Accounting Theory: An Introduction

advertisement

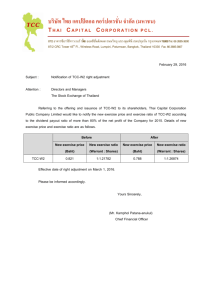

Accounting Theory: An Introduction Lectured by Dr. Siriluck Sutthachai Accounting Department Faculty of Management Science Khon Kaen University, Thailand Accounting History Early History of Accounting Record-keeping A Systematic bookkeeping (A.C. Littleton): The art of writing; Arithmatic; Private property; Money; Commerce; Capital Luca Pacioli: Double-Entry Bookkeeping Accounting and Capitalism International Accounting Issues Accounting Institutions International Institutions International Accounting Standard Board: International Accounting Standards (IASs) and International Financial Reporting Standards (IFRSs) International Organisation of Securities Commission (IOSCO) International Federation of Accountants (IFAC) European Union (EU) United Nation World Bank Accounting Institutions International Institutions Securities Exchange Commission (SEC) Financial Accounting Standards Board (FASB): Statements of Financial Accounting Standards (SFASs) The American Institute of Certified Public Accountants (AICPA) Thai Accounting: An Overview The Development of Thai Accounting Before Ayudhya period: No clear evidence to indicate when Thai accounting established. However, record keeping for trading in Thailand could be traced back since King Ramkamhang period. Ayudhya period: Record keeping with Chinese style. The Development of Thai Accounting Rama I to Rama IV period: Chinese accounting could be prevail in Thailand before Western accounting system. Rama V period: Thai accounting system had been fully influenced by Westerners when King Rama V restructured Thai institutions. Thai accounting education Auditing Bookkeeping and tax calculation Accounting Law and Regulations The Civil and Commercial Code: prescribes the minimum general accounting requirements for all business entities. The Ministerial Regulation No.2 (1976): prescribes the format and details for presenting financial reports. Accounting Law and Regulations The Public Limited Companies Act (section 113): public companies are required to prepare not only financial statements, according to the Ministerial Regulation No. 2, but also their annual report. The Securities Exchange of Thailand Act (section 56): a listed company is required to prepare and submit periodic reports Accounting Law and Regulations The Accounting Act B.E.2543 (2000): requires all limited companies to comply with the TASs, issued by the ICAAT with the approval of the BSAP, unless there are other accounting rules for certain sectors. The Accounting Professions Act B.E. 2547 (2004): aims to restructure the two accountancy bodies—the BSAP and the ICAAT. Thai Accounting Bodies The Board of Supervision of Accounting Professions (BSAccP): mainly responsible for supervising and approving the IAPT tasks. The Institute of Accounting Professions of Thailand (IAPT): responsible for checking and controlling accounting professionals with the authority for giving or revoking auditors’ and accountants’ licences, publishing the ethical guidelines for auditors and accountants, and issuing accounting and auditing standards. Thai Accounting Bodies The Thai Accounting Standard Board (TASB): set up Thai accounting standards. The Thai Accounting Association (ThAA): aims to raise the standard of accounting education, particularly of accounting academics and course design, in Thailand. The Accounting Professions Act B.E. 2547 The Ministry of Commerce-DBD The Board of Supervision Accounting Professions (BSAccP) The Institute of Accounting Professions of Thailand (IAPT) The Thai Accounting Standard Board The Committee of Accounting Enthic Supervision Other committees e.g. Auditing Standards Board, AIS Committee and Corporate Govenance Committee Thai Accounting Bodies Thai Professional Accounting Bodies Federation of Thai Accounting Thai Accounting Standards Board Thai Auditing Standards Board Thai Accounting Association The Institute of Internal Audit of Thailand Thai Accounting Standards Accounting Act B.E. 2482 (1939) and Auditor Act B.E. 2505 (1962), were issued and referred to the generally accepted accounting principles (GAAP). Thai accounting standards have been developed by using western accounting standards as a model. Thai Accounting Standards In 1972, the ICAAT issued Recommended Accounting Concepts and Principles. In 1979, the first five accounting standards were issued. From 1986 to 1997, 25 standards were issued. From 1998 onwards, Thailand has adopted and adapted IASs. The Adoption of IASs The table presents which IASs have been adopted