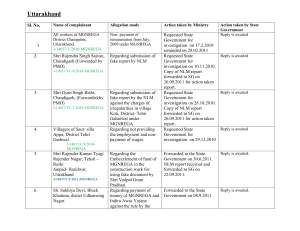

Annual Master Circular NATIONAL WORKSHOP ON BEST PRACTICES UNDER MGNREGA 20 TH AND 21 ST NOVEMBER,2015 RATIONALE MGNREGA-a paradigm shift in modern workfare programs in the social sector; marked by scale at the expenditure of 33,000 to 40,000 Cr. INR. Ten years of implementation; Independent research shows program effects on targeting, mitigating risk and arresting distress migration in vulnerable households. Strong pro-poor and pro-woman approach. Several administrative and technological innovations to its credit. --------------------------------------------------------------------------------------------------------------------------Flip side: Plethora of directives, instructions and advisories (1039 approx.) leading to confusion and contradictions. Clarity and Simplicity in instructions critical towards effective implementation. OBJECTIVE/ PROCESS/ CHALLENGE Take stock of the amendments, revisions, advisories, guidelines and orders issued from 2007 till November, 2015. Review and align the circulars, emphasize the non-negotiables, weed out the contradictions and inconsistencies, if any. Circulate a simple instructional Framework for Implementation -for feedback and comments of the States and other stakeholders. Finalise a Master Circular after due feedback process. This will be revisited every year for necessary additions/deletions. Move away from being too prescriptive, thereby allowing some degree of flexibility within the overall framework of the Act, encouraging innovations and good practices in the process. OBJECTIVE/ PROCESS/ CHALLENGE – contd. Collecting all the circulars on MIS and files (There were 939 circulars on MIS and around 100 circulars that were not on MIS had to be pulled out from files) Grouping them subject/ theme wise Reading all the circulars – line by line Compile these into a single draft circular with the desired flowcomprehensible and clear. Relevant Circulars on MIS Topic/Subtopic(Area) No. of Advisories/Orders/Directives Act and Schedule 75 Demand Registration-Job Cards, Rozgar Divas and labour Groups 13 Unemployment Allowance 1 Payment in Wages and Delay in Payments 52 Planning and Preparation of Labour Budgets 158 Works and Convergence 114 MGNREGA MIS, Payment Systems under MGNREGA, DBT and the Aadhar platform 181 Financing MGNREGA and SOP on Complaints and Stoppage of funds 47 IEC Activities under MGNREGA 24 Transparency and Accountability-Social Audits, Grievance Redress, Ombudsperson under MGNREGA 14 Skilling and Capacity Building-Project LIFE, Cluster Facilitation Team Project, Barefoot Technician (BFT) Project and Engagement with CSO 136 Awards 31 KEY AREAS FOR EMPHASIS Overall Framework of the Act and Schedules and the amendments thereof Areas for Emphasis are: 1.Intensifying Demand Registration 2.Reiterating the payment of Unemployment Allowance and Delay Compensation. 3. Focus on Transparency and Accountability(Social Audit, Grievance Redress, Rozgar Divas) 4. Emphasizing Directives on Works, MIS and Planning(IPPE II). 5. Focus on Capacity Building Interventions –Project LIFE, CFT and BFT, Training of Technical personnel. ACT AND SCHEDULES 1. States have to frame their respective Schemes within the overall framework of the Act, Schedules and the amendments from time to time. 2. Provision of 50 days of Wage Employment for the Scheduled tribes HHs in Forest areas 3. Union Cabinet has decided u/s 3(4) of MGNREGA to provide upto 50 days additional wage employment beyond the stipulates 100 days in areas affected by drought/natural calamities 4. CEGC and SEGC shall be constituted and shall perform their duties as per Section 10, 11 and 12 of the Act. DEMAND REGISTRATION - JOB CARDS, ROZGAR DIWAS, LABOUR GROUPS 1. Accurate registration of demand for work non-negotiable. 2. Registration of Demand to be kept open on a continuous basis. No rationing 3. Issuance of a dated receipt is mandatory. 4. JC must remain in the custody of the JC holder. Possession of JC with anyone other than the JC holder concerned is a violation of Section 25 of the Act. 5. JC cannot be cancelled in a routine manner 6. Rozgar Divas to be operationalised 7. States to take steps to form Labour Groups UNEMPLOYMENT ALLOWANCE [Reiteration that the] States are required to 1. Frame Rules governing the procedure for payment of unemployment allowance 2. Make necessary budgetary provision for payment of unemployment allowance 3. Operationalise the system of payment using NREGASoft 4. Put in place a monitoring mechanism (GP wise) 5. Take remedial measures like ensuring SoW etc. PAYMENT OF WAGES 1. No payment of wages shall be made in cash, unless specifically allowed by the Govt of India. 2. The State Government shall link the wages, without any gender bias, with the quantity of work done- on piece rate basis 3. Separate SoRs for age, gender, PwD and any other vulnerability, based on time and motion studies COMPENSATION FOR DELAY IN WAGE PAYMENTS •Compensation at the rate of 0.05% of the unpaid wages per day of delay beyond the 16th day of closure of muster roll States are required to:1. Divide the processes leading to determination and payment of wages into these stages. 2. Specify stage with Measurement of work; Computerizing the muster rolls; Computerizing of measurements; 3. Generation of wage lists; and Uploading Fund Transfer Orders. 4. States may divide these processes into sub-processes with maximum time limits, along with the functionary or agency which is responsible for discharging the specific function. 5. Operationalise the system of payment based on NREGASoft. 6. Compensation to be paid after due verification by PO, within 15 days from the due date. 7. The compensation shall be paid from the SEGF upfront. 8. This can be recovered from the functionaries/ agencies responsible for the delay. PLANNING AND PREPARATION OF LABOUR BUDGET 1. A month wise anticipated quantum of demand for work. 2. A plan that outlines the quantum and schedule of works to be provided to those who demand work. 3. As per Para 7 of schedule-I, MGNREGA, “There shall be a systematic, participatory planning exercise at each tier of Panchayat, conducted between August to December month of every year, as per a detailed methodology laid down by the State Government. ….’ --------------------------------------------------------------------------------------------------------------------------------- 1. Focus on IPPE II and converging five RD Schemes- Mahatma Gandhi NREGA, NRLM, Indira Awaas Yojana, National Social Assistance Programme, and the Deen Dayal Upadhyaya Grameen Kaushalya Yojana. 2. State Rural Development Plans to be presented before the Empowered Committee, Chaired by S-RD REVISED TIMELINES TO BE FOLLOWED Action to be Taken Time Launch of GP level planning process and discussion of the planning process by Gram Sabha. 2nd October Approval of the Gram Panchayat Level Plan by the Gram Sabha 30th November Submission of Gram Panchayat Level Plan to the Block Panchayat 5th December Approval of Block Level Consolidated Annual Plan by Block Panchayat and submission of the 20th December same to DPC Presentation of District Annual Plan and LB to District Panchayat by the DPC 20th January Approval of District Annual Plan by the District Panchayat and submission of the same to State 31st of January Government DPC to ensure that shelf of projects for each GP is ready 15th February Submission of Labour Budget to the Central Government 15th February Meetings of the Empowered committee and finalisation of 16th February onwards Communication of the LB to the States by MoRD and further by the states to Districts, Blocks, 31st March and GPs Communication of Opening Balance by states, Release of upfront / 1st Tranche by the Centre 7th April EXECUTION AND QUALITY MANAGEMENT OF WORKS 1. Focus on Agriculture And Allied Activities; at least 60% of the works to be taken up in a district in terms of cost, shall be for creation of productive asset directly linked to agriculture and allied activities through development of land, water and trees. 2. Wage Material Ratio; the cost of the material component including the wages of the skilled and semi-skilled workers shall not exceed forty per cent at the Gram Panchayat level. For works taken up by the implementing agencies other than Gram Panchayats, the overall material component including the wages of the skilled and semi-skilled workers shall not exceed forty percent at the District level. 3. No labour displacing machines shall be used. However, there may be activities in executing works which cannot be carried out by manual labour, where use of machines may become essential for the quality and durability of the works. Schedule of Rates to be followed. 4. Procurement Rules to be followed as laid down. WORKS TO BE TAKEN ON PRIORITY 1. Anganwadi Centers (2 lakh Anganwadi Centers in 11 States - Andhra Pradesh, Assam, Bihar, Chhattisgarh, Jharkhand, Madhya Pradesh, Maharashtra, Odisha, Rajasthan, Telengana and Uttar Pradesh on priority basis) 2. Pradhan Mantri Krishi Sinchai Yojana in Convergence 3. IHHL under MGNREGA 4. Category A, Category B works At least one labour intensive work to remain open in all the GPs at all times. MAHATMA GANDHI NREGA - MIS 1. Essential that States/ UTs do timely reporting so that the public domain (http://nrega.nic.in) represents the picture of MGNREGA implementation almost on or close to real-time. 2. States advised to make the MB entry in MIS mandatory. Some states have done this; the remaining States/ UTs which have not made MB entry in MIS mandatory are once again advised to do so. 3. Implementation of e-MR, Ministry vide letter No K-11011/2/2008-NREGAMonTS (1742), dated 5th February, 2013, has shared detailed guidelines along with the FAQs and its benefits.. PAYMENT ARCHITECTURE 1. Following the Direct Benefit Transfer (DBT) protocol i.e. through the State Employment Guarantee Fund (SEGF) account , direct to the worker accounts, based on a FTO to be generated by States’ implementing agencies is in process. 2. MMS Protocol: Role Based Model, MMS modules, implementation of guidelines, Training for the Nodal officers. 3. Project for internet connectivity through VSAT at 468 locations. It is being operationalized by the DeiTY. Requesting completion of pending actions by the States. 4. Focus on Aadhaar seeding and Aadhar Based Payments 5. No worker may be denied work on account of non possession of Aadhaar Card. FINANCING MAHATMA GANDHI NREGA 1. Process to be followed: Number of Tranches, Calculations for the tranches, the requisite documents to be furnished 2. Quantum of funds released as part of the second tranche, depends on the performance of the States. 3. Matching of the Central funds with State share. IEC – MAHATMA GANDHI NREGA 1. Expenditure for IEC activities taken up by the States/Districts can be met from the funds earmarked for administrative expenses (6% of the state funds). 2. State IEC Nodal officers are nominated by the States to look after IEC activities of MGNREGA in the State. The name and details of State IEC Nodal officers need to be conveyed to the Ministry. 3. State IEC plans have to be formulated 4. Rozgar Diwas and Social Audit are considered as major tools for IEC activities CORE MESSAGES For IEC 1. MGNREGA guarantees hundred days of wage employment in a financial year, to a rural household whose adult members volunteer to do unskilled manual work. 2. Individual beneficiary oriented works can be taken up on the lands of Scheduled Castes and Scheduled Tribes, small or marginal farmers or beneficiaries of land reforms or beneficiaries under the Indira Awaas Yojana of the Government of India. 3. Within 15 days of submitting the application or from the day work is demanded, wage employment must be provided to the applicant. 4. Workers have the right to get unemployment allowance in case employment is not provided within fifteen days of submitting the application or from the date when work is sought. 5. Wages must be paid within fifteen days of work done 6. Permissible works which can be taken up by the Gram Panchayats 7. MGNREGA focuses on the economic and social empowerment of women 8. MGNREGA provides “Green” and “Decent” work. 9. Social Audit of MGNREGA works is mandatory, which ensures accountability and transparency 10. MGNREGA works address the climate change vulnerability and protect the farmers from such risks and conserve natural resources. 11. The Gram Sabha is the principal forum for wage seekers to raise their voices and make demands. It is the Gram Sabha and the Gram Panchayat which approve the shelf of works under MGNREGA and fix their priority. SOCIAL AUDIT, GRIEVANCE REDRESS, OMBUDSMAN •States to set up independent SAUs and recruit minimum core staff to ensure implementation of Audit of Scheme Rules 2011 •Allocation of 1% of total MGNREGA expenditure in States to SAU at beginning of the financial year •Corrective action by State Governments on findings of Report of C&AG Compliance Audit on Social Audit •Minimum principles of transparency and accountability in MGNREGA •Wall writings and proactive disclosure of records at the GP Level •Operationalization of Ombudsman Guidelines •States to form Grievance Redress Rules for the State •SoP on Complaints shared, by the Ministry, with the States needs to be followed. SKILLING AND CAPACITY BUILDING UNDER MGNREGA • Project for Livelihoods in Full Employment under Mahatma Gandhi NREGA (Project LIFE- MGNREGA) •CONVERGENCE OF MGNREGA AND NRLM AND THE CFT STRATEGY •BAREFOOT TECHNICIANS •Creation of State Technical Resource Team (STRT), District Technical Resource Team (DTRT) and Block Technical Resource Team (BTRT) under MGNREGA AWARDS Mahatma Gandhi NREGA Annual Awards are presented at “Mahatma Gandhi NREGA Sammelan” on 2nd February. The following awards are given: Awards Given to States Awards given to Districts 1. Sustainable livelihood 1. Effective initiatives in through convergence 2. Transparency and MGNREGA administration accountability. 3. Social Inclusion Awards given to GP Awards given for Financial Inclusion to Post Offices 1. Best performing Gram Panchayat/Sarpanch 1. Excellence in NREGA Administration (Financial Inclusion) Given to the Department of Posts. The overall framework and scheme for awards is uploaded on the MGNREGA website: nrega.nic.in. POINTS FOR DISCUSSION Unemployment Allowance and Compensation for Delay in payment of Wages shall be met up front, automatically, as they become due. MIS shall be enabled accordingly. The paid amounts should be deducted from State entitlements. Staffing of Social Audit Unit Conduct of Social Audit in at least 50% of GPs in a year. Positioning of Core Staff esp. technical staff Utilization of 6% E-MR/ physical MR OR both E-MR may be issued by GP (Sec 15 (7)) Performance based remuneration payment Suggestions are invited from the States. The Ministry will examine them and redraft the Circular. The redrafted Circular will again be circulated among the States, for comments. The Master Circular and references (circulars, advisories and directives – minimised as much as possible) made therein shall be the basis for implementation and all other circulars, which have not been referred to will stand superseded. THANK YOU