Section 1.02 Power Point

advertisement

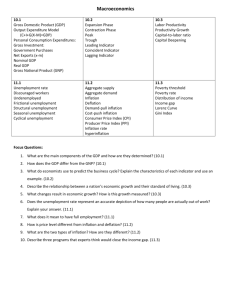

Essential Standard 1.00 Understand the role of business in the global economy. 1 Objective 1.02 Understand economic conditions 2 Topics • Measuring economic activities • Classifying economic conditions 3 Measuring Economic Activities 4 Measuring Economic Activities Gross Domestic Product (GDP) • GDP: a country’s total dollar value of all final goods and services produced in one year. – Most commonly used measure to determine a country’s overall economic growth Growth in GDP • Major categories included in GDP – Consumer spending: for food, clothing, housing, other consumer items – Business spending: for buildings, equipment, inventory – Government spending: for employee pay, and to purchase supplies and other goods and services – Exports & imports: 5 – Exports out of the country (minus) Imports into the country GDP per capita GDP per capita = output per person =_________GDP__________ Total Population of the Country 6 Measuring Economic Activities Labor Activities • Unemployment rate: includes the people of the labor force that are not working, but are willing to work, are looking for work, but can’t find a job. • Productivity means …The production output in relation to a unit of input (by a worker.) Gains in Productivity Result in Record Output – What can contribute to employees increasing their production? • Equipment, technology, training, management 7 Measuring Economic Activities Labor Activities – U.S. 12/10 rate=9.4% • represents over 14,500,000 people – North Carolina’s 12/10 rate=9.8% • North Carolina’s 07/10 rate=9.8% – U.S. lowest: North Dakota 3.8% • Lowest area unemployment: Lincoln, Nebraska 3.5% – U.S. highest: Nevada 14.5% • Highest area unemployment: El Centro, CA 28.3% – Raleigh/Cary rate=7.8% • 07/10=8.4% • Current highest NC is Rocky Mt.=12.6% 8 Measuring Economic Activities Consumer Spending Measurements of consumer spending: • Personal Income: includes the total wages and salaries plus investment income and government payments to individuals. • Retail Sales: sales of durable and non durable goods and services purchased by consumers (autos, building materials, furniture, gas, $ spent at 9 restaurants, etc) Measuring Economic Activities Investment (for the future) • The money used for capital projects (land, buildings, equipment, research) comes from three main sources: • Personal savings: – People and businesses deposit money in bank savings accounts. Banks then lend this money to businesses which use the borrowed money to buy equipment or products for their businesses. – Savers, in turn, earn interest on money used by companies and other individuals. – What happens if people don’t save?? 10 Measuring Economic Activities Investment (for the future) • The money used for capital projects (land, buildings, equipment, research) comes from three main sources: • The stock market: – Stock represents ownership in a company. If a company wants to expand, it can sell stock to raise money. – Higher earnings for businesses increases their value, which causes a demand for people wanting to buy the businesses stock. 11 Measuring Economic Activities Investment (for the future) • The money used for capital projects (land, buildings, equipment, research) comes from three main sources: • The bond market: – Bonds represent debt for a company. If a company wants to expand, it can sell bonds to raise money. • Bondholders purchase the bonds, and earn interest on the money they have loaned to businesses and the government. • Eventually, the company pays the bondholders back their money, with interest. 12 Borrowing Activities … By Governments: If governments want to spend more than they brings in through taxes and fees, they may have to borrow money. This overspending is known as a budget deficit. U.S. National Debt Companies may borrow money to start up or expand. Using borrowed funds efficiently can result in an increase in sales and profits. 13 Measuring Economic Activities GDP Per capita Consumer Spending 14 Classification of Economic Conditions 15 Situation PROSPERITY RECESSION DEPRESSION RECOVERY Employment trend Labor: People who want to work are working; unemployment low Wages: Good Unemployment increases as workers are laid off. Supply and demand of goods and services trend/GDP GDP: Increasing Consumer Demand: Increasing Demand decreases as people Demand for products and lose jobs; services is very weak; GDP GDP: growth slows for 2 or falls rapidly more quarters Demand increases; GDP begins to rise Possible actions of businesses Profits strong as is production Companies hiring & expanding (Macy’s may open more stores) Businesses decrease production as demand decre ases; profits suffer Businesses may strategize on ways to stimulate demand for goods & services Businesses begin rehiring and increasing production; companies may again begin recruiting efforts at colleges Prolonged period of high unemployment Business failures and closings increase; companies make changes (such as moving employees from full time to part time to decrease hours and reduce benefits) just to stay open PROSPERITY DEPRESSION Unemployment decreases companies begin to rehire workers Year Income Income percent change from year 1 Gallon of milk cost Gallon of milk cost percent change from year 1 1 2 3 $36,000 $38,000 $21,000 n/a 5.6% -42% $2.49 $2.99 $3.19 n/a 20% 28% Over a three-year period, how has the income been impacted by the cost of a gallon of milk? 17 Consumer Prices • • • • • Inflation Causes of inflation Consumer Price Index (CPI) Deflation Causes of deflation 18 Measuring Economic Activity • Inflation. – The rapid rise in prices caused by an inadequate supply of goods and services. – Total demand exceeds total supply. – Dollars are plentiful, so their value declines and prices increase – The result is a decline in purchasing power; A dollar does not buy as much as it did before inflation. – Retirees and individuals on a fixed income are financially hurt the most because their income buys less. Inflation Reduces Consumers’ Ability to Buy Goods and Services As prices go up Money does not buy as much Consumers cut back on their spending Benefits of Inflation • Economists suggest that an inflation rate of 2-3% is healthy for the economy. – Wages rise more slowly than prices. – Producers make more profit and can hire more workers. – Unemployment is lower. – Newly employed workers spend more money and stimulate the economy. – The United States usually has mild to moderate inflation. Disadvantages of Inflation • If you do not keep up with inflation, consumers will have a lower standard of living. – Inflation most affects people on a fixed income, retirees and the unemployed. – Most workers are affected when inflation is at a moderate level. Disadvantages of Inflation • Increasing inflation reduces the consumers' ability to buy goods and services. – Money does not buy as much (the value of the dollar goes down). – Consumers will purchase only necessary goods. – Consumers will have to cut back on their spending Disadvantages of Inflation – Inflation occurs when there is too much money in the economy. – The government raises interest rates to take money out of the economy. – Rising interest rates discourage consumers and businesses from borrowing money. • Sales of durable goods fall. • Consumers "make do" with current homes, cars, etc. • Business owners do not borrow to expand. Disadvantages of Inflation • Workers ask for higher wages; businesses raise prices to pay for the increases. • As consumers stop spending, business sales fall and owners must cut back. – Some businesses have to layoff workers – People who lose their jobs will be able to buy fewer goods and services • Careful financial management is crucial in dealing with inflation. Disadvantages of Inflation • Careful budgeting helps consumers cope with limited economic resources. – Wise decision-making is also necessary to combat the effects of inflation. – Comparison shopping, not impulse buying. – Change lifestyle as needed. – Savings and investments must keep up with or ahead of inflation so that the money saved does not lose value. Measuring Economic Activity • Consumer Price Index (CPI). – A measure of the average change over time in the prices paid by urban consumers for a market basket of 400 consumer goods and services: • Food and beverage. • Housing. • Apparel. • Transportation. • Medical Care. • Education. Measuring Economic Activity • Deflation: – A decrease in the volume, or amount, of currency so that there is less currency available for goods and services within a free market; this tends to force market prices lower. – Deflation occurs when too few dollars are chasing too many goods. Scarce dollars are worth more, so prices go down. Interest Rates • Types: – – – – – – – Prime rate Discount rate T-bill rate Treasury bond rate Mortgage rate Corporate bond rate Certificate of deposit rate What is the primary purpose of each? • How do interest rates impact businesses? 29 Prime Rate • The interest rate charged by banks to their most creditworthy customers (usually the most prominent and stable business customers). • The rate is almost always the same amongst major banks. • Adjustments to the prime rate are made by banks at the same time • The prime rate does not adjust on any regular basis. • The Prime Rate is usually adjusted at the same time and in correlation to the adjustments of the Fed Funds Rate. Discount Rate • The interest rate charged to commercial banks and other depository institutions • On loans they receive from their regional Federal Reserve Bank's lending facility • Under the primary credit program, loans are extended for a very short term (usually overnight) T-bill Rate • A short-term debt obligation backed by the U.S. government • Maturity of less than one year • Sold in denominations of $1,000 • Maximum purchase of $5 million • Commonly have maturities of one month (four weeks), three months (13 weeks) or six months (26 weeks). Treasury Bond (T-Bond) Rate • A marketable, fixed-interest U.S. government debt security • Maturity of more than 10 years • Make interest payments semi-annually • The income that holders receive is only taxed at the federal level Treasury Bond (T-Bond) Rate • Issued with a minimum denomination of $1,000 • Sold through auction Mortgage rate • Interest rate on a loan secured by a mortgage on a property • A Mortgage is a debt instrument that is secured by the collateral of specified real estate property • Borrower is obliged to pay back with a predetermined set of payments Corporate Bond Rate • A debt security issued by a corporation and sold to investors • The backing for the bond is usually the payment ability of the company – typically money to be earned from future operations • Considered higher risk than government bonds Corporate Bond Rate • Interest rates are almost always higher, even for top-flight credit quality companies. • Issued in blocks of $1,000 in par value • A major source of capital for many businesses Certificate of Deposit Rate • A savings certificate entitling the bearer to receive interest. • Bears a maturity date • A specified fixed interest rate – Can be issued in any denomination • Generally issued by commercial banks – Insured by the FDIC • Ranges from one month to five years. Certificate of Deposit Rate • It is a time deposit that restricts holders from withdrawing funds on demand. • It is still possible to withdraw the money, this action will often incur a penalty.