IFM10 Ch20 Lecture

advertisement

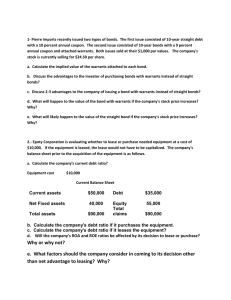

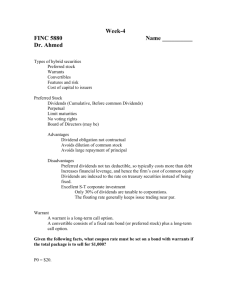

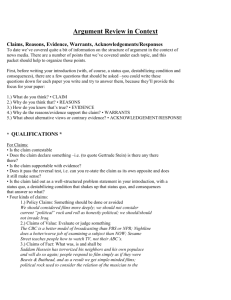

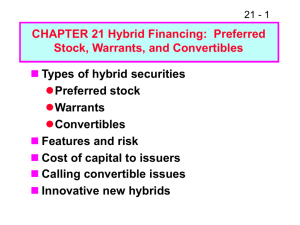

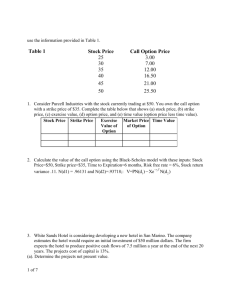

CHAPTER 20 Hybrid Financing: Preferred Stock, Warrants, and Convertibles 1 Topics in Chapter Types of hybrid securities Preferred stock Warrants Convertibles Features and risk Cost of capital to issuers 2 How does preferred stock differ from common stock and debt? Preferred dividends are specified by contract, but they may be omitted without placing the firm in default. Most preferred stocks prohibit the firm from paying common dividends when the preferred is in arrears. Usually cumulative up to a limit. (More...) 3 Some preferred stock is perpetual, but most new issues have sinking fund or call provisions which limit maturities. Preferred stock has no voting rights, but may require companies to place preferred stockholders on the board (sometimes a majority) if the dividend is passed. Is preferred stock closer to debt or common stock? What is its risk to investors? To issuers? 4 Advantages and Disadvantages of Preferred Stock Advantages Dividend obligation not contractual Avoids dilution of common stock Avoids large repayment of principal Disadvantages Preferred dividends not tax deductible, so typically costs more than debt Increases financial leverage, and hence the firm’s cost of common equity 5 Floating Rate Preferred Dividends are indexed to the rate on treasury securities instead of being fixed. Excellent S-T corporate investment: Only 30% of dividends are taxable to corporations. The floating rate generally keeps issue trading near par. 6 However, if the issuer is risky, the floating rate preferred stock may have too much price instability for the liquid asset portfolios of many corporate investors. 7 How can a knowledge of call options help one understand warrants and convertibles? A warrant is a long-term call option. A convertible consists of a fixed rate bond (or preferred stock)plus a longterm call option. 8 What coupon rate must be set on the following bond with warrants if the total package is to sell for $1,000? P0 = $20. rd of 20-year annual payment bond without warrants = 10%. 45 warrants with a strike price (also called an exercise price) of $25 each are attached to bond. Each warrant’s value is estimated to be $3. 9 Step 1: Calculate VBond VPackage = VBond + VWarrants = $1,000. VWarrants = 45($3) = $135. VBond + $135 = $1,000 VBond = $865. 10 Step 2: Find Coupon Payment and Rate 20 12 -865 N I/YR PV 1000 PMT FV Solve for payment = 84 Therefore, the required coupon rate is $84/$1,000 = 8.4%. 11 If after issue the warrants immediately sell for $5 each, what would this imply about the value of the package? At issue, the package was actually worth: VPackage = $865 + 45($5) = $1,090. This is $90 more than the selling price. (More...) 12 The firm could have set lower interest payments whose PV would be smaller by $90 per bond, or it could have offered fewer warrants and/or set a higher strike price. Under the original assumptions, current stockholders would be losing value to the bond/warrant purchasers. 13 Assume that the warrants expire 10 years after issue. When would you expect them to be exercised? Generally, a warrant will sell in the open market at a premium above its value if exercised (it can’t sell for less). Therefore, warrants tend not to be exercised until just before expiration. (More...) 14 In a stepped-up strike price (also called a stepped-up exercise price), the strike price increases in steps over the warrant’s life. Because the value of the warrant falls when the strike price is increased, step-up provisions encourage in-the-money warrant holders to exercise just prior to the step-up. Since no dividends are earned on the warrant, holders will tend to exercise voluntarily if a stock’s payout ratio rises enough. 15 Will the warrants bring in additional capital when exercised? When exercised, each warrant will bring in an amount equal to the strike price, $25. This is equity capital and holders will receive one share of common stock per warrant. The strike price is typically set some 20% to 30% above the current stock price when the warrants are issued. 16 Because warrants lower the cost of the accompanying debt issue, should all debt be issued with warrants? No. As we shall see, the warrants have a cost which must be added to the coupon interest cost. 17 What is the expected return to the bondwith-warrant holders (and cost to the issuer)? You need to estimate when the warrants are likely to be exercised and the expected stock price on that exercise date. (More...) 18 The stock (currently $20) is expected to grow at a rate of 8% per year The company will exchange stock worth $43.18 for one warrant plus $25. The opportunity cost to the company is $43.18 - $25.00 = $18.18 per warrant. Bond has 45 warrants, so the opportunity cost per bond = 45($18.18) = $818.10. 19 Here are the cash flows on a time line: 0 1 +1,000 -84 9 -84 10 11 -84 -84 -818.10 19 20 -84 -84 - 1,000 -902.10 - 1,084 Input the cash flows into a calculator to find IRR = 11.93%. This is the pre-tax cost of the bond and warrant package. (More...)20 The cost of the bond with warrants package is higher than the 10% cost of straight debt because part of the expected return is from capital gains, which are riskier than interest income. The cost is lower than the cost of equity because part of the return is fixed by contract. (More...) 21 When the warrants are exercised, there is a wealth transfer from existing stockholders to exercising warrant holders. But, bondholders previously transferred wealth to existing stockholders, in the form of a low coupon rate, when the bond was issued. 22 At the time of exercise, either more or less wealth than expected may be transferred from the existing shareholders to the warrant holders, depending upon the stock price. At the time of issue, on a risk-adjusted basis, the expected cost of a bond-withwarrants issue is the same as the cost of a straight-debt issue. 23 Assume the following convertible bond data: 20-year, 8.5% annual coupon, callable convertible bond will sell at its $1,000 par value; straight debt issue would require a 10% coupon. Call protection = 5 years and call price = $1,100. Call the bonds when conversion value > $1,200, but the call must occur on the issue date anniversary. P0 = $20; D0 = $1.00; g = 8%. Conversion ratio = CR = 40 shares. 24 What conversion price (Pc) is built into the bond? Par value Pc = # Shares received = $1,000 = $25 . 40 Like with warrants, the conversion price is typically set 20%-30% above the stock price on the issue date. 25 What is (1) the convertible’s straight debt value and (2) the implied value of the convertibility feature? Straight debt value: 20 N 10 I/YR PV 85 PMT 1000 FV Solution: -872.30 26 Implied Convertibility Value Because the convertibles will sell for $1,000, the implied value of the convertibility feature is: $1,000 - $872.20 = $127.70. The convertibility value corresponds to the warrant value in the previous example. 27 What is the formula for the bond’s expected conversion value in any year? Conversion value = CVt = CR(P0)(1 + g)t. For t = 0: CV0 = 40($20)(1.08)0 = $800. For t = 10: CV10 = 40($20)(1.08)10 = $1,727.14. 28 What is meant by the floor value of a convertible? What is the floor value at t = 0? At t = 10? The floor value is the higher of the straight debt value and the conversion value. Straight debt value0 = $872.30. CV0 = $800. Floor value at Year 0 = $872.30. 29 Straight debt value10 = $907.83. CV10 = $1,727.14. Floor value10 = $1,727.14. A convertible will generally sell above its floor value prior to maturity because convertibility constitutes a call option that has value. 30 If the firm intends to force conversion on the first anniversary date after CV >$1,200, when is the issue expected to be called? N 8 I/YR -800 PV 0 PMT 1200 FV Solution: n = 5.27 Bond would be called at t = 6 since call must occur on anniversary date. 31 What is the convertible’s expected cost of capital to the firm? 0 1,000 1 -85 2 3 4 5 6 -85 -85 -85 -85 -85 -1,269.50 -1,354.50 CV6 = 40($20)(1.08)6 = $1,269.50. Input the cash flows in the calculator and solve for IRR = 11.8%. 32 Does the cost of the convertible appear to be consistent with the costs of debt and equity? For consistency, need rd < rc < rs. Why? (More...) 33 Check the values: rd = 10% and rc = 11.8% rs = D0(1 + g) P0 +g= $1.00(1.08) $20 + 0.08 = 13.4% Since rc is between rd and rs, the costs are consistent with the risks. 34 WACC Effects Assume the firm’s tax rate is 40% and its capital structure consists of 50% straight debt and 50% equity. Now suppose the firm is considering either: (1) issuing convertibles, or (2) issuing bonds with warrants. Its new target capital structure will have 40% straight debt, 40% common equity and 20% convertibles or bonds with warrants. What effect will the two financing alternatives have on the firm’s WACC? 35 Convertibles Step 1: Find the after-tax cost of the convertibles. 0 1 1,000 -51 2 3 -51 -51 4 5 -51 -51 6 -51 -1,269.50 -1,320.50 INT(1 - T) = $85(0.6) = $51. With a calculator, find: rc (AT) = IRR = 8.71%. 36 Convertibles Step 2: Find the after-tax cost of straight debt. rd (AT) = 10%(0.06) = 6.0%. 37 Convertibles Step 3: Calculate the WACC. WACC (with convertibles) = 0.4(6.0%) + 0.2(8.71%) + 0.4(13.4%) = 9.5%. WACC (without = 0.5(6.0%) + 0.5(13.4%) convertibles) = 9.7%. 38 Some notes: We have assumed that rs is not affected by the addition of convertible debt. In practice, most convertibles are subordinated to the other debt, which muddies our assumption of rd = 10% when convertibles are used. When the convertible is converted, the debt ratio would decrease and the firm’s financial risk would decline. 39 Warrants Step 1: Find the after-tax cost of the bond with warrants. 0 +1,000 1 ... -50.4 9 -50.4 10 -50.4 -818.10 -868.50 11 -50.4 ... 19 20 -50.4 -50.4 -1,000.0 -1,060.0 INT(1 - T) = $84(0.60) = $50.4. # Warrants(Opportunity loss per warrant) = 45($18.18) = $818.10. Solve for: rw (AT) = 8.84%. 40 Warrants Step 2: Calculate the WACC if the firm uses warrants. WACC (with warrants) = 0.4(6.0%) + 0.2(8.84%) + 0.4(13.4%) = 9.53%. WACC (without = 0.5(6.0%) + 0.5(13.4%) warrants) = 9.7%. 41 Besides cost, what other factors should be considered? The firm’s future needs for equity capital: Exercise of warrants brings in new equity capital. Convertible conversion brings in no new funds. In either case, new lower debt ratio can support more financial leverage. (More...) 42 Does the firm want to commit to 20 years of debt? Convertible conversion removes debt, while the exercise of warrants does not. If stock price does not rise over time, then neither warrants nor convertibles would be exercised. Debt would remain outstanding. 43 Recap the differences between warrants and convertibles. Warrants bring in new capital, while convertibles do not. Most convertibles are callable, while warrants are not. Warrants typically have shorter maturities than convertibles, and expire before the accompanying debt. (More...) 44 Warrants usually provide for fewer common shares than do convertibles. Bonds with warrants typically have much higher flotation costs than do convertible issues. Bonds with warrants are often used by small start-up firms. Why? 45 How do convertibles help minimize agency costs? Agency costs due to conflicts between shareholders and bondholders Asset substitution (or bait-and-switch). Firm issues low cost straight debt, then invests in risky projects Bondholders suspect this, so they charge high interest rates Convertible debt allows bondholders to share in upside potential, so it has low rate. 46 Agency Costs Between Current Shareholders and New Shareholders Information asymmetry: company knows its future prospects better than outside investors Outside investors think company will issue new stock only if future prospects are not as good as market anticipates Issuing new stock send negative signal to market, causing stock price to fall 47 Company with good future prospects can issue stock “through the back door” by issuing convertible bonds Avoids negative signal of issuing stock directly Since prospects are good, bonds will likely be converted into equity, which is what the company wants to issue 48