ECO 365 – Intermediate Microeconomics

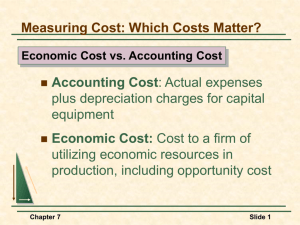

advertisement

Lecture Notes Cost Minimization Before looked at maximizing Profits (π) = TR – TC or π =pf(L,K) – wL – rK But now also look at cost minimization That is choose L and K to minimize costs = wL + rK subject to Y = f(L, K). From this problem derive a cost function C = C(w, r, Y). Minimum cost of producing output Y given input prices w and r. How do we get these minimum costs? Recall the definition of an IsoQuant Shows the relationship between two inputs, L and K, holding output (Y) constant. What would an isoquant look like? If use more L => what would happen to K to keep Y constant? Thus, isoquants are downward sloping and convex (why?) K Y=Y* L Isoquants show a given output, Y*, that the firm wants to produce. How to minimize costs of producing this output? Isocost curve = shows combinations of L and K keeping cost constant. Recall C = total costs = wL + rK or K = C/r – w/rL This is an isocost line. Intercept = C/r Slope = -w/r What does the line look like for C=100 r=10 and w=20? Isocost curve is given by K = C/r – w/rL K Everywhere on isocost curve total cost = 100 As Costs Increase Move to a higher Isocost Intercept = C/r = 10 Slope = -w/r = -20/10 = -2 Intercept = C/w = 5 L Problem is to choose L and K to produce a given output, Y* (on fixed isoquant), so that costs are minimized (on lowest isocost possible.) Where is the point of minimum cost on C1? Tangency point between isocost and isoquant. K C1 C2 K* Y=Y* L* L Tangency between isocost and isoquant occurs where slopes are equal or Slope of isoquant = technical rate of substitution = - MPL /MPK. Slope of isocost = -w/r Therefore cost minimization requires that: - MPL /MPK = -w/r or - MPL /w = MPK/r Does this look familiar at all? These are the conditions required for long-run profit maximization. Therefore, cost minimization and profit maximization occur simultaneously. Let L* and K* define optimal (cost minimizing) L and K L* = f(Y*, w, r) K* = f(Y*, w, r) These are the conditional or derived factor demand curves. Derived from what? How are profit maximization and cost minimization different? If maximizing profit => must also be minimizing costs. If minimizing costs are you necessarily maximizing profit? No. Why not? Revealed Cost Minimization Similar idea to revealed profit maximization Observe choices in two time periods, t and s, where firm choose L and K to minimize costs => must be true that: (1) wt Lt + rt Kt ≤ wt Ls + rt Ks - why? (2) ws Ls + rs Ks ≤ ws Lt + rs Kt - why? WACM = Weak Axiom of Cost Minimization To be minimizing costs the costs from actual choices must be ≤ the costs from other possible choices at that time. Follow the same steps to transform (1) and (2) to get: ΔwΔL + ΔrΔK ≤ 0 – implications? If Δr = 0 and Δw > 0 => ΔL ≤ 0 or derived D for labor must be downward sloping. Same is true of the derived D for Kapital. Returns to Scale and Cost Functions Define Average Costs = AC = (C(w, r, Y*))/Y* or: AC = C(Y*)/Y* - (assuming w and r are constant). AC and returns to scale Constant Returns to Scale AC is constant as Y increases Increasing Returns to Scale AC is decreasing as Y increases Decreasing Returns to Scale AC is increasing as Y increases Why? What does the AC and C look like with the three types of returns to scale? ↑ returns $ → returns ↓ returns AC Y $ C1 ↑ returns C2 → returns C3 ↓ returns Y Short-Run Costs L may vary but K is fixed . C = CS (Y, K) with K fixed. Or choose L to min C=wL +rK, again with K fixed. Simpler problem (also assumes w and r are fixed). Short run factor demand functions are given by: L* LS ( w, r , K , Y ) K* K Short-run Costs are given by: CSR (Y , K ) wLS (w, r, K ) r K note that long-run costs = C (Y ) CSR (Y , K * (Y )) What does this mean? Cost Curves First, examine the Short-Run Cost Curves CSR (y) = Cv(y) + F or TC = TVC +TFC So that ACSR (y) = CSR(y) / y = CV(y)/y + F/y Or ACSR(y) = AVC(y) + AFC(y) What do the curves look like? C C(y) CV(y) F y costs are increasing at an increasing rate. Why? Because of the fixed factor k (i.e. as L ↑ more and more => MPL must decline ) Law of diminishing MP What do cost curves like this imply about AC’s? B A AVC $ $ Why? Why? AFC y y C $ Why ? y Since AC=AFC+ AVC A & B imply C A is easy; B follows from assumption about MPL in the SR. Now suppose MPL ↑ at first as L increases due to specialization and decreases as L increases past some point => now what does the cost curve look like? $ AC AVC Why? y Marginal Costs MC(y) = ΔCSR (y)/ Δy = Δ Cv(y)/ Δ y + Δ F / Δy Total or variable cost curve or rate of change of costs Also note that MC=AVC for 1st unit of output MC(∆y) = (Cv(Δ y) + F – Cv(0) –F) / Δy = Cv(Δ y) / Δy = AVC(Δy) Since variable costs = 0 when y=0 Recall… (1) AVC may initially fall as y increases (not necessary) but must eventually rise due to fixed factors. (2) AC initially falls due to decreacng AFC but eventually rises de to increased AVC. (3)MC= AVC for 1st unit produced (4) MC= AVC at min AVC why? (5) MC=AC at min AC why? MC AC AVC MC Area under MC up to Y*= total variable costs of producing y* why? Y* Example C(y) = y3 + 4 Cv(y)= y3 Cf(y)= 4 AVC = y2 AC=y2 + 4/y MC=3y2 MC AC AVC TVC TC Long-Run Costs (1) No fixed factors: K can vary (2)Can think of costs associated with different plant sizes For any given LR output, y, there will be some optimal K or plant size (3)Once K is chosen in the LR, K becomes fixed in the SR Long Run AC is the envelope of SR AC curves Recall: LR Costs or C(y*) C(y*) =CSR(y*, K*(y*)) Why? If not at optimal K in short-run => C(y) < CSR(y, K(y)) – why? Now, what if not at optimal K in SR? i.e. y changes in the SR => C(y*) < CSR(y*, K*(y*) Why? …K is not chosen optimally Relationship between SR and LR AC must be… SRAC* SRAC2 SRAC1 LRAC y* y1 Y2 y This follows since C(y*) <CSR(y*, K*(y*)) =>ACs (y, K*) > AC(y) since AC (y) = C(y)/y And ACs (y, K*) = Cs(y, K*)/(y) LRAC is the lower envelope of all SRAC curves (only true for continuous plant sizes) NOTE: if only discrete levels of plant sixe => say only three: SRAC1 SRAC3 SRAC2 Long-Run Marginal Cost Discrete Plant Sizes SRAC 1 SRAC2 SRAC3 y LRAC = SRAC until move to new one. LRMC = SRMC until move to new one. =>LRMC =SRMC as long as LRAC=SRAC for 1,2,3, etc… Continuous Plant Sizes Same idea is true for LRMC here but continuous SRMC 1 SRAC $ LRMC LRAC 1 y* y