SOS3_04 Fiona Williams_eMobility ETSI INTEROP

advertisement

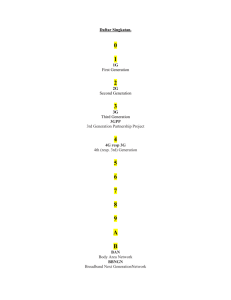

eMobility – A shared European Vision Dr. Fiona Williams Chairman, eMobility steering board http://www.emobility.eu.org/ Fiona.Williams@ericsson.com • eMobility as a Technology Platform – – – – Objectives Mission Rationale for investment The organisation and membership • The Vision & Strategic Research Agenda • Next Steps – meeting the global challenge Key objectives of Technology Platforms • The drawing up of a Strategic Research Agenda including long term vision • Identify technology and non-technology barriers to development, deployment and the use of technology • The achievement of the necessary critical mass for research and innovation • The mobilisation of substantial public and private funding • Projects in Framework Programme 7 will be carried out under the umbrella of the eMobility Technology Platform Technology Platforms - The shared vision • Support the renewed Lisbon Strategy for a competitive, knowledge-based society • Drive future technology developments in mobile and wireless communications that serve Europe's citizens and the European economy • Enhance cooperation between industry players, the research community and public authorities • Mid- to long-term vision (2015+ ) to maximise the benefit of mobile and wireless communications, thus enabling economic and social advances in the EU • Formulation of an action plan and time-table for the key developments • Evolution of a consistent policy, spectrum and regulatory framework Mission Statement • Achieve full mobile access to applications for European citizens, building on European strength in wireless communication • Develop the technology to provide optimal applications relying on the most promising technologies and network resources • Focus European R&D resources to exploit the coming business opportunities in mobile and wireless to the benefit of the European economy, and ensuring eInclusion especially for new member states Rationale for investment • Mobile & wireless products and services have an economic impact greater than the INTERNET • Public investments in other regions is growing rapidly (Asia, N. America) • Job creation – from 4 Million jobs now to 10 Million in 2010 • Europe should ride the next wave of wireless innovation • Mobile services account for about 3% of European GDP at present Organisations by Category Belgium Bulgaria Czech Republic Denmark Finland France Germany Greece Hungary Ireland Israel Italy Luxemburg Norway Poland Portugal Romania Russia Slovenia Spain Sweden Switzerland The Netherlands Turkey U.K T ota l 12 1 2 1 9 12 23 19 1 6 6 21 1 3 10 5 7 1 6 54 9 4 5 2 26 246 Research Domain Industry SME 82 industry 106 research 58 SME Open invitation to join the eMobility Platform has motivated more than 246 organisations to sign up April 27th, 2005 Brussels Members per country 82 industry 106 research 58 SME 9 9 3 6 246 members 26 1 5 1 23 12 12 10 1 2 6 4 1 5 7 54 1 21 2 19 Israel: 6 eMobility organisation Public launch – • General Assembly Inaugural Meeting – • March 18, 2005 in Brussels April 5, 2005, in Brussels Expert Advisory Group Steering Board Mirror Group Mirror Group Meetings – – April 27, 2005 in Brussels October 11, 2005 in Brussels Executive Group Secretariat • Cross Technology Platforms Meeting – – • General Assembly – • September 7, 2005 in Brussels February 16,2006 in Brussels November 23, 2005, in Brussels with first elections of the Steering Board members Strategic Research Agenda – Regularly updated … Working Groups on issues of common interest eMobility Projects in the FP7 timeframe Project Project Project Project C O M M O N V I S I O N Project Project Strategic Research Agenda Project Project • eMobility as a Technology Platforms • The Vision & Strategic Research Agenda • Next Steps – meeting the global challenge SRA Scope • Essential components of e-Mobility SRA • Identifying strategic & important research & technologies • In-line with FP7 timeline and beyond • Shows full awareness of what is (has) being done in FP6, Eureka and other programmes … • Builds on existing state-of-start, identifying new research issues to realise a long term Vision Vision Basis: New User Requirements Utility Talking & Messaging Doing (alone) (person-to-person) Sharing (one-to-some) Automating (machine-to-machine[s]) Publishing (one-to-many) Freetime Entertainment Work The Shared Vision “Improving the individual’s quality of life, achieved through the availability of an environment for the instant provision of and access to meaningful, multi-sensory information and content” SRAv4 ToC, November 2005 1. Vision of Future Mobile & Wireless Communications 2. Seamless User Experience 3. Business Infrastructures 4. Security and trust architectures 5. Ubiquitous Services 6. Ubiquitous Connectivity 6.1 Ubiquitous Networks 6.2 Access Radios 6.3 Platforms and Implementation 6.4 Opportunistic Communications 7. Basic & Multidisciplinary Research 8. Accompanying Measures – Non-Technical Barriers Different Innovation Cycles in future research Refining the concepts Short cycles – up to ~ a year Dynamic evolution of services Regular updates of targets required Services Creating concepts Medium cycles – several years for IP based functions (e.g. for mobility) Systems B3G in operation Validation with users Networks Service Platforms Creating concept ideas Understanding users Long cycles – up to ~ a decade Investigation and test of new radio technology Regulation and allocation of spectrum Development of radio products Radio Mobile Convergence Portable Media MP3 PDA Smart Phone Convergent devices Cellular Phones DSC Gaming Mobile Imaging Video Numerous Devices, Services, Business Models, Connectivity Modes, Cross-Industry Interfaces Networks Connectivity Networking tomorrow will be as pervasive as microprocessors are today Services Corporate Fixed PA N Services WLAN VA N 4G 3G 2.5 G CAN HAN Ubiquitous Services • Mobile applications and services are no longer separate “add-ons”, but are an integral part of everyday life! This includes also personal service creation! • Service creation technology is a key enabler to boost the services market in Europe “Make service creation and delivery as easy as constructing and delivering Web pages” Simplicity To Manage Complexity: User --Improved User Experience Industry --Minimising cost --Reducing innovation cycle Capability Evolution -Efficiency Drive performance and efficiency beyond today’s limits Typical range (km) 30 10 GSM GPRS EGPRS 1 UMTS HSDPA “4G “Super3G ” ” 802.16 0.1 0.01 0.1 1 802.11 802.11 b a 10 Typical user rate (Mbps) New Approach to Efficiency • Current practice: • Air-interface and system-level protocols not designed together • System planning and protocols are designed based on fixed average statistics (particularly freq. allocation) whereas mobile networks are dynamic in nature • Future Approach: • Joint optimisation of link-level & system level • New system topologies • Adaptation (cross-layers) • Auto-planning (self-organisation) • Opportunistic Communications – DSA (Network) & DSS (Terminal-CR) Security, Privacy & Trust Rationale • Technology convergence • Transactions across different networks • Context-based communications – Demand high emphasis on provision of network security for user’s trust, confidence and security and security of user’s information for privacy. Research Priorities • Secure Software Environment including O/S • Virus protection (virus, trojan, DoS attacks)/Intrusion Detection • Secure exchange of user profile data • Safe Terminal Re-configurability • Secure Execution Environment • Secure SW Download Special Thanks to EAG INT, France Prof. Djamal Zeghlache IMEC, Belgium Liesbet van der Perre Instituto Superior Tecnico, Portugal Prof. Luis Correira UPC, Spain Prof. Ramon Agusti University of Oulu, Finland Prof. Matti Latva-aho Univ. of Surrey, UK Prof. Rahim Tafazolli (Chair) Kings College London, UK Prof. Hamid Aghvami Aalborg University, Denmark Prof. Ramjee Prasad Cefriel, Italy Flavio Giovanelli Mobile VCE, UK Walter Tuttlebee KTH, Sweden Prof. Jens Zander VTT, Finland Kyösti Rautiola NTUA, Greece Prof. Miltos E. Anagnostou CEA-Leti, France Laurent Herault CEIT, Spain Prof. Pedro Crespo Alcatel, France Francois Carrez Motorola, France Marco Fratti Ericsson, Germany Fiona Williams Siemens, Germany Werner Mohr Nokia, Finland Juha Saarnio (Deputy Chair) Nokia, Finland Mika Klemettinen Bell Labs Europe, The Netherlands Franz Panken Ericsson, Sweden Göran Malmgren • eMobility as a Technology Platforms • The Vision & Strategic Research Agenda • Next Steps – meeting the global challenge eMobility Relationships with other Bodies Other Technology Platforms National R&D Programmes bmb+f Interaction between Technology Platforms • eMobility Relationships with other Bodies Sharing ideas - creating a larger space – Complementing areas - together addressing the entire value chain of the industry Other Technology Platforms National R&D Programmes • Initial meetings between Technology Platforms “Core Groups” – • Identifying common technology and non-technology barriers to development, deployment and the use of technology Providing focus - maximising use of resources – • bmb+f Agreed areas of interest between different platforms provides means for good efficiency and less duplication The Liaison officer’s responsibility – To carry out and initiate contacts identified Research in a global context Research – Coordination – Standardisation… China/863-projects US-activities EU-initiatives EU-projects ”Other” WWRF Technology Platforms Japan Korea Standardisation related Organisations • ITU-R • ITU-T • 3GPP • 3GPP2 • OMA • IETF • W3C •... •... Global Activities on Future Systems North America • Research on systems beyond 3G e.g. at Motorola, Nortel, Lucent etc. China Dominated by global IT industry • IEEE activities in • • • • • IEEE 802.11a, b, g, h, n IEEE 802.15 IEEE 802.16, a, d, e IEEE 802.20 IEEE 802.21 • Claims from start-ups and IT companies to provide 4G solutions • • Flarion (Fast Low Latency Access with Seamless Handoff and OFDM) • Arraycomm – advanced antenna technology and SDMA • Navini Networks – Advanced beamforming technology for range & coverage • IP Wireless – TD-CDMA with IP core network • Aperto Networks – Fixed Broadband Wireless Access vendor • Redline Communications – Fixed BWA • Airspan – Fixed BWA • Alvarion – Fixed BWA • Intel – Active in 802.16 development and its promotion in WiMAX Many activities are on short-range and WLAN enhancements Europe • UMTS • UMTS enhancements • Research on systems beyond 3G in FP6 • 3G licenses not yet granted • Research on beyond 3G in 863 FuTURE Project • Joint Research Center Shanghai CJK – China, Japan, Korea • Cooperation on government level, one working group on mobile communication Globally • Cooperation between SDOs • ITU-R Framework Recommendation • WWRF, since 2001 Europe is being challenged ! • Asian countries, such as China and Korea, are making substantial efforts to overtake Europe in this strategically crucial domain • The USA dominates in the short-range wireless technology sector and invests its defense budget in supporting technological advances Europe today accounts for around one third of global ICT sales, which are growing at 5% per year, with double-digit growth in emerging markets such as India and China Scope of eMobility to address the challenges • Competitive phase – Competition law has to be respected – Limited cooperation • Semi-competitive phase – Specification and standardisation – Industry standards and proprietary solutions also possible and relevant • Pre-competitive phase – Collaborative research, much cooperation • Collaboration at European level must add value Potential topics beyond research Large-scale European approaches to system research and development Market Development - How to meet the demand of the world markets Regulations for growth - How to stimulate the internal European organisation/market Standards and specifications for seamless services - How to create “seamless” eMobility Infospace and services infrastructure - How to establish the capabilities required (Usage driven) Developing the technology base for leadership - How to get the techno-economics right Impact of R & D will be on … • eGovernance – Communication between state & citizen • Environmental and personal security – Always-on sensing and monitoring • Societal interactions – Interpersonal and person-business relationships as well as behavior will change • Increased industrial efficiency – Always-everywhere brings new business models, revolutionising value-chains Meeting the Challenge • Competing in a changing world Leadership requires concerted efforts of all players including regulators and governments to provide the environment needed for growth • Consensus building Complexity and need for global standards, requires cooperation beginning with research • Europe’s industry is fully committed 10-20% of turn-over are committed to R & D, where the collaborative R&D comprises less than 1% April 5th, 2005 Brussels Thank you for listening!