An Information Technology Perspective of Sarbanes

advertisement

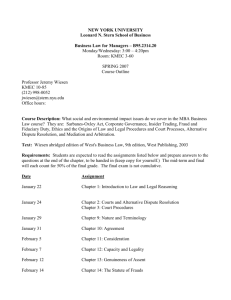

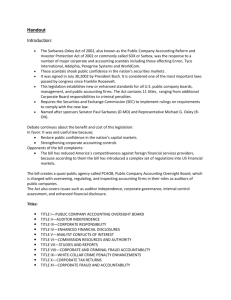

An Information Technology Perspective of Sarbanes-Oxley David M. Cannon, Ph.D., CPA (Ohio), CCP Assistant Professor Department of Accounting and Taxation Grand Valley State University West Michigan Accounting and Auditing Symposium May 27, 2004 Primary Sarbanes-Oxley Sections Relevant to IT • Section 302 – CEOs and CFO must attest to accuracy of financial statements (a)(2) – CEO and CFO must certify that to their knowledge, quarterly and annual reports contain no untrue statement of a material fact or fails to omit material fact – CEOs and CFO must certify that • they are responsible for internal controls (a)(4)(A) • that the controls are designed such that material information is made known to the CEO and CFO (a)(4)(B) • that they have evaluated the effectiveness of internal control within 90 days prior to quarterly and annual reports (a)(4)(C) Primary Sarbanes-Oxley Sections Relevant to IT • Section 404 – Annual report must contain a report on the effectiveness of internal control – external auditor must provide assurance on internal control report • Section 409 – Real time disclosure requirements for “material changes in the financial condition or operations” Pervasiveness of IT in business processes • IT is critical to financial business processes in all but tiniest organizations • Many significant transactions entered into and/or processed without human intervention – Stock trades – Goods Orders – Payments for Goods and Services Pervasiveness of IT in business processes (continued) • Trend toward integrated, inter-enterprise systems – Supply Chain Management (SCM) – Electronic Data Interchange (EDI) – eXtensible Markup Language (XML) – eXtensible Business Reporting Language (XBRL) – Enterprise Application Integration (EAI) Pervasiveness of IT in business processes (continued) • Real-time, integrated global systems now common • Current emphasis is on advance specification of business rules instead of human judgements on individual transactions Basic Perspective Differences Between IT and Finance Organizational Perspective • IT typically views individual information systems in isolation Risk Perspective • IT is concerned with information technology operational and systems development risks • Finance is concerned with the entire reporting entity • Finance is concerned with financial risk and reporting risk Characteristics of Section 302 & 404 Compliant Systems • Well-defined and documented • Transparent • Accurate • Verifiable Based on Sarbanes-Oxley and insurance IT: think you don’t have to worry? RebusIS Insurance Solutions White Paper Well-defined and documented processes Documentation of business processes often – – – – – Incomplete Inconsistent Obsolete Obscured Just plain wrong • Internal control documentation situation is • worse Repeatability lacking for manual processes Well-defined and documented processes (continued) • What about non-routine processes? • How do we ensure that changes in business processes are documented? • What about outsourced processes? Transparency • Most financial controls are embedded within information systems and require specialized IT knowledge to identify, understand and test – – – – – – Parameter files (Software, Hardware and Network) Program source code Job Control Language (JCL), Scripts Scheduling Software (ex: CA-7) Access Control Software (ex: RACF) Change Control Software (ex: Librarian) Transparency • Many business processes cross organizational boundaries – – – – – Outsourcing Enterprise Application Integration (EAI) Supply Chain Management (SCM) eXtensible Markup Language (XML) eXtensible Business Reporting Language (XBRL) • Are the processes used by external entities to • implement outsourced business processes known, visible and documented? Are the controls over such processes known, visible and documented? Accuracy • Does a company’s business processes result in the “right number” being reported? (Reliability) – Human error – System design deficiencies – Program bugs – System operational errors Accuracy • Is there repeatability (stability) in the processes? Potential problems: – Manual entries – Spreadsheets – Manual procedures and processes Verifiability • Does the information system provide the information required to verify how the reported numbers are produced? – Audit trails – Change control system(s) – Business process and control documentation tracking systems Section 409 Compliance Issues • Diversity of operating environments – – – – – – Multiple vendors Multiple platforms Operating systems Programming languages Networks System operating cycles • Batch vs. real-time • Daily, weekly, monthly cycles • Ad Hoc Interfaces between business • processes Manual Procedures Technologies conducive to Section 409 compliance • ERP systems • Real-Time systems • Middleware • Data Warehouses • Data Marts • Section 409 Reporting systems Information Technology Cultural Issues • • • • • • Lack of domain knowledge Preference for “elegant” solutions Preference for new and emerging technologies Focus on individual tasks instead of the big picture Sense that organizational rules don’t always apply to IT The “others just don’t get it” The Information Technology Function’s Role Pre-Sarbanes-Oxley: • IT is responsible solely for controls over IT operational processes – controls over IT operations – controls over IT development – general controls over IT function processes • Financial controls are outside IT domain – view often promoted by finance/accounting – controls are merely application function to IT The Information Technology Function’s Role (continued) Pre-Sarbanes-Oxley: • “no need for IT to have basic understanding of business processes” – “business process is within functional domain” – “tell us what you want and we’ll build it” – “system meets specifications” … but not necessarily business requirements The Information Technology Function’s Role (continued) Pre-Sarbanes-Oxley: • “no need to understand financial controls” – viewed as functional requirement of application – few IT professionals have formal training in internal control – assumes that choice of technical design and implementation has no effect on controls The Information Technology Function’s Role (continued) Pre-Sarbanes-Oxley: • controls often viewed by IT as separate from business process rather than integral to process • IT’s Risk perspective limited to – IT security risks – IT operational risks • IT TYPICALLY HAS LITTLE OR NO KNOWLEDGE OR CONSIDERATION OF FINANCIAL REPORTING RISK! What can IT do to comply with Sarbanes-Oxley? • Understand that the rules have changed – Business processes and their controls must be continuously transparent – Controls must be viewed as an essential component of systems – Complete, correct, and up-to-date documentation is no longer simply a good practice, it is critically necessary – IT Governance is here and now What can IT do to comply with Sarbanes-Oxley? • Understand that the rules have changed (continued) – Financial reporting risk must be considered in all IT decisions • Outsourcing and inter-enterprise integration • Choice of technology • Systems design, implementation and maintenance • Vendor selection – IT professionals must have a basic understanding of business processes and financial controls What can IT do to comply with Sarbanes-Oxley? • Insist on full representation on and participation • • in Sarbanes-Oxley compliance projects Provide technical expertise to assist in the documenting of controls Assist in the selection and implementation of Sarbanes-Oxley compliance tools – – – – Business Process Management (BPM) tools Document management tools Data mining applications Monitoring tools (dashboards, exception reporting systems) What can IT do to comply with Sarbanes-Oxley? (continued) • Request the internal audit function to facilitate a control self-assessment • Adopt a Comprehensive IT Control Framework – Control Objectives for Information Technology (COBIT) The good news for IT . . . “There is no discretionary spending where the alternative is a prison sentence.” From Sarbanes-Oxley and insurance IT: think you don’t have to worry? RebusIS Insurance Solutions White Paper Questions?