PowerPoint w/notes - MnSCU Finance

advertisement

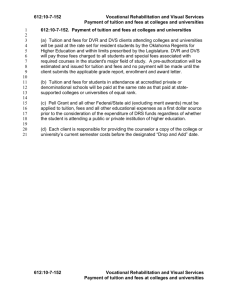

System Finances (Finance 101) Board of Trustees October 2014 The Minnesota State Colleges and Universities system is an Equal Opportunity employer and educator. Agenda Introduce board policy framework Review major trends Provide overview of the system’s operating budget and capital investment program 2 Board policy framework 3 Board financial responsibilities Provide oversight Set policy Approve certain decisions 4 Decisions requiring board approval Revenue and expenditure annual operating budget plans - establishment of financial management policies including the reserve policy acceptance and release of annual audited financial statements Biennial budget requests -tuition and fee rates - optional fee maximums room and board rates - student union facilities fees Contracts of three million dollars or more (policy change to $1M pending) - sale or disposition of real property -retirement program administration and oversight Criteria for multi-year capital budgets -prioritized multi-year capital investment program -revenue fund debt management and all bond sales System information technology long range strategic plan -approval of finance and IT related policies 5 Financial authorities the board has delegated to the chancellor Procurement and professional/technical contracts over $100,000 less than $3M (change to $1M under board consideration) Master facilities plan for the colleges/universities Execution and delivery of all documents regarding the acquisition, disposal, transfer or leasing of real property after Board approval Systemwide reserve and institutional reserves per board policy Oversight of college/university financial management Naming of buildings, sites and common areas Master technology plans for colleges/universities Development and management of acceptable use procedure for information technology related resources and assets 6 Financial authorities the chancellor has delegated to the presidents Administrative and financial management Budget monitoring Composite financial index oversight Purchases and professional/technical contracts Up to $100,000 Optional fees up to Board-approved maximums Individual tuition and fee waivers per policy Fundraising for the college/university Acceptance of gifts & grants, except for real property Leasing real property College/university financial reporting 7 Vice chancellor assurance practices Annual financial reviews with campus leadership Monthly, quarterly and semiannual monitoring reports Watch list and work out protocols Regional financial and facilities quarterly management meetings Facilities program management reviews Strong communication systems 8 Board financial risk management strategy Annual financial statement/audit discipline Operating budget reserves maintenance/improvement policy Unrestricted net asset improvements Composite financial index improvements Capital improvements tied to facilities condition index 9 Major trends 10 Revenue drivers State economic outlook Public support for public higher education Tuition rate and competitive environment Overall enrollment Federal and state financial aid funding policy 11 Cost drivers Negotiated contracts (salaries and benefits) Enrollments Health care costs (employer-paid insurance cost) Technology (investments in new technology and system maintenance) Size of campus physical plants, building operations, maintenance and preservation 12 Primary dynamics Enrollment – local management within system strategic framework Tuition and revenue – board establishes rates, colleges/universities collect and spend Financial aid revenue – state and federal program guidelines Gifts and fund raising – colleges/universities solicit and spend State support – established by legislature, allocated per board approved method Wage and benefit costs – based upon state or board approved systemwide contracts 13 FYE enrollment grew rapidly but has fallen since its peak in 2011 170,000 157,903 160,000 153,447 150,000 FYE 144,609 143,924 140,000 130,000 135,494 142,274 135,839 132,586 120,000 110,000 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 est est Fiscal Year 14 Tuition revenue and state support per FYE remains stable in constant dollars $11,000 $9,679 $10,000 $9,950 $9,240 $8,811 $9,000 $8,501 $8,000 $7,187 $7,000 $8,917 $7,445 $7,586 $7,187 $7,756 $7,280 $7,091 $6,992 $7,331 $7,388 $6,000 $5,000 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 est est Actual 15 Constant Dollars State support increasing Changing relationship between tuition and state support 100% 90% 80% 70% 66.3% 60.1% 55.3% 60% 55.2% 52.6% 58.0% 56.1% 51.4% 50% 44.7% 40% 47.4% 48.6% 44.8% 33.7% 39.9% 42.0% 43.9% 30% 20% Tuition Appropriation 10% 0% 2002 16 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 est 2015 est State support per student FYE has begun to improve in constant dollars, but is still 32% below 2002 levels $6,000 $5,000 $4,766 $4,368 $3,994 $4,000 $3,863 $3,924 $3,000 $3,980 $3,715 $3,847 $3,079 $3,261 $3,070 $3,247 $2,787 $2,813 $2,000 $1,000 $2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 est est 17 Anoka-Ramsey CC Pine Technical Lake Superior College Hennepin Technical Saint Paul College Fond du Lac Tribal&CC Inver Hills CC Mesabi Range CC St. Cloud T&CC Itasca CC Hibbing CC Vermillion CC Rainy River CC MN State C&TC Century College South Central College Alexandria T&CC Ridgewater College Central Lakes College North Hennepin CC Northwest Technical Riverland CC Northland C&TC Rochester C&TC MN West C&TC MN State -SE Technical Dakota County TC Normandale CC Anoka Technical Metropolitan State St. Cloud State MSU, Mankato Bemidji State Winona State MSU Moorhead Southwest MN State U of M Crookston NW Health Sciences Martin Luther U of M Morris U of M Duluth U of M Rochester Rasmussen College U of M Twin Cities Walden Mpls Business College Capella Crossroads Oak Hills Duluth Business Argosy, Twin Cities Globe MN School of Business North Central Concordia, St. Paul Dunwoody Institute of Production & Recording Crown Art Institutes, MN Bethany Northwestern St. Mary's St. Scholastica Bethel St. Catherine Mpls Art & Design Concordia, Moorhead Augsburg Hamline St. Thomas St. John's St. Benedict Gustavus St. Olaf Macalaster Carleton 2013-14 Tuition and Required Fees Minnesota’s most affordable higher education option $50,000 Minnesota State Colleges and Universities 18 $45,000 Most Expensive $40,000 Private colleges and universities; University of Minnesota $35,000 $30,000 $25,000 $20,000 $15,000 Least Expensive $10,000 $5,000 College/University Source: Chronicle of Higher Education, October 23, 2013 $0 Tuition & Fees as % of Median Income Affordability: Tuition & fees as a percent of median income 40% 33.2% 30% 27.7% 28.0% 28.9% 34.4% 36.9% 35.5% 35.0% 14.3% 14.4% 15.0% 29.1% 20% 10.7% 10.9% 10% 11.6% 12.8% 13.6% 6.4% 6.4% 6.7% 6.8% 7.3% 7.5% 7.7% 7.7% 8.1% 4.9% 4.9% 5.1% 5.1% 5.4% 5.6% 5.7% 5.7% 5.9% 2006 2007 2008 2009 2010 2011 2012 2013 0% 2005 19 11.2% 37.0% 14.8% 8.0% 5.8% 2014 State Colleges State Universities University of Minnesota Private Colleges and Universities Source: System Office Research – Academic and Student Affairs Estimated net student tuition cost in fiscal year 2015 2014-2015 tuition rate for full-time students (30 Credits - 15 per term) minus estimated state and Pell grants State Universities State Colleges Income Levels for State Grant Recipients Average 2014-2015 Student Tuition Cost Income Levels for State Grant Recipients Average 2014-2015 Student Tuition Cost Less than $20,000 $626 Less than $20,000 $801 $20,000 to $39,999 $1,197 $20,000 to $39,999 $1,254 $40,000 to $59,999 $2,062 $40,000 to $59,999 $2,671 $60,000 and above $3,134 $60,000 and above $4,419 Average for all state grant recipients $1,247 Average for all state grant recipients $2,022 Non-state grant recipients $4,816 Non-state grant recipients $6,782 20 Inflation adjusted expenses per FYE remain below pre-recession levels $12,000 $11,000 $10,277 $10,249 $9,967 $10,000 $9,719 $10,052 $10,145 $10,313 $9,599 $9,582 $9,442 $9,325 $8,981 $9,000 $8,000 $7,000 $6,000 FY2002 21 FY2003 FY2004 FY2005 FY2006 FY2007 FY2008 FY2009 FY2010 FY2011 FY2012 FY2013 Institutional support expenses per FYE $1,700 $1,600 $1,500 $1,455 $1,400 $1,398 $1,456 $1,436 $1,417 $1,381 $1,357 $1,342 $1,327 $1,300 $1,259 $1,200 $1,100 $1,000 FY2008 FY2009 FY2010 Actual 22 FY2011 Adjusted for inflation FY2012 FY2013 Reduction in the size of the system office $45 3.8% 3.7% 43.5 3.6% $43 3.6% $41 41.0 3.4% 40.5 39.4 Appropriation in Millions $39 3.2% 38.8 3.2% 3.1% $37 36.7 39.8 39.0 3.2% 3.1% 36.7 37.1 3.0% 3.0% $35 2.9% 2.8% 33.1 $33 33.1 2.6% 2.6% $31 2.4% $29 2.3% 2.3% 2.2% 2.2% $27 $25 2.0% FY2002 FY2003 FY2004 FY2005 FY2006 System Office Appropriation 23 FY2007 FY2008 FY2009 FY2010 FY2011 FY2012 System Office Percentage of Systemwide GEN Revenue FY2013 Institutional spending restraint continues System ranks 38th out of 51 in institutional spending per FYE Rankings have averaged 37th-40th last four years Spending is 15% below the national average per FYE Spending levels per FYE are below all contiguous neighbors (Iowa, WI, North Dakota, South Dakota) 24 Operating budget 25 Revenue Trends Percent Share of Revenue General Fund FY2009 - FY2013 (nominal dollars) 70% 60% 50% 40% 30% 20% 10% 0% State Appropriation Tuition (Gross) FY2009 26 FY2013 Total Change Expense Trends General fund expenses FY2009 vs FY2013 (nominal dollars) 90% 80% 70% 60% 50% 40% 30% 20% 10% 0% Salaries & Benefits Operating Expenses FY2009 27 FY2013 Change FY 2016-17 financial outlook Improved, but risk of softening state funding environment Continued commitment to affordable tuition Uncertain enrollment outlook Contract settlements known 28 Pressures from all sides Investment requirements for quality academic and student support are pressured by: Affordability commitment holding down tuition revenue Enrollment growth strategies needed to best serve the state State investment levels up slightly after years of sharp decline Capital investment requirements (buildings and technology) competing for campus operating funds Accreditation agencies and Board of Trustees increasing focus on financial sustainability of colleges and universities increasing pressure for net asset and operating margin improvements 29 FY2014-2015 all-funds budget ($ in millions) FY2014 Budget FY2015 Budget Dollar Change Percent Change Revenues $1,919.9 $1,924.7 $4.8 0.3% Expenses $1,907.3 $1,919.9 $12.6 0.7% $12.6 $ 4.8 Budget balance 30 General fund budget ($ in millions) Revenues State appropriation Tuition Other revenues Programmed fund balance Total budgeted revenues Expenses Compensation Other operating costs Budget balance 31 FY2014 Budget FY2015 Budget Dollar Change Percent Change $587.9 $811.8 $113.4 $622.1 $793.5 $104.8 $34.2 ($18.3) ($8.6) 5.8% -2.3% -7.6% $14.9 $1,528.0 $15.0 $1,535.4 $0.1 $7.4 0.3% 0.5% $1,139.9 $379.4 $1,519.3 $1,156.7 $376.5 $1,533.2 $16.8 ($2.9) $13.9 1.5% -0.8% 0.9% $8.7 $2.2 Composite financial index Trends for college and universities 18 16 Number of Institutions 14 12 10 2011 8 2012 2013 6 4 2 < 1.00 1.00 - 3.00 3.00 - 5.00 Composite Financial Index 5.00 - 7.00 State of Minnesota General Fund Expenditures FY2014-2015 Biennium $39.6 Billion Total Health & Human Services 29% K-12 Education 42% All Other Expenses 9% Property Tax Aids & Credits 8% Higher Education 7% Public Safety & Judiciary 5% 33 Higher Education State Funding FY2014-2015 Biennium $2.8 Billion Total Office of Higher Education 16% MN State Colleges & Universities 43% University of Minnesota 41% 34 Minnesota State Colleges and Universities FY2013 General Fund– Revenues $1,509 Million Total Other $91 6% State Appropriation $553 37% Tuition $865 57% Source: FY2013 Audited Financial Statements 35 Allocation process 36 Revenue practices All tuition and fee revenue is collected and retained by the colleges and universities. These funds are not centrally redistributed All grants and gifts controlled by the colleges and universities All auxiliary income controlled by the colleges and universities All state funds appropriated to the Board and distributed to the colleges and universities in a lump sum 37 State support allocation Institutional allocations: priority funds and institutional base allocations Systemwide set asides: enterprise technology, debt service (system share), attorney general, etc. System office support 38 “Allocation Framework” provides a method for distributing state funds to colleges and universities A single model that equitably recognizes the diversity of Minnesota State College and University students' needs and supports the unique educational goals of each institution. Allocation of funds are based on a number of factors such as enrollment, cost of instruction, national benchmark data, and other institutional data. Allocation framework distributed $461M in FY2015 Framework changes now under study by the Charting the Future implementation team on system incentives and rewards 39 Allocation framework design Instruction (56%) Student Support and Administrative Services (30%) Facilities (8%) Library (4%) Research and Public Service (2%) 40 Allocation framework design principles Methodology used to distribute base funds to colleges and universities: Rewards cost efficient instruction State funds follow enrollment changes Substantially formulaic CTF work asking: What does it incent and reward now? What should it incent and reward? 41 Capital investment 42 Capital financing Campus resources from operating budget or gifts General obligation bonds sold by the state to finance new construction, renovation or demolition of academic and program space to improve learning Revenue bonds sold by the Board to finance revenue producing facilities such as dormitories, dining halls, student unions, etc. 43 Net assets by fund type FY2013 (in millions) Other $143 7% 44 General $1,722 83% Revenue $218 10% Total capital investment - bonds (FY2000-2014) $300 $250 Millions $200 $150 $100 $50 $0 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 Capital Projects 45 HEAPR Revenue Fund GO debt service as percent of total expenses While continuing to invest in infrastructure, debt service has remained a fraction of overall MnSCU expenses $2,000 $1,800 Millions (nominal dollars) $1,600 $1,400 1.3% 1.2% 1.5% 1.1% 1.5% 1.4% 1.3% 1.1% 1.0% $1,200 $1,000 $800 $600 $400 $200 $FY2005 FY2006 FY2007 FY2008 FY2009 Expenditures and Prinicipal 46 FY2010 Total G.O. Debt FY2011 FY2012 FY2013 Summary Affordability commitment Enrollment growth strategies Capital budget development underway – spring 2015 approval Operating budget development underway - spring 2015 approval FY2014 audit underway – November 2014 presentation 47 End deck 48