Exhibit A - State of Wisconsin Investment Board

advertisement

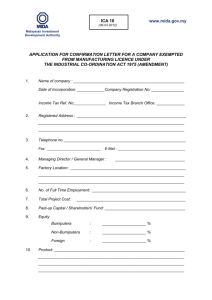

121 E. Wilson St. │ P.O. Box 7842 │ Madison, WI 53707 Tel: (608) 266-2381 │ Fax: (608) 266-2436 REQUEST FOR PROPOSAL – ENTERPRISE INVESTMENT MANAGEMENT SYSTEM CONSULTING SERVICES IN TROD U CT IO N & BA CK G ROUN D The State of Wisconsin Investment Board (SWIB) manages investments for several trust funds including the Wisconsin Retirement System (“WRS”), which is the ninth largest public pension plan in the United States and 30th largest public/private pension fund in the world, with total managed assets of approximately $90 billion as of November 2012. The plan provides retirement benefits for over 566,000 current and former public employees. Although member and employer contributions are substantial, investment returns account for the majority of the pension plan’s growth. SWIB’s primary focus is on investment management as it does not manage plan benefits of the retirement system. The investment portfolio conforms to investment policy established by the Board of Trustees (“Trustees”). Portfolio allocations are established through periodic, comprehensive asset allocation and liability modeling analyses prepared with the assistance of consultants to SWIB. Since 2007, SWIB has systematically been building capacity and expertise to manage more assets internally. Currently over 55% of trust fund assets are managed internally by SWIB staff. SWIB is also implementing a variety of new investment strategies, including shorting, currency overlays, inflation protection, exchange-traded and over the counter derivatives, and hedge funds. At the same time, SWIB is also enhancing its trading and risk analysis capabilities. SWIB currently employs 145 staff in a wide variety of investment and support related specialties. About 70% of SWIB employees hold advanced degrees or professional certifications. One-third holds multiple degrees or certifications. (See Organizational Chart - Exhibit A) SWIB must be able to compete in a constantly changing global marketplace. SWIB has adapted and evolved its resource capabilities over many years and the current environment is not designed to provide the operational agility necessary to quickly implement new investment strategies. Current and new processes are sometimes manually intensive and the future direction will require more automation. As SWIB enhances its internal investment management capabilities with more complex strategies, the flexibility to readily access and analyze the data across all portfolios is becoming more important. Additionally, SWIB uses many separate applications to support its investment management business process, and as a result, the integration is not optimal and requires constant monitoring and reconciliation between systems. As part of SWIB’s 2013 strategic planning process, senior leadership recognized the need to consider SWIB’s entire enterprise investment management needs, identify industry leading capabilities and options, and develop a path to enhance its technological and operational infrastructure for current and potential future strategic initiatives. SWIB is seeking a consultant who can assist in exploring potential functionality used by other investment managers, assessing current and future business requirements, analyzing the current environment, identifying opportunities for improvement and automation, and developing a multi-year plan to enhance its investment management platform and related business processes. SWIB utilizes numerous investment systems such as Bloomberg, Charles River, Eagle Systems (PACE), Wilshire (Abacus, Axiom and Atlas), Factset, Pertrac, Advent Tamale, and FX Connect to manage the investment business process. SWIB’s custodian, BNY Mellon, is required to provide accounting and custody extract files/feeds to SWIB’s in-house systems and platforms through both standard and custom daily and monthly interfaces. Generally, transactions are posted on trade date for international managed portfolios to 1 121 E. Wilson St. │ P.O. Box 7842 │ Madison, WI 53707 Tel: (608) 266-2381 │ Fax: (608) 266-2436 allow for the monitoring of positions, including cash, on a near real time basis. Portfolio reconciliation is performed on a T+1 basis. (See Exhibit B – Chart of Custodial Services and Exhibit C – List of Major Applications and Systems) The custodian acts as the official book of record for investment activity. SWIB has daily interfaces with the custodian and reconciles to the custodian both daily and monthly depending on the portfolio. The custodian also provides comprehensive monthly performance measurement and investment compliance monitoring services with limited daily information. Unitization is not currently utilized for accounting purposes, but it is an option under SWIB’s current contract with the custodian. Current asset classes include global equities, global fixed income, real estate, private equity and alternative assets. SWIB has recently added hedge funds, shorting capabilities with the ability to borrow from other internally managed portfolios at market rates, and derivative strategies that require cross-asset approaches to risk management, performance measurement and monitoring. SWIB’s current asset allocation targets are attached in Exhibit D. New strategies and business needs, combined with the need to be more agile in efficiently deploying new strategies, has highlighted the need for improved business processes utilizing well integrated systems to manage and report data. SWIB seeks firms and assigned consultants who have significant experience with global diversified asset managers, extensive knowledge in investment strategies and risk management, and a reputation for developing plans and implementing solutions that are within budget, high quality and that have withstood the stress of actual system deployment and implementation. The following additional caveats apply: Proposal Preparation Costs SWIB will not pay costs incurred in the preparation of the response to this request for proposal. All costs shall be borne by the consultancy. Top scoring vendors may be asked to conduct a presentation at SWIB’s office – see: Timing of the Process and Key Calendar Dates (page 7). Submitted Documentation All sales, supporting materials, and other documentation submitted with the response will be retained by SWIB, unless otherwise requested by the consultancy at the time of submission. Market References Consultancies shall make no references to SWIB in any literature, promotional material, brochures, or sales presentations without the express written consent of SWIB. 2 121 E. Wilson St. │ P.O. Box 7842 │ Madison, WI 53707 Tel: (608) 266-2381 │ Fax: (608) 266-2436 MINIMUM CRITERIA A proposer must meet the following minimum criteria to be given further consideration. Failure to meet the minimum criteria will result in the Proposal's immediate rejection. o The Primary Firm, along with its subcontractors, if any, must have significant prior experience providing investment-related business management and technology consulting services to existing global diversified asset managers. If subcontractors are proposed, the Primary Firm must have worked with the subcontracting firm(s) a minimum of 5 years. o The individual primary consultant assigned to SWIB’s account (the “Primary Consultant”) must have had a minimum of 5 years of experience serving as primary consultant for global diversified asset managers. The assigned primary consultant must have direct access to needed firm resources. Such resources must include experts in the investment management industry. 3 121 E. Wilson St. │ P.O. Box 7842 │ Madison, WI 53707 Tel: (608) 266-2381 │ Fax: (608) 266-2436 S CO PE OF S ERV IC ES 1. Identify, Educate and Conceptualize a. Identify and assess key business needs (front, middle, back office), technology systems and their capabilities/dependencies, strategic business direction, internal resources and current SWIB business model. i. Areas in scope include (for each major asset class including global equities, global fixed income, real estate, private equity and debt, and alternative assets): 1. Portfolio Management a. Analysis and modeling 2. Trading 3. Investment Risk Management & Attribution a. Portfolio Level b. Fund Level 4. Compliance 5. Performance Measurement & Attribution a. Monthly Fund, asset class and portfolio b. Daily portfolio and sub-account performance c. Factor based performance attribution 6. Data Management a. Business Intelligence b. Data Warehousing c. Reporting 7. Investment Accounting a. Security and Fund Level Accounting b. Reconciliation c. Cash flow Management d. Financial Reporting e. Post trade Settlement & Processing 8. Although not in scope for implementation or product selection, the scope of this engagement includes analysis and advice on how best to integrate SWIB administrative systems with the enterprise investment management systems plan. b. Interview key representatives from all departments and functions in scope. c. Review current software/service providers and outsourcing vendors. Develop an understanding of the current systems and processes. d. Identify current state key process flows and data. e. Identify how business functions, processes, and systems are interacting including the interfaces between them. f. Provide perspective/insight on SWIB’s current Business, Data, and Application Architectures relative to a typical asset management firm. g. Educate, conceptualize and prioritize challenges with stakeholders. h. Deliverables: 4 121 E. Wilson St. │ P.O. Box 7842 │ Madison, WI 53707 Tel: (608) 266-2381 │ Fax: (608) 266-2436 i. Preliminary assessment of SWIB’s current business and technology models and challenges associated with it vs. the stated strategic direction of the organization ii. High level diagram showing key process flows and the data used within them. iii. High level diagram showing how key business processes, functions and systems are interacting including the interfaces (manual or automated) between them. iv. Preliminary assessment of the opportunities to automate and streamline operational processes and associated savings. v. Educational seminar on investment system best practices for senior management team. This will be used to prepare staff for the benchmarking step. 2. Benchmarking Industry Standards and Design (What is Possible?) a. Review the competitive landscape. b. Explore industry leading practices and conduct benchmark review with mutually agreeable leading global diversified asset managers. c. Prepare analysis of current state versus potential future state including gaps with areas requiring most significant improvement prioritized. d. Deliverables: i. Current state analysis showing gaps and identifying areas requiring most significant improvement. ii. Conceptual diagram of solution that meets business needs for overall structure and relationship between key business functions, processes, systems and the flow of data between them (Business Architecture). iii. High-level definition of key data sources, data storage vehicles and interfaces (Data Architecture). iv. Identify options and present recommendations for future state application architecture considering buy/build/outsource options (Application Architecture). v. Information and advice necessary for SWIB to determine the direction to take with its administrative systems. vi. Educational seminar summarizing findings including ways SWIB’s current environment could change to align with best practices. 3. Define future state (application, infrastructure, organizational, sourcing and governance). a. Articulate at least two options, with supporting arguments, for a recommended future state that addresses gaps in the existing state and support anticipated changes and evolution in the business. b. Develop an implementation roadmap that phases in changes over a reasonable period of time designed to help ensure successful conversion. c. Provide cost/benefit analysis for options and recommended improvements. Summarize the benefits of executing the plan (increases in efficiency, improved capabilities, increased organizational agility, reduced risk, etc.) and related key metrics to track and monitor. d. Deliverables: i. Fully documented options that include quick-hit and long term improvements. ii. Sequence collection of projects and activities including dependencies. Estimate timelines and resource requirements. iii. Cost Benefit Summary. 5 121 E. Wilson St. │ P.O. Box 7842 │ Madison, WI 53707 Tel: (608) 266-2381 │ Fax: (608) 266-2436 iv. Potential vendor list. v. Written observations, recommendations, or advice on the integration into the enterprise investment management system or future direction of SWIB’s Administrative Systems. vi. Recommended change management plan. 6 121 E. Wilson St. │ P.O. Box 7842 │ Madison, WI 53707 Tel: (608) 266-2381 │ Fax: (608) 266-2436 Proposal Specifications—Public Records Under Wisconsin’s public records law (Wis. Stat. §§ 19.31-19.39, the “Public Records Law”), upon the expiration of the response deadline, all responses shall be deemed public records and shall be subject to requests for public disclosure. Respondents should assume that materials included in their response constitute and are presumed to be public records and, as such, may be subject to disclosure under the Public Records Law, unless an exception is applicable. The Public Records Acknowledgement, which is included in this packet and must be completed and submitted with each response, contains additional information about the Public Records Law and the steps necessary to claim that materials included in a response are exempt from disclosure. Withdrawal/Irrevocability of Responses A respondent may withdraw and resubmit a response prior to the response deadline. No resubmissions will be allowed after the response deadline. Waiver/Cure of Minor Informalities, Errors and Omissions SWIB reserves the right to waive or permit cure of minor informalities, errors or omissions prior to the selection of finalists, and to conduct discussions with any qualified respondents and to take any other measures with respect to this questionnaire in any manner necessary to serve the best interest of SWIB and its beneficiaries. Communications with SWIB SWIB’s Contact for this questionnaire is listed below. During the selection process, communications with other SWIB officials are prohibited (other than routine business with existing service providers or for existing contractual relationships), in order to ensure integrity of the process. FAILURE TO OBSERVE THIS RULE IS GROUNDS FOR DISQUALIFICATION. Rejection of Proposals SWIB reserves the right to request additional information from consultancies and reserves the right to reject any proposal without specifying the reason for its actions. Information and Representations The consultancies shall be bound by the information and representations contained in any response submitted, and except to the extent otherwise agreed to in writing by SWIB, the information and representations contained in the response submitted by a consultancy will be incorporated into any final agreement between SWIB and such consultancy. Contract Term and Funding The contract shall be effective on the contract execution date and shall continue until terminated, according to the terms of the agreement. Additional renewals or extensions of related work are optional. Award SWIB reserves the right to refrain from awarding all or any part of the engagement contemplated by this RFP. 7 121 E. Wilson St. │ P.O. Box 7842 │ Madison, WI 53707 Tel: (608) 266-2381 │ Fax: (608) 266-2436 PUBL IC RE CO RD S AC K NOWL EG E M EN T We hereby represent, acknowledge, and agree as follows: (i) SWIB is a public agency subject to Wisconsin’s public record law (Wis. Stat. §§ 19.31-19.39, the “Public Records Law”), which provides generally that all records relating to a public agency's business are open to public inspection and copying unless exempted under the Public Records Law. (ii) Materials we submit to SWIB in connection with this questionnaire are open to public inspection under the Public Records Law unless such materials fall within an exemption under the Public Records Law. (iii) Our proposal INCLUDES / DOES NOT INCLUDE (circle one) materials that we believe are exempt from disclosure under the Public Records Law. (iv) To the extent our proposal includes materials that we believe are exempt from disclosure under the Public Records Law, we understand that we must: (1) provide a letter identifying the materials that we believe are exempt from disclosure and explaining the basis for exemption; and (2) submit, in addition to the regular version of our proposal, one copy of a redacted version that excludes the potentially exempt materials. (v) SWIB will presume that any materials that are not identified and redacted pursuant to paragraph (iv), above, are open to public inspection, and we waive any right to subsequently claim exemption from disclosure for any such materials. (vi) If we make an unreasonable claim for exemption under the Public Records Law, such claim may reduce the score for our proposal. (vii) SWIB at all times retains the right to make the final determination regarding what, if any, portion of a proposal is subject to disclosure under the Public Records Law. (viii) For the avoidance of doubt, SWIB will treat the terms of any agreement entered into as a result of the questionnaire as open to public inspection under the Public Records Law. ACKNOWLEDGED AND AGREED Date: Signature: Printed Name and Title: 8 121 E. Wilson St. │ P.O. Box 7842 │ Madison, WI 53707 Tel: (608) 266-2381 │ Fax: (608) 266-2436 TI MI NG OF T H E P RO C ES S AND K EY C AL EN DAR DAT ES Questionnaire Release Date February 27, 2013 Vendor Questions Due Date March 6, 2013 Response Due Date March 13, 2013 Notification to Short Listed Vendors April 1, 2013 Vendor Presentations Week of April 8, 2013 Vendor Selection and Commencement of Contract Negotiation Week of April 15, 2013 Commencement of Work Week of May 1, 2013 Response to this questionnaire is required by close of business, March 13, 2013. This timeline is tentative and can be modified at any time at SWIB’s discretion. 9 121 E. Wilson St. │ P.O. Box 7842 │ Madison, WI 53707 Tel: (608) 266-2381 │ Fax: (608) 266-2436 RES PO NS E INS T RUC TI ON S Inquiries regarding this questionnaire should be sent to: rhiannon.friedel@swib.state.wi.us Please submit one electronic copy and six hard copies of the completed documents to: Ms. Rhiannon Friedel State of Wisconsin Investment Board Lake Terrace 121 E. Wilson St. Madison, WI 53707 (608) 261-0181 rhiannon.friedel@swib.state.wi.us Please note: SWIB expects all points/questions contained in this questionnaire to be addressed/answered. Unaddressed points or unanswered questions may cause vendors to be eliminated. SWIB’s questionnaire is this Word document containing points/questions that require a written response. Enter your responses to the points/questions in this document. In responding, feel free to provide expanded detail regarding any limitation or constraint for each response. The questionnaire MUST be returned in its original format. Do not respond using Adobe PDF files. PDF files are acceptable for Appendices only. 10 121 E. Wilson St. │ P.O. Box 7842 │ Madison, WI 53707 Tel: (608) 266-2381 │ Fax: (608) 266-2436 QUES T IO NNAI RE 1. Minimum Criteria for Consideration a. Please submit proof that your firm fulfills the minimum requirements outlined on Page 2. 2. Stability and Experience of the Firm a. Provide a brief history of your firm, including its year of organization and the percentage owned by current active employees; the locations of your firm’s headquarters and branch offices; and the ownership structure of your firm, including any parent, affiliated companies or joint ventures. b. Describe the financial condition of your firm and include a copy of your firm's financial statement for the most recent annual reporting period. Include any significant developments in the organization which have occurred since January 1, 2012 (changes in ownership, personnel reorganization, etc.) and describe any anticipated near term changes in the organization's basic ownership structure or any other significant changes in the organization. c. Describe your firm’s capabilities and competitive advantage in providing the specifically requested consulting services to SWIB. d. Disclose any business relationships with investment related technology vendors or with implementers of such systems. e. Describe any circumstances that could conflict with your firm’s duty to provide unbiased advice to SWIB, including any significant personal or business relationships of your firm or its key personnel that could affect advice provided on SWIB’s behalf. f. Since January 1, 2008, has your firm, the Primary Consultant(s), or another officer or principal been involved in any business litigation, securities or tax law violation investigations or proceedings, regulatory or other legal proceedings or government investigation involving allegations of fraud, negligence, criminal activity or breach of fiduciary duty relating to consulting activities? If so, please describe, provide an explanation, and indicate the current status. g. Provide a list of current or former global diversified asset manager as clients and the timeframe when they were clients. h. Provide at least three recent examples of when your firm has provided similar consulting services to other large global diversified asset managers and the status of recommendations and implementations. Provide at least three references with contacts that SWIB may consult. 3. Consultant Experience a. Name and include a brief resume of the person(s) you propose to be Primary Consultant(s) for SWIB. State which of your firm’s offices would service this account. Include an organizational chart, as an exhibit, showing functions, positions, and titles of all personnel involved in providing consulting services. b. Individual consultants considered for an engagement with SWIB should have at least 5 years of experience consulting for global asset managers and ability to demonstrate significant understanding of portfolio management, trading and settlement activities, risk management, performance attribution. They must also possess knowledge of various investment security types and transactions and a bachelor’s degree or higher. Please submit the resumes of 3 qualified senior consultants associated with the requisite experience who will be assigned to this engagement. 11 121 E. Wilson St. │ P.O. Box 7842 │ Madison, WI 53707 Tel: (608) 266-2381 │ Fax: (608) 266-2436 4. 5. 6. 7. c. For each proposed consultant, provide at least two examples of consultant experience with similar engagements for global diversified asset managers. d. Explain how the team dedicated to the SWIB account would function, including Primary Consultant(s), back-up, quality control, research, and support services. In addition, please explain how the team will interact and communicate with SWIB regarding project status, issues and next steps. e. What are the procedures for addressing SWIB’s issues when the Primary Consultant(s) or other assigned personnel are traveling or unavailable? f. How many client relationships will the Primary Consultant(s) have other than SWIB? g. Provide an estimate of the percentage of the Primary Consultant’s time, as well as the time of other consultants, dedicated to the SWIB engagement. Consultant Requirements - Please indicate your firm’s willingness to meet these requirements. a. Consultants must be able to be on site at SWIB’s location for the majority of any engagement. Some remote work may be permitted on a portion of any given engagement, but it is expected that most engagements will require an on-site presence. SWIB’s consultant travel policy and current per-diem amounts are attached – Exhibit E. b. Consultants must pass a criminal background check prior to working within SWIB’s facilities or on SWIB’s systems. The specifics of the checks performed may vary over time and will be confirmed prior to accepting any specific consultant for an engagement. Engagement Approach a. Explain how your firm plans to approach the scope of services required for this project. Include recommended steps, approximate timeline and level of consultant and SWIB resources requirements. Be specific. i. Describe your proposed approach to assessing SWIB’s strategic direction, key business needs, business model and anticipated changes and evolution. ii. Describe your approach to understanding the current state of SWIB’s systems, internal resources, data, technology, business processes, current state and how various elements are connected. iii. Describe how you would provide advice on how an administrative system would integrate with SWIB’s enterprise investment management system. iv. Describe the approach you would take to benchmarking and include some recommendations. Provide information on projects where similar benchmarking efforts were undertaken. v. Describe how you envision developing options for future state. b. Provide examples of similar approaches for other clients, including sample deliverables. Training Plan, Communication & Change Management a. Explain your approach to educating senior management about best practices for investment management processes and systems. b. Describe how your firm will address change management and communication to stakeholders throughout the effort. Timeline a. Provide a timeline, and approximate number and type of SWIB resources needed during the engagement. 12 121 E. Wilson St. │ P.O. Box 7842 │ Madison, WI 53707 Tel: (608) 266-2381 │ Fax: (608) 266-2436 8. Fee Proposal a. Provide a fee proposal outlining the rates for the various services to be provided by your organization, and the consultant hours to be provided during the engagement. The fee proposal MUST be submitted in a separate sealed envelope, clearly marked as: ‘FEE PROPOSAL – INVESTMENT MANAGEMENT PROCESS CONSULTANT’ Failure to adhere to this submission requirement may result in a rejection of the proposal. 13 121 E. Wilson St. │ P.O. Box 7842 │ Madison, WI 53707 Tel: (608) 266-2381 │ Fax: (608) 266-2436 Exhibits Exhibit A: SWIB Organization Chart Exhibit B: Chart of Custodial Services Exhibit C: List of Major Applications and Systems Exhibit D: Asset Class Exposure and Rebalancing Summary, as of December 31, 2012. Exhibit E: Consultant Guidelines for Travel Exhibit F: SWIB’s 2012 Annual Report is available at: http://www.swib.state.wi.us/FY12Annual.pdf 14