0008 AAR - Returns - Audits

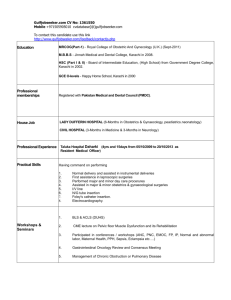

advertisement

Income Tax Bar Association Karachi WORKSHOP ON INCOME TAX Hotel Sheraton, Karachi 29 - 30 August, 2005 Income Tax Bar Association Karachi Workshop on Income Tax RETURNS, AUDIT, ASSESSMENT & APPEALS By: ALI A. RAHIM Director Mehmood Idrees Masood & Co. Hotel Sheraton 29-30 August 2005 2 CONTENTS Income Tax Bar Association Karachi Workshop on Income Tax Returns, Audit, Assessment & Appeals Returns Statements Assessments & Amendments Appeals ADR Audit Hotel Sheraton 29-30 August 2005 3 RETURNS Income Tax Bar Association Karachi Ordinary Returns (Section-114) 1. Every company 2. Other than a company Workshop on Income Tax Hotel Sheraton 29-30 August 2005 Charged to tax in previous two years Claims loss brought forward Owns immovable property With land area of 250 Sq. Yds. or more; or a flat within Municipal areas Cantonment or Islamabad Capital Territory (not applicable to widows, orphans below the age of 25, a disable person of non-residents) 4 RETURNS (Contd…) Income Tax Bar Association Karachi Workshop on Income Tax Hotel Sheraton 29-30 August 2005 Persons not Required to File Returns (Section 115) 1. Salary - employer’s certificate will suffice 2. Others - falling under Presumptive Tax Regime (a) Section-5 Tax on dividends (b) Section-6 Tax on certain payment to non-residents (c) Section-7 Tax on shipping and air transport income of non-residents (d) Section-113A Tax on retailers (individuals/AOP’s) having turnover upto Rs. 5 Million (e) Section-113B Tax on retailers (turnover exceeding Rs. 5 Million) of textile fabrics, articles of apparel ready made garments or fashionwear, articles of leather including footwear, carpets, surgical goods or sports goods (individuals/AOPs) (f) Section-148 Imports (except for manufacturers, other than edible oil, importing raw materials and also for plant, machinery and equipment by an industrial undertaking). (g) Section-153 Payment for goods & services (goods supplied and execution of contracts other than service contracts) (h) Section-154 Exports (i) Section-156 Prize & winnings (j) Section-156A Petroleum products (commission to petrol pump operators) (k) Section-233(3) Brokerage and commission (l) Section-233A(a)&(b) Purchase and sale of shares in lieu of commission earned by members of stock exchanges (m) Section-234(5) Owner of goods transport vehicles 5 RETURNS (Contd…) Income Tax Bar Association Karachi Workshop on Income Tax Returns for Tax Year 2005 R-1 Return of total income (for companies) R-2 Return of total income (non-salaried individual & AOP’s) R-3 Employers certificate in lieu of returns (salary) R-4 Attachment to R-3 R-5 Statement of final taxation R-6 Statement of final taxation for retailers (turnover upto Rs. 5 Million) W-1 Wealth statement Annexure-I Hotel Sheraton 29-30 August 2005 Particulars of directors of companies or members of AOP’s Annexure-II-A Income/(Loss) from business for individuals & AOP’s Annexure-II-B Income/(Loss) from business for companies Annexure-II-C Adjustment of book profits for companies Annexure-II-D Carry forward and brought forward of unabsorbed depreciation, initial allowance, amortization and business losses Annexure-II-E Depreciation, initial allowance and amortization 6 RETURNS (Contd…) Income Tax Bar Association Karachi Workshop on Income Tax Hotel Sheraton 29-30 August 2005 Returns for Tax Year 2005 Annexure-II-F Gain/(Loss) on disposal of depreciable assets and intangibles Annexure-II-G Bifurcation of income/(loss) attributable to sales/receipts etc., subject to financial taxation. Annexure-III Share of income/(loss) from business of AOP’s Annexure-IV Income/(Loss) from property Annexure-V Capital gain/Capital loss Annexure-VI Income/(Loss) from other sources Annexure-VII Foreign income Annexure-VIII Tax reduction, credits and averaging Annexure-IX Tax on retirement benefits, arrears of salary and prior years profit and debt Annexure-X Tax already paid including adjustments Annexure-XI Statement of final taxation Annexure-XII Key information for companies 7 STATEMENTS Income Tax Bar Association Karachi Quarterly Statements Salaries/non-salaries (Rule 44(2) Annual Statements Salaries [Rule, 44(1)] Other than salary [Rule, 44(1)] Workshop on Income Tax Hotel Sheraton 29-30 August 2005 8 ASSESSMENTS (Section 120 to 126) Income Tax Bar Association Karachi Normal Assessment All returns other than revised returns are deemed to be assessed on the day it is filed/received by the Workshop on Income Tax Commissioner (for complete returns only) Incomplete returns - commissioner to send notice for short documents/information (other than short payment of tax) within due date Hotel Sheraton 29-30 August 2005 Time limit - one year 9 ASSESSMENTS (Contd…) Income Tax Bar Association Karachi Section 121 - Best Judgment Assessment Failure to comply with notice for filing return under section 114 (normal returns etc.) Workshop on Income Tax Failure to furnish return under section 143 or 144 (non-resident ship owners or aircraft charters) Failure to file wealth statement under section 116 Failure to produce books/documents required to be maintained under section 174 (refer Rules, 28 to Hotel Sheraton 29-30 August 2005 Rule, 33) 10 ASSESSMENTS (Contd…) Income Tax Bar Association Karachi Workshop on Income Tax Section 122 - Amendment of Assessment 1. Assessments completed under section 120 or 121 of the Income Tax Ordinance, 2001 (or issued under section 59, 59A, 62, 63 or 65 of the Income Tax Ordinance, 1979) - after providing hearing opportunity to the taxpayer. 2. Time period - 5 years from original filing - no limit on number of times assessments can be amended. 3. Revised returns filed [under section 114(6)] also treated as amended assessment when received by commissioner. Hotel Sheraton 29-30 August 2005 4. Time limit for orders under section 65 of the Income Tax Ordinance, 1979 can not be extended or curtailed. 11 ASSESSMENTS (Contd…) Income Tax Bar Association Karachi Workshop on Income Tax Section 122 - Amendment of Assessment 5. Basis of amendment - definite information. Income has escaped assessment. Income has been under assessed. Income has been charged to lower rate of tax. Any income has been misclassified. 6. Definite information – defined Hotel Sheraton 29-30 August 2005 Sale or purchase of goods Receipts from services or other receipts Acquisition, possession or disposal of money, asset, valuable article or investment Expenditure 12 ASSESSMENTS (Contd…) Income Tax Bar Association Karachi Section 122A - Revision By Commissioner 1. Commissioner - SUO MOTU can call for records of orders passed by taxation officer 2. Make inquiries 3. Pass order - not prejudicial to the interest of the Workshop on Income Tax taxpayer 4. Restriction Time for appeal before Commissioner of Income Tax (Appeals)/Income Tax Appellate Tribunal has not expired Appeal is not pending before Commissioner of Hotel Sheraton 29-30 August 2005 Income Tax (Appeals)/Income Tax Appellate Tribunal 13 ASSESSMENTS (Contd…) Income Tax Bar Association Karachi Section 123 - Provisional Assessment Concealed assets impounded by any department or agency Section 124 – Assessment Giving Effect to Order (other than direct relief) of Commissioner of Income Tax (Appeals)/Income Tax Appellate Tribunal Workshop on Income Tax Set aside order within one year from the end of financial year in which such order is received unless an appeal or reference is preferred to the Higher Authority. Direct relief is allowed by Commissioner of Income Tax (Appeals) or Income Tax Appellate Tribunal within two months of such order. Hotel Sheraton 29-30 August 2005 Order where income is not taxable in one year or relate to another person, but taxable in another year or another taxpayer, such order shall be passed by the Commissioner. 14 ASSESSMENTS (Contd…) Income Tax Bar Association Karachi Section 124A – Power to Modify Assessment Question of law to be followed by Commissioner compulsorily unless reversed by Higher Appeal Authority. Workshop on Income Tax Limitation of time not applicable. Section 125 - Assessment of Disputed Property Assessment order to be passed within one year from the end of the financial year of any order passed by any Hotel Sheraton 29-30 August 2005 Civil Court. 15 APPEALS (Section 127 to 132) Income Tax Bar Association Karachi SR. NO. 1. Workshop on Income Tax COMMISSIONER OF INCOME TAX (APPEALS) INCOME TAX APPELLATE TRIBUNAL Against Commissioner of Income Tax (Appeals) order Tax as per return Not applicable Rules, 76 Rules, 77 Lesser of 10% of tax or Rs. 1,000 Lesser of 10% of tax or Rs. 2,500 Company Rs. 1,000 Rs. 2,000 Others Rs. Rs. Appeal against orders passed under section 121, 122, 143, 144, 162, 170 182 to 189, 161(1), 172(3)(f) or 221 2. Tax to be paid 3. Prescribed form verified 4. Verified in the prescribed manner 5. Fee Where Assessment framed Other cases 6. Time limit 200 30 Days 500 60 Days Hotel Sheraton 29-30 August 2005 16 APPEALS (Contd…) Income Tax Bar Association Karachi New Changes [Commissioner of Income Tax (Appeals)] Financial Year 2005 Commissioner of Income Tax (Appeals) can only confirm, modify or annual the assessment order Workshop on Income Tax (not set aside) Can now examine evidence. New Changes (Income Tax Appellate Tribunal) Financial Year 2005 Hotel Sheraton 29-30 August 2005 Decide appeals within six months 17 ALTERNATE DISPUTE RESOLUTION Income Tax Bar Association Karachi Workshop on Income Tax Section 134A 1. Person aggrieved with the order of Commissioner of Income Tax/Income Tax Appellate Tribunal/Court may file application to Central Board of Revenue. 2. Central Board of Revenue after review shall forward application to ADR Committee. 3. ADR Committee to comprise of three person. One person from department. Hotel Sheraton 29-30 August 2005 Two persons being Chartered Accountant or Cost and Management Accountants, Advocates, Income Tax Practitioner or Reputable Taxpayers. 18 ALTERNATE DISPUTE RESOLUTION (Contd…) Income Tax Bar Association Karachi 4. ADR will examine issue, conduct inquiry, seek expert opinion, conduct audit and make recommendation. 5. Central Board of Revenue, based on committee’s recommendations may pass such orders. Workshop on Income Tax 6. Order of Central Board of Revenue, if acceptable to the applicant is binding on department and taxpayer. 7. If, the order is not acceptable, applicant can continue to persue his legal remedies (if not time barred). Hotel Sheraton 29-30 August 2005 Important: Time period for filing an appeal cannot be extended even if taxpayer has approached Central Board of Revenue for ADR. 19 AUDIT (Section 177) Income Tax Bar Association Karachi Workshop on Income Tax Hotel Sheraton 29-30 August 2005 1. Central Board of Revenue to lay down criteria for selection. 2. Commissioner to select cases based on the criteria. 3. Central Board of Revenue will keep criteria confidential. 4. Besides the Central Board of Revenue’s criteria, the Commissioner may also select cases for audit based on the following: The person’s history of compliance or noncompliance. The amount of tax payable by the person. Class of business conducted by the person. Any other matter, which the commissioner considers material to determine the correct income or tax. 20 Income Tax Bar Association Karachi Workshop on Income Tax Hotel Sheraton 29-30 August 2005 21