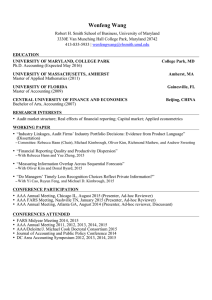

Grant Thornton LLP - Indiana University

advertisement

Professional Opportunities Orientation Program Indiana University Careers in Public Accounting • Firm choice • Career path • Changing environment Firm choice • Big "4" Firms (KPMG, PWC, E&Y, D&T) • Middle tier firms (GT, BDO, Crowe, McGladrey, American Express) • Local accounting firms Big "4" Firms •Large, national and multi-national firms •Primary focus is full service to the Fortune 1000, but will also have a "middle market" or entrepreneurial division •Several opportunities for career paths outside the general audit and tax path •Tax is divided between compliance and consulting •Opportunity to work overseas Middle tier firms • Vary in size • Some are national and multi-national, some are regional in nature • Primary focus is full-service to middle market companies both public and private • Tax professionals will do both compliance and consulting • Opportunities exist to work outside the typical audit and tax areas, but not to the extent as at the Big 4 • Opportunity to work overseas in some cases Local accounting firms • Small one/two office firms • Primary focus is serving the accounting and tax needs of the local small business • Careers in the smaller firms will entail working in both tax and audit/financial accounting The Career Path in Public Accounting Assurance and Tax Professionals • Associate • Senior Associate • Manager • Senior Manager • Partner Associate • One to two years. • Responsible for tax return preparation and/or low risk areas of the audit assignment. • Assignments can include anything, including making copies • In the second year, responsibilities will increase and in some cases will be responsible for an engagment Senior Associate • After two years • Senior Associate, Senior, In-charge • Responsible for planning, executing and wrapping up engagements • Main client contact and the driver of the audit/tax return process • Completion of job including financial statements • Supervise, train, and review the work of associates Senior Associate (continued) • Research and summarize technically complex issues • Assist manager with day to day client relations • Knows the most about the job/project Manager • Usually after 5 years • Three basic roles: – Core Business Role • Manage multiple engagements • Detail review of work papers • Day to day client relations • Train and supervise senior and staff • Research and conclude on technical issues and questions from clients Manager (continued) – Human Resources Role • Recruiting • Advise, Mentor, Coach staff • Teach staff through continuing professional education classes Manager (continued) – Sales and Marketing Role • Network with referral sources: attorney’s, bankers • Participate in proposal writing and presenting • Generate leads for new business • Belong to professional organizations: AICPA, State Society’s Senior Manager • 8 to 10 years • Same responsibilities as manager except time split is different • More time is spent in Sales and Marketing role than any other • Senior Managers may have more administrative duties associated with how the department works as a team Partner • • • • 12 to 15 years Final review of audit or tax return Sign-off of audit report or tax return Maintain high-level of client relations: attend Board Meetings, Audit Committee meetings • Help client with highly complex issues: strategic planning, mergers, acquisitions Partner (continued) • • • • Generate client leads Prepare proposals and lead proposal meetings Speak at professional organizational meetings Teach continuing professional education seminars Changing environment • Public perception • Sarbanes-Oxley Act – what services can a public accounting firm perform – how are public accounting firms going to be regulated – internal control focus • Changes at the SEC, NYSE and other exchanges