Accounting for Partnership Lecture

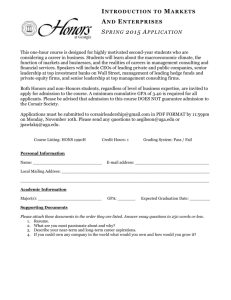

advertisement

Accounting for partnerships 1 PARTNERSHIP FORM OF ENTITY A partnership is defined as … –Is a contract whereby two or more persons bind themselves to contribute money, property or industry to a common fund with the intention of dividing the profits among themselves 2 Characteristics of partnerships 3 Characteristics of partnerships 1. Association of individuals – Voluntary association – May be based on handshake or written agreement – Partnership not a legal entity, so is not taxed – Individual partners pay tax on their share of profit 4 Characteristics of partnerships continued 2. Mutual agency – Each partner acts on behalf of the partnership when engaging in partnership business – Act of any partner is binding on all other partners 3. Limited life – May be ended voluntarily at any time through the acceptance of a new partner or withdrawal of a partner – May be ended by involuntarily by death of incapacity of a partner 5 Characteristics of partnerships continued 4. Unlimited liability – Each partner is personally and individually liable for all partnership liabilities 5. Co-ownership of property – Partnership assets are owned jointly by the partners – If partnership is dissolved, assets do not legally revert to original contributor – Partners have a claim on total assets equal to the balance in individual capital account – Partnership profit or loss is co-owned 6 Advantages and disadvantages of partnerships • • • • • Advantages Combining skills and resources of 2 or more individuals Ease of formation Not subject to as much government regulation as companies Ease of decision making No taxation on partnership profits • • • • Disadvantages Mutual agency Limited life Unlimited liability Partners must be able to work together 7 Kinds of partner • As to contribution – Capitalist partner contributes money or property – Industrial partner contributes skills, knowledge, industry or service – Capitalist-industrial partner contributes money or property and industry • As to liability ₋ General partners have unlimited liability ₋ Limited partners have limited liability 8 Kinds of partnership • General Partnership ₋ Partners are all general partner • Limited Partnership ₋ Composed of one or more general partner and one or more limited partner 9 Articles of Partnership • A written contract made by the partners specifying such details as … – – – – – – – Names and contributions of the partners Rights and duties of partners Basis for sharing net income or loss Provision for withdrawals of assets Procedures for settling disputes Procedures for withdrawal or addition of a partner Rights and duties of surviving partners in the event of a partner’s death 10 Review question 1 A. B. C. D. Which of the following is not a characteristic of a partnership? Taxable entity Co-ownership of property Mutual agency Limited life 11 Review question 2 A. B. C. D. Statement 1: A lawyer and doctor may formed a partnership as business partners to practice their profession. Statement 2: A limited partner must pay first his personal creditors before paying the partnership creditors. Only 1st is true Only 2nd is true Both true Both false 12 BASIC PARTNERSHIP ACCOUNTING • Major accounting issues in relation to partnerships are – Forming a partnership – Dividing profit or loss – Preparing financial statements – Dissolution of partnership – Liquidation of partnership 13 Forming a partnership • Initial investment – Rules to be observed: The amount of contribution shall be based on the partner’s agreement. In the absence of any agreement, it shall be contributed equally. ₋ Sample problem1: A and B form a partnership with the total agreed capitalization of P150, 000 to be contributed in cash of 40% and 60% by A and B, respectively, through the issuance of their personal checks. The amount contributed and capital credited to be recorded per agreement would be: 14 Forming a partnership cont. – Sample problem2 A and B form a partnership with the total agreed capitalization of P150, 000 to be contributed in cash through the issuance of their personal checks. The amount contributed and capital credited to be recorded per agreement would be 15 Forming a partnership cont. • Valuation of partners’ contribution ₋ If cash contribution – based on face value ₋ If non cash – based on agreed value, in the absence of agreed value it shall be based on fair value. *Fair value or fair market value – represents the estimated amount in which the seller and buyer would be willing to exchange value in an open market. • Once partnership has been formed – Accounting is similar to accounting for transactions of any other type of business organisation 16 Forming a partnership continued • Example 1 – Carrying amount and fair value of assets invested Carrying amt Fair value A.Gibson T.Jones A.Gibson T.Jones Cash P 8 000 P 9 000 P 8 000 P 9 000 Office equipment 5 000 4 000 Accum. depreciation (2 000) Accounts receivable 4 000 4 000 Allow. for doubtful debts (700) (1 000) P11 000 P12 300 P12 000 P12 000 17 Forming a partnership continued – Journal entries to record investments Cash Office Equipment A. Gibson, Capital (To record investment of Gibson) 8 000 4 000 Cash Accounts Receivable Allowance for Doubtful Debts T. Jones, Capital (To record investment of Jones) 9 000 4 000 12 000 1 000 12 000 18 Forming a partnership continued • Example 2 C, D and E formed a partnership with agreed total capitalization of P30, 000 which should be contributed equally by C and D. Meanwhile, E was designated to manage the operation of the partnership as industrial partner with a share of 20% from partnership profits. C and D contribute the following assets: Cash Land Office equipment Supplies Notes Payable (assumed by the partners) Fair Value Agreed Value Partner C Partner D Partner C Partner D P 10 000 P 10 000 P 5 000 11 000 7 000 5 000 6 000 4 000 2 000 1 000 2 000 2 000 . P 10 000 P 17 000 P 15 000 P 15 000 19 Review question 3 A. B. C. D. In accounting for the formation of a partnership, each partner’s initial investment is recorded at … the carrying amount of assets invested the fair value of assets invested the historical cost of assets invested the book value of assets invested 20 Dividing profit or loss • Art. 1799 of the New Civil Code provides that any stipulation that excludes one or more partners from any share in the profits or losses is null and void. • Art. 1797 provides the following guidelines on how partnership profits and losses shall be distributed among the partners: 21 Dividing profit or loss As to Capitalist Partner 1. Division of profits a. In accordance with agreement b. In the absence of an agreement, in accordance with capital contributions. 2. Division of losses a. In accordance with agreement b. If only the division of profits is agreed upon, the division of losses will be the same as the agreement on the division of profit c. In the absence of agreement, based on capital contribution Dividing profit or loss II. As to Industrial Partner 1. Division of profits a. In accordance with agreement b. In the absence of an agreement, industrial partner shall receive a just and equitable share of the profits. 2. Division of losses a. In accordance with agreement b. In the absence of agreement, industrial partner shall have no share in the losses Dividing profit or loss continued Closing entries: 1. DR each revenue account for its balance and CR Profit and Loss Summary for total revenue 2. DR Profit and Loss Summary for total expenses and CR each expense account for its balance 3. DR (CR) Profit and Loss Summary for its balance and CR (DR) each partner’s capital account for their share of profit (loss) 4. DR each partner’s capital account for the balance in that partner's drawing account and CR each partner’s drawing account for the same amount 24 Dividing profit or loss continued – Example • Partnership profit for year is P32 000 • Partners share profit and loss equally Profit and Loss Summary L. Cooke, Capital (P32 000 x 50%) D. Kam, Capital (P32 000 x 50%) (To transfer profit to partners’ current accounts) 32 000 L. Cooke, Capital 8 000 D. Kam, Capital 6 000 L. Cooke, Drawings D. Kam, Drawings (To close drawings accounts to current PowerPoint presentation by Dr Anne accounts) Abraham, University of Western Sydney 16 000 16 000 8 000 6 000 25 Dividing profit or loss continued Example2: Assume that Adam and Eve formed a partnership with original capital contributions of P60,000 and P30,000 respectively. The profit agreement is 60% and 40% respectively. During the year, the partnership generated an income of P100,000. a) Give the closing entry for the above problem. b) Assuming instead of profit, it was P100,000 loss. c) Assuming no agreement was made, give the closing entry under assumption (a) and (b) 26 Dividing profit or loss continued Profit-and-loss ratios Typical profit-and loss ratios include: 1 A specified ratio – expressed as a proportion (6:4), a percentage (70% and 30%), or a fraction (2/3 and 1/3) 2 A ratio based on either: – capital balances at beginning of year or – ending capital balances 27 Dividing profit or loss continued 3 Interest on partners’ capital balances and the remainder on a agreed ratio 4 Salaries or Bonus allowed for partner’s services, the remainder to be divided in an agreed ratio 5 Multiple base of allocation Salaries to partners, interest on partners’ capitals, and the remainder on a fixed ratio) 28 Dividing profit or loss continued Sample Problem : Assume that Adam and Eve formed a partnership with original capital contributions of P60,000 and P30,000 respectively. General ledger for their capital accounts before closing entries are shown below: 29 Dividing profit or loss continued During the year Net Income of P100,000 was earned by the partnership. They agreed that profit will be divided: 1. 60% to Adam and 40% to Eve 2. Based on capital ratio: (a.) Beginning capital (b.) Ending capital 3. 10% Interest on beginning capital and the balance will be distributed equally 4. Salary to Eve for P10,000 and the balance distributed 60% for Adam and 40% to Eve. 5. 10% interest on ending capital, salary to Eve for 10,000, 10% bonus based on Net Income before salaries and interest for Adam. The balance will be divided equally. 6. 10% interest on ending capital, salary to Eve for 10,000, 10% bonus based on Net Income after salaries and interest for Adam. The 30 balance will be divided equally Dividing profit or loss continued INSUFFICIENT INCOME As a rule. The prescribed allocation for salaries and/or interest should still be given in spite of the insufficiency of partnership’s net income to cover them. The earnings deficiency resulted for giving salaries and/or interest shall be allocated among the partners based on their profit and loss sharing. 31 Dividing profit or loss continued Insufficient Income • Sample Problem: – M. Kings and S. Lee agree on • Salary allowances of P8400 to Kings and P6000 to Lee • Interest allowances of 10% on beginning capital balances • 10% Bonus to S. Lee • Remainder shared equally – Beginning capital balances • Kings P28 000 and Lee P24 000 – Profit for the year is P5,000 32 Dividing profit or loss continued Division of profit Net Profit to be distributed Salary allowance Interest allowance Kings (P28 000 x 10%) Lee (P24 000 x 10%) Balance: (50:50) Kings (P14,600 x 50%) Lee (P14,600 x 50%) Total division of profit Kings Running bal. P 5,000 P 8,400 P 6,000 (9,400) 2,800 (7,300) Lee 2,400 (12,200) (14,600) (7,300) (7,300) 0 P 3,900 P 1,100 33 Dividing profit or loss continued – Entry to record division of profit Profit and Loss Summary M. Kings, Capital S. Lee, Capital (To close profit to partners’ capital accounts) 5 000 3 900 1 100 34 Review question 4 A. B. C. D. NBC reports net income of P60 000. If partners N, B, and C have an income ratio of 50%, 30%, and 20%, respectively, C’s share of net income is … P30 000 P12 000 P18 000 P20 000 35 Review question 5 A. B. C. D. XYZ reports net loss of P60 000. X initial contributions amounting to P50,000, Y contributes P30,000 and Z contributes his time and service in the business. There is no agreement on how profit and loss will be distributed. How much is the share in the loss of each partner? P37,500, 22,500, 0 P20,000, 20,000, 20,000 P30,000, 30,000, 0 P27,272, 16,364, 16,364 36 Partnership financial statements • Income statement – Identical to proprietorship except for division of profit • Statement of financial position – Identical to proprietorship except for owners’ equity section • Partnership statement of changes in equity – Used to explain the changes in each partner’s capital account and in total partnership equity during the year 37 Partnership financial statements KINGSLEE Statement of Changes in Partners’ Equity For the year ended 31 December 2013 Max Kings Steven Lee Total . Capital, 1 January P 28,000 P 24,000 P 52,000 Add: Share on Profit 12,400 9,600 22,000 Total 40,400 33,600 74,000 Less: Drawings 7,000 5,000 12,000 Capital, 31 December P 33,400 p 28,600 P 62,000 38 Partnership financial statements KINGSLEE Statement of Financial Position (partial) As at 31 December 2013 Total Liabilities(assumed amount) P 115,000 Owners’ Equity Max Kings, Capital P 33,400 Steven Lee, Capital 28,600 Total Owners’ Equity 62,000 TOTAL LIABILITIES AND OWNERS’ EQUITY P 177,000 39 Review question 5 A. B. C. D. Which of the following statements about the partnership financial statements is not true? The capital balances of each partner are shown on the statement of financial position Changes in each partner’s capital account is shown on statement of changes in equity Each partner’s drawings is shown on the statement of financial position Distribution of profit is shown in income statement 40 Partnership dissolution The dissolution of a partnership is the change in the relation of the partners caused by any partner ceasing to be associated in the carrying on of the business. The change of partners in the partnership ends their original agreement, thus terminating the partnership. 41 ADMISSION OF A PARTNER • The admission of a new partner results in legal dissolution of the existing partnership and the beginning of a new one • To recognise economic effects it is necessary only to open a capital account for each new partner • A new partner may be admitted either by: – Purchasing the interest of an existing partner or – Investing assets in a partnership 42 ADMISSION OF A PARTNER continued PowerPoint presentation by Dr Anne Abraham, University of Western Sydney 43 Purchase of a partner’s interest • The admission of a partner by purchase of an interest in the firm is a personal transaction between one or more existing partners and the new partner • Price paid is negotiated and determined by the individuals involved • The price may be equal to or different from the capital equity acquired • Any money or other consideration exchanged is the personal property of the participants and not the property of the partnership 44 Purchase of a partner’s interest continued • Example – Cox agrees to pay P10 000 cash to Adler and Barker each for 1/3 of their interest in the Adler-Barker partnership – At the time of admission of Cox, each partner has a P30 000 capital balance 45 Purchase of a partner’s interest continued – Entry to record admission of Cox • Each partner will give up P10 000 (1/3 x P30 000) C. Adler, Capital 10 000 D. Barker, Capital 10 000 L. Cox, Capital 20 000 (To record admission of Cox by purchase) 46 Purchase of a partner’s interest continued – Ledger balances after purchase of partners’ interest C. Adler, Capital 10 000 30 000 Bal. 20 000 D. Barker, Capital 10 000 30 000 Bal. 20 000 L. Cox, Capital 20 000 – Total partnership capital before and after admission of Cox is P60,000 47 Purchase of a partner’s interest continued Sample Problem2: The capital balances and agreed profit and loss distribution of Eric and Vincent partnership prior to dissolution are as follows: Partners Capital Balances P&L Ratio Vincent 250,000 25% Eric 750,000 75% Lally wants to buy 50% of the interest of Eric to give her interest of 37.5% in the partnership’s asset and in the partnership’s profit and loss. 48 Purchase of a partner’s interest continued Sample Problem2 cont’d... Case 1: Purchase at Book Value: Assume that Lally paid P375,000 directly to Eric. Case 2: Purchase Lesser than Book Value: Assume that Lally paid P350,000 directly to Eric. Case 3: Purchase More than Book Value: Assume that Lally paid P400,000 directly to Eric. What is the journal entry for the admission and what is the 49 new profit and loss ratio of new partnership? Purchase of a partner’s interest continued – Entry to record admission of Lally under case1,2 and 3 • Eric will give up 50% of his share (50% x 750,000) Eric, Capital 375 000 Lally, Capital 375 000 (To record admission of Lally by purchase) Note: 1. Gain or loss in the purchase of interest transaction is a personal gain or loss of the partner/s involved. 2. Total capital before and after admission of Lally is P1,000,000 3. New P&L ratio after admission of Lally: Vincent-25%, Eric50 37.5%, Lally-37.5% Purchase of a partner’s interest continued Sample Problem3: The capital balances and agreed profit and loss distribution of Pat and Sponge partnership prior to dissolution are as follows: Partners Capital Balances P&L Ratio Pat 150,000 30% Sponge 350,000 70% Mr. Crab wants to buy 20% of the interest in the partnership’s asset and profit by paying directly to each of the existing partners. 51 Purchase of a partner’s interest continued Sample Problem3 cont’d... Case 1: Purchase at Book Value: Assume that Mr. Crab paid P100,000 directly to the partners. Case 2: Purchase Lesser than Book Value: Assume that Mr. Crab paid P60,000 directly to the partners. Case 3: Purchase More than Book Value: Assume that Mr. Crab paid P150,000 directly to the partners. What is the journal entry for the admission and what is the 52 new profit and loss ratio of new partnership? Investment of assets in a partnership • When a partner is admitted by investment, both the total assets and the total partnership capital change • When the new partner’s investment differs from the capital equity acquired, the difference is considered a bonus either to: 1. The existing (old) partners or 2. The new partner 53 Investment of assets in a partnership continued • Example – Cox invests P30 000 cash in the Adler-Barker partnership for a 1/3 capital balance – Journal entry to record admission Cash 30 000 L. Cox, Capital 30 000 (To record admission of Cox by investment) 54 Investment of assets in a partnership continued – Ledger balances after investment of assets C. Adler, Capital 30 000 D. Barker, Capital 30 000 L. Cox, Capital 30 000 Total Partnership ‘s Capital 60 000 30 000 Bal. 90 000 55 Investment of assets in a partnership continued Bonus to old partners • Results when new partner’s investment in the firm is greater than the capital credit on the date of admittance • Sample Problem 1: – Boyd and Chan with total capital of P120 000 agree to admit Dante to the partnership – Dante acquires a 25% ownership interest by making a cash investment of P80 000 – Current profit sharing ratio is Boyd 60% and Chan 40% 56 Investment of assets in a partnership continued • Steps in determining bonus 1 Determine the total contributed capital of the new partnership • New partner’s investment + capital of the old partnership • P120 000 + P80 000 = P200 000 2 Determine the new partner’s agreed capital • Multiply the total capital of the new partnership by the new partner’s ownership interest • P200 000 x 25% = P50 000 57 Investment of assets in a partnership continued 3 Determine the amount of bonus • Subtract the new partner’s capital credit from the new partner’s investment • P80 000 - P50 000 = P30 000 4 Allocate the bonus to the old partners on the basis of their original income ratios • Boyd: P30 000 x 60% = P18 000 • Chan: P30 000 x 40% = P12 000 58 Investment of assets in a partnership continued – Entry to record admission of Dante Cash 80 000 S. Boyd, Capital 18 000 T. Chan, Capital 12 000 L. Dante, Capital 50 000 (To record admission of Dante and bonus to old partners) 59 Investment of assets in a partnership continued Bonus to new partner • Results when the new partner’s investment is less than his or her capital credit in the firm • Capital balances of the old partners are decreased based on their income ratios before the admission of the new partner 60 Investment of assets in a partnership continued Bonus to new partner • Sample Problem2: – Boyd and Chan with total capital of P120 000 agree to admit Dante to the partnership – Dante acquires a 25% ownership interest by investing cash of P20 000 – Current profit sharing ratio is Boyd 60% and Chan 40% 61 Investment of assets in a partnership continued – Entry to record admission of Dante Cash 20 000 S. Boyd, Capital 9 000 T. Chan, Capital 6 000 L. Dante, Capital 35 000 (To record admission of Dante and bonus) 62 Investment of assets in a partnership continued Sample Problem 3: The capital balances and agreed profit and loss distribution ratio of the partners before admitting Judy are as follows: Job Capital Balances Profit & Loss Ratio John 120,000 20% Jun Total 240,000 240,000 40% 40% 600,000 100% Judy admitted by investing cash of P200,000 for 30% interest 63 in the partnership assets and profits Investment of assets in a partnership continued Sample Problem 3 cont’d… Required: 1.) Journalized admission of new partner Judy 2.) What is the new profit and loss sharing of the partners? 3.) Assume that Judy admitted by investing cash of P200,000 for 20% interest in the partnership. 64 Review question 6 A. B. C. D. Yen purchases 50% of Baht’s capital interest in the Euro-Baht Partnership for P12 000. If the capital balance of Euro and Baht are P20 000 and P36 000 respectively, Yen’s capital balance following the purchase is … P12 000 P28 000 P10 000 P18 000 65 LIQUIDATION OF A PARTNERSHIP • The liquidation of a partnership terminates the business • In a liquidation, it is necessary to: 1 Sell noncash assets for cash and recognise a gain or loss on realisation 2 Allocate gain/loss on realisation to the partners based on their profit-and-loss ratios 3 Pay partnership liabilities in cash 4 Distribute remaining cash to partners on the basis of their capital balances 66 LIQUIDATION OF A PARTNERSHIP continued • Creditors must be paid before partners receive any cash distributions • Each step must be recorded by an accounting entry • No capital deficiency means that all partners have credit balances in their capital accounts • Capital deficiency means at least one partner’s account has a debit balance 67