Women's Legacy Fund

advertisement

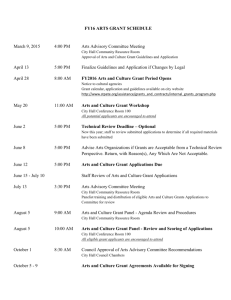

History of Community Foundations First one established in Cleveland in 1914 by banker Frederick Goff Devised as a way to keep charitable trusts in use for the community long after donors passed away Grew to about 300 by the early 1990’s, then expanded rapidly Currently have more than 700 nation-wide with assets totaling over $44 billion California has 69 established community foundations with total assets more than $5 billion SLOCCF Board 2011 Mission The San Luis Obispo County Community Foundation is a public trust established to assist donors in building an enduring source of charitable funds to meet the changing needs and interests of the community. Vision As residents of San Luis Obispo County, we are a thriving, engaged society that is responsible for ourselves and for one another, for our diverse communities, and for maintaining the beauty, productivity, and sustainability of our environment. Foundation Goals $4 million in Leadership Fund, $2 million in Community Needs Fund Effective grantmakers Promoting local philanthropy Our approach so far Thoughtful & carefully planned Early use of consultants Access state-wide and national resources Not competing with local nonprofits Marketing the Community Foundation Primarily one-on-one discussions with people of wealth or community movers & shakers Specifically, at the professional advising community: one-on-one meetings, presentations to firms, professional associations One newsletter per year Annual report Speaking to local service organizations and community groups Press releases Retained Verdin Marketing Ink in 2003 Board Structure Maximum of 15 members, self-perpetuating Representative of all major geographical parts of the County Terms are three years in length; can serve no more than 10 consecutive years then must be off the board for five years Officers are President, Vice President, Secretary and Treasurer Board structure cont. Elected at annual meeting in January, but President generally serves for two years and the V.P is the de-facto president elect No compensation, except for reimbursement for legitimate expenses Board meets first Wednesday of every month BOARD MEMBER’S LEGAL OBLIGATIONS: Duty of Care – exercising best judgment when making decisions (reasonable caution). Duty of care demands active participation and thoughtful attention (learning about programs, attending meetings, participating in discussions, making sure you obtain the necessary information to ask questions). LEGAL OBLIGATIONS Duty of Loyalty – putting aside personal and professional interests for the good of the organization. You are expected to focus exclusively on what’s best for the foundation. A conflict-of-interest policy, signed annually by each board member, is one way to ensure this duty of loyalty. LEGAL OBLIGATIONS Duty of Obedience – means ensuring that the foundation stays true to its mission and purpose – overseeing distribution of funds and monitoring compliance with all applicable laws and regulations. Minimum Board Responsibilities Attend meetings and events Serve on at least one committee Formally introduce the Foundation to a minimum of three people per year Make a meaningful contribution of whatever size to the Board of Directors Fund annually Staff Executive Director: (1.0 FTE) Overall management of foundation, primarily asset development and finance Director of Grants & Programs: (.875 FTE) Supervision of all grants, scholarships & program-related activities. Scholarship Program Associate: (.5 FTE) Oversees and promotes all scholarships; provides some donor services. Donor Services Associate: (.5 FTE) Coordinates donor services. Finance Manager: (.5 FTE) All business functions including disbursements, accounting, deposits and monthly reconciliations, as well as human resources Finance Assistant (.5) Office Manager: (1.0 FTE) Administrative support to staff, gift processing & acknowledgments Total FTE = 4.875 Committees Standing Committees Development: Design overall asset acquisition plan for foundation. Grants: Design and structure grantmaking program, recommend strategic initiatives. Finance & Investment: Develop investment policies and oversee investments. Supervise outside investment manager. Administration & Personnel: Personnel, governance issues. Also serves as nominating committee. Audit: Work with auditor, plan and review audit. Scholarship: Oversee Scholarship Funds. Visibility and Marketing: Develop marketing and communications plans and materials. Committees cont. Ad hoc Committees: Women’s Legacy Fund Work to develop and oversee the growth of this fund which is held at SLOCCF Growing Together Fund Advisory Committee Partnership of representatives from different groups to identify and support the needs of lesbian, gay, bisexual, and transgendered community Children’s Health Initiative Committee A board representative attends committee meetings of this countywide group ensuring health insurance coverage for all the children in the county TEACh Committee Supports the educational experience of students in the San Luis Coastal Unified School District. State & National Context All community foundations are locally governed and controlled Nationally, members of the Council on Foundations, which represents all 62,000 foundations – private, family, operating, community & corporate Annual meeting for 700 community foundations, usually in the fall. Board urged to attend. This year’s meeting will be September 19-21, in San Francisco State & National Context cont. We are active members in the League of California Community Foundations Meets twice per year, including Board Chair/CEO retreat Also conducts workshops, trainings and assistance Local Context Initiative of Foundation for Community Design Established in 1998, 11-member Board of Directors Opened doors in 1999, hired staff Secured operational grants from Irvine & Packard Foundations for FY 2000-2011 Accomplishments to date 100% Board contributions 1999-2010 $30+ million in assets, ~$27 million endowed Developed over 200 various funds Distributed over $16 million in grants since 2000 Created Real Estate Foundation of San Luis Obispo Licensed to offer Charitable Gift Annuities Growth of the Endowment $30,000,000 $25,000,000 $20,000,000 $15,000,000 $10,000,000 $5,000,000 $0 98 999 000 001 002 004 005 006 007 008 009 010 9 1 1 2 2 2 2 2 2 2 2 2 2 Number of Funds 250 211 189 200 162 150 128 New Funds Current Funds 102 100 73 38 50 8 20 07 20 05 20 03 20 01 19 99 0 Grantmaking 2000 -2010 Scholarships 6.1% Historical Recreation 0.4% 0.5% Arts Health 24.2% 17.1% Community Enhancement 12.1% Human Services 16.5% Faith-Based 2.3% Education 18.6% Environment 2.2% Total grants: $15,850,680 Strategies for Building the Endowment One-on-one meetings with donors – Board contacts Professional advisor meetings and workshops Public Relations – video, cable PSAs, press releases, newsletters, annual report Demonstrate foundation impact through grants provided, grantee receptions Promoting local philanthropy What challenges lie ahead Find new avenues to potential donors/fund holders Build unrestricted endowment to continue strengthening local nonprofits Fund foundation operations beginning in 2011 until sustainability What steps have we taken? Leadership Fund Bridge Fund Increasing the Community Needs Fund Grants & Programs Janice Fong Wolf, Director of Grants & Programs Lee Hollister, Committee Chair Three types of grantmaking: •Small responsive grants •Strategic Grant Initiatives •Donor-Advised Grants Strategic Framework Demonstrate to donors the Foundation’s past effectiveness with grants Demonstrate to donors existing needs in the community Tie grantmaking with development committee via shared members Target areas to fund with larger grants, but maintain the Foundation’s reputation for diversity of funding from Arts to the Zoo General Grants Program Proposals accepted once per year Five funding areas: Arts, Community Enhancement, Education, Health, Human Services Maximum grant amount $10,000 Organizational Strengthening/Capacity Building Priority Core Operating Strategic Grant Initiatives Focused grantmaking with deeper grantee engagement & larger grant amounts Raising a Reader Fund Pathways to Adulthood Initiative Growing Together Fund Women’s Legacy Fund Art Inspires! Donor-Advised Grantmaking Due Diligence Assist with NPO research Facilitate proposals from organizations Programs Isabel P. Ruiz Humanitarian Award Paul Wolff Accessibility Advocacy Award Scholarship programs Nonprofit Strengthening Data Collection/Dissemination: ACTION for Healthy Communities, GTI Community Scan, Focus Groups, SLO County Hunger Study, Obesity Task Force, Status of Women/Girls Convene NPO by service type, i.e. Food Distribution providers, Animal Welfare providers Nonprofit management workshops Initiated Executive Directors Roundtable Bi-weekly column in Tribune Business Section Financial Accounting & Investments Investments • Finance & Investment Committee, Bill Raver, Treasurer and Chair • UBS Golden Gate Institutional Consulting Accounting/Bookkeeping • Holly Corbett, Director of Finance • Michelle Romonek, Finance Assistant • Kim Ramos, Office Manager FIMS - Foundation Information Management System Bookkeeping at the Community Foundation Double entry; accrual basis; fiscal year = calendar year Audited annually by Caliber Funds and fund accounting Donor-created Funds 158 Endowed Funds – Original gifts are never used (“principal is never invaded”) – The earnings on the invested principal increases the fund and is used for granting, fees, etc. – Annually 4.5% of the average balance for the last three years is made available for grants (individual fund agreements may vary) 51 Pass-through Funds – All gifts are distributed within a year – Interest is income for SLOCCF Operating Fund Board Created Funds SLOCCF Operating Fund Pass-through Board Funds Endowed Board Funds Leadership Fund Community Needs Fund Board of Directors Fund Bridge Fund Operating Reserve Fund Restricted Gifts Fund Grants Fund Executive Director’s Discretionary Fund Sample Financial Statements Statement of Fund Activity – “Fund Statement” Statement of Financial Position – “Balance Sheet” Operating Fund Budget Comparison – “Income Statement with Budget” Statement of Fund Activity Statement of Financial Position Operating Fund Budget Comparison Investing Foundation Assets UBS Golden Gate Institutional Consulting - Kevin Sanchez & Brian Sharpes, investment consultants Overseen by Finance & Investment Committee Investment Policy calls for a balanced portfolio Emphasis on asset diversification ~ 60% equities, 40% fixed income Long-term investment horizon: goal 8-10% return per year