Hamilton's Financial Plan

advertisement

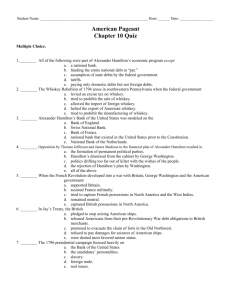

Hamilton’s Financial Plan Revolutionary War Debts The United States had acquired about $54 million in debts from the Revolutionary War – $42 million to American citizens – $12 million to foreigners The states had $25 million more in war debts. st 1 Secretary of the Treasury President Washington’s Secretary of the Treasury Alexander Hamilton proposed in his Report on Public Credit his plan to fix the economic crisis facing the young nation ALEXANDER HAMILTON Report on Public Credit Hamilton’s plan in this report (1790) featured four major areas: 1) Assumption of states’ war debts by the federal govt. 2) Redemption of bonds sold by the govt. under the Articles of Confederation 3) Selling of new national securities to create a permanent national debt 4) Excise tax on whiskey 1 – Assumption of State Debts Many southern states had repaid all of their debts Most indebted states were in the North Southerners claimed Hamilton was protecting Northern business interests at the expense of the South Hamilton was able to sway Southerners to support this by promising the permanent capital would be located in the South SITE OF THE FUTURE CAPITOL (Between Maryland and Virginia along the Potomac River) 2 – Redemption of Bonds During the war the government issued bonds to people who had lent it money or served in the army When the govt. failed to repay the bonds, speculators offered to buy them at much lower than their face value. Hamilton proposed that all bonds be repaid at face value. – This would be a way to win confidence in the new government – Sound bonds would be a a sign of nations financial and health and encourage Americans to invest in nation’s future 2 – Redemption of Bonds Opponents, like James Madison, wanted the original bond holders to be paid. – He stated that only Hamilton’s speculator friends (rich northeasterners) would profit – war veterans would be cheated out of their money as they sold their bonds for next to nothing to speculators This proved unworkable as govt. was unable to identify the original bond holders, and Hamilton’s plan passed JAMES MADISON 3 – Selling Securities for Permanent National Debt Hamilton planned to raise the $54 million to pay off the national debt (to foreign nations and Confederate bond holders) by “funding” it New securities would be sold which would be a combination of federal stock and western lands The new securities would pay 4% interest as the old bonds paid 6% (thus govt. saved money) and would be safer investments than the old bonds 3 – Selling Securities for Permanent National Debt Hamilton recommended that the debt from the new securities should not be paid off – The 4% annual interest could easily be paid off by collecting tariff money and excise taxes – Investors would enjoy the profits and safety of investing money in these new securities 4 – Excise Tax on Whiskey This tax on whiskey was relatively small but angered western farmers who relied on the sale of whiskey produced from their grain Led to the 1794 Whiskey Rebellion Hamilton was sent by Pres. Washington with 13,000 troops to put this rebellion down TAX COLLECTOR RUN OFF Money from this tax helped pay state debts and interest on new securities sold Further Economic Measures ALEXANDER HAMILTON Hamilton later added two other reports (in 1791) that featured the following: 5) A National Bank 6) Tariffs to support industry 5 – Bank of the United States Private investors would own and operate the bank. The federal government would have a safe place to deposit tax revenues. The bank could give inexpensive loans to the govt. in times of need The bank would also have the power to issue paper currency backed by the federal govt. 1ST BANK OF THE U.S. 5 – Bank of the United States Arguments over the creation of the B.U.S.: – Opponents argued it would give rich northerners who invested in the bank too much influence over government – Opponents argued that no mention of Congress setting up national banks is contained in the Constitution (strict construction or strict interpretation) – However, Hamilton argued that Congress can pass any laws necessary to carry out its expressed duties (loose construction) A 20 year charter for the B.U.S. was passed in 1791 6 – Protective Tariffs Hamilton sought tariffs to: – protect infant American industry for a short term until it could compete – raise revenue to pay the expenses of government – raise revenue to directly support manufacturing through bounties (subsidies) Both parties supported the idea of a tariff though southerners and westerners in time would support lower ones than those sought by northerners Subsidies to industry didn’t pass, but became part of the upcoming American System plan Results of Hamilton’s Plan Two political parties formed: – Federalists – those who supported Hamilton’s plan – Democratic-Republicans – led by Thomas Jefferson who feared the plan would give too much power to the national govt. and support the rich in the north THOMAS JEFFERSON Results of Hamilton’s Plan Revolutionary War debts were paid off – High state taxes (like those that led to Shay’s Rebellion in Mass.) were lightened when states war debts were assumed by the federal govt. U.S. Economy grew: – Exports tripled in the next 5 years – Paper money and securities led to wealth which allowed entrepreneurs to invest in new businesses – U.S. had money available when it needed it (for example the Louisiana Purchase)