NZ financial system

advertisement

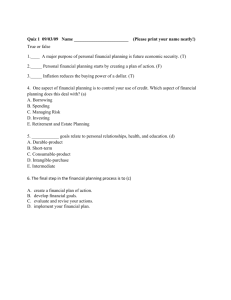

Money and Monetary Policy Interest Rates Exchange Rates Anthony Byett Economist fxmatters.co.nz November 2006 Money and Banking Definition of money NZ banking system Money in NZ Review Introducing a stock into the flow model Money is a stock concept – measured at a point in time Income is a flow concept Refer Callander 2nd Ed p360 – per annum concept Households Goods & services produced from capital & labour Firms Forms of Money Utu, favour exchange Gold, greenstone, cigarettes Notes & coins Refer: * The Economist 22-Dec-01 pp85-87 Transaction accounts – access by cheque, EFT-POS, telephone Savings accounts – NB some accessible by ATM, telephone Debit cards (as opposed to credit cards) Functions of Money Why hold money? Medium of exchange. In order to function it must have the following properties: - acceptable - portable - durable - scarce - divisible Store of value Unit of account Means of deferred payment Refer Callander 2nd Ed p533 Money in NZ How much? Recent figures put money = $171 billion – I.e. Jun-06 “M3 money supply” reported by RB – including $2.8 billion notes & coins – remainder were bank deposits Had been $93b in Mar-99 – breakdown of this figure to come in following slides Banking in NZ Institutions Government > collects taxes & borrows money > buys goods & services, pays benefits Reserve Bank > banker to Government & banks > supervises registered banks > implements monetary policy > issues currency DMO > Government’s Treasury Registered banks > accept deposits/makes loans > manage pooled investments > process transactions Other financial institutions M3 Financial Institutions Owners, assets ($b) and S&P credit ratings 1 ANZ National ANZ, Aus 2 WestpacTrust* Westpac, Aus 3 BNZ NAB, Aus 4 ASB Bank CBA, Aus 5 Hong Kong* HK Shanghai 6 Deutsche Bank* DB, Germany TSB NZ trust Others (3 banks/sub & 2 non-bank) TOTAL (at Dec-05) 251 87 48 46 42 6 6 3 13 AAAAAAAAAAAABBB- * Branches Note: Kiwibank ($2.5b) is a bank but not within M3 survey (yet) Source: www.rbnz.govt.nz and www.kpmg.co.nz Balance Sheets of Banks Assets Liabilities + Loans - Deposits + Reserves - Capital (or liquids) NB: deposit is – customer’s asset, and – bank's liability (as owed customer) Refer Callander 2nd Ed p535 NZ “M3” Balance Sheet ASSETS (Mar-99 total=$143b) $b NZD claims (lending) 122 Non-NZD claims 5 NZ Government securities 7 Claims on RBNZ/notes & coins 1 Other assets 9 LIABILITIES NZD funding (deposits) 100 Non-NZD funding 28 Capital 8 Other liabilities 7 Source: www.rbnz.govt.nz or RBNZ Financial Statistics Definitions of money supply LIABILITIES ($billion at Mar-99) NZD funding (deposits) 100 Transaction accounts (net*) 12 Other call accounts (net) 27 Other deposits (net) 52 * the netting involves the deduction of inter-institutional deposits and government deposits Source: www.rbnz.govt.nz or RBNZ Financial Statistics Monetary Aggregates M1 M2 M3 Move from narrow to broad definition of money – as per The Economist, Financial Indicators Definitions of Money Supply LIABILITIES ($billion at Mar-99) NZD funding (deposits) 100 $2 billion notes & coins held by public Transaction accounts (net) +12 14 = M1 Other call accounts (net) +27 41 = M2 Other deposits (net) +52 93 = M3 Source: www.rbnz.govt.nz or RBNZ Financial Statistics Money Supply Note that ……. Unexercised overdrafts – not part of money supply Debit cards and cheques – not themselves money Credit cards – accumulate debt to be settled with M1 money Financial Assets and Liquidity Money just one asset Liquidity the ease with which an asset can be converted into an M1 asset (i.e. money ) without loss of capital value Spectrum of liquidity (See Callander, p536) Cash Physical/human assets NB liquidity may incur opportunity costs Money Creation The creation process – bank asset & liability growth Limits on natural growth – Daily settlement – Government does not create money – Government flows offset Money and inflation Money and growth Where Does Money Come From? Primitive Bankers – acted as custodians – issued receipts for gold deposits Refer Callander 2nd Ed p535 – receipts used for transaction purposes Banking Evolved – bankers made loans (for interest) by issuing more receipts – assumed not all holders of deposits would want gold at the same time reserves only needed to be a fraction of their deposits (liabilities) Initial Goldsmith’s Balance Sheet Assets $ Liabilities $ Gold Reserves 100 Deposits 100 See Callander, Fig A.2, p538, Balance Sheet A Goldsmith’s Balance Sheet after Lending Assets $ Liabilities $ Gold Reserves 100 Deposits 500 Loans 400 Reserves = 20% of deposits Compare Callander, Fig A.2, p538, Balance Sheet B Fractional Reserve Banking A banker holds only a fraction of the outstanding deposits in reserve funds In New Zealand – up to mid 1980’s a system of compulsory reserve ratios operated (Reserve Ratio) – ‘Prudential reserve ratios’ are used today Banking pre-80s Assets $ Liabilities Loans Deposits Reserves of Govt. Securities Capital Regulated Reserve Ratios – only replaced in the mid-1980s $ Banking Today Assets $ Liabilities Loans Deposits Liquids Capital Self-imposed liquidity management – includes government, bank & corporate securities Minimum capital ratios by regulation $ Money Creation more deposits >>> more lending Assets $ Liabilities Loans Deposits Liquids Capital Often associated with government spending – Gov’t spends money that it does not have Banks will on-lend (or repay other funding) $ Money Creation more lending >>> more deposits Assets $ Liabilities Loans Deposits Liquids Capital $ More likely the cause today – A bank lends money during day (which it may not have) – Loan money is deposited in bank – Loan becomes “self-funding” Managing Money Growth in NZ Government issues debt to fund any revenue shortfall (I.e. does not create money) – Long-term: Government Stock issued monthly (approx.) – Short-term: Treasury Bills issued weekly RBNZ also smoothes daily government flows – through daily and now intra-day settlement – through open market operations The Settlement Process Settlement banks bank with the RBNZ – non-settlement banks bank with settlement banks At end of day*, the net daily inter-bank flows are known (* next morning actually) – money owed to other banks paid with RBNZ balances – i.e. settlement cash – if bank has no “cash” – tries to borrow from other bank Refer Callander 2nd Ed p473 – can borrow from RBNZ @ 0.25% over cash target – or +0.30% if rolling intra-day bank bill repo Smoothing Settlement Cash RBNZ conduct daily “open market operations” (OMO) to smooth flows – largely to offset government flows Too much cash forecast RBNZ sells T-Bills for cash Not enough cash forecast RBNZ lends cash – banks borrow cash using Bills and Bonds as security – actually sell bills/bonds and forward purchase (repo) Does Money Matter? Remember week 6 and GDP… The quantity equation MV = PY M= stock of money ($) Refer: * Sherwin, “Inflation”, Economic Alert, Apr-99 P= price level ($) V= velocity of circulation (times per year) Y= volume of production (number of “things”) if velocity steady, money growth will match nominal production growth more money > more output and/or more inflation The Output Gap Linking money to AD/AS model More “money” leads to greater aggregate demand We cannot satisfy all this demand with new products/services Price Level AD AD1 AS Inflation Feeds through to higher prices Real Output Refer Callander 2nd Ed p420, Fig 20.6 Money and Inflation Money and House Prices HOUSE PRICES & HOUSEHOLD DEBT 30% % 18 C ha nge M 3 le nding t o ho us e ho lds ( right ) 20% 15 C ha nge N Z ho us e pric e ( le f t ) 10% 12 0% 9 Source: QVNZ, RBNZ, ASB -10% M ar-94 6 M ar-97 M ar-00 M ar-03 M ar-06 Summary Money typically is bank deposits Can be created from thin air Growth constrained by capital requirements – and source of funding – And by government financing with debt Also volatility reduced by RBNZ cashflow smoothing Some loose connection between money and inflation/growth exists Monetary Policy Monetary Policy Process NZ monetary policy a three step process: 1. An inflation target is set by the Reserve Bank Governor (Bollard) & Treasurer (Cullen) 2. An inflation forecast is formed by the RBNZ 3. The RBNZ adjusts short-term interest rates to bring the forecast into line with the target » via cash rate target Inflation In theory, inflation a momentum – the ongoing rise of prices, wages, money supply In practice, inflation is the change in CPI – goods & services that households consume – weighted according to proportion of spending Inflation high late 70s, low now – vicious cycle: higher wages, prices & devaluations – tried to contain with wage/price freeze early 80s – eventually moved to independent Reserve Bank – also tight gov’t control, competitive economy, floating exchange rate Inflation RBNZ Act 1989 Part II “The primary function of the Bank is to formulate and implement monetary policy directed to the economic objective of achieving and maintaining stability in the general level of prices” Inflation target set for term of Governor’s office RBNZ actions to be consistent with policy target RBNZ to consult & advise Gov’t (and others) Governor-General can set another objective for 12 month periods Policy statements every 6 months The Inflation Target Contract between RBNZ Governor and Treasurer – Governor appointed to September 2007 Stability agreed to as CPI inflation between 1-3% p.a. on average over the medium term Exceptions allowed (if >0.25 was rule of thumb): – terms of trade shock – changes to indirect taxes – natural disaster shock – changes to government levies (see Policy Targets Agreement, September 2002) Consumer Price Index As at June 2006 Annual rate 4.0% – Large contributions from housing & petrol % NZ CPI INFLATION 6 % 6 No ntradables 4 4 2 2 0 0 But inflation? – To what extent will rises be ongoing? Tradable vs Nontradable Inflation Tradables -2 M ar-92 -2 M ar-95 M ar-98 M ar-01 M ar-04 The inflation forecast RBNZ forecasts inflation look at annual CPI forecast out 24 months in RBNZ model, inflation determined by: – exchange rate movements – international price of exports & imports – unit labour costs – output gap – inflation expectations influential factors are TWI & unit labour costs Implementation of Policy If forecast inflation does not match the target – then some policy response is required Policy signalled via interest and exchange rate forecasts Policy acts through short-term interest rates Policy is implemented through the official cash rate target – from 17 March 1999 RBNZ Transmission Path Diagram Fig 27.3, p490 Current Monetary Policy RBNZ Jun-06 Projections Forecast annual CPI of 3.9% p.a. (falling to 2.4%) Cash rate unchanged on the day (7¼%) Assumes growth slowing – GDP Mar 04/05 +3.5% to 06/07 +1.1% “Growth to remain low … headline CPI inflation above 3% well into 2007 … do not expect to tighten … no scope for easing of the OCR this year” Source: www.rbnz.govt.nz No imminent change expected ANTICIPATED 90-DAY BANK BILL % (as priced by futures) 7.6 7.4 7.2 7.0 6.8 A s a t 2 1- A ug 6.6 Source: ASB 6.4 To day Dec-06 Jun-07 Dec-07 Monetary Theory and Practice General Theory links money growth with inflation Correlation between money and nominal output exists in long-run (Quantity equation again) – in short-run, relationship is not evident Chronic and acute inflation has been associated with money-financed government budget deficits Monetary Theory and Practice NZ experience NZ Government debt-finances Money growth plays small role Early 90s fall in inflation coincided with international recession and fiscal tightening There exist long and uncertain lags between changes to monetary conditions and inflation Large changes in interest rates are needed to change exchange rates & inflation rates – Low elasticity with respect to interest rates. Interest Rates Many interest rates – primary & secondary markets – wholesale & retail (say <$1m) Short-term yields (or rates) set in money market where cash, bills and notes are traded Long-term yields (or rates) set in bond market where bonds, gov’t stock & notes are traded 90 Day Bank Bill % NZ 90-DAY BANK BILL (at year end) 20 16 12 8 4 Source: ASB Bank 0 74 78 82 86 90 94 98 02 Retail Floating Rates % RETAIL FLOATING RATES 12 % 12 Source: ASB 10 10 H o us ing 8 8 6 6 T o p D e po s it ( 0 - 12 m o nt hs ) 4 Jan-93 4 Jan-96 Jan-99 Jan-02 Jan-05 Retail Floating Rates and Wholesale Rates % % FLOATING RATES 12 12 Source: ASB 10 10 A S B H o us ing 8 6 8 9 0 - da y bill 4 Jan-93 6 TD ( 0 - 12 m t hs ) Jan-96 Jan-99 Jan-02 4 Jan-05 A 90-day bank bill what is it? A “bank bill” in NZ now is typically a certificate stating the bank will pay a fixed sum (the face value) to the holder at a set date – in essence, a tradeable bank deposit – called a Negotiable Certificate of Deposit (NCD) More traditionally (and still traded today) a “bank bill” was a Bank Accepted Bill (BAB) – two parties set up a loan which a bank then endorses – bank guarantees payment in case of default A 90-day Bank Bill some characteristics Returning to Negotiable Certificate of Deposit – typically issued by banks for 30-180 days – e.g. bank will pay holder $0.5m in 90-days – holder can sell to another party if they wish – banks initially receive market value Market value of bill determined by bill rate – NB the rate is a discount rate – Value = 500,000/(1+rate*90/365) – e.g. rate=6.0% implies value =$492,710 Major Money Market Instruments Name Issuer Treasury Bills Government Promissory Notes Corporates Bank Bills Banks Derivatives linked to Bank Bills: – Futures, Forward Rate Agreements (FRAs) – Options – Interest rate swaps Fixed Lending Rates % % 3 YEAR RATES 12 12 Source: ASB 11 11 A S B H o us ing 10 10 9 9 8 8 7 7 6 6 5 5 Jan-93 Jan-96 Jan-99 Jan-02 Jan-05 Major Market Instruments Securities promising the holder a defined cashflow – Bill (short term) – e.g. pay $100,000 to holder on 10-Aug-2005 – no coupon or interest rate – Bond (long term) – includes coupon rate as well – e.g. pay $100,000 to holder on 15-5-2010 plus $3,000 on the 15th of each May & Oct – can get zero coupon bonds Major Bond Market Instruments Name Issuer Government Stock Government Medium Term Note Corporates/Banks Bond Corporates/Banks Derivatives linked to Government Stock: – futures (3yr only) – options Wholesale Yield Curve 10 9 8 31/12/97 31/12/99 7 6 5 << Days >< Years >> 4 0 30 60 90 120 150 180 270 1 2 3 4 5 The Yield Curve Differing theories Segmented markets – different people operate in different markets – rates loosely connected Expectations – longer-term rates as series of expected short-term rates Liquidity or risk premium – premium required to induce people to hold longer-term investment Element of all in NZ, strong expectation influence Interest Rates Influences Inflation ( real rate) Monetary policy Offshore interest rates Exchange rate expectations Extent of borrowing Next: – some graphical evidence – some theory Refer National Bank, Sep 1996 NZ Inflation % % NZ CPI INFLATION 20 20 15 15 10 10 5 5 Source: Stats NZ, ASB Bank 0 0 74 78 82 86 90 94 98 02 NZ Inflation & Interest Rates NZ INFLATION & 90-DAY BANK BILL % 20 % 20 Y e a r E nd 9 0 - da y 16 16 12 12 8 8 Y e a r E nd CP I 4 4 Source: ASB Bank 0 74 78 82 0 86 90 94 98 02 OCR and Other Rates % NZ SHORT-TERM RATES (July 1999 to August 2006) 10 9 10 A S B V a ria ble H o m e Lo a n 9 8 8 7 7 6 9 0 - da y ba nk bill 6 5 5 4 4 Jul-99 Jul-01 Jul-03 Jun-05 Offshore & Local Interest Rates % 90-DAY BANK BILL YIELDS % (actual and futures pricing) 12 12 10 10 NZ 8 8 6 6 4 AUS 4 2 2 0 0 Jan-93 Jan-96 Jan-99 Jan-02 Jan-05 Jan-08 Long-term Interest Rates % 10YR GOVERNMENT YIELDS 11 10 % 11 A US 10 9 9 8 8 NZ 7 7 6 6 5 5 4 4 3 3 Jan-93 Jan-96 Jan-99 Jan-02 Jan-05 Interest rates Theories Interest rates as a price reflecting decisions about flows savings = investment Interest rates as a price reflecting decisions about stocks (I.e. a portfolio decision) demand for bonds = supply of bonds These decision processes may be independent! Interest rates Savings & investment People require a positive return to save – i.e. give up current consumption for future consumption – savings are expected to rise should rates rise People willing to pay now to invest – i.e. pay funding cost now in expectation of future return – the higher the return, the higher the interest rate – clouded by ‘return-insensitive investment’ – e.g. government investment Interest rate a balance of productivity & time preference The equilibrium interest rate Bringing together savings and investment Interest rate Savings Refer “How low can they go?” The Economist, 2-Dec-95 Investment Amount of savings/investment The equilibrium interest rate A model of the current account deficit Interest rate Savings Rate set low Investment BOP deficit Amount of savings/investment Interest Rates Demand & supply of bonds Motives for holding bonds – spare cash not needed for transaction purposes – as a store of wealth in general Bond supply – Corporates issues to get cash for investment – either into physical assets or financial assets Interest rate a balance of demand and supply for bonds Bond Supply Curve Rate of interest SUPPLY (borrowers) Bond Stock Bond Demand Curve DEMAND (lenders) Rate of interest Bond Stock The Equilibrium Interest Rate Bringing together bond supply and money demand Rate of interest DEMAND r SUPPLY Bond Stock The Equilibrium Interest Rate Balancing portfolio decisions Bonds are just one financial asset Interest rates are also set in other markets – e.g. money market In general, returns are established in many financial markets – e.g. share markets “interest rates” are the result of portfolio decisions Summary Interest rates result from the interaction of many decisions – both about production/saving – and about asset allocation In the short-run, RBNZ policy is the major determinant of short-term rates – longer-term, savings and investment issues will be more influential Long-term rates are strongly influenced by offshore rates Banking References “The banking system in NZ”, Chris Moore, Economic Alert, May 1996 “NZ banks ...”, David Tripe, Massey University, quarterly Chapter 9 in “Structure & dynamics of NZ industries”, Pickford & Bollard, Dunmore Press, 1988 Chapter in Overview of NZ Economy, NZDMO, see www.treasury.govt.nz/nzefo “Liberalisation of the financial markets in NZ”, Arthur Grimes, RBNZ Bulletin, December 1998 “Developments in the banking industry”, RBNZ Bulletin, Each June quarter “Consolidated table of KIS”, RBNZ Bulletin, June 1997 Banking Web Sites http:// www.rbnz.govt.nz/ http:// www.asbbank.co.nz/ http:// www.anz.co.nz/ http:// www.bnz.co.nz/ http:// www.westpac.co.nz/ http:// www.nationalbank.co.nz/ http://centre-banking-studies.massey.ac.nz/ http://www.kpmg.co.nz/ http://www.bis.org/ Monetary Policy References Various RBNZ publications – see www.rbnz.govt.nz Critics of monetary policy – “Prosperity denied”, Bob Jones, Canterbury University Press, 1996 – Chapter 7 in “The NZ experiment”, Jane Kelsey, Auckland University Press, 1995 Interest Rate References general “Interest rates and money markets in Australia”, Tom Valentine, Financial Training & Analysis Services, 1991 “The Reuters guide to official interest rates”, Ferris & Jones, Probus Publishing, 1995 “NZ’s money revolution”, Edna Carew, Allen & Unwin, 1987 Reserve Bank Bulletins incl. “An overview of the money and bond markets in NZ”, Sep & Dec 1995. Some more websites bloomberg.com yahoo.com dismal.com worldeconomist.com thepaperboy.com yardeni.com imf.org stats.govt.nz treasury.govt.nz Exchange rates Currency newsletter For those with an interest in currency markets … What would you like to read in a weekly currency newsletter? Email: anthony.byett@fxmatters.co.nz See www.fxmatters.co.nz Exchange rate determinants Some generalisations in the short-run, high interest rates will lead to a strong currency in the medium term, large current account deficits will lead to depreciations in time, low inflation rates will lead to an appreciating currency Exchange rate volatility rates are more volatile than fundamentals fundamentals matter in the long run – but not in short run herding as a response to uncertainty – Refer A Kirman, Bank of England Bulletin, Aug 95 Exchange rates and interest rates INTEREST RATE DIFFERENCE & NZ DOLLAR % 5 US D 0 .7 5 4 0 .6 5 U SD p er N Z D ( r ig ht ) 3 2 0 .5 5 1 N Z - U S 9 0 d ay ( lef t ) 0 .4 5 0 Source: ASB Bank -1 0 .3 5 93 95 96 98 00 02 Exchange rates and inflation US/NZ INFLATION & NZ DOLLAR % US D 110 1.4 US P ric e s pe r N Z P ric e s ( lhs ) 90 1.2 1.0 70 Y e a r E nd N Z D ( rhs ) 0 .8 50 30 0 .6 Source: ASB Bank 74 78 82 0 .4 86 90 94 98 02 Exchange rates and the current account % CURRENT ACCOUNT & NZ DOLLAR R ate Current Account as a %of GDP, NZD/USD at year end 0 1.4 -4 1.2 B OP ( lhs ) -8 NZD ( rhs ) - 12 - 16 0 .9 0 .7 Source: ASB Bank 74 78 82 0 .4 86 90 94 98 02 NZ dollar NZD/AUD & interest rate differential c e nt s NZD/AUD & 90-DAY RATES % 95 3 90 2 85 1 80 0 N Z 9 0 - d ay less A U S 9 0 - d ay 75 -1 70 -2 NZD/ AUD Source: ASB Bank 65 -3 91 93 95 97 99 01 03 NZ dollar Large influence of AUD US D US D NZD & AUD 0 .8 5 0 .7 5 US D pe r N Z D 0 .7 5 0 .6 5 US D pe r A UD 0 .6 5 0 .5 5 0 .5 5 0 .4 5 Source: ASB Bank 0 .4 5 93 95 96 0 .3 5 98 00 02 Other currencies versus the US dollar EXCHANGE RATE INDICES (versus USD, relative to average 1993-2003 = 100) 14 0 NZD 12 0 JPY AUD 10 0 80 60 EU R Source: ASB Bank 93 95 97 99 01 03 US dollar US DOLLAR & US BOP Inde x %G D P 15 0 B OP ( r ig ht ) 14 0 0 13 0 12 0 -2 110 10 0 U SD Ind ex ( lef t ) 90 -4 Source: ASB Bank 80 -6 70 74 78 82 86 90 94 98 02 Australian dollar Following commodity prices USD AUD/USD & COMMODITY PRICES, 1983 to 2002 INDEX 0.95 0.9 115 CBA Commodity Price Index, rhs 110 0.85 0.8 105 AUD/USD, lhs 0.75 100 0.7 95 0.65 90 0.6 0.55 0.5 85 80 0.45 75 Dec-83 Dec-85 Dec-87 Dec-89 Dec-91 Dec-93 Dec-95 Dec-97 Dec-99 Nov-01 Australian dollar Or is it? USD Index 1997=100 130 AUD & CBA AUSTRALIAN COMMODITY PRICE INDEX 120 C B A A US Inde x in US D ( lhs ) 110 100 USD 0.99 Index NZD AND COMMONWEALTH BANK 1997=100 NZ COMMODITY PRICE INDEX 120 0.92 115 0.85 110 0.77 0.71 Index in USD com pared w ith end of w eek NZD/USD exchange rate NZD/USD (right) 105 0.67 0.63 0.59 100 90 USD 0.55 0.70 95 80 0.62 USD Index (left) 0.51 90 0.47 0.55 85 0.43 0.48 80 A UD / US D ( rhs ) 70 So urces: CB A , Datastream So urces: CB A , Datastream 60 94 95 96 97 98 99 00 01 02 03 04 0.39 94 95 96 97 98 99 00 01 02 03 04 Currency Supply and demand USD Per NZD Refer Callander 2nd Ed p340 Supply Demand Amount of currency Summary Exchange rates result from the interaction of many decisions – both about trading goods and services – and about investing in assets In the short-run, interest rates are often the key determinant – longer-term, any trade imbalance will impact In NZ, the AUD is a large influence