Human Dimension Deck v3 - ASE

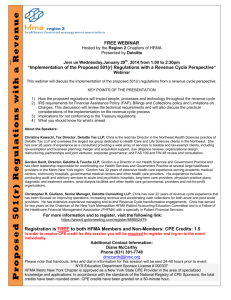

advertisement

The Future of Loss Reserving

A Bayesian 21st Century

R for Insurance Conference

Amsterdam

June 28, 2015

Jim Guszcza, PhD, FCAS

Deloitte Consulting LLP

jguszcza@deloitte.com

2

Deloitte Analytics Institute

© 2011 Deloitte LLP

Motivation:

Why Bayes, Why Now

Probably what we want

“Given any value (estimate of future payments) and our current

state of knowledge, what is the probability that the final payments

will be no larger than the given value?”

-- Casualty Actuarial Society (2004)

Working Party on Quantifying Variability in Reserve Estimates

I read this as a request for a Bayesian predictive distribution.

4

Deloitte Analytics Institute

© 2011 Deloitte LLP

Bayes gives us what we want

“Modern Bayesian methods provide richer information, with greater

flexibility and broader applicability than 20th century methods.

Bayesian methods are intellectually coherent and intuitive. Bayesian

analyses are readily computed with modern software and hardware.”

-- John Kruschke, Indiana University Psychology

5

Deloitte Analytics Institute

© 2011 Deloitte LLP

Why Bayes

• “A coherent integration of evidence from different sources”

• Background information

• Expert knowledge / judgment (“subjectivity” is a feature, not a bug)

• Other datasets (e.g. multiple triangles)

• Shrinkage, “borrowing strength”, hierarchical model structure – all coin of the realm

6

Deloitte Analytics Institute

© 2011 Deloitte LLP

Why Bayes

• “A coherent integration of evidence from different sources”

• Background information

• Expert knowledge / judgment (“subjectivity” is a feature, not a bug)

• Other datasets (e.g. multiple triangles)

• Shrinkage, “borrowing strength”, hierarchical model structure – all coin of the realm

• Rich output: full probability distribution estimates of all quantities of interest

• Ultimate loss ratios by accident year

• Outstanding loss amounts

• Missing values of any cell in a loss triangle

7

Deloitte Analytics Institute

© 2011 Deloitte LLP

Why Bayes

• “A coherent integration of evidence from different sources”

• Background information

• Expert knowledge / judgment (“subjectivity” is a feature, not a bug)

• Other datasets (e.g. multiple triangles)

• Shrinkage, “borrowing strength”, hierarchical model structure – all coin of the realm

• Rich output: full probability distribution estimates of all quantities of interest

• Ultimate loss ratios by accident year

• Outstanding loss amounts

• Missing values of any cell in a loss triangle

• Model the process that generates the data

• As opposed to modeling the data with “procedural” methods

• We can fit models as complex (or simple) as the situation demands

• Nonlinear growth patterns, trends, autoregressive, hierarchical, structure, …

8

Deloitte Analytics Institute

© 2011 Deloitte LLP

Why Bayes

• “A coherent integration of evidence from different sources”

• Background information

• Expert knowledge / judgment (“subjectivity” is a feature, not a bug)

• Other datasets (e.g. multiple triangles)

• Shrinkage, “borrowing strength”, hierarchical model structure – all coin of the realm

• Rich output: full probability distribution estimates of all quantities of interest

• Ultimate loss ratios by accident year

• Outstanding loss amounts

• Missing values of any cell in a loss triangle

• Model the process that generates the data

• As opposed to modeling the data with “procedural” methods

• We can fit models as complex (or simple) as the situation demands

• Nonlinear growth patterns, trends, autoregressive, hierarchical, structure, …

• Conceptual clarity

• Single-case probabilities make sense in the Bayesian framework

• Communication of risk: “mean what you say and say what you mean”

9

Deloitte Analytics Institute

© 2011 Deloitte LLP

Today’s Bayes

Is our industry

living up to its

rich Bayesian

heritage?

10

Deloitte Analytics Institute

© 2011 Deloitte LLP

Bayesian Principles

The Fundamental Bayesian Principle

“For Bayesians as much as for any other statistician, parameters are

(typically) fixed but unknown. It is the knowledge about these

unknowns that Bayesians model as random…

… typically it is the Bayesian who makes the claim for inference in a

particular instance and the frequentist who restricts claims to

infinite populations of replications.”

-- Andrew Gelman and Christian Robert

12

Deloitte Analytics Institute

© 2011 Deloitte LLP

The Fundamental Bayesian Principle

“For Bayesians as much as for any other statistician, parameters are

(typically) fixed but unknown. It is the knowledge about these

unknowns that Bayesians model as random…

… typically it is the Bayesian who makes the claim for inference in a

particular instance and the frequentist who restricts claims to

infinite populations of replications.”

-- Andrew Gelman and Christian Robert

Translation:

• Frequentist: Probability models the infinite replications of the data X

• Bayesian:

13

Deloitte Analytics Institute

Probability models our partial knowledge about 𝜃

© 2011 Deloitte LLP

Updating Subjective Probability

• Bayes’ Theorem (a mathematical fact):

Pr( H E ) Pr( E | H ) Pr( H )

Pr( H | E )

Pr( E )

Pr( E )

• Bayes’ updating rule (a methodological premise):

• Let P(H) represents our belief in hypothesis H before receiving evidence E.

• Let P*(H) represent our belief about H after receiving evidence E.

• Bayes Rule: P*(H) = Pr(H|E)

Pr( H ) Pr( H | E )

E

14

Deloitte Analytics Institute

© 2011 Deloitte LLP

Learning from data

Suppose Persi tosses a coin 12 times and gets 3 heads.

What is the probability of heads on the 13th toss?

15

Deloitte Analytics Institute

© 2011 Deloitte LLP

Learning from data

Suppose Persi tosses a coin 12 times and gets 3 heads.

What is the probability of heads on the 13th toss?

Frequentist analysis

𝑋𝑖 ~𝑖𝑖𝑑 𝐵𝑒𝑟𝑛 𝜃 𝐿 𝜃|𝐻 = 3, 𝑛 = 12 =

16

Deloitte Analytics Institute

𝜃3 1 − 𝜃

9

𝜃𝑀𝐿𝐸 = 14

© 2011 Deloitte LLP

Learning from data

Suppose Persi tosses a coin 12 times and gets 3 heads.

What is the probability of heads on the 13th toss?

Frequentist analysis

𝑋𝑖 ~𝑖𝑖𝑑 𝐵𝑒𝑟𝑛 𝜃 𝐿 𝜃|𝐻 = 3, 𝑛 = 12 =

𝜃3 1 − 𝜃

9

𝜃𝑀𝐿𝐸 = 14

Thoughts

• “Parameter risk”: 12 flips is not a lot of data (“credibility concerns”)

• We’ve flipped other coins before… isn’t that knowledge relevant?

• It would be nice to somehow “temper” the estimate of ¼ or “credibility weight”

it with some other source of information

• It would be nice not to just give a point estimate and a confidence interval,

but say things like: 𝑃𝑟 𝐿 < 𝜃 < 𝑈 = 𝑝

17

Deloitte Analytics Institute

© 2011 Deloitte LLP

Learning from data

Suppose Persi tosses a coin 12 times and gets 3 heads.

What is the probability of heads on the 13th toss?

Bayesian analysis

𝜃~𝐵𝑒𝑡𝑎 𝛼, 𝛽 𝜃~𝐵𝑒𝑡𝑎 𝛼 + 3, 𝛽 + 9

18

Deloitte Analytics Institute

© 2011 Deloitte LLP

Learning from data

Suppose Persi tosses a coin 12 times and gets 3 heads.

What is the probability of heads on the 13th toss?

Bayesian analysis

𝜃~𝐵𝑒𝑡𝑎 𝛼, 𝛽 𝜃~𝐵𝑒𝑡𝑎 𝛼 + 3, 𝛽 + 9

Thoughts

• “Parameter risk”: quantified by the posterior distribution

• Prior knowledge: encoded in the choice of {𝛼, 𝛽}

• Other data: maybe Persi has flipped other coins on other days… we could

throw all of this (together with our current data) into a hierarchical model

• Mean what we say and say what we mean: 𝑃𝑟 𝐿 < 𝜃 < 𝑈 = 𝑝 is a

“credibility interval”… it’s what most people think confidence intervals say…

(but don’t!)

19

Deloitte Analytics Institute

© 2011 Deloitte LLP

Prior distributions: a feature, not a bug

“Your ‘subjective’ probability is not something fetched out of the

sky on a whim; it is what your actual judgment should be, in view

of your information to date and other people’s information.”

-- Richard Jeffrey, Princeton University

20

Deloitte Analytics Institute

© 2011 Deloitte LLP

Prior distributions: a feature, not a bug

“Your ‘subjective’ probability is not something fetched out of the

sky on a whim; it is what your actual judgment should be, in view

of your information to date and other people’s information.”

-- Richard Jeffrey, Princeton University

• “Subjective” probability is really “judgmental” probability

• The choice of likelihood function is also “subjective” In this sense

• ODP (or other) distributional form

• Inclusion of covariates

• Trends

• Tail factor extrapolations

• ….

21

Deloitte Analytics Institute

© 2011 Deloitte LLP

Bayesian Computation

An intractable problem

Before 1990: this sort of thing was often viewed as a parlor trick

because of the need to analytically solve high-dimensional integrals:

f (Y | X ) f (Y | ) f ( | X )d

f ( X | ) ( )

d

f (Y | )

f ( X | ) ( )d

f ( | X )

23

Deloitte Analytics Institute

f ( X | ) ( )

f ( X | ) ( )d

© 2011 Deloitte LLP

Why Everyone Wasn’t a Bayesian

Before 1990: this sort of thing was often viewed as a parlor trick

because of the need to analytically solve high-dimensional integrals:

f (Y | X ) f (Y | ) f ( | X )d

24

Deloitte Analytics Institute

f ( X | ) ( )

d

f (Y | )

f ( X | ) ( )d

© 2011 Deloitte LLP

MCMC makes it practical

After 1990: The introduction of Markov Chain Monte Carlo

[MCMC] simulation to Bayesian practice introduces a

“new world order”:

Now we can simulate Bayesian posteriors.

25

Deloitte Analytics Institute

© 2011 Deloitte LLP

Chains we can believe in

We set up random walks through parameter space that… in the limit… pass

through each region in the probability space in proportion to the posterior

probability density of that region.

• How the Metropolis-Hastings sampler generates a Markov chain {1, 2, 3,… }:

1.

Time t=1: select a random initial position 1 in parameter space.

2.

Select a proposal distribution p() that we will use to select proposed random steps away from our

current position in parameter space.

3.

Starting at time t=2: repeat the following until you get convergence:

a)

b)

c)

At step t, generate a proposed *~p()

Also generate u ~ unif(0,1)

If R > u then t= *. Else, t= t-1.

f ( * | X ) p ( t 1 | * )

R

f ( t 1 | X ) p ( * | t 1 )

Step (3c) implies that at step t, we accept the proposed step * with

probability min(1,R).

26

Deloitte Analytics Institute

© 2011 Deloitte LLP

Let’s go to the Metropolis

• So now we have something we can easily program into a computer.

• At each step, give yourself a coin with probability of heads min(1,R) and flip it.

f ( X | * ) ( * ) p ( t 1 | * )

R

f ( X | t 1 ) ( t 1 ) p ( * | t 1 )

• If the coin lands heads move from t-1 to *

• Otherwise, stay put.

• The result is a Markov chain (step t depends only on step t-1… not on prior

steps). And it converges on the posterior distribution.

27

Deloitte Analytics Institute

© 2011 Deloitte LLP

Random walks with 4 different starting points

• We estimate the lognormal

density using 4 separate sets

of starting values.

10

8

2

0

5

10

15

0

mu

sigma

6

4

sigma

6

sigma

6

4

0

5

10

15

10

15

mu

10

ln( x)

8

, z

2

5

2

3

4

5

2

5

2

4

6

2

24

3

4

2

8

x 2

exp z

0

1

sigma

f ( x | , )

5

10

• Data: 50 random draws from

lognormal(9,2).

sigma

8

2

34

4

10

First 5 Metropolis-Hastings Steps

0

0

3

2

0

28

Deloitte Analytics Institute

5

10

mu

15

mu

0

5

mu

© 2011 Deloitte LLP

Random walks with 4 different starting points

• After 10 iterations, the lower

right chain is already in the

right neighborhood.

10

8

4

6

8

7

5

6 9

10

0

0

0

5

10

15

0

5

10

15

10

6

2

3

5

7 8

6

2

2

7

6

5

4

10

9

0

0

3

2

0

Deloitte Analytics Institute

15

mu

4

sigma

6

4

10

9

8

4

29

10

8

10

mu

8

sigma

sigma

24

3

2

4

10

sigma

10

8

7 85

6

9

6

2

34

2

sigma

First 10 Metropolis-Hastings Steps

5

10

mu

15

mu

0

5

mu

© 2011 Deloitte LLP

Random walks with 4 different starting points

10

8

6

4

8

7

5

6 9

1110

12

13

14

15

16

17

18

19

20

0

0

0

5

10

15

0

5

10

10

mu

6

2

3

4

sigma

6

4

4

5

7 8

6

20

2

7

6

5

13

16

18

17

12

11

10

919

8

15

14

2

4

12

11

10

18

17

16

15

14

13

920

19

0

0

3

2

0

30

Deloitte Analytics Institute

15

8

10

mu

8

sigma

sigma

24

3

2

4

10

11

12

13

14

16

15

17

18

19

20

sigma

10

7 85

6

9

6

2

34

8

First 20 Metropolis-Hastings Steps

2

sigma

• After 20 iterations, only the 3rd

chain is still in the wrong

neighborhood.

5

10

mu

15

mu

0

5

10

mu

15

© 2011 Deloitte LLP

Random walks with 4 different starting points

10

10

8

6

0

5

10

15

10

mu

6

4

2

3

4

5

7 8

6

49

50

25

24

12

11

10

18

17

16

15

14

13

9

23

22

148

21

20

9

39

42

41

40

38

37

36

31

30

29

35

34

33

32

47

46

45

44

43

28

27

26

0

0

2

2324

25

2930

31

32

2826

27

22

34

33

20

21 42

41

40

39

38

37

36

35

47

46

45

44

43

49

48

50

2

7

6

5

13

16

18

17

12

11

10

919

8

15

14

sigma

8

10

6

4

sigma

25

2324

2930

32

2831

27

26

3433

22

20

3635

21

49

50

42

41

40

39

3843

37

47

46

45

44

48

4

15

mu

3

2

0

Deloitte Analytics Institute

8

7

5

6 9

1110

12

13

14

15

16

17

18

19

0

0

5

8

sigma

0

4

31

24

3

2

4

10

11

12

13

14

16

15

1743

44

49

50

31

30

18

129

20

932

28

27

26

25

24

47

46

45

48

23

22

21

42

41

40

39

3833

37

36

35

34

sigma

10

7 85

6

9

6

2

34

8

First 50 Metropolis-Hastings Steps

2

sigma

• After 50 iterations, all 4 chains

have arrived in the right

neighborhood.

5

10

mu

15

mu

0

5

10

mu

15

© 2011 Deloitte LLP

Random walks with 4 different starting points

• By 500 chains, it appears

that the burn-in has long

since been accomplished.

5

10

10

8

6

25

2324

2930

32

2831

27

26

3433

22

20

36

35

315

314

313

312

21 393

394

388

392

391

390

389

310

309

308

307

311

301

300

49

52

51

123

122

180

88

87

86

85

84

451

450

449

442

60

141

140

139

138

137

231

230

229

228

227

364

59

441

440

472

302

462

461

460

459

458

457

456

473

474

463

439

120

119

395

396

401

400

399

407

406

405

404

62

420

419

418

417

416

415

398

397

409

408

125

248

247

421

70

69

403

68

67

66

65

64

63

4

410

02

267

266

265

479

478

477

218

269

268

136

476

475

270

467

466

465

124

217

183

191

190

112

111

7980

78

185

184

447

117

116

446

445

444

443

293

232

495

332

83

82

81

115

110

249

306

305

75

74

189

188

187

186

448

114

494

109

108

118

113

750

77

6

412

95

147

303

151

150

143

142

469

468

304

411

146

145

144

452

455

454

453

149

94

1

48

225

224

223

358

357

356

257

256

258

363

362

361

360

359

365

204

203

202

201

200

107

242

237

236

235

106

105

134

133

243

216

215

214

213

212

211

2

241

240

239

238

73

209

208

207

206

72

71

210

05

167

166

165

263

262

261

260

259

42

41

40

39

38

37

245

430

429

428

427

244

246

437

436

435

434

433

432

431

47

46

45

44

43

282

281

48

438

264

102

101

100

178

177

176

175

174

99

98

97

96

104

103

162

161

160

179

355

354

413

255

254

253

252

251

173

414

163

299

298

297

296

295

345

294

371

370

377

376

380

379

367

366

369

368

375

374

373

372

498

497

496

3

352

351

350

349

348

347

500

499

378

353

46

326

132

471

156

155

154

153

322

321

320

319

318

317

324

152

323

331

330

329

328

327

336

335

334

333

387

470

131

130

129

128

127

126

325

164

93

92

91

90

89

168

199

195

194

193

192

158

157

485

484

483

482

481

480

234

233

491

490

489

488

56

159

197

170

196

198

493

492

172

171

487

486

339

344

343

342

341

340

61

383

382

381

287

286

285

284

283

316

292

423

422

135

291

290

289

288

338

337

57

55

250

226

58

54

53

121

273

272

271

464

182

181

386

385

384

280

279

278

277

276

275

274

426

425169

424

222

221

220

219

4

15

0

5

10

15

6

8

10

mu

4

2

3

4

5

7 8

6

315

314

313

312

394

393

388

392

391

390

389

310

309

308

307

311

301

300

123

122

180

451

450

449

49

52

51

50

442

141

140

139

138

137

231

230

229

228

227

364

441

440

472

302

462

461

460

459

458

457

456

473

60

474

463

88

87

86

85

84

439

120

119

59

8

92

91

90

96

395

396

400

399

401

407

406

405

404

398

397

409

408

421

420

419

418

417

416

415

25

24

125

248

247

403

410

4

02

267

266

265

479

478

477

218

269

268

69

68

67

66

65

64

63

62

136

476

475

270

467

466

465

124

217

70

183

191

190

112

111

185

184

447

117

116

446

445

444

443

293

232

495

332

110

115

249

306

305

189

188

187

186

448

114

494

109

108

118

113

95

94

147

303

7980

78

151

150

143

142

469

468

83

82

81

304

412

411

146

145

144

452

75

74

455

454

453

149

1

93

7

77

48

225

224

223

358

357

356

257

256

258

363

362

361

360

359

365

204

203

202

201

200

107

242

237

236

235

106

105

134

133

243

216

215

214

213

212

211

2

241

240

239

238

209

208

207

206

210

05

263

262

261

260

259

427

12

11

10

245

430

429

428

18

17

16

15

14

13

244

246

437

436

435

434

433

432

431

9

23

22

282

281

1

21

20

73

72

71

9

438

167

166

165

264

102

101

100

178

177

176

175

42

41

40

39

99

98

97

96

38

37

36

104

103

162

161

160

179

355

354

31

30

29

255

254

253

252

251

413

35

34

33

32

47

46

45

44

43

163

48

414

299

298

297

296

295

345

174

294

371

370

377

376

380

379

367

366

369

368

375

374

373

372

498

497

496

3

352

351

350

349

348

347

500

499

173

378

353

46

326

132

471

156

155

154

153

322

321

320

319

318

317

324

152

323

331

330

329

328

327

336

335

334

333

131

130

129

128

387

470

127

126

325

164

168

199

195

194

193

192

158

157

485

484

483

482

481

480

234

233

491

490

489

488

159

197

170

196

198

493

492

172

171

487

486

169

339

344

343

342

341

340

423

422

383

382

381

287

286

285

284

283

316

292

135

291

290

289

288

338

337

250

226

121

273

272

271

61

464

28

27

26

182

181

57

56

58

426

386

385

384

280

279

278

277

276

275

274

55

54

53

425

424

222

221

220

219

0

0

2

2324

25

2930

31

32

2826

27

22

34

33

20 442

388

389

462

461

317

463

451

450

449

316

315

314

313

441

440

439

456

312

420

231

230

229

228

227

419

418

417

416

415

88

87

86

85

84

421

364

120

119

8

92

91

90

96

472

473

151

150

474

149

21 296

183

447

446

445

444

443

311

310

309

185

184

180

248

247

448

308

307

56

181

270

269

268

267

266

265

112

111

42

218

479

478

477

69

117

116

68

67

66

65

64

63

62

61

60

476

475

41

40

39

115

460

459

38

37

36

35

110

217

249

452

454

453

57

55

114

47

46

45

44

43

109

108

118

59

58

70

113

49

48

54

53

52

51

455

95

94

332

400

399

398

397

396

495

191

409

408

407

406

405

404

403

402

401

190

189

232

494

410

350

349

348

93

433

432

7980

78

437

436

435

434

83

82

81

75

74

351

438

750

77

261262

260

259

107

225

224

223

106

105

430

429

428

427

257

256

258

431

263

156

155

154

153

242

214

213

212

211

237

236

235

205

204

203

202

201

200

152

358

209

208

207

206

243

210

413

412

411

216

215

241

240

239

238

357

356

363

362

361

360

359

365

329

414

264

299

298

297

286

295

283

302

301

300

157

294

486

245

287

488

282

281

293

292

291

244

246

285

284

290

289

288

491

487

73

72

71

490

489

467

102

101

100

147

99

98

97

96

104

103

143

142

141

140

139

138

255

254

253

137

252

251

322

321

320

319

318

324

355

354

146

145

144

323

466

465

464

1

325

48

395

346

345

377

376

375

374

373

372

371

370

380

379

367

366

369

423

422

368

394

393

347

352

378

353

167

166

165

469

468

303

471

470

331

330

336

387

498

497

496

136

135

134

133

335

334

333

306

500

499

305

304

123

122

234

485

484

483

482

481

480

197

273

196

195

194

193

192

199

198

162

161

160

188

187

186

233

174

173

426

179

178

177

176

175

458

457

272

271

493

492

182

121

163

339

338

337

344

343

274

342

341

340

425

424

250

226

164

158

383

382

381

159

170

169

168

171

280

279

278

275

386

385

384

172

132

131

130

129

128

127

126

125

277

276

392

391

390

124

327

326

328

222

221

220

219

2

7

6

5

13

16

18

17

12

11

10

919

8

15

14

sigma

4

6

8

10

mu

3

2

0

Deloitte Analytics Institute

8

7

5

6 9

1110

12

13

14

15

16

17

18

19

0

0

0

4

32

24

3

2

4

10

11

12

13

14

16

15

17

388

44

43

389

317

316

315

314

313

312

311

310

309

49

52

51

50

31

30

29

32

364

442

60

231

230

229

228

227

88

87

86

85

84

451

450

449

120

119

59

8265

92

91

90

96

18

441

440

439

151

150

332

270

269

268

267

266

149

183

472

69

1

20

68

67

66

65

64

63

62

185

184

473

180

474

248

247

462

461

460

459

458

457

456

308

307

9

181

70

463

112

111

218

117

116

400

399

398

397

396

479

478

477

409

408

407

406

405

404

403

402

401

420

419

418

417

416

415

115

476

475

110

217

249

114

421

109

108

118

410

113

467

95

94

191

190

189

232

28

27

26

25

24

466

465

93

7980

78

83

82

81

412

411

448

447

446

445

444

443

75

74

363

362

361

365

748

77

261262

260

259

107

469

468

225

224

223

237

236

235

106

105

354

257

256

452

238

258

455

454

453

263

345

156

155

154

153

242

214

213

212

211

205

204

203

202

201

200

152

209

208

207

206

243

210

216

215

241

240

239

3

347

73

352

351

350

349

348

72

71

353

46

264

299

298

297

296

286

295

102

101

100

326

147

157

99

98

97

96

283

294

302

301

300

336

437

486

104

103

245

322

321

320

319

318

143

142

141

140

139

138

287

324

491

490

489

488

495

244

246

282

281

293

292

255

254

253

285

284

291

290

289

288

323

433

432

137

252

251

331

330

329

328

327

335

334

333

498

497

496

146

145

144

325

436

435

434

494

493

492

500

499

47

46

45

487

1

438

48

367

374

373

372

371

370

369

395

380

379

378

377

376

368

366

431

430

429

428

427

375

394

393

344

343

342

339

338

337

341

340

387

23

22

413

21

414

167

166

165

306

471

470

305

304

303

136

135

134

133

123

122

234

197

273

485

484

483

482

481

480

196

195

194

193

192

199

198

383

382

381

162

161

160

188

187

186

233

174

173

179

178

177

176

175

272

271

182

121

163

274

61

358

357

356

423

422

250

226

57

56

360

359

58

392

391

164

390

170

169

168

158

171

386

385

384

172

159

55

54

53

280

279

278

277

276

275

355

426

132

131

130

129

128

127

126

125

464

42

41

40

39

38

37

36

425

424

124

35

34

33

222

221

220

219

sigma

10

8

7 85

6

9

6

2

34

2

sigma

sigma

The time the chain

spends in a neighborhood

approximates the

posterior probability that

(,) lies in this

neighborhood.

sigma

• The chain continues to

wander.

First 500 Metropolis-Hastings Steps

5

10

mu

15

mu

0

5

10

mu

15

© 2011 Deloitte LLP

In 3D

Recall the true lognormal

parameters are:

=9 and =2

33

Deloitte Analytics Institute

© 2011 Deloitte LLP

Metropolis-Hastings results

Metropolis-Hastings Simulation of Lognormal(9,2)

8.0

9.0

mh$mu

0.5

0.0

10.0

1.5

mu

1.0

• The MH simulation is gives

consistent results:

8.0

8.5

9.0

9.5

10.0

0

2000

coda$mu

2.0

10

sigma

Deloitte Analytics Institute

8

6

2

4

mh$sigma

1.0

0.5

0.0

1.5

34

10000

Index

1.5

• Only the final 5000 of the 10000

MH iterations were used to

estimate ,

6000

2.0

2.5

coda$sigma

3.0

0

2000

6000

Index

10000

© 2011 Deloitte LLP

Metropolis-Hastings results

Metropolis-Hastings Simulation of Lognormal(9,2)

8.0

9.0

mh$mu

0.5

0.0

10.0

1.5

mu

1.0

Note the very rapid

convergence despite

unrealistic initial values.

8.0

8.5

9.0

9.5

10.0

0

2000

coda$mu

6000

10000

Index

0.0

1.5

35

Deloitte Analytics Institute

6

4

2

0.5

1.0

mh$sigma

8

1.5

2.0

10

sigma

2.0

2.5

coda$sigma

3.0

0

2000

6000

Index

10000

© 2011 Deloitte LLP

An easier way to get the same result

Call JAGS from within R

Density of mu

0.0

8.5

0.4

9.0

0.8

9.5

1.2

10.0

Trace of mu

8000

10000

8.0

8.5

9.0

9.5

10.0

Iterations

N = 500 Bandwidth = 0.06648

Trace of tau

Density of tau

0

0.10

2

0.20

4

0.30

6

0.40

8

6000

6000

36

Deloitte Analytics Institute

8000

Iterations

10000

0.1

0.2

0.3

0.4

N = 500 Bandwidth = 0.01229

© 2011 Deloitte LLP

Bayesian Loss Reserving

Methodology: sophisticated simplicity

“It is fruitful to start simply and complicate if necessary. That

is, it is recommended that an initial, sophisticatedly simple model be

formulated and tested in terms of explaining past data and in

forecasting or predicting new data. If the model is successful… it can

be put into use. If not, [it] can be modified or elaborated to

improve performance…”

-- Arnold Zellner, The University of Chicago

38

Deloitte Analytics Institute

© 2011 Deloitte LLP

Methodology: sophisticated simplicity

“It is fruitful to start simply and complicate if necessary. That

is, it is recommended that an initial, sophisticatedly simple model be

formulated and tested in terms of explaining past data and in

forecasting or predicting new data. If the model is successful… it can

be put into use. If not, [it] can be modified or elaborated to

improve performance…”

-- Arnold Zellner, The University of Chicago

This is precisely what Bayesian Data Analysis enables us to do!

39

Deloitte Analytics Institute

© 2011 Deloitte LLP

Methodology: sophisticated simplicity

“It is fruitful to start simply and complicate if necessary. That

is, it is recommended that an initial, sophisticatedly simple model be

formulated and tested in terms of explaining past data and in

forecasting or predicting new data. If the model is successful… it can

be put into use. If not, [it] can be modified or elaborated to

improve performance…”

-- Arnold Zellner, The University of Chicago

Start with a simple model and then add structure to account for:

• Other distributional forms (what’s so sacred about GLM or exponential family??)

• Negative incremental incurred losses

• Nonlinear structure (e.g. growth curves)

• Hierarchical structure (e.g. fitting multiple lines, companies, regions)

• Prior knowledge

• Other loss triangles (“complement of credibility”)

• Calendar/accident year trends

• Autocorrelation

• …

40

Deloitte Analytics Institute

© 2011 Deloitte LLP

Background: hierarchical modeling from A to B

• Hierarchical modeling is used when one’s data is grouped in some important

way.

• Claim experience by state or territory

• Workers Comp claim experience by class code

• Claim severity by injury type

• Churn rate by agency

• Multiple years of loss experience by policyholder.

• Multiple observations of a cohort of claims over time

• Often grouped data is modeled either by:

• Building separate models by group

• Pooling the data and introducing dummy variables to reflect the groups

• Hierarchical modeling offers a “middle way”.

• Parameters reflecting group membership enter one’s model through appropriately specified

probability sub-models.

41

Deloitte Analytics Institute

© 2011 Deloitte LLP

Common hierarchical models

Yi X i i

• Classical linear model

• Equivalently:

Yi ~ N(+Xi, 2)

• Same , for each data point

• Random intercept model

• Where:

Yi ~ N(j[i]+Xi, 2)

• And:

j ~ N(, 2)

Yi j[i ] X i i

• Same for each data point; but varies by group j

• Random intercept and slope model

• Both and vary by group

Yi ~ N j[i ] j[i ] X i ,

42

Deloitte Analytics Institute

2

Yi j[i ] j[i ] X i i

j

where ~ N ,

j

2

,

2

© 2011 Deloitte LLP

Simple example: policies in force by region

• Simple example: Change in

PIF by region from 2007-10

PIF Growth by Region

region1

• 32 data points

region2

region3

region4

2600

• 4 years

• But we could as easily have

80 or 800 regions

• Our model would not

change

pif

pif

pif

2400

pif

• 8 regions

2200

2000

region5

region6

region7

region8

year

year

year

year

2600

pif

pif

pif

2400

pif

• We view the dataset as a

bundle of very short time

series

2200

2000

2007

43

Deloitte Analytics Institute

2008 2009

year

2010

2007

year

2008 2009

year

2010

year

© 2011

Deloitte LLP

Classical linear model

Yi ~ N ( X i , 2 )

• Option 1: the classical

linear model

PIF Growth by Region

region1

pif

pif

• Just throw all of the data into

one pot and regress

region4

2400

pif

• Don’t reflect region in the model

design

region3

2600

pif

• Complete Pooling

region2

2200

• Same and for each

region.

2000

region5

region6

region7

region8

year

year

year

year

2600

• This obviously doesn’t cut it.

pif

pif

pif

2400

pif

• But filling 8 separate regression

models or throwing in regionspecific dummy variables isn’t

an attractive option either.

2200

• Danger of over-fitting

• i.e. “credibility issues”

2000

2007

44

Deloitte Analytics Institute

2008 2009

year

2010

2007

year

2008 2009

year

2010

year

© 2011

Deloitte LLP

Randomly varying intercepts

Yi ~ N ( j[i ] X i , 2 )

• Option 2: random intercept

model

PIF Growth by Region

2400

2200

2000

region5

region6

region7

region8

year

year

year

year

2600

pif

pif

pif

2400

pif

• A major improvement

region4

pif

• This model has 9

parameters:

{1, 2, …, 8, }

region3

pif

2600

pif

• Yi = j[i] + Xi + i

region2

pif

region1

• And it contains 4

hyperparameters:

{, , , }

j ~ N ( , 2 )

2200

2000

2007

45

Deloitte Analytics Institute

2008 2009

year

2010

2007

year

2008 2009

year

2010

year

© 2011

Deloitte LLP

Randomly varying intercepts and slopes

Yi ~ N j[i ] j[i ] X i ,

• Option 3: the random slope

and intercept model

j

where ~ N ,

j

2

,

2

PIF Growth by Region

2400

region4

pif

• This model has 16

parameters:

{1, 2, …, 8,

1, 2,…, 8}

region3

pif

2600

pif

• Yi = j[i] + j[i] Xi + i

region2

pif

region1

• (note that 8 separate models

also contain 16 parameters)

2

2200

2000

region5

region6

region7

region8

year

year

year

year

2600

pif

pif

pif

2400

pif

• And it contains 6

hyperparameters:

{, , , , , }

2200

It’d be the same number of

hyperparameters if we had 80

or 800 regions

46

Deloitte Analytics Institute

2000

2007

2008 2009

year

2010

2007

year

2008 2009

year

2010

year

© 2011

Deloitte LLP

A compromise between complete pooling and no pooling

PIF

PIF t

Complete Pooling

k

kt k

k 1, 2,.., 8

No Pooling

• Ignore group

structure altogether

• Estimate a separate

model for each group

Compromise

Hierarchical Model

• Estimates parameters

using a compromise

between complete

pooling and no pooling.

Yi ~ N j[i ] j[i ] X i ,

47

Deloitte Analytics Institute

2

j

where ~ N ,

j

2

,

2

© 2011 Deloitte LLP

A credible approach

• For illustration, recall the random intercept model:

Yi ~ N ( j[i ] X i , 2 )

j ~ N ( , 2 )

• This model can contain a large number of parameters {1,…,J,}.

• Regardless of J, it contains 4 hyperparameters {, , , }.

• Here is how the hyperparameters relate to the parameters:

ˆ j Z j ( y j x j ) (1 Z j ) ˆ

where Z j

nj

2

nj

2

Bühlmann credibility is a special case of hierarchical models.

48

Deloitte Analytics Institute

© 2011 Deloitte LLP

Shrinkage Effect of Hierarchical Models

• Illustration: estimating workers

compensation claim frequency

by industry class.

no pool

• Poisson hierarchical model

(aka “credibility model”)

Modeled Claim Frequency by Class

Poisson Models: No Pooling and Simple Credibility

51 19

126

24 68

70

50

4786

53

66 56 115

107

114

121

35

130

42

133

93

58 64

124

88

30

1

63

26

hierach

0.00

grand mean

0.05

0.10

Claim Frequency

49

Deloitte Analytics Institute

© 2011 Deloitte LLP

Validating the fully Bayesian hierarchical

model

Year 7 Validation

Year-7 claims (red dot) and 90% posterior credible interval

Roughly 90% of

the claims from

the validation time

period fall within

the 90% posterior

credible interval.

83

46

82

25

45

105

92

98

38

43

122

41

44

120

99

20

91

6

84

112

119

80

89

29

76

97

5

101

39

74

0

50

Deloitte Analytics Institute

50

100

150

200

250

© 2011 Deloitte LLP

Case Study:

A Fully Bayesian Model

Collaboration with Wayne Zhang and Vanja Dukic

Data

A garden-variety Workers Compensation Schedule P loss triangle:

AY

1988

1989

1990

1991

1992

1993

1994

1995

1996

1997

premium

2,609

2,694

2,594

2,609

2,077

1,703

1,438

1,093

1,012

976

chain link

chain ldf

growth curve

12

404

387

421

338

257

193

142

160

131

122

Cumulative

24

36

986 1,342

964 1,336

1,037 1,401

753 1,029

569

754

423

589

361

463

312

408

352

Losses in 1000's

48

60

1,582 1,736

1,580 1,726

1,604 1,729

1,195 1,326

892

958

661

713

533

72

1,833

1,823

1,821

1,395

1,007

84

1,907

1,903

1,878

1,446

96

1,967

1,949

1,919

108

2,006

1,987

120

2,036

CL Ult

2,036

2,017

1,986

1,535

1,110

828

675

601

702

576

2.365 1.354 1.164 1.090 1.054 1.038 1.026 1.020 1.015

1.000

4.720 1.996 1.473 1.266 1.162 1.102 1.062 1.035 1.015

1.000

21.2% 50.1% 67.9% 79.0% 86.1% 90.7% 94.2% 96.6% 98.5% 100.0%

12,067

CL LR

0.78

0.75

0.77

0.59

0.53

0.49

0.47

0.55

0.69

0.59

CL res

0

29

67

89

103

115

142

193

350

454

1,543

• Let’s model this as a longitudinal dataset.

• Grouping dimension: Accident Year (AY)

We can build a parsimonious non-linear model that uses random effects to

allow the model parameters to vary by accident year.

52

Deloitte Analytics Institute

© 2011 Deloitte LLP

Growth curves – at the heart of the model

• We want our model to

reflect the non-linear nature

of loss development.

Weibull and Loglogistic Growth Curves

Heursitic: Fit Curves to Chain Ladder Development Pattern

• GLM shows up a lot in the

stochastic loss reserving

literature…

• Growth curves (Clark 2003)

• = ultimate loss ratio

• = scale

• = shape (“warp”)

• Heuristic idea

Cumulative Percent of Ultimate

• … but are GLMs natural models

for loss triangles?

1.0

x

G( x | , )

x

0.8

0.6

G( x | , ) 1 exp ( x / )

0.4

0.2

• We judgmentally select a

growth curve form

• Let vary by year (hierarchical)

• Add priors to the

hyperparameters (Bayesian)

53

Deloitte Analytics Institute

Loglogistic

Weibull

0.0

12

24

36

48

60

72

84

96

108

120

Development Age

132

144

156

168

180

© 2011 Deloitte LLP

An exploratory non-Bayesian hierarchical model

t

i (t j )

yi (t j ) i * pi *

t

2

i ~ N ,

i (t j ) i (t j 1 ) i (t j )

It is easy to fit non-Bayesian hierarchical

models as a data exploration step.

Log-Loglistic Hierarchical Model (non-Bayesian)

2500

1988

1989

1990

1991

1992

2250

2000

1750

y

y

1250

y

y

y

1500

1000

750

Cumulative Loss

500

250

Premium

260.9

Ult LR ==0.82

2500

Premium

269.4

Ult LR ==0.79

1993

1994

1995

1996

1997

t

t

t

t

t

2250

2000

1750

y

y

y

y

1250

y

1500

1000

750

500

250

Premium

170.3

Ult LR ==0.51

12

54

36

60

84

108

Deloitte tAnalytics Institute

12

36

60

84

t

108

12

36

60

84

t

Development Time

108

12

36

Premium

Ult LR = 143.8

0.5

60

84

t

108

12

36

60

84

108

© 2011

Deloitte LLP

t

Adding Bayesian structure

• Our hierarchical model is “half-way Bayesian”

• On the one hand, we place probability sub-models on certain parameters

• But on the other hand, various (hyper)parameters are estimated directly from the data.

• To make this fully Bayesian, we need to put probability distributions on all

quantities that are uncertain.

• We then employ Bayesian updating: the model (“likelihood function”) together with

the prior results in a posterior probability distribution over all uncertain quantities.

• Including ultimate loss ratio parameters and hyperparameters!

We are directly modeling the ultimate quantity of interest.

• This is not as hard as it sounds:

• We do not explicitly calculate the high-dimensional posterior probability distribution.

• We do use Markov Chain Monte Carlo [MCMC] simulation to sample from the posterior.

• Technology: JAGS (“Just Another Gibbs Sampler”), called from within R.

55

Deloitte Analytics Institute

© 2011 Deloitte LLP

Example

(with Wayne Zhang and Vanja Dukic)

• Posterior credible intervals of incremental losses – by accident year

• Based on non-linear hierarchical growth curve model

56

Deloitte Analytics Institute

© 2011 Deloitte LLP

Example

(with Wayne Zhang and Vanja Dukic)

• Posterior credible intervals of incremental losses – by accident year

• Based on non-linear hierarchical growth curve model

57

Deloitte Analytics Institute

© 2011 Deloitte LLP

Posterior distribution of aggregate outstanding losses

• Non-informative priors were used

• Different priors tested as a sensitivity

analysis

Outstanding Loss Estimates at Different Evaluation Points

Estimated Ultimate Losses Minus Losses to Date

At 120 Months

chain ladder estimate

• A full posterior distribution falls

out of the analysis

• No need for boostrapping, ad hoc

simulations, settling for a point

estimate with a confidence interval

500

1000

1500

2000

2500

3000

3500

4000

3000

3500

4000

3000

3500

4000

At 180 Months

• Use of non-linear (growth curve)

model enables us to project

beyond the range of the data

• Choice of growth curves affects the

estimates more than the choice of

priors!

500

1000

1500

2000

2500

At Ultimate

• This choice “does the work of” a

choice of tail factors

58

Deloitte Analytics Institute

500

1000

1500

2000

2500

© 2011 Deloitte LLP

Why Bayes

• “A coherent integration of evidence from different sources”

• Background information

• Expert knowledge / judgment (“subjectivity” is a feature, not a bug)

• Other datasets (e.g. multiple triangles)

• Shrinkage, “borrowing strength”, hierarchical model structure – all coin of the realm

• Rich output: full probability distribution estimates of all quantities of interest

• Ultimate loss ratios by accident year

• Outstanding loss amounts

• Missing values of any cell in a loss triangle

• Model the process that generates the data

• As opposed to modeling the data with “procedural” methods

• We can fit models as complex (or simple) as the situation demands

• Nonlinear growth patterns, trends, autoregressive, hierarchical, structure, …

• Conceptual clarity

• Single-case probabilities make sense in the Bayesian framework

• Communication of risk: “mean what you say and say what you mean”

59

Deloitte Analytics Institute

© 2011 Deloitte LLP

A Parting Thought

Parting thought: our field’s Bayesian heritage

“Practically all methods of statistical estimation… are based on… the

assumption that any and all collateral information or a priori knowledge is

worthless. It appears to be only in the actuarial field that there has been an

organized revolt against discarding all prior knowledge when an estimate is to

be made using newly acquired data.”

-- Arthur Bailey (1950)

61

Deloitte Analytics Institute

© 2011 Deloitte LLP

Parting thought: our field’s Bayesian heritage

“Practically all methods of statistical estimation… are based on… the

assumption that any and all collateral information or a priori knowledge is

worthless. It appears to be only in the actuarial field that there has been an

organized revolt against discarding all prior knowledge when an estimate is to

be made using newly acquired data.”

-- Arthur Bailey (1950)

... And today, in the age of MCMC, cheap

computing, and open-source software...

62

Deloitte Analytics Institute

© 2011 Deloitte LLP

Parting thought: our field’s Bayesian heritage

“Practically all methods of statistical estimation… are based on… the

assumption that any and all collateral information or a priori knowledge is

worthless. It appears to be only in the actuarial field that there has been an

organized revolt against discarding all prior knowledge when an estimate is to

be made using newly acquired data.”

-- Arthur Bailey (1950)

... And today, in the age of MCMC, cheap

computing, and open-source software...

“Scientific disciplines from astronomy to zoology are moving to Bayesian data

analysis. We should be leaders of the move, not followers.”

-- John Kruschke, Indiana University Psychology (2010)

63

Deloitte Analytics Institute

© 2011 Deloitte LLP

Appendix:

Some MCMC Intuition

Metropolis-Hastings Intuition

• Let’s take a step back and remember why we’ve done all of this.

• In ordinary Monte Carlo integration, we take a large number of independent

draws from the probability distribution of interest and let the sample average of

{g(i)} approximate the expected value E[g()].

1

N

N

g (

i 1

(i )

)

N

g ( ) ( )d Eg ( )

• The Strong Law of Large Numbers justifies this approximation.

• But: when estimating Bayesian posteriors, we are generally not able to take

independent draws from the distribution of interest.

• Results from the theory of stochastic processes tell us that suitably well-behaved

Markov Chains can also be used to perform Monte Carlo integration.

65

Deloitte Analytics Institute

© 2011 Deloitte LLP

Some Facts from Markov Chain Theory

How do we know this algorithm yields reasonable approximations?

• Suppose our Markov chain 1, 2, … with transition matrix P satisfies some

“reasonable conditions”:

•

Aperiodic, irreducible, positive recurrent (see next slide)

•

Chains generated by the M-H algorithm satisfy these conditions

• Fact #1 (convergence theorem): P has a unique stationary (“equilibrium”)

distribution, . (i.e. =P). Furthermore, the chain converges to .

•

Implication: We can start anywhere in the sample space so long as we through out a sufficiently

long “burn-in”.

• Fact #2 (Ergodic Theorem): suppose g() is some function of . Then:

1

N

66

N

g (

i 1

(i )

)

N

g ( ) ( )d Eg ( )

•

Implication: After a sufficient burn-in, perform Monte Carlo integration by averaging over a suitably

well-behaved Markov chain.

•

The values of the chain are not independent, as required by the SLLN.

•

But the Ergodic Theorem says we’re close enough to independence to get what we need.

© 2011 Deloitte LLP

Deloitte Analytics Institute

Conditions for Ergodicity

More on those “reasonable conditions” on Markov chains:

• Aperiodic: The chain does not regularly return to any value in the state

space in multiples of some k>1.

• Irreducible: It is possible to go from any state i to any other state j in some

finite number of steps.

• Positive recurrent: The chain will return to any particular state with

probability 1, and expected return time finite.

• Intuition:

•

The Ergodic Theorem tells us that (in the limit) the amount of time the chain spends in a particular

region of state space equals the probability assigned to that region.

•

This won’t be true if (for example) the chain gets trapped in a loop, or won’t visit certain parts of the

space in finite time.

• The practical problem: use the Markov chain to select a representative sample

from the distribution , expending a minimum amount of computer time.

67

Deloitte Analytics Institute

© 2011 Deloitte LLP