CHAPTER ONE

advertisement

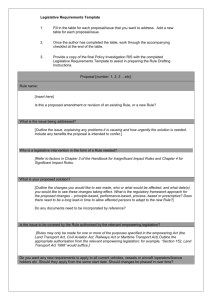

CHAPTER TWO THE INTERNAL REVENUE CODE EXPECTED LEARNING OUTCOMES Appreciate and understand: • The significance of the Internal Revenue Code • The legislative process • How to find legislative history • How to locate and analyze Code provisions • How to properly cite the Code Sources of tax law Sixteenth Amendment ratified in 1913 created income tax. Internal Revenue Code was created in 1939 and subsequently revised in 1954 and 1986. Statutory authority = Internal Revenue Code (Legislative) Administrative authority (Executive) Judicial authority (Judicial) THE SIGNIFICANCE OF THE INTERNAL REVENUE CODE Compilation of tax statutes enacted by Congress THE LEGISLATIVE PROCESS House Ways and Means Committee House of Representatives Senate Finance Committee Senate Conference Committee Both Houses President FINDING LEGISLATIVE HISTORY Each act is a “Public Law” and given a designated number – pg. 54 Recent public laws (CCH and RIA) Older legislation • Cumulative Bulletins • BNA’s Primary Sources Joint Committee On Taxation Created by the IRC Works with W&M committee and SFC committee – Brings tax law knowledge to the process. Provide explanations of the law: Blue Book Do not confuse with conference committee in the legislative process ORGANIZATION OF THE CODE Title 26 of the United States Code Organized into segments See Illustration on pg. 58 Citation of Code: Sec. #, subsection, paragraph, subparagraph, clause: Sec 162(g) (1)(A)(i) – see pg. 62-63. Flush language--- LOCATING RELEVANT PROVISIONS Table of Contents – reference noted is to Code Section Index Knowledge of pertinent provision Reference from a secondary source Analyzing the Code Logical skimming Terms of art: special meaning when using the IRC • Determining the tax context and relative importance of words. • IRC Sec 7701 – useful definitions Connecting words: or v. and to assess if criteria are met. Measuring words: less than, equal to, greater than etc. Use of male pronoun: used for brevity Analyzing the Code (Continued) Limiting language: For purposes of a) this title v. b) this section Pinballing: reference to other sections rather than repeat of provisions Sunset provisions: time limitation of section, requiring future reenactment. Transition provisions: safe harbors during pending legislation. Historical notes: insight into previous versions of the code section. Accessing the Code Print/Paper CD-ROM Modem Web