corporation

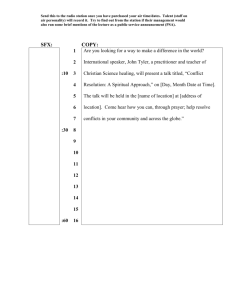

advertisement

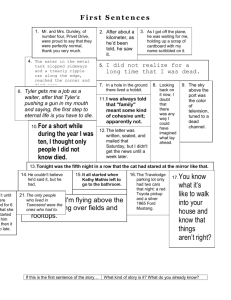

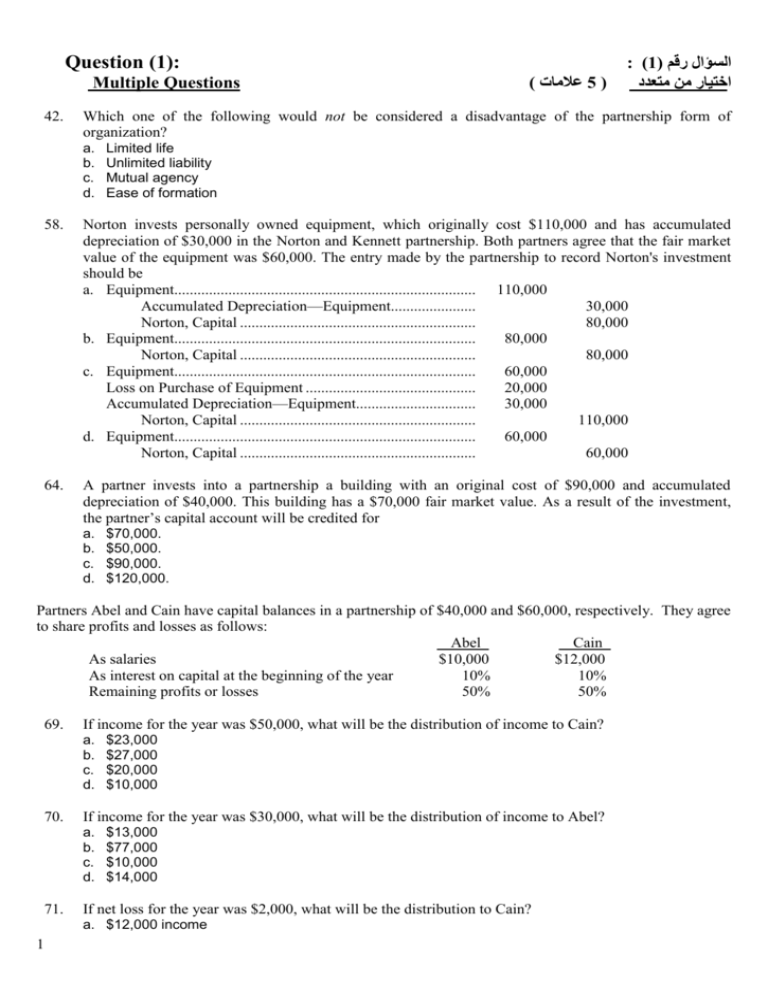

Question (1): Multiple Questions 42. ) عالمات5 ( : )1( السؤال رقم اختيار من متعدد Which one of the following would not be considered a disadvantage of the partnership form of organization? a. b. c. d. Limited life Unlimited liability Mutual agency Ease of formation 58. Norton invests personally owned equipment, which originally cost $110,000 and has accumulated depreciation of $30,000 in the Norton and Kennett partnership. Both partners agree that the fair market value of the equipment was $60,000. The entry made by the partnership to record Norton's investment should be a. Equipment.............................................................................. 110,000 Accumulated Depreciation—Equipment...................... 30,000 Norton, Capital ............................................................. 80,000 b. Equipment.............................................................................. 80,000 Norton, Capital ............................................................. 80,000 c. Equipment.............................................................................. 60,000 Loss on Purchase of Equipment ............................................ 20,000 Accumulated Depreciation—Equipment............................... 30,000 Norton, Capital ............................................................. 110,000 d. Equipment.............................................................................. 60,000 Norton, Capital ............................................................. 60,000 64. A partner invests into a partnership a building with an original cost of $90,000 and accumulated depreciation of $40,000. This building has a $70,000 fair market value. As a result of the investment, the partner’s capital account will be credited for a. b. c. d. $70,000. $50,000. $90,000. $120,000. Partners Abel and Cain have capital balances in a partnership of $40,000 and $60,000, respectively. They agree to share profits and losses as follows: Abel Cain As salaries $10,000 $12,000 As interest on capital at the beginning of the year 10% 10% Remaining profits or losses 50% 50% 69. If income for the year was $50,000, what will be the distribution of income to Cain? a. b. c. d. 70. If income for the year was $30,000, what will be the distribution of income to Abel? a. b. c. d. 71. $23,000 $27,000 $20,000 $10,000 $13,000 $77,000 $10,000 $14,000 If net loss for the year was $2,000, what will be the distribution to Cain? a. $12,000 income 1 b. $1,000 income c. $1,000 loss d. $2,000 loss Use the following information for questions 115–116. Carley and Kingman are partners who share income and losses in the ratio of 3:2, respectively. On August 31, their capital balances were: Carley, $175,000 and Kingman, $150,000. On that date, they agree to admit Lerner as a partner with a one-third capital interest. a 115. If Lerner invests $125,000 in the partnership, what is Carley's capital balance after Lerner's admittance? a. b. c. d. a $150,000 $158,333 $160,000 $175,000 116. If Lerner invests $200,000 in the partnership, what is Kingman's capital balance after Lerner's admittance? a. b. c. d. $175,000 $160,000 $157,500 $150,000 a 127. Which of the following is correct when admitting a new partner into an existing partnership? Purchase of an Interest Admission by Investment a. Total net assets unchanged unchanged b. Total capital increased unchanged c. Total net assets unchanged increased d. Total capital unchanged unchanged a 134. When a partner withdraws from the firm, which of the following reflects the correct partnership effects? Payment from Payment from Partners' Personal Assets Partnership Assets a. Total net assets decreased decreased b. Total capital decreased decreased c. Total net assets unchanged decreased d. Total capital unchanged unchanged ANSWER FORM Q:1 Q:2 Q:3 Q:4 Q:5 SECOND Category : practical applications and analysis skills The aim from these questions is to asses the students ability to analyze and comprehend Information In addition to his ability to apply the Information in a practical way . Q:6 Q:7 Q:8 Q : 9 Q : 10 أسئلة الجانب التطبيقي وقياس قدرة الطالب على التحليل واالستنتاج: الفئة الثانية الهدف من هذا النوع من األسئلة هو فحص قدرة الطالب على التحليل واالستنتاج ومقدار .مهارته في الربط بين المعلومات النظرية التي درسها والجانب التطبيقي العملي للمادة Ex. 165 Hope & Crosby Co. reports net income of $34,000. The partnership agreement provides for annual salaries of $24,000 for Hope and $15,000 for Crosby and interest allowances of $4,000 to Hope and $6,000 to Crosby. Any remaining income or loss is to be shared 70% by Hope and 30% by Crosby. Instructions 2 Compute the amount of net income distributed to each partner. Solution 165 (8 min.) Salary allowance Interest allowance Total salaries and interest Remaining deficiency ($15,000) Hope ($15,000 × 70%) Crosby ($15,000 × 30%) Total division Hope $24,000 4,000 28,000 Crosby $15,000 6,000 21,000 Total $39,000 10,000 49,000 (4,500) $16,500 (15,000) $34,000 (10,500) $17,500 Ex. 168 Prepare a partners' capital statement for Crestwood Company based on the following information. Crest Wood Beginning capital $30,000 $27,000 Drawings during year 15,000 8,000 Net income was $35,000, and the partners share income 60% to Crest and 40% to Wood. Solution 168 (8 min.) CRESTWOOD COMPANY Partners' Capital Statement Beginning capital Add: Net income Less: Drawings Ending capital Crest $30,000 21,000 51,000 15,000 $36,000 Wood $27,000 14,000 41,000 8,000 $33,000 THIRD Category : Unfamiliar problems solving The aim from these questions is to asses the students ability to use the information he learned to solve unfamiliar problems which appear in life and the degree of intelligence to deal with it . Total $57,000 35,000 92,000 23,000 $69,000 الفئة الثالثة: أسئلة الذكاء والقدرة على. حل المشكالت العملية الهدف من هذا النوع من األسئلة هو فحص قدرة الطالب على استخدام المعلومات التي درسها . لحل المشكالت غير المألوفة التي تظهر في الواقع العملي ودرجة الذكاء في التعامل معها Ex. 171 The ODS Partnership is to be liquidated when the ledger shows the following: Cash Noncash Assets Liabilities Oslo, Capital Decker, Capital Silas, Capital $ 50,000 200,000 50,000 75,000 100,000 25,000 Oslo, Decker, and Silas' income ratios are 6:3:1, respectively. Instructions Prepare separate entries to record the liquidation of the partnership assuming that the noncash assets are sold for $150,000 in cash. 3 Solution 171 (15 min.) 1. Cash ................................................................................................... Loss on Realization ........................................................................... Noncash Assets ......................................................................... 150,000 50,000 2. Oslo, Capital ($50,000 × 6/10) .......................................................... Decker, Capital ($50,000 × 3/10) ...................................................... Silas, Capital ($50,000 × 1/10) .......................................................... Loss on Realization .................................................................. 30,000 15,000 5,000 3. Liabilities ........................................................................................... Cash .......................................................................................... 50,000 4. Oslo, Capital ($75,000 – $30,000) .................................................... Decker, Capital ($100,000 – $15,000) .............................................. Silas, Capital ($25,000 – $5,000) ...................................................... Cash ($50,000 + $150,000 – $50,000) ..................................... 45,000 85,000 20,000 200,000 50,000 50,000 150,000 a Ex. 174 The Howell and Parks Partnership has partner capital account balances as follows: Howell, Capital Parks, Capital $550,000 250,000 The partners share income and losses in the ratio of 60% to Howell and 40% to Parks. Instructions Prepare the journal entry on the books of the partnership to record the admission of Tyler as a new partner under the following three independent circumstances. 1. Tyler pays $350,000 to Howell and $150,000 to Parks for one-half of each of their ownership interest in a personal transaction. 2. Tyler invests $850,000 in the partnership for a one-third interest in partnership capital. 3. Tyler invests $175,000 in the partnership for a one-third interest in partnership capital. a Solution 174 1. (20 min.) Howell, Capital ............................................................................... Parks, Capital .................................................................................. Tyler, Capital ......................................................................... (To record admission of Tyler by purchase) 275,000 125,000 400,000 Total net assets and total capital of the partnership do not change. 2. Cash ................................................................................................ Howell, Capital ...................................................................... Parks, Capital ......................................................................... Tyler, Capital ......................................................................... (To record admission of Tyler and bonus to old partners) Total capital of existing partnership Investment by new partner, Tyler 4 850,000 180,000 120,000 550,000 $ 800,000 850,000 Total capital of new partnership $1,650,000 Tyler's capital credit = $1,650,000 × 1/3 = $550,000 Tyler's investment Tyler's capital credit Bonus to old partners $850,000 550,000 $300,000 Allocation to old partners Howell (60% × $300,000) Parks (40% × $300,000) 3. a $180,000 120,000 $300,000 Cash ................................................................................................ Howell, Capital ............................................................................... Parks, Capital .................................................................................. Tyler, Capital ......................................................................... (To record Tyler's admission and bonus) Solution 174 325,000 (cont.) Total capital of existing partnership Investment by new partner, Tyler Total capital of new partnership $800,000 175,000 $975,000 Tyler's capital credit = $975,000 × 1/3 = $325,000 Bonus to Tyler ($325,000 – $175,000) = $150,000 Reduction of old partners' capital Howell ($150,000 × 60%) Parks ($150,000 × 40%) 5 175,000 90,000 60,000 $ 90,000 60,000 $150,000